- Accountant Resume Examples

- Financial Analyst Resume Examples

- Bookkeeper Resume Examples

- Auditor Resume Examples

- Tax Preparer Resume Examples

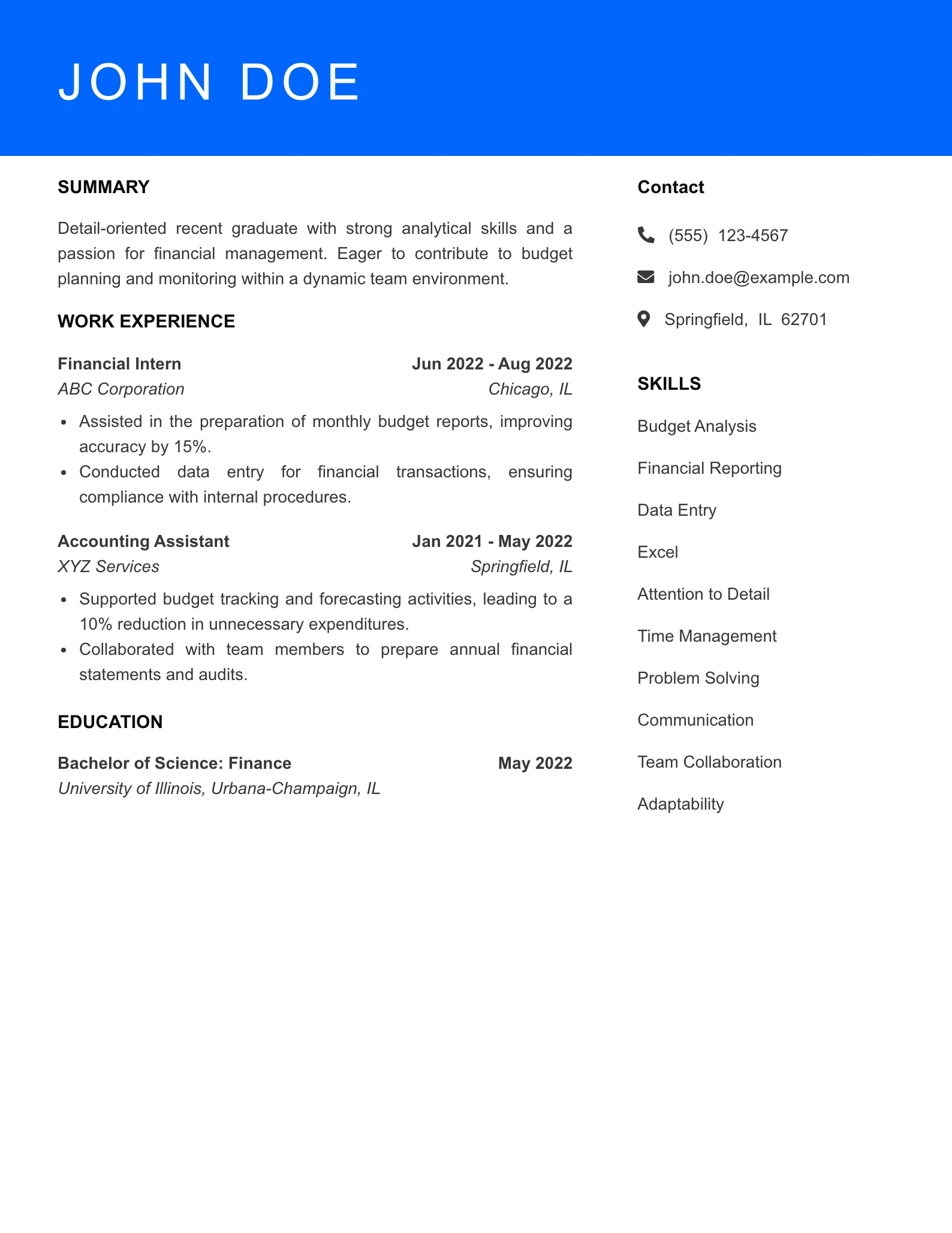

- Budget Analyst Resume Examples

- Payroll Specialist Resume Examples

- Credit Analyst Resume Examples

- Accounts Payable Resume Example

- Financial Advisor Resume Example

- Controller Resume Example

- Treasury Analyst Resume Example

- Bank Teller Resume Example

- Personal Banker Resume Example

- Mortgage Underwriter Resume Example

- Loan Officer Resume Example

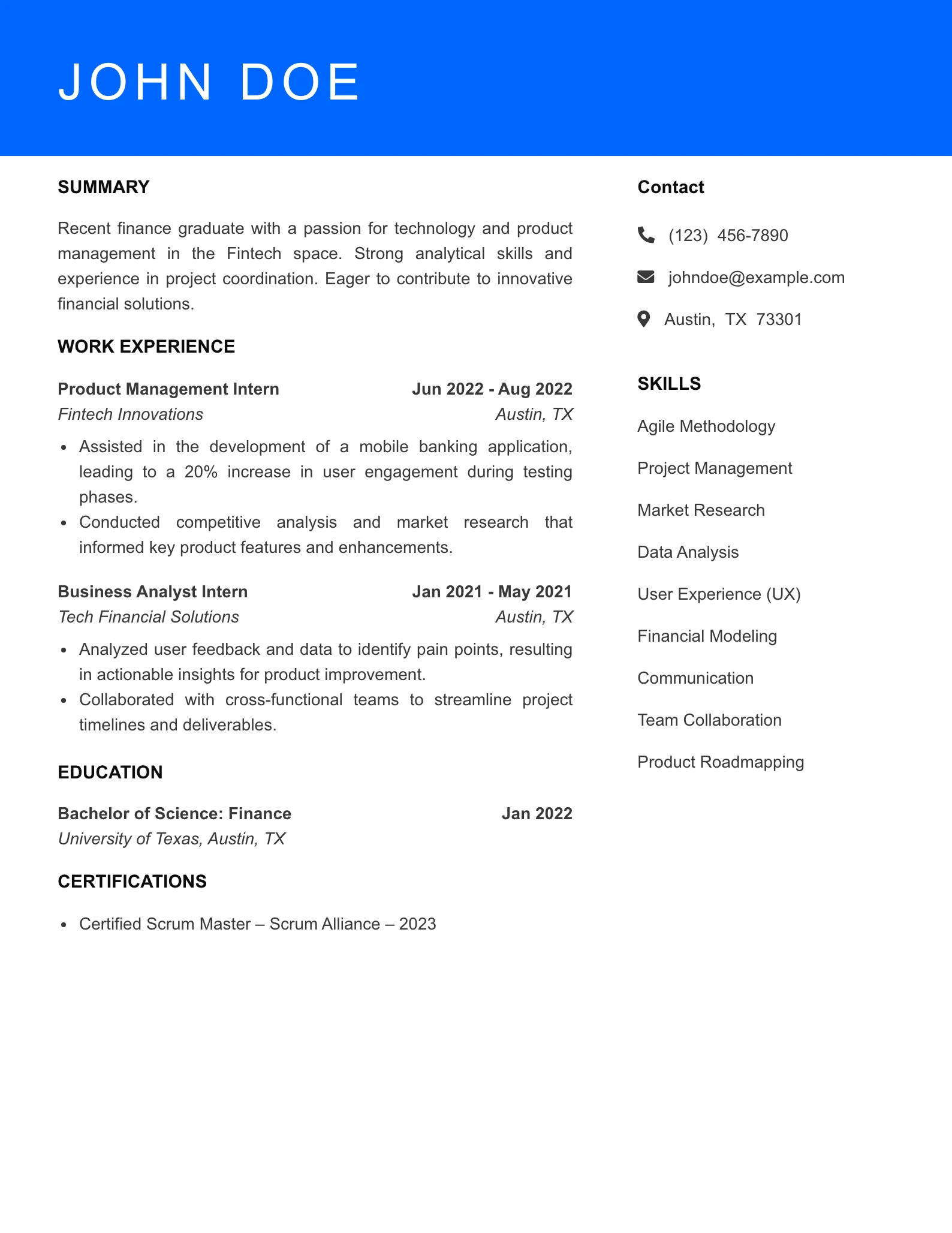

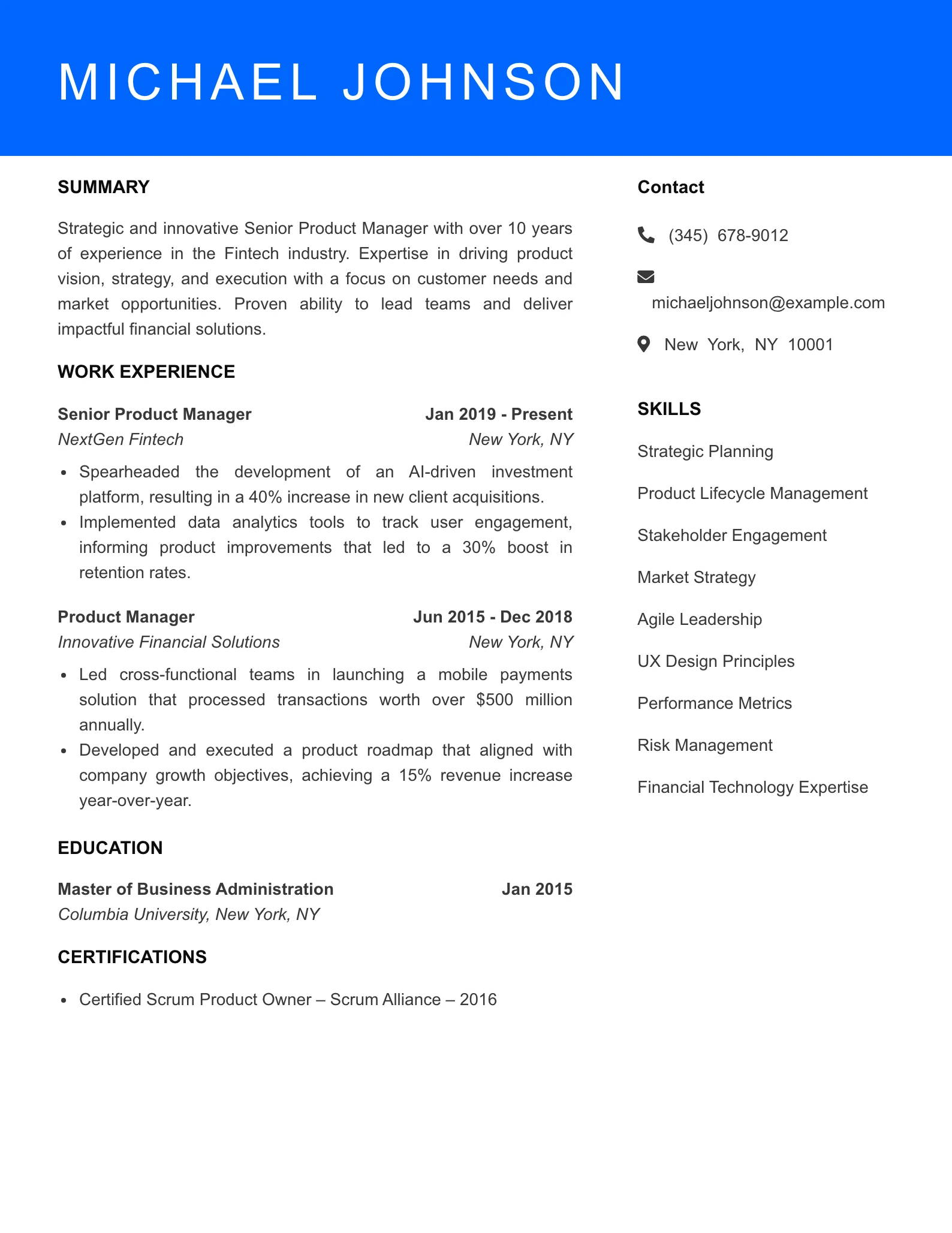

- Fintech Product Manager Resume

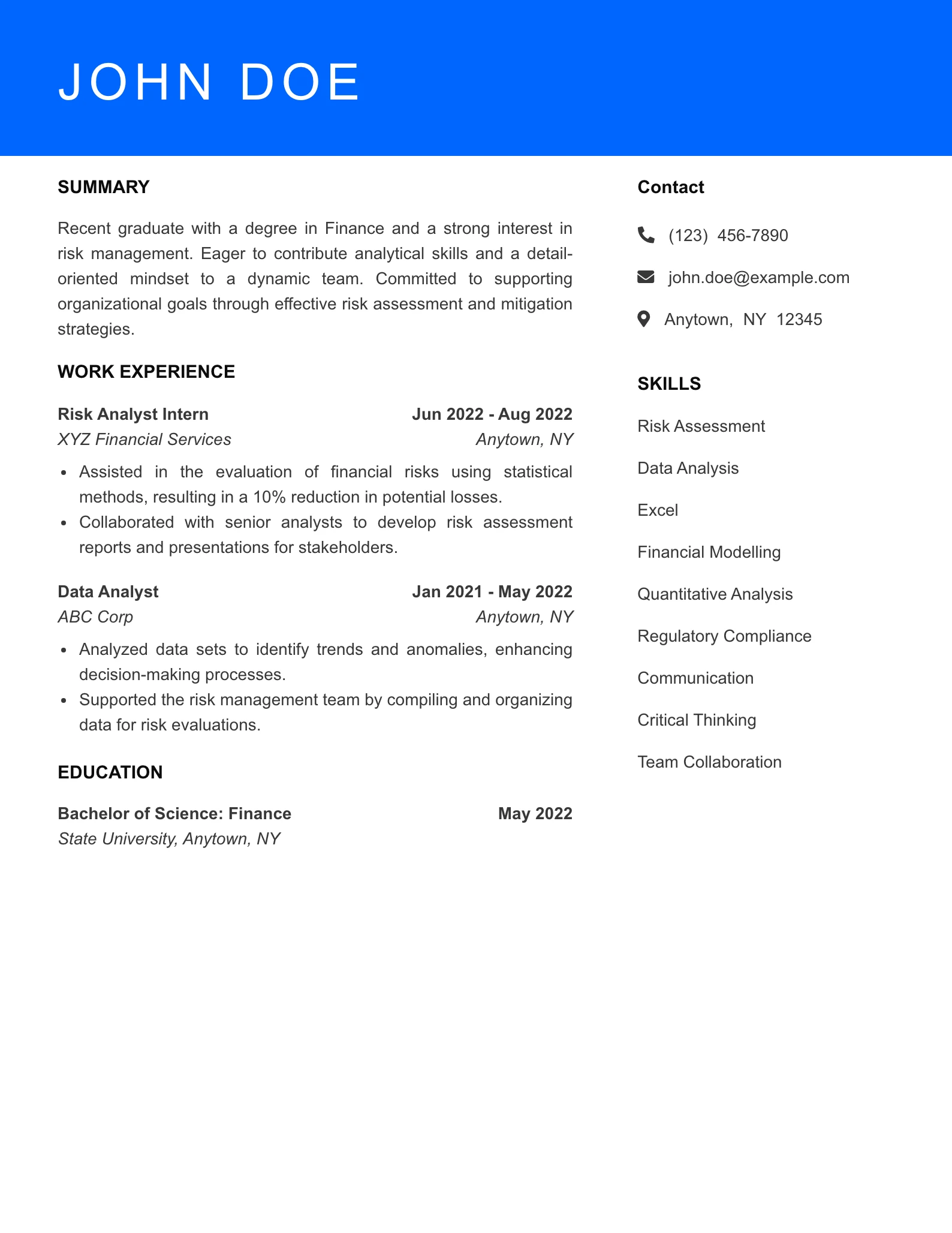

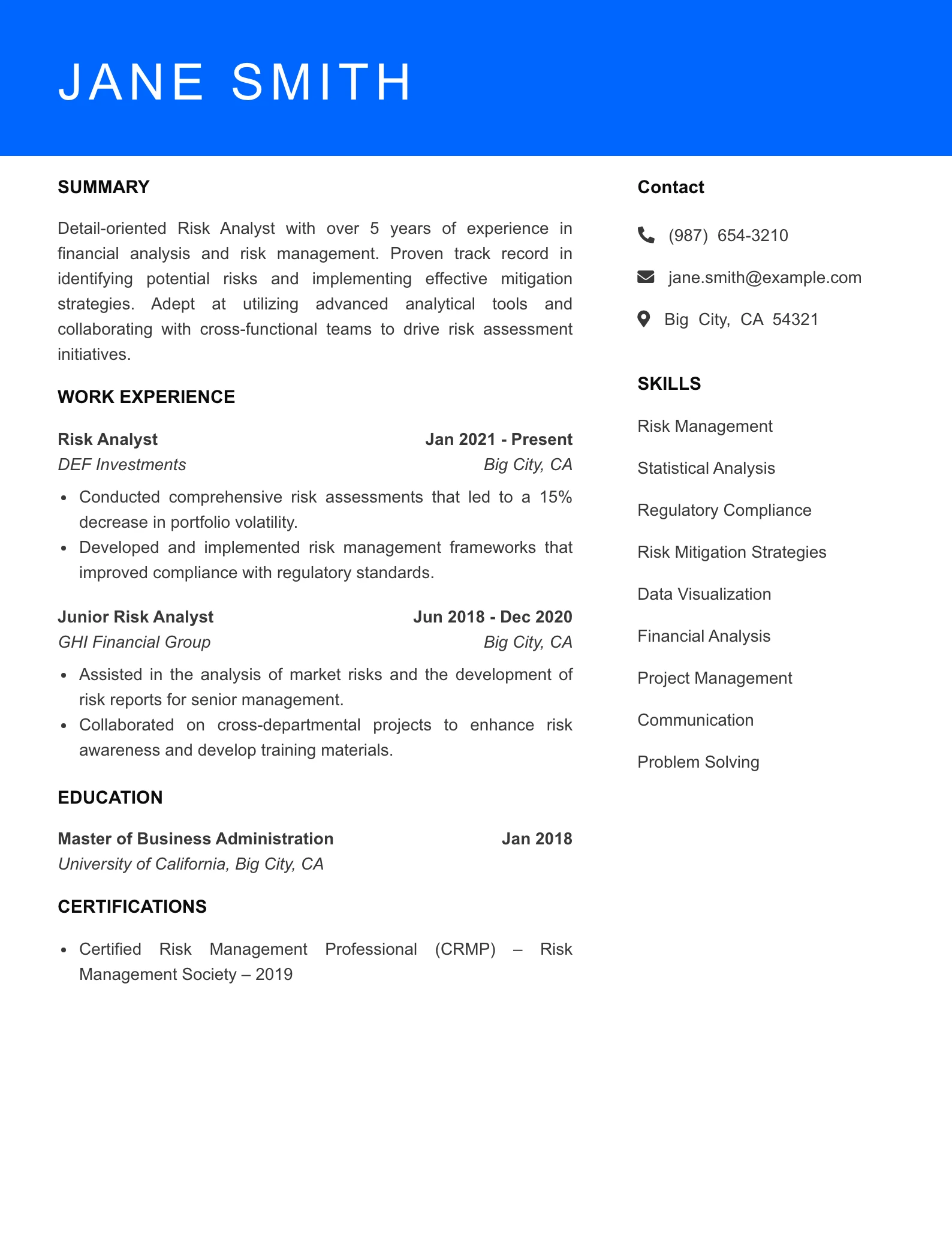

- Risk Analyst Resume Example

- Financial Operations Resume Example

- Collections Agent Resume Example

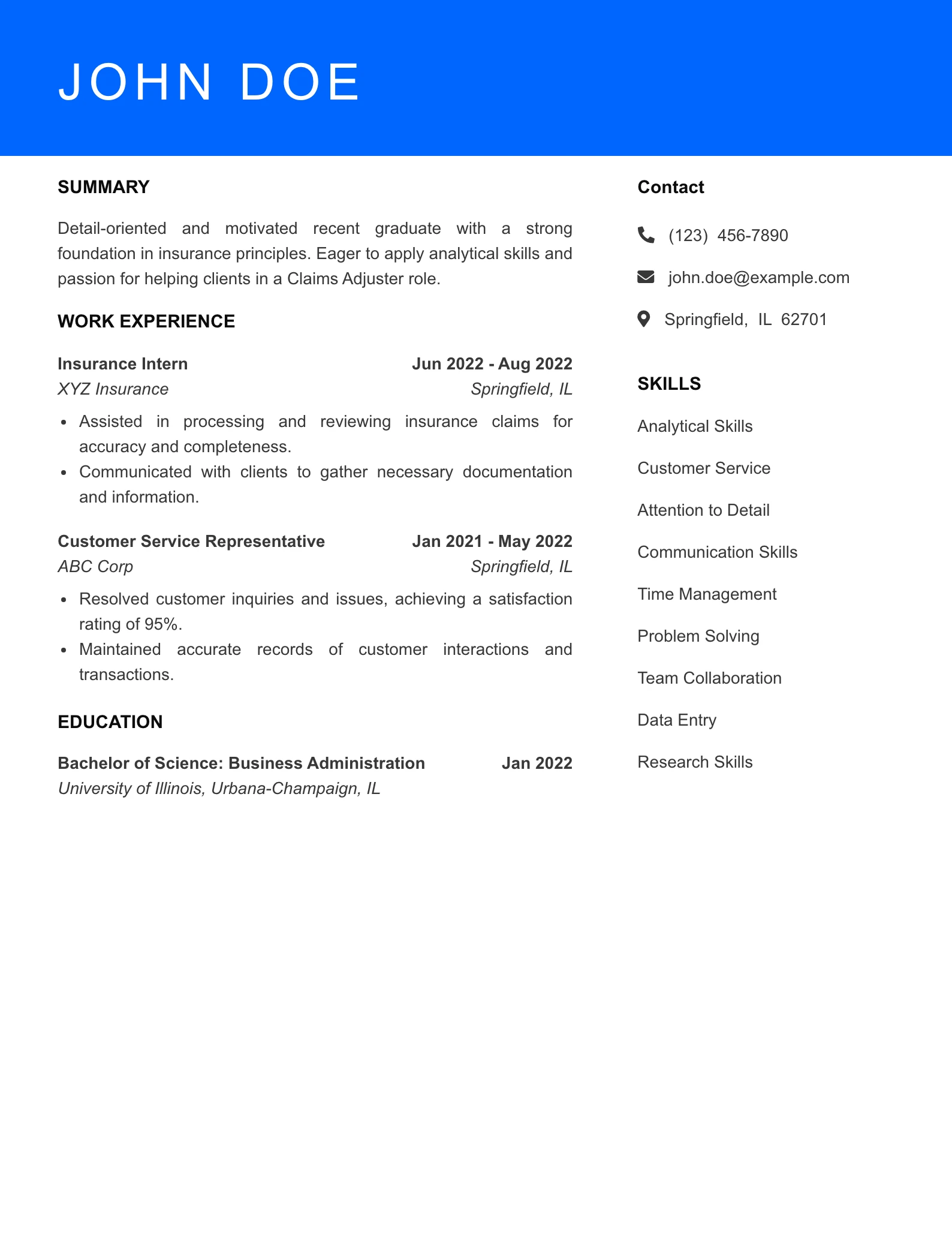

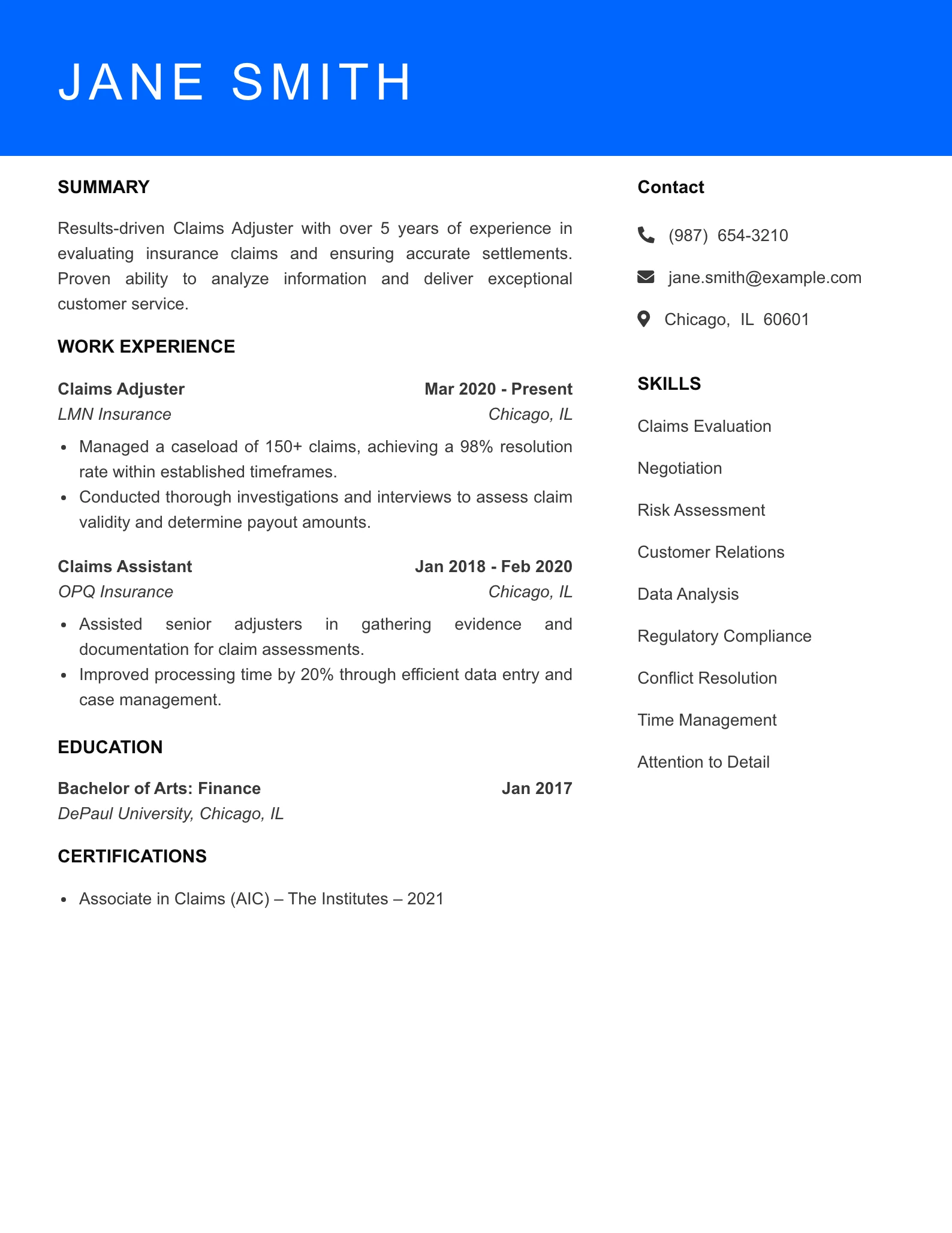

- Claims Adjuster Resume Example

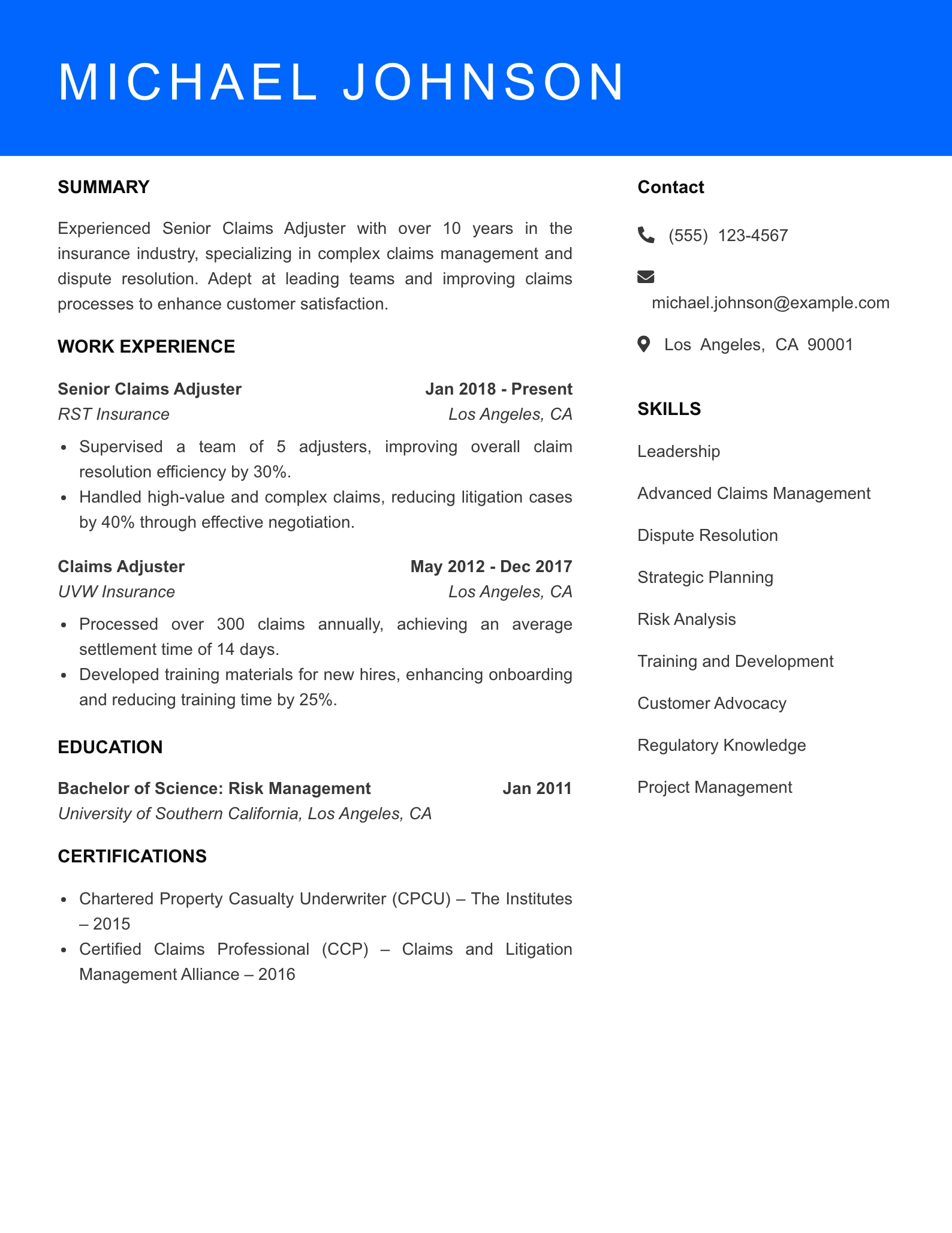

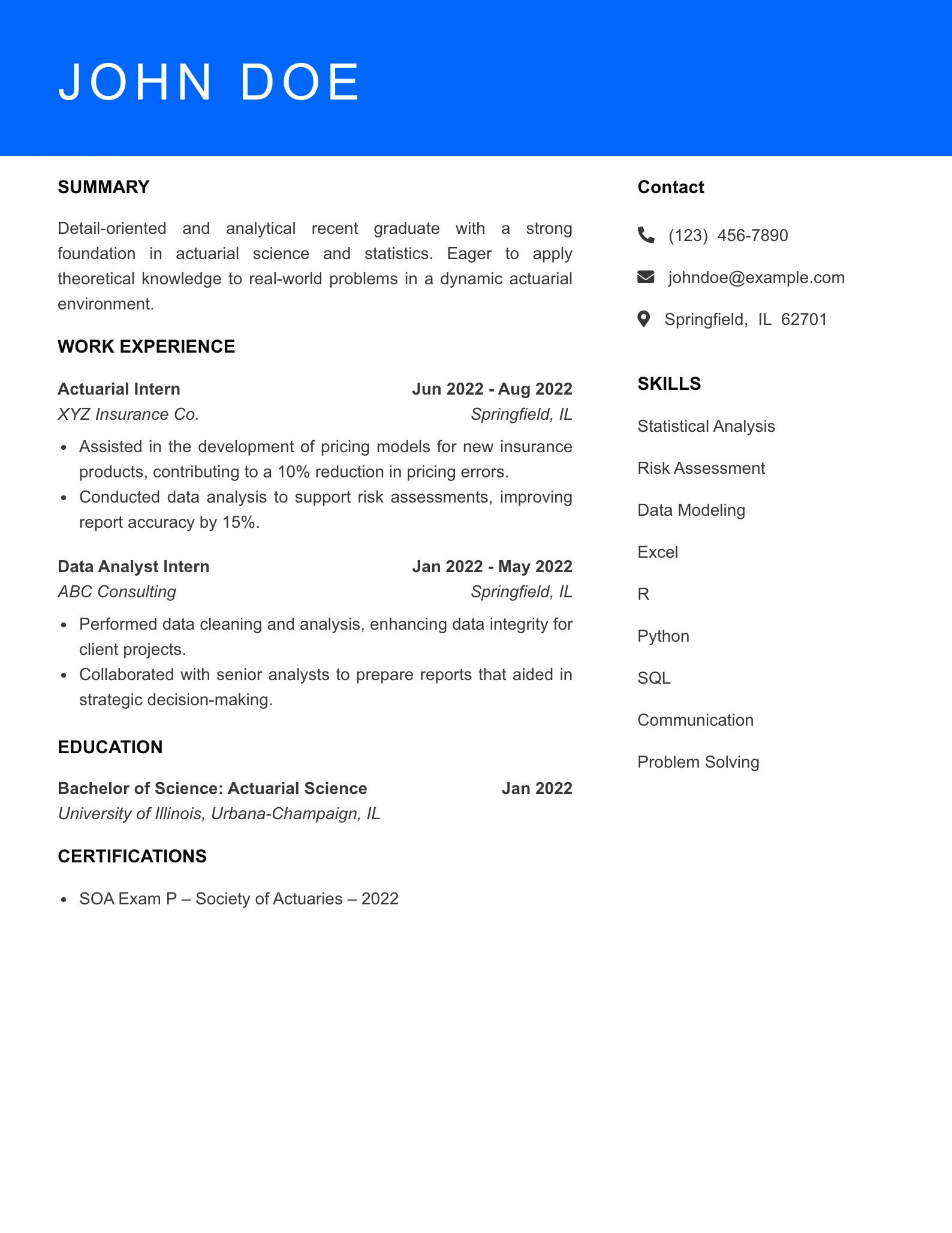

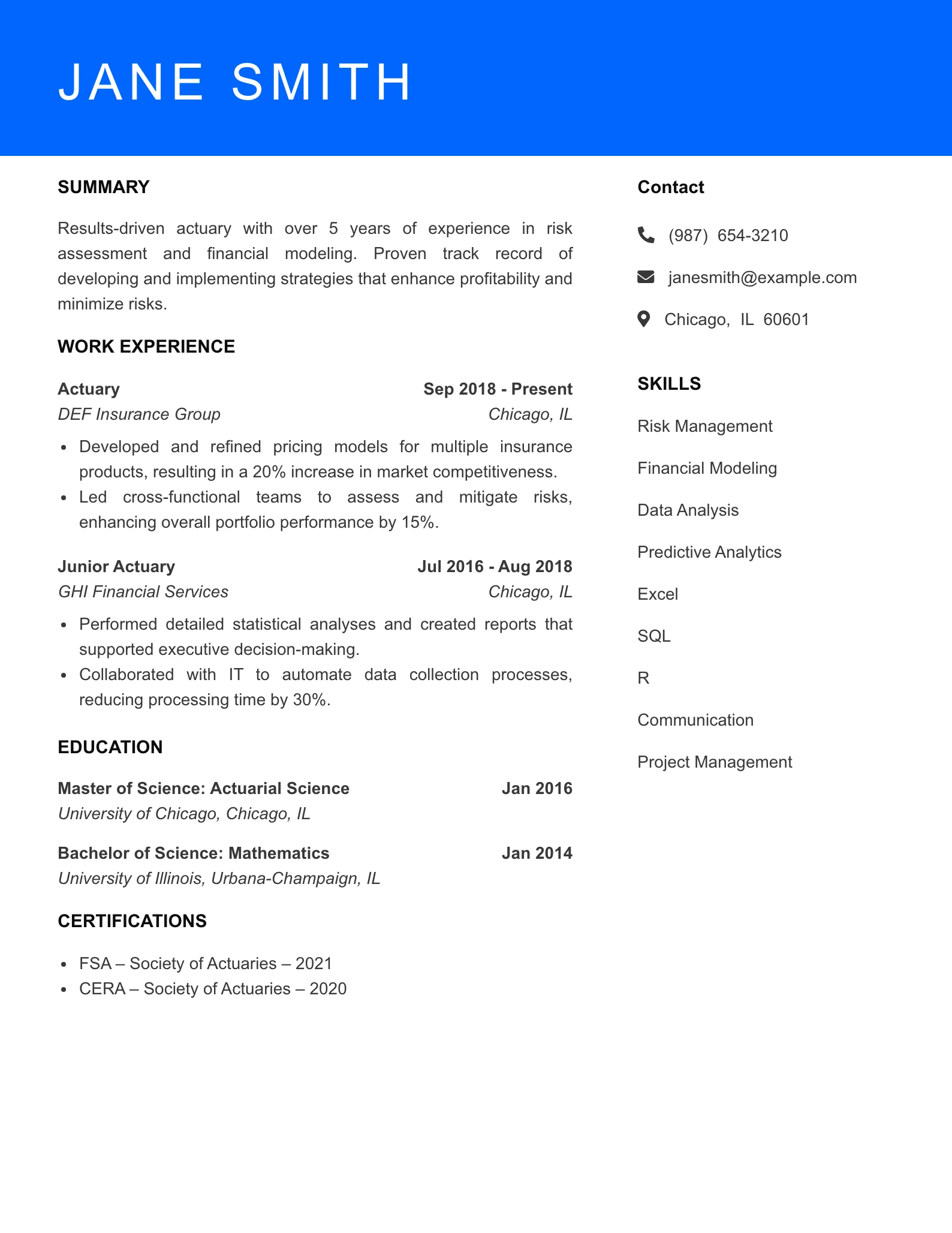

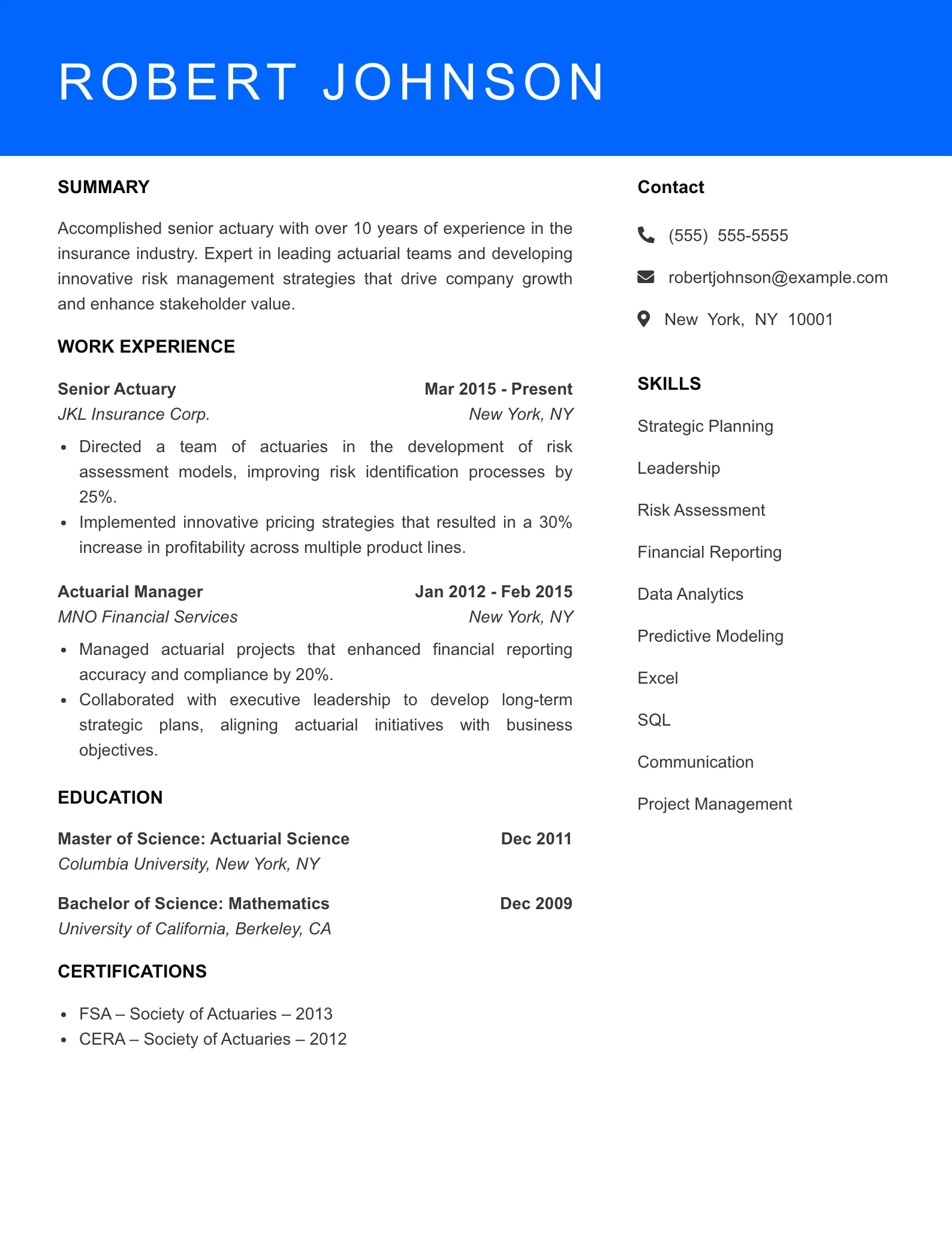

- Actuary Resume Example

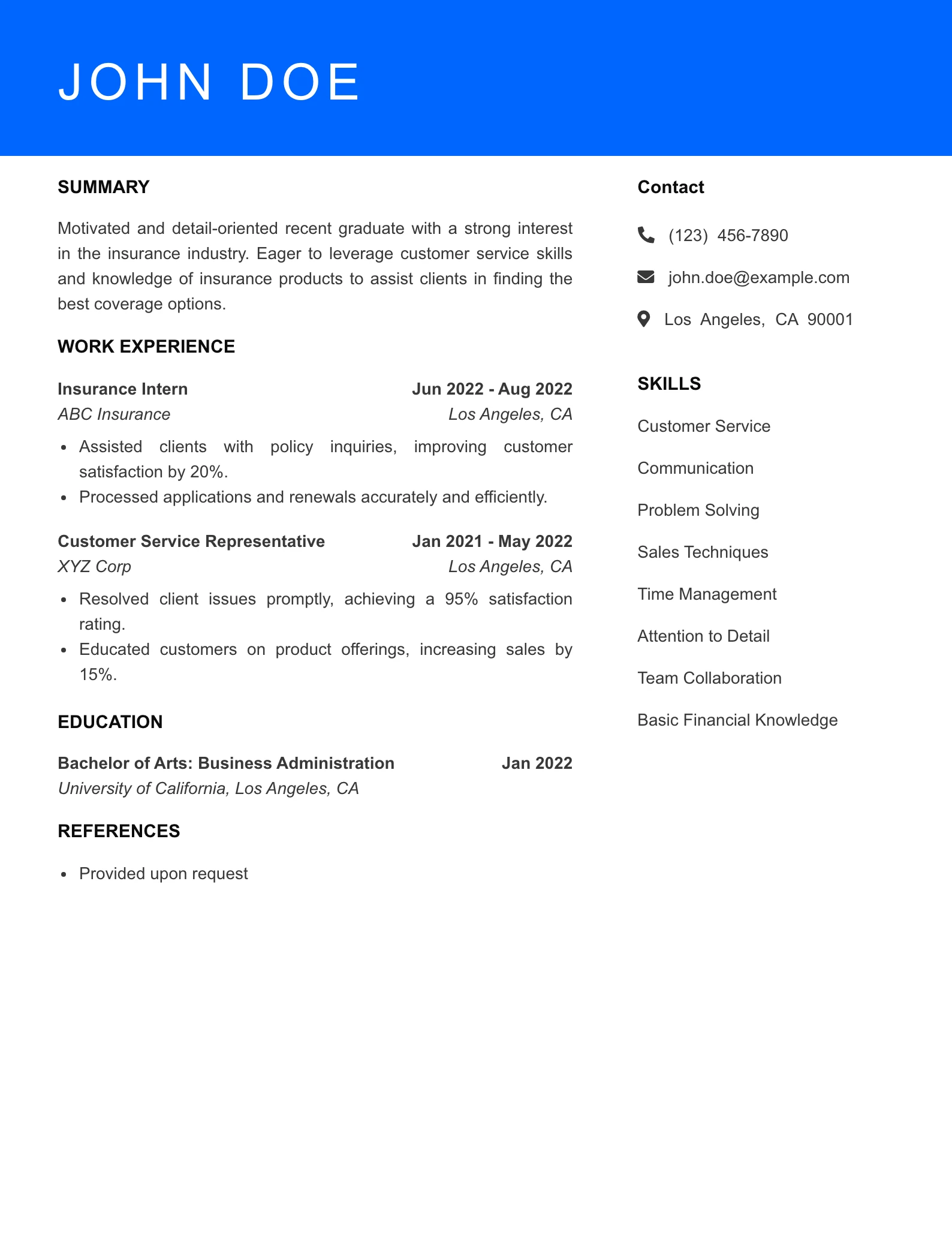

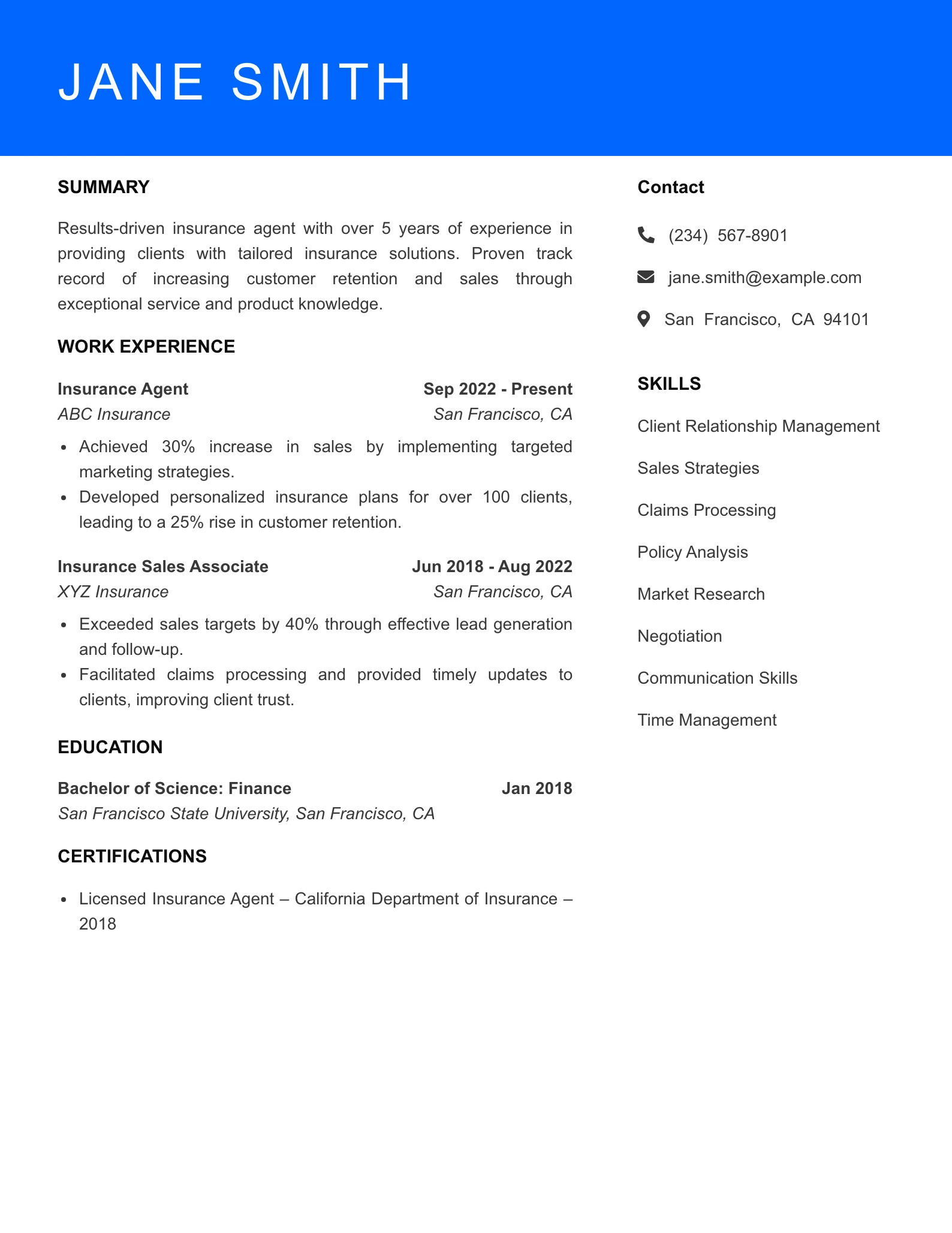

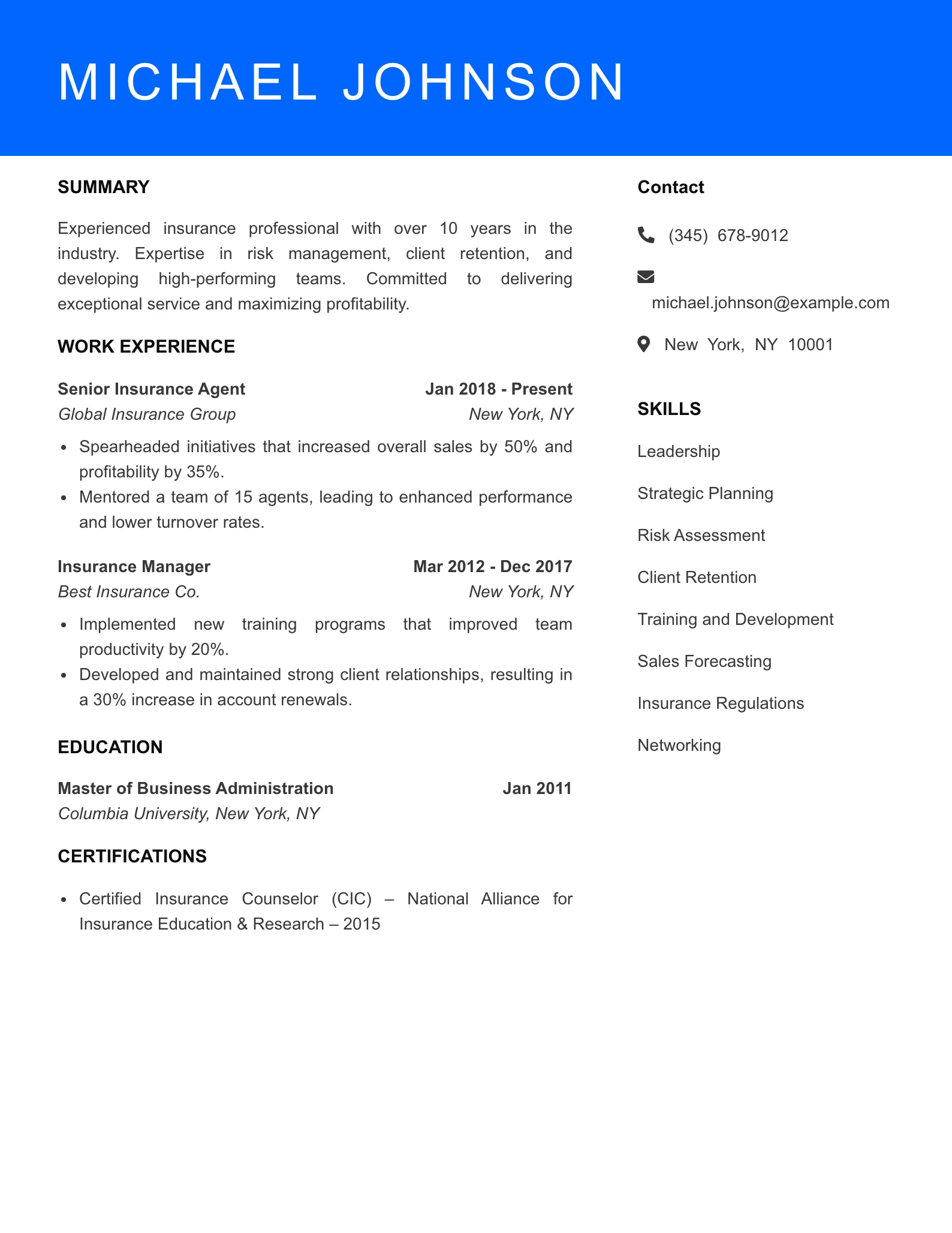

- Insurance Agent Resume Example

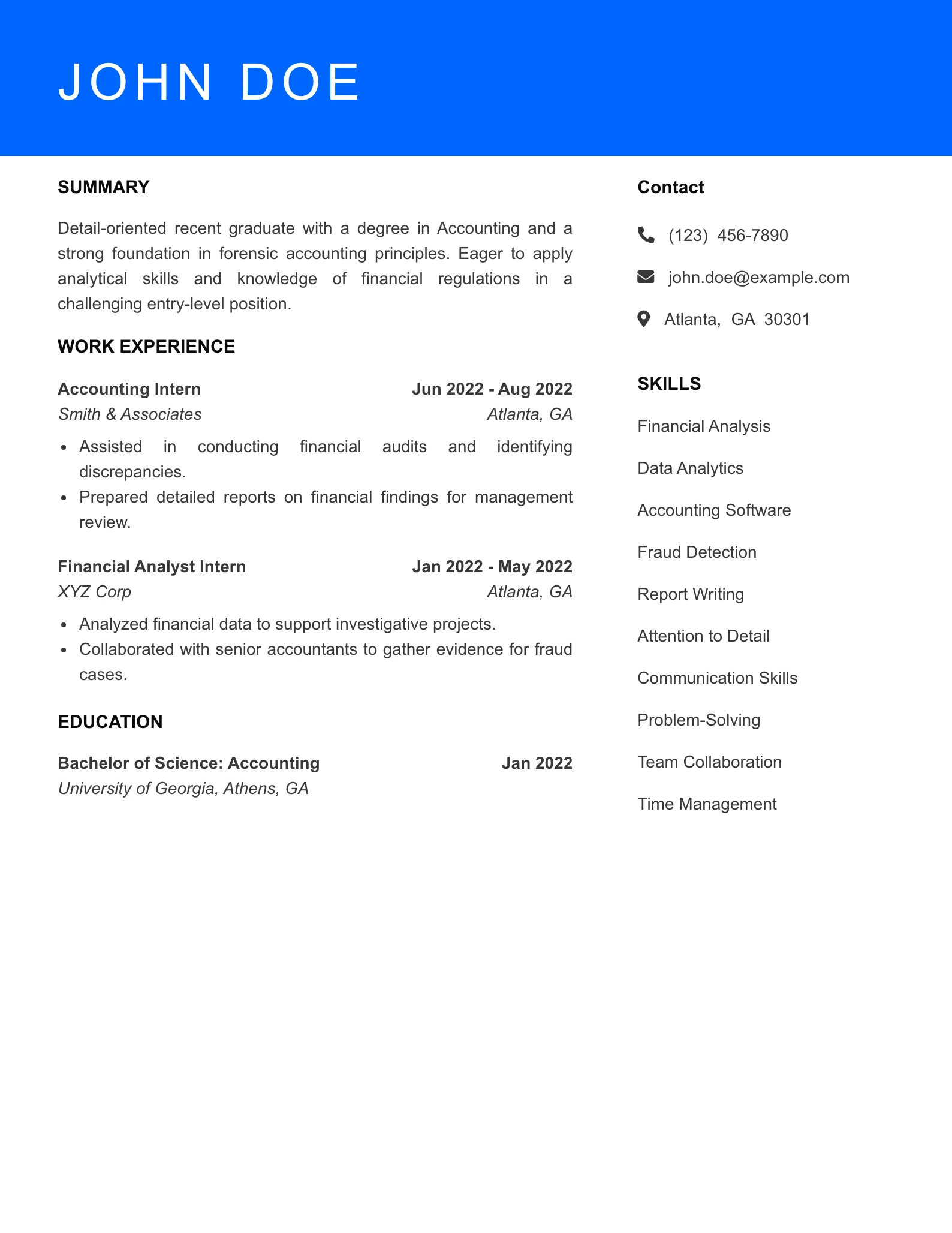

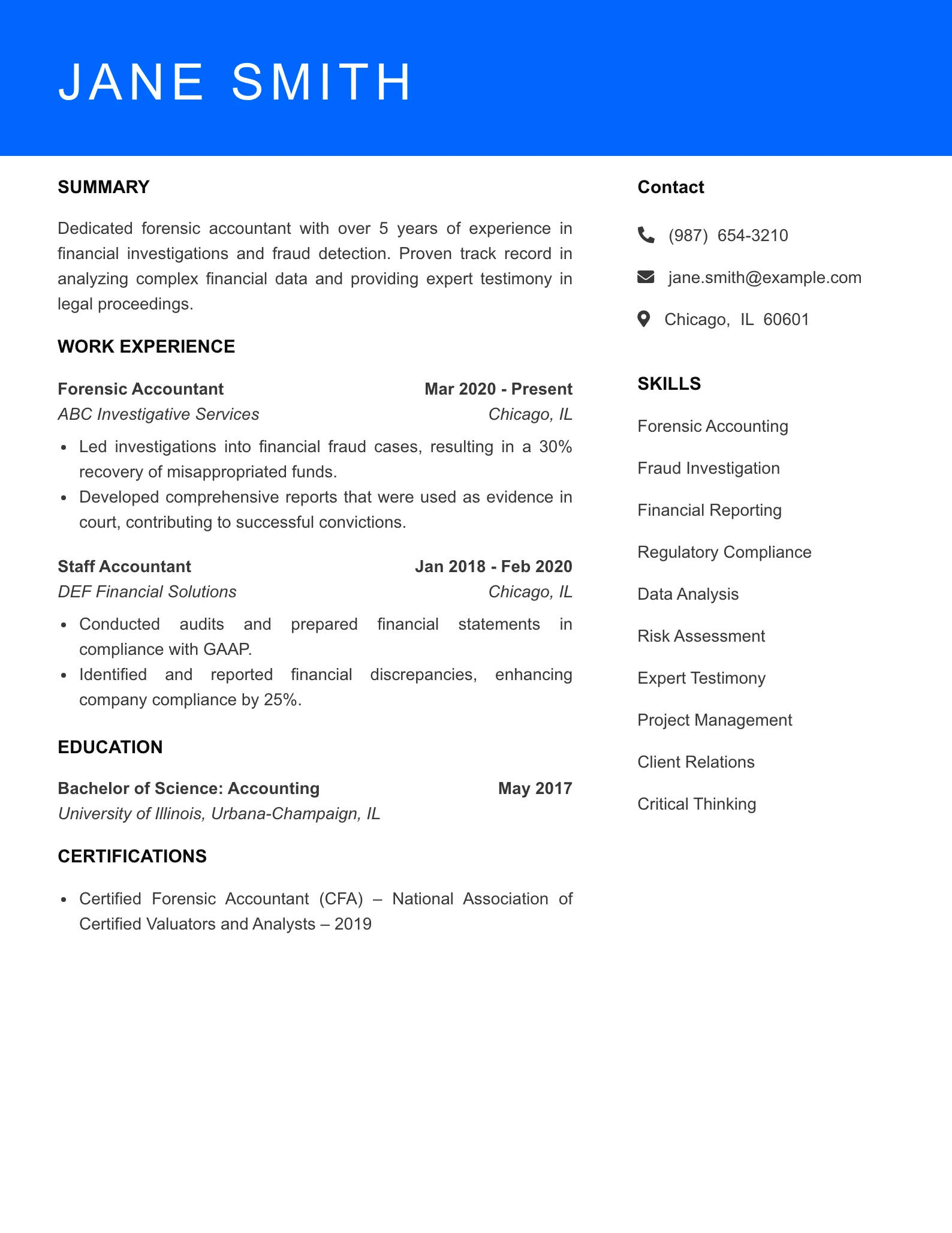

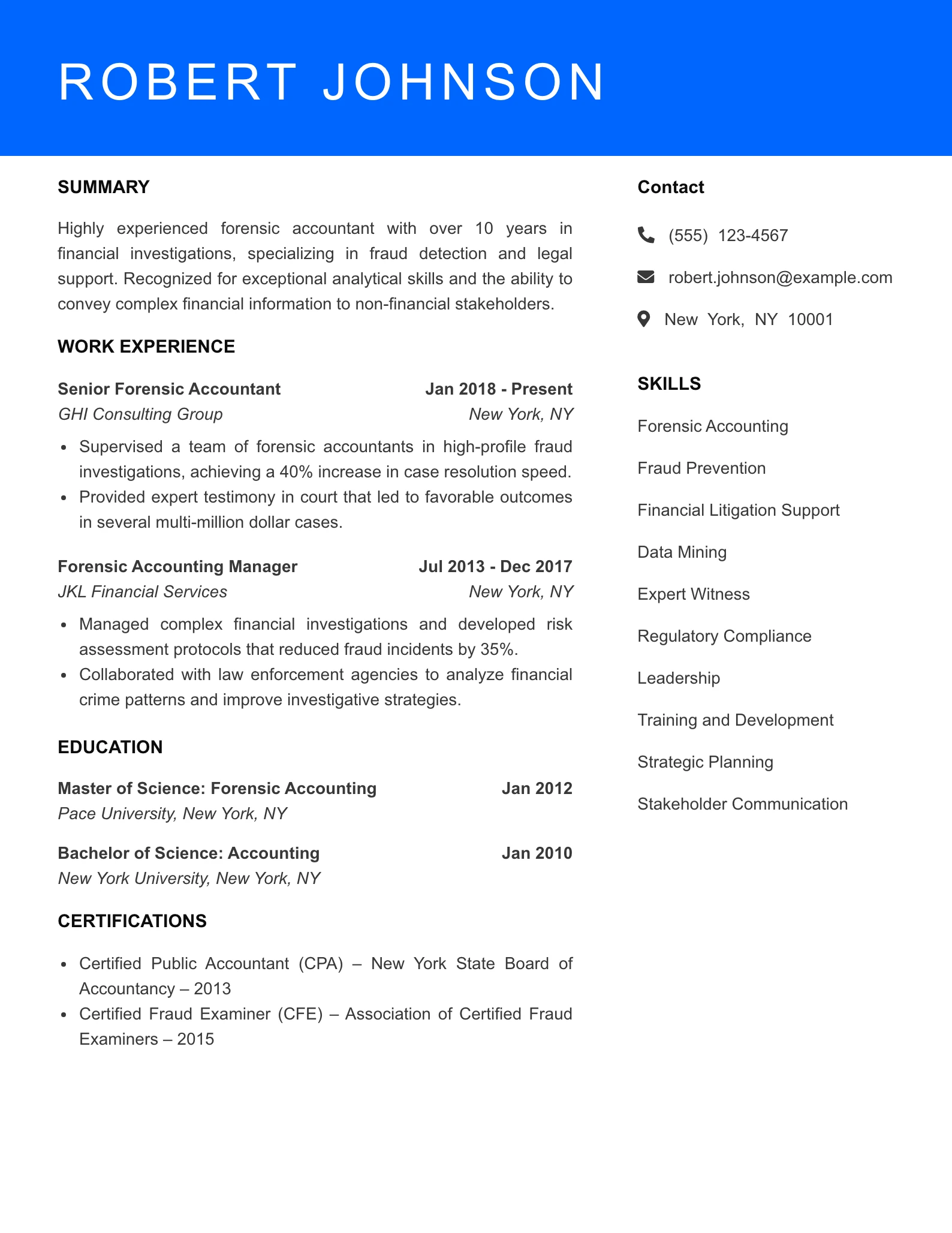

- Forensic Accountant Resume

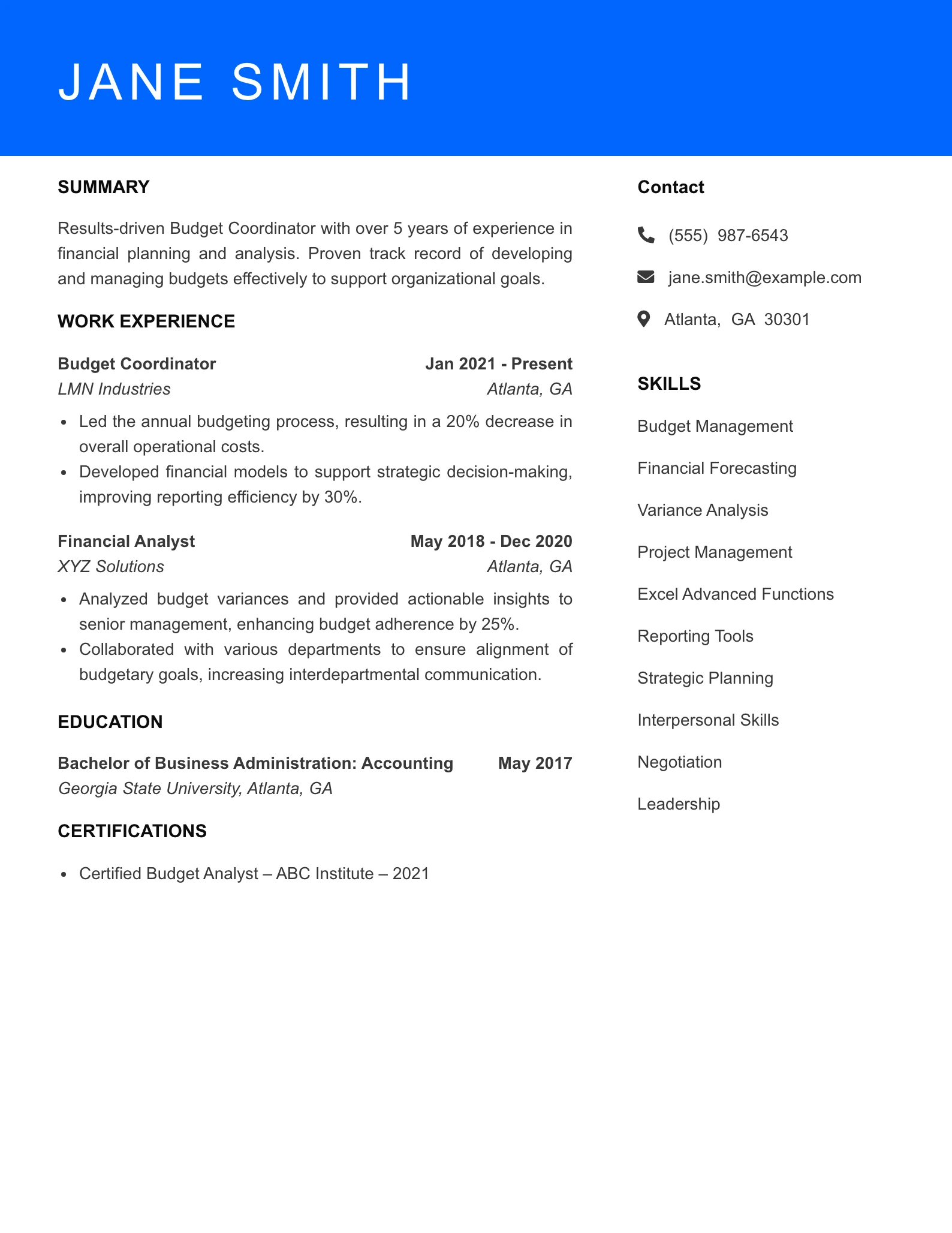

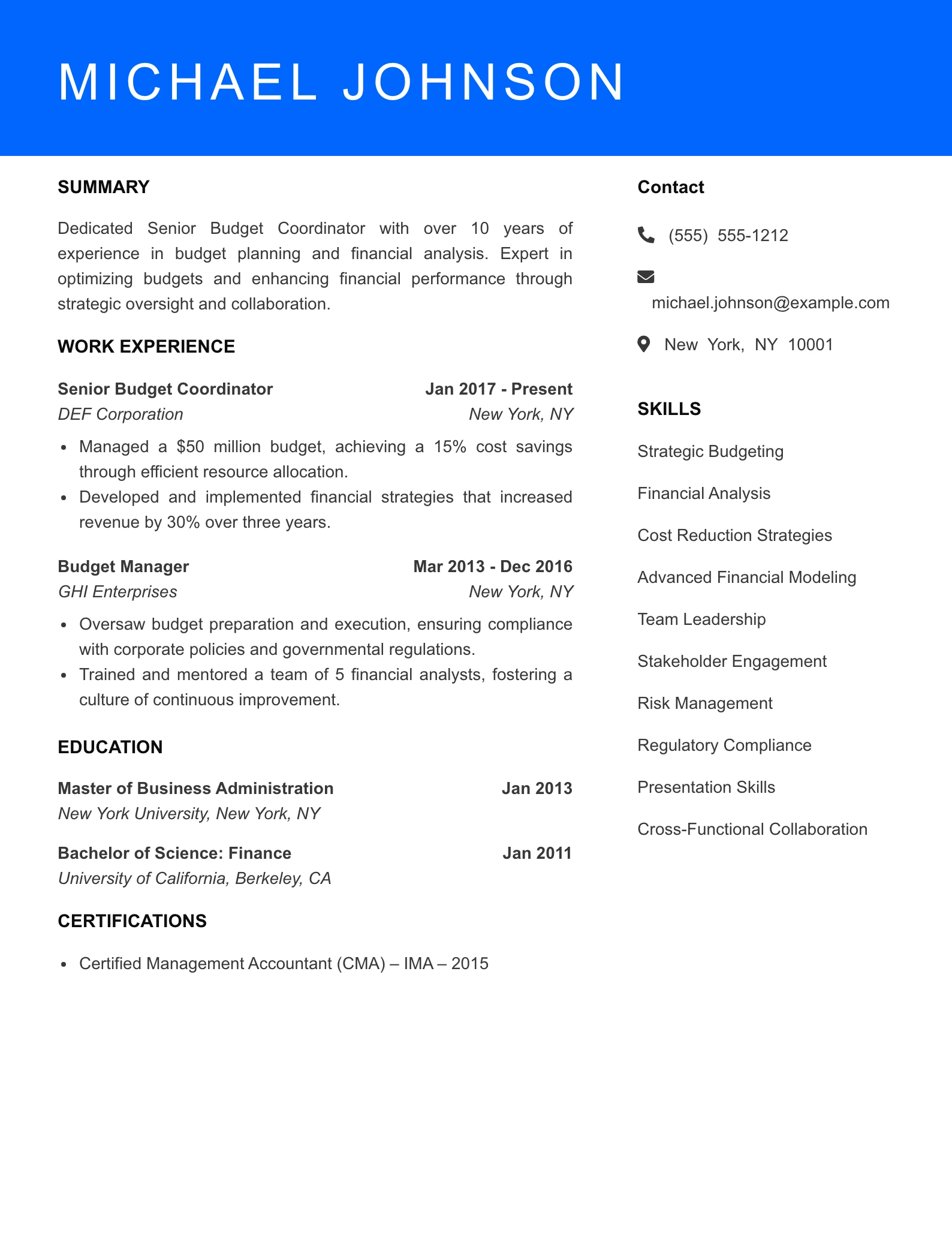

- Budget Coordinator Resume Example

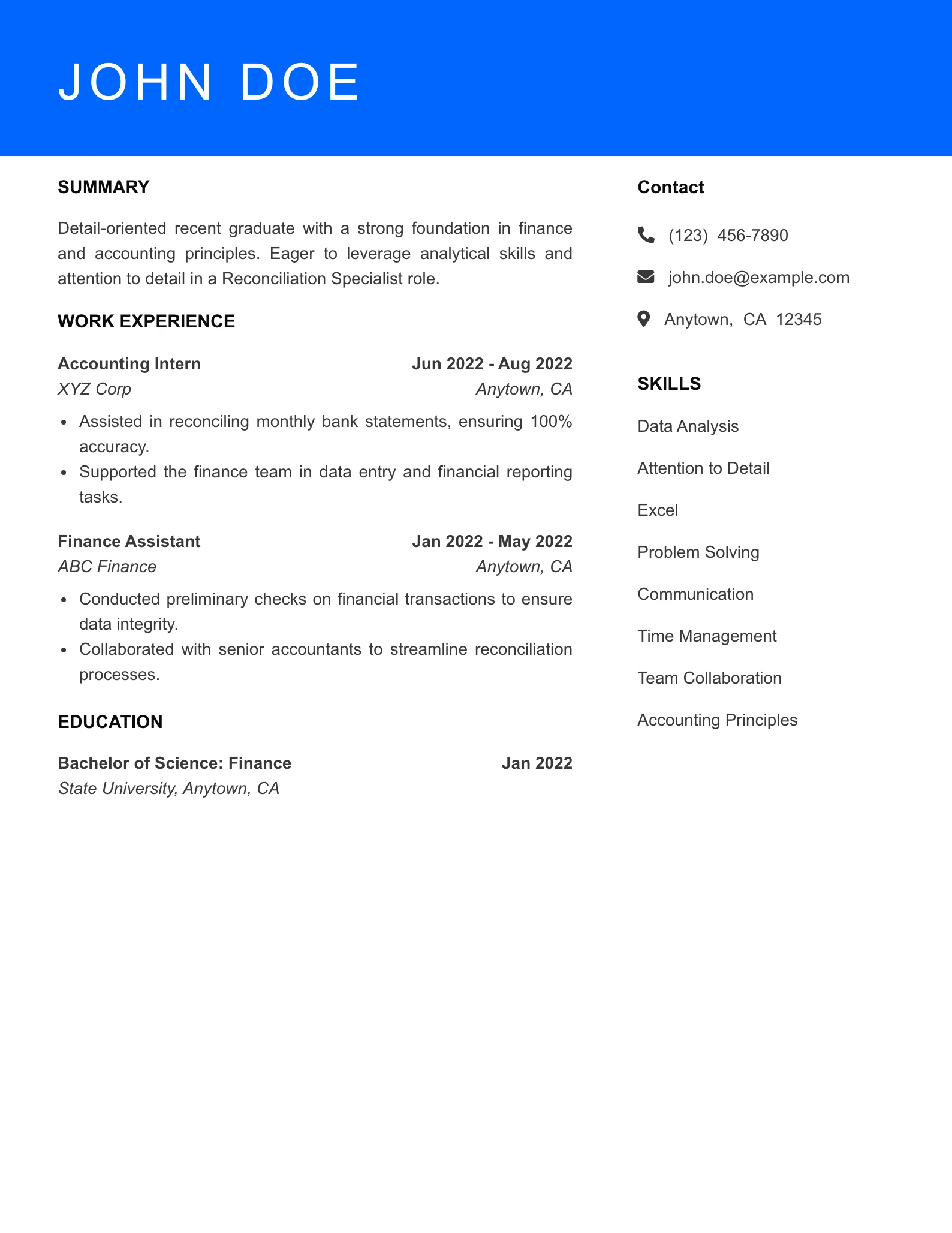

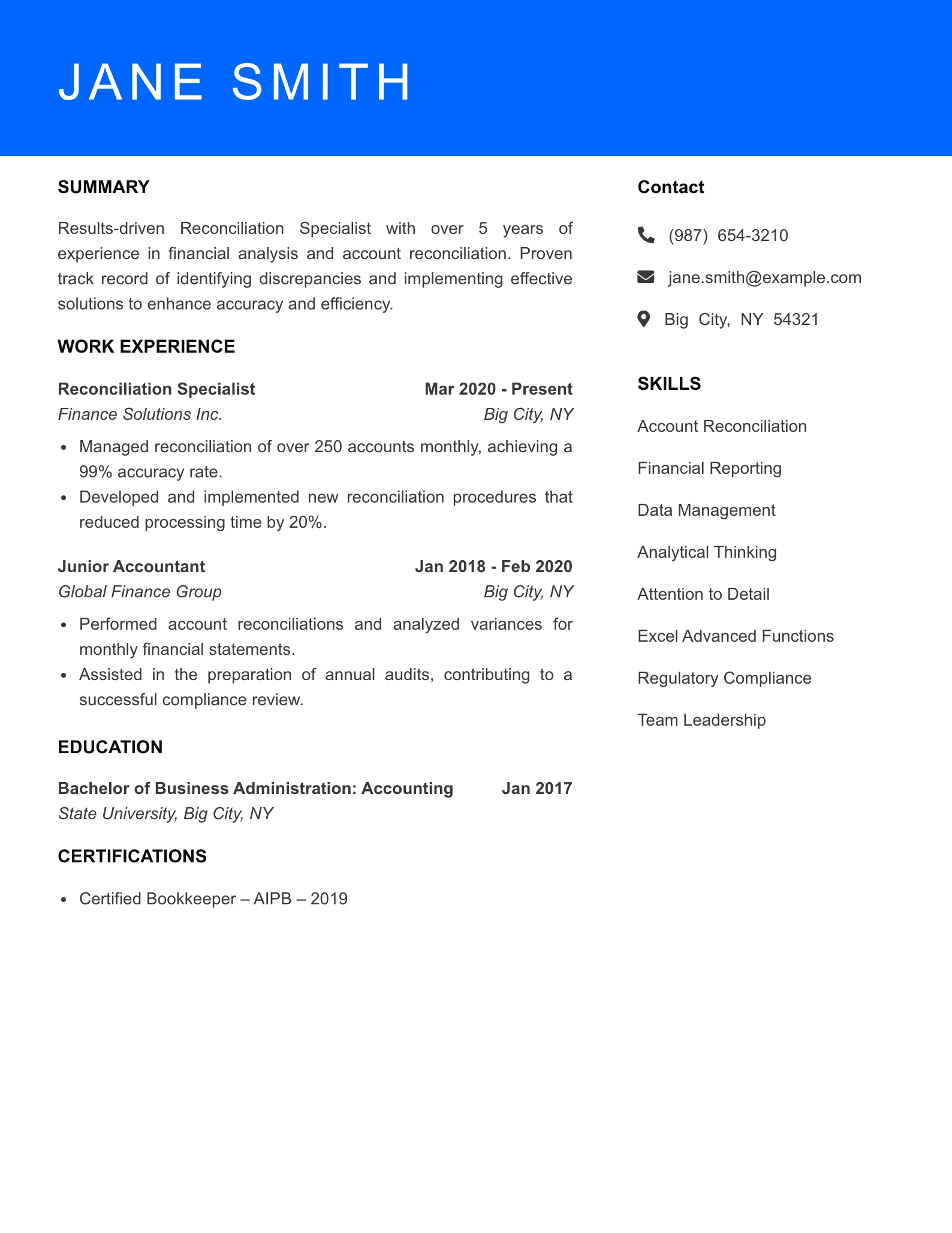

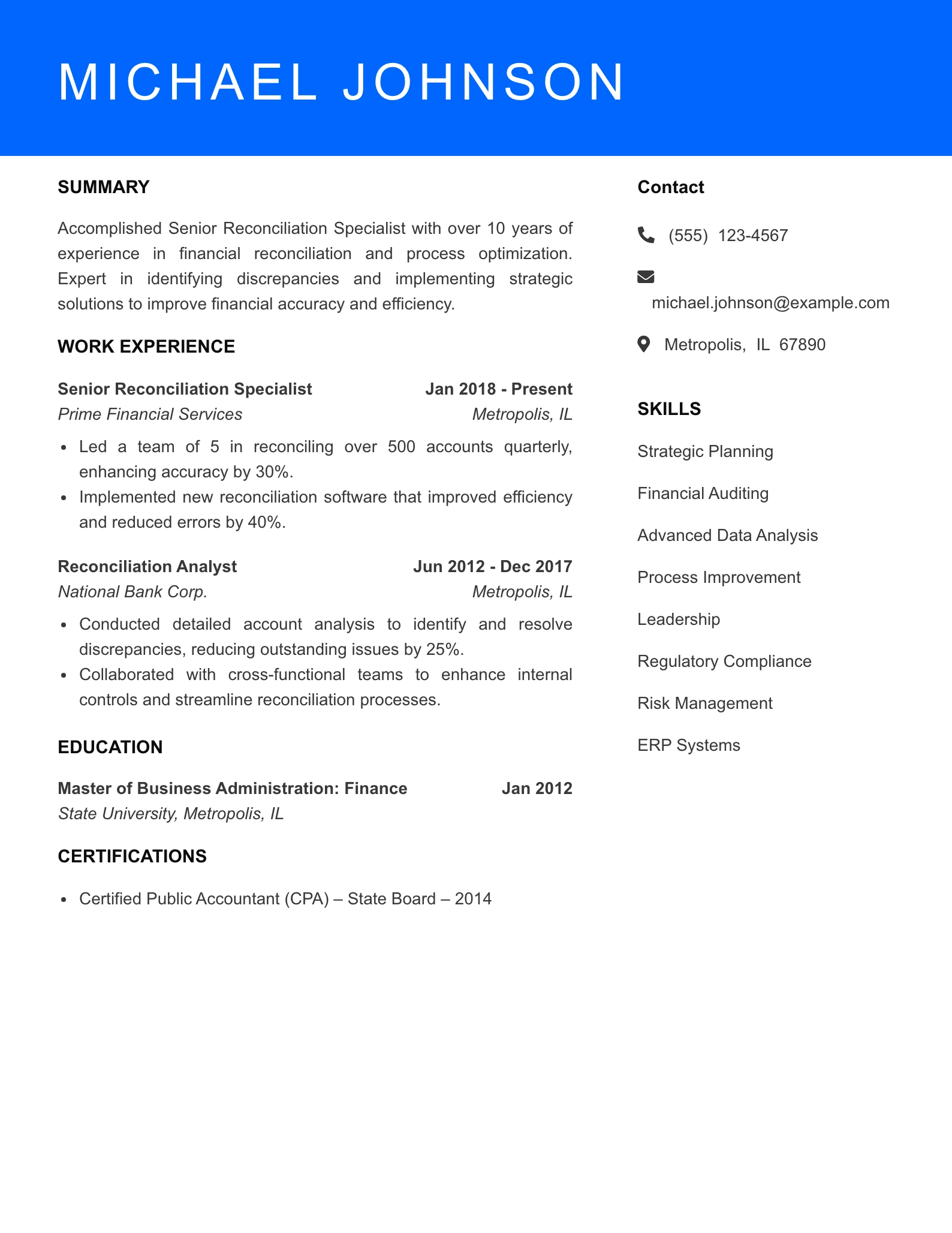

- Reconciliation Specialist Resume

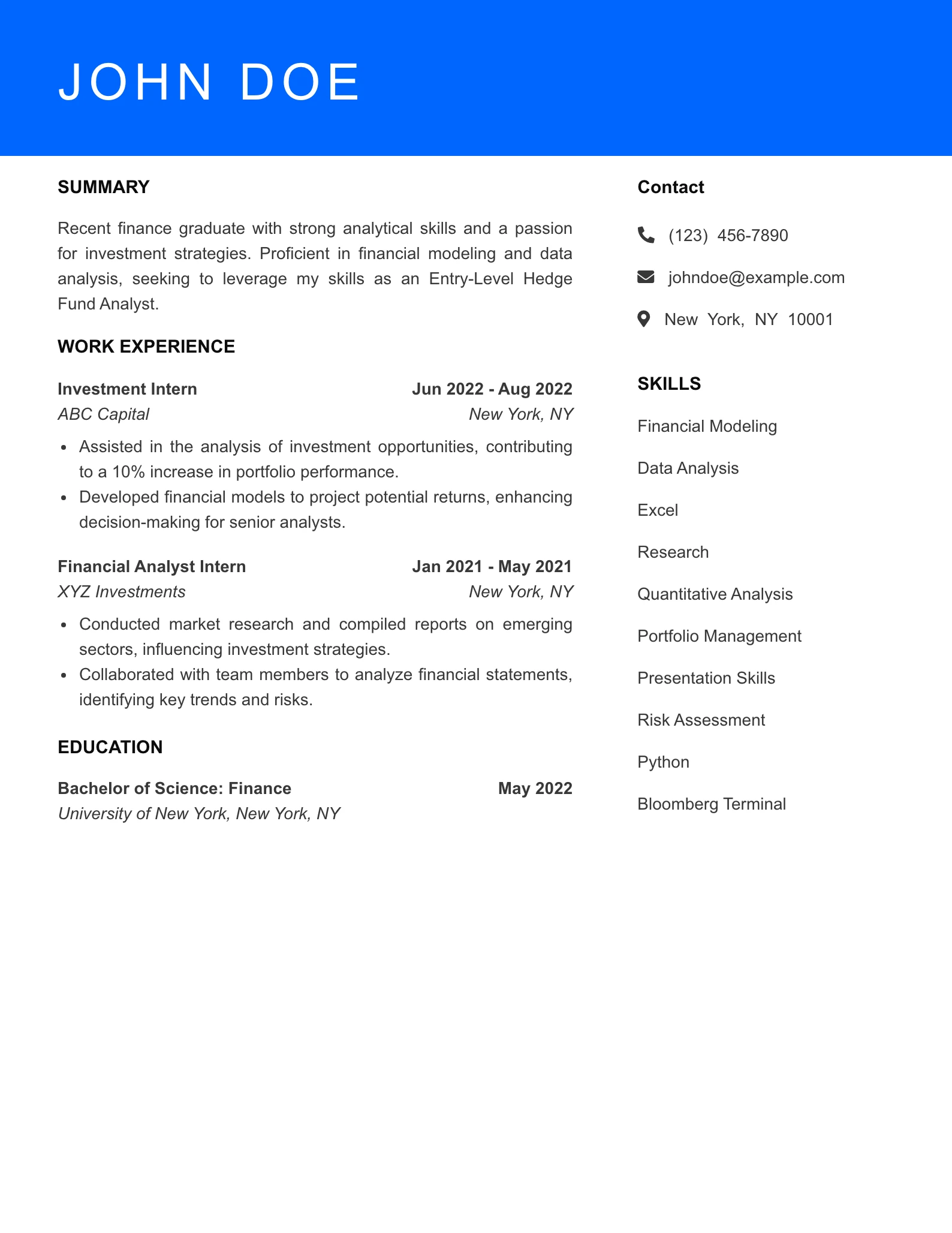

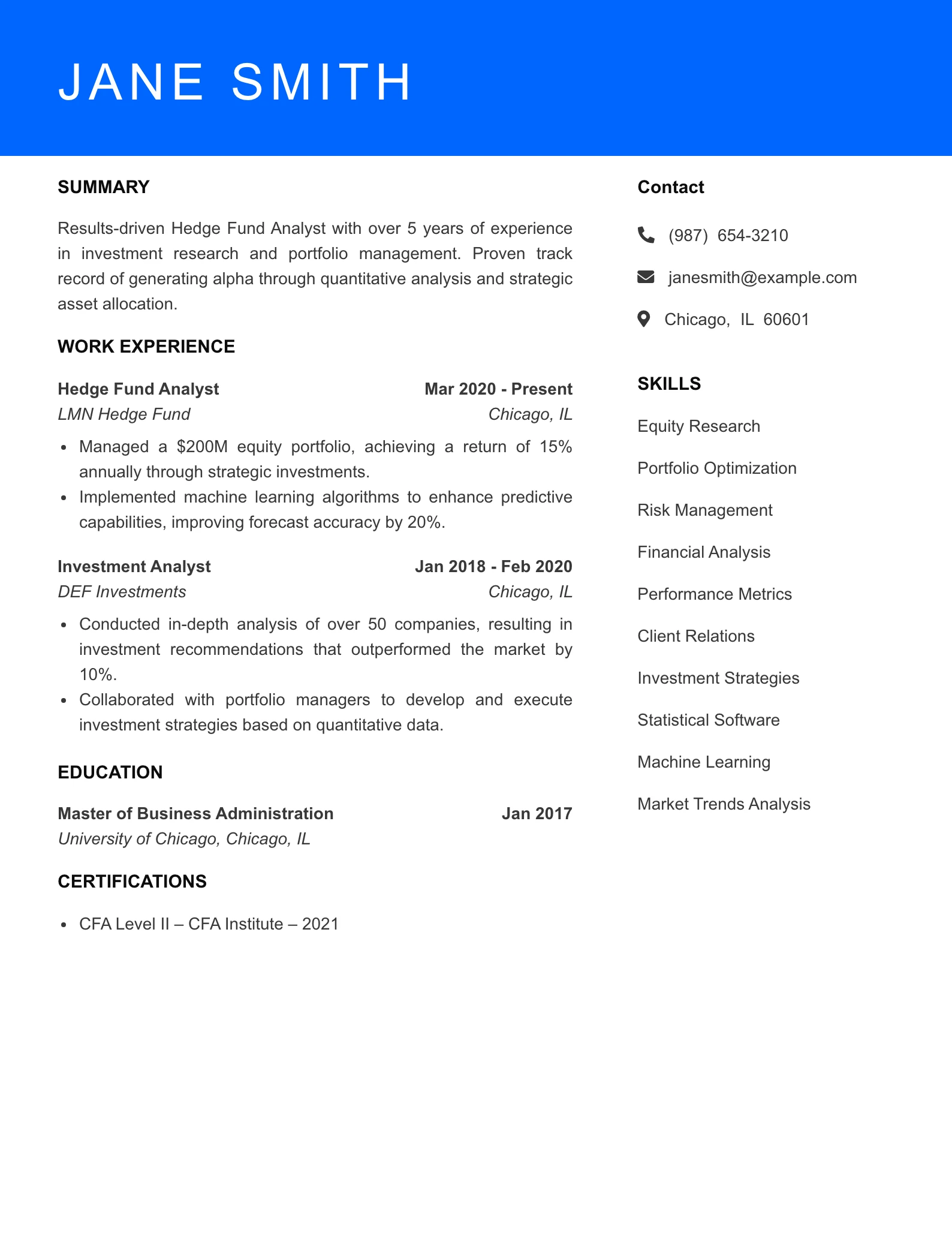

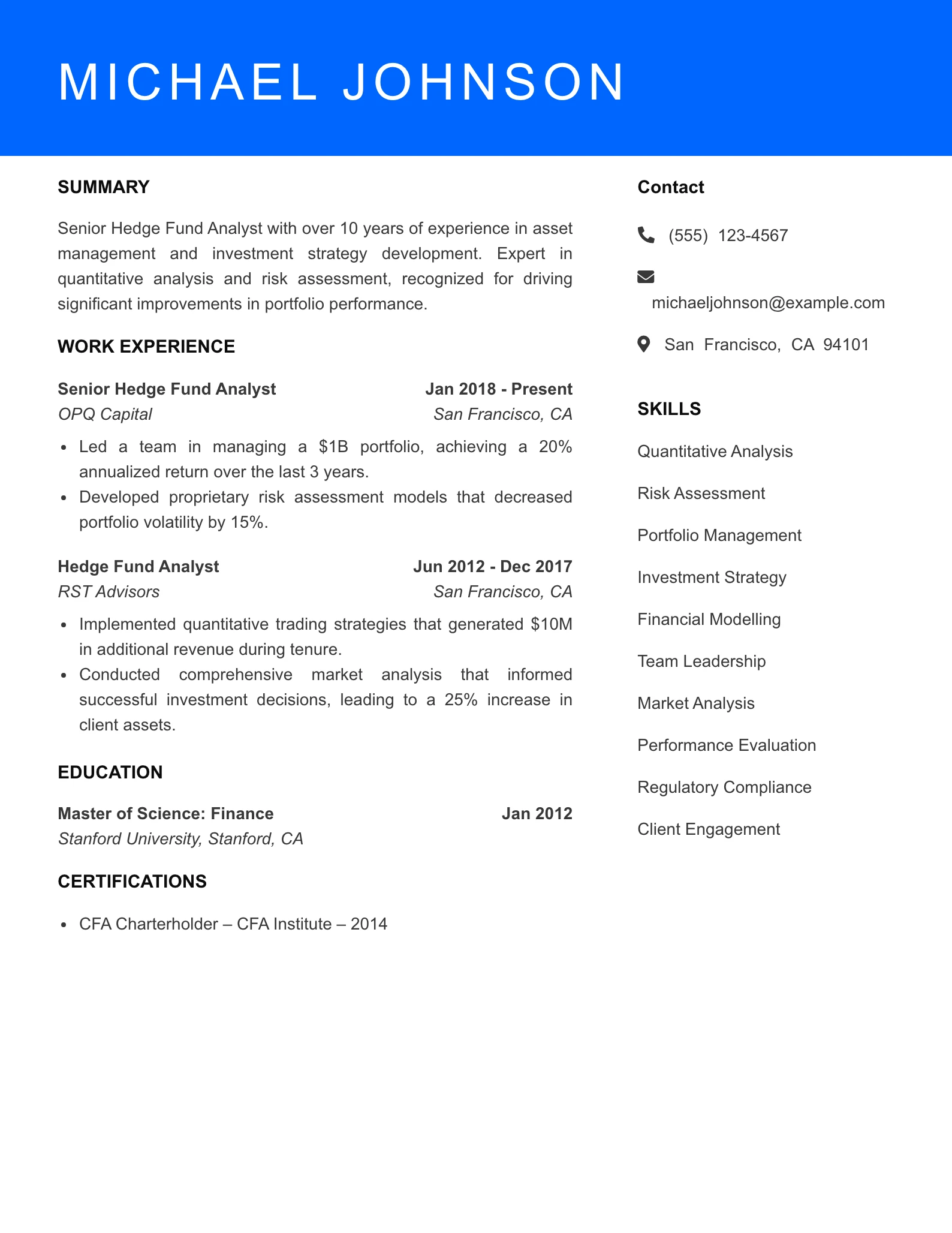

- Hedge Fund Analyst Resume Example

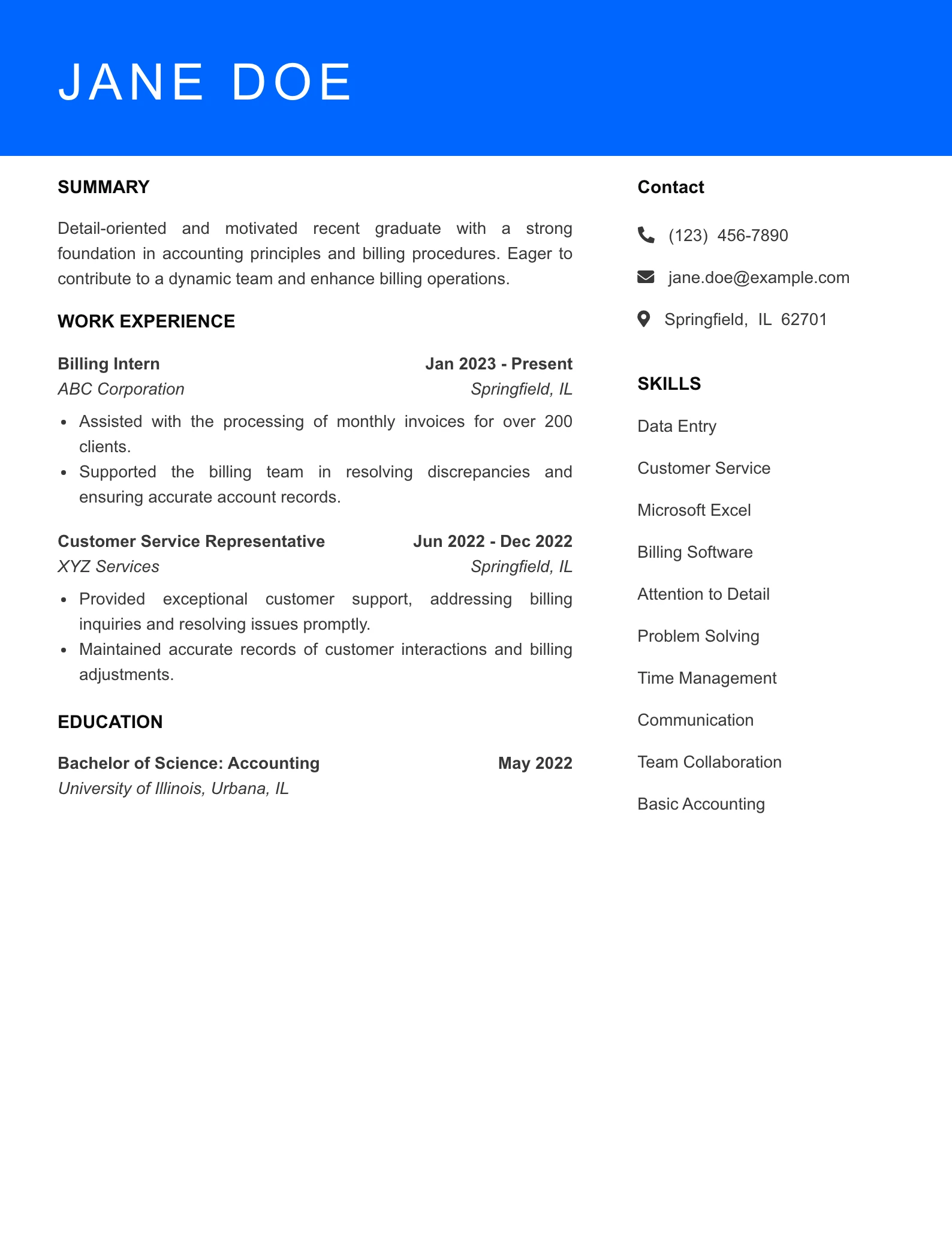

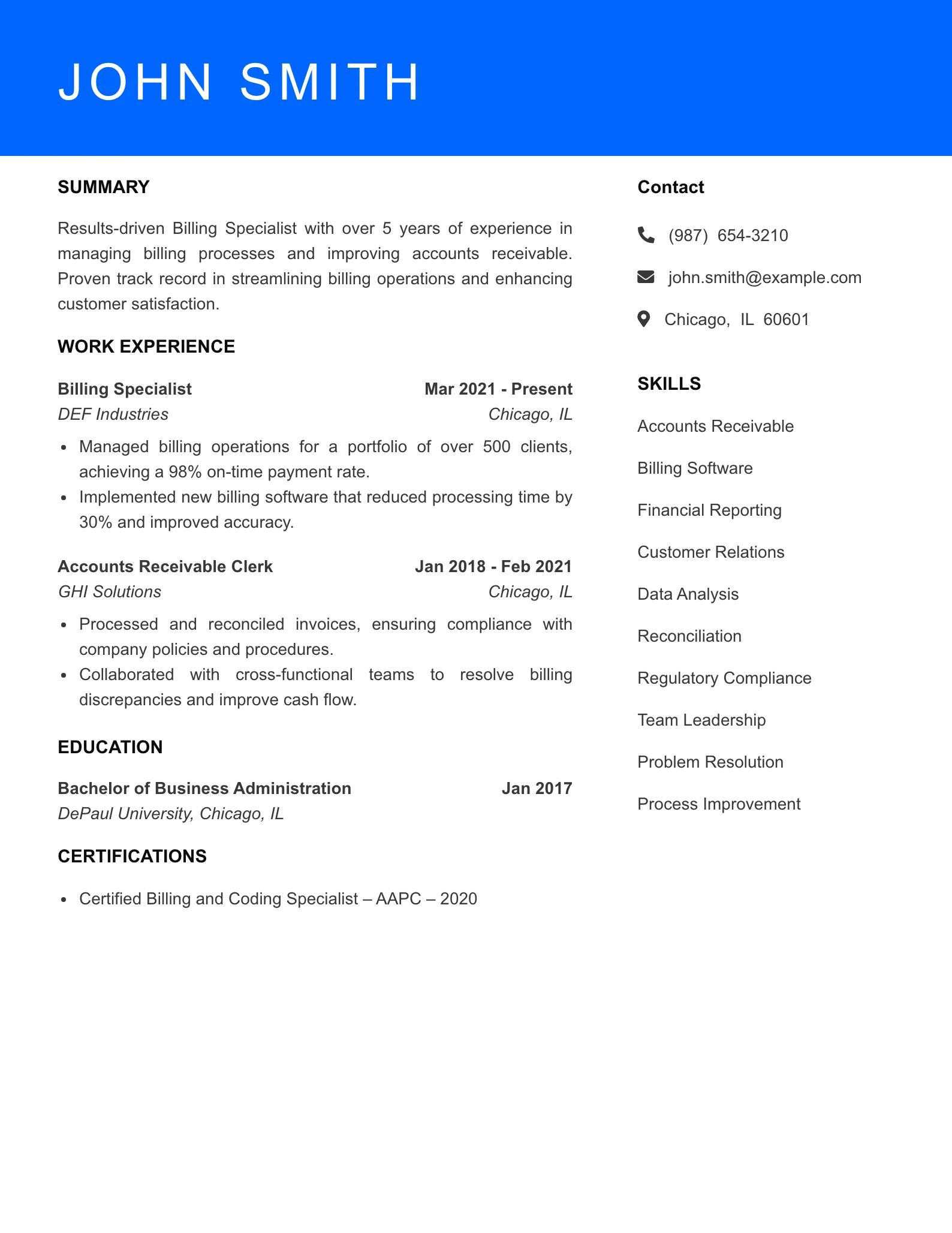

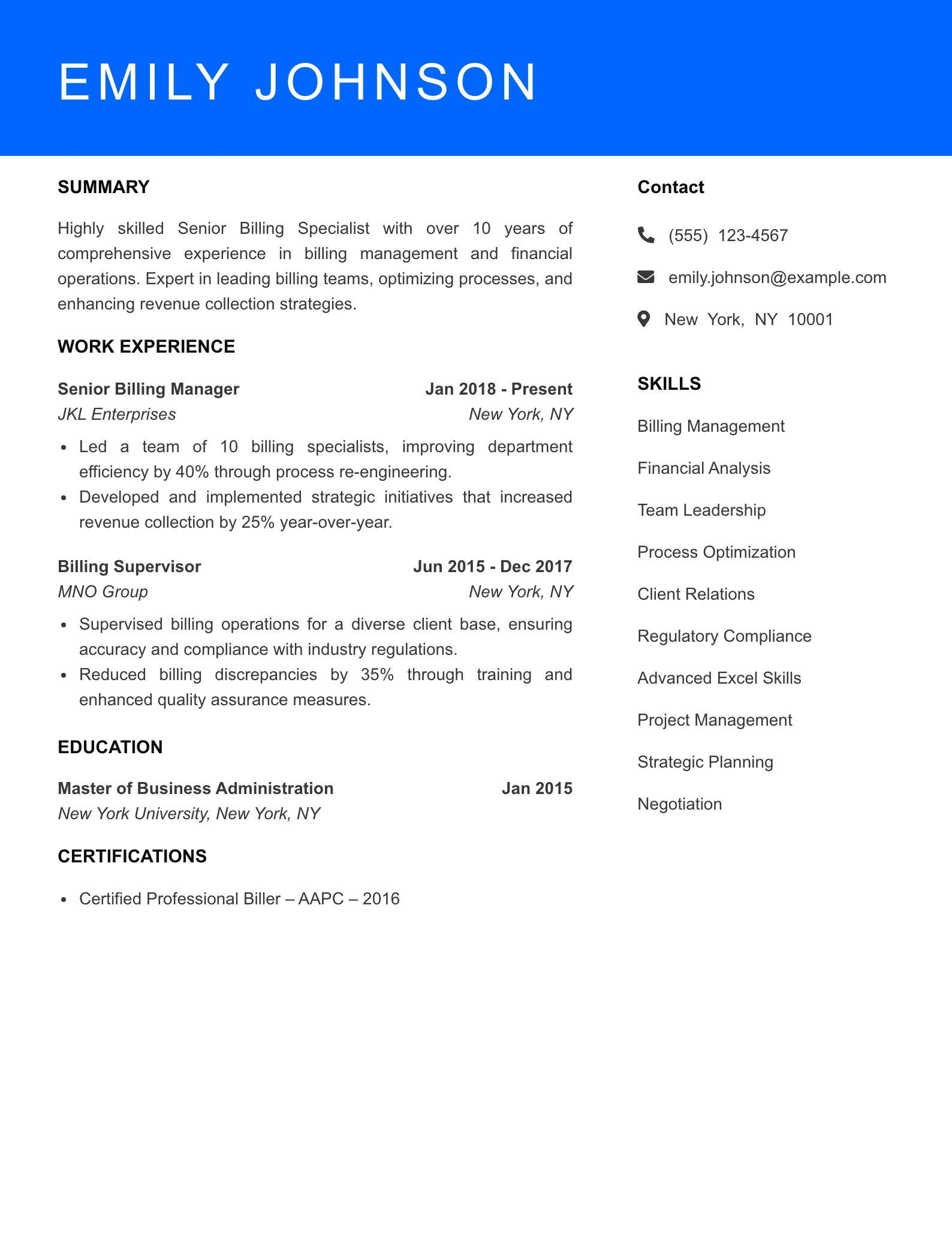

- Billing Specialist Resume Example

Your Guide to Finance Resumes That Get Noticed

Crafting a resume that stands out in the finance industry

In the competitive world of finance, having a well-crafted resume can be the key to unlocking your next career opportunity. This page serves as your comprehensive resource for creating effective finance resumes that capture the attention of hiring managers and help you land interviews.

Introduction to the Job Sector

In the finance sector, a strong resume is more than a summary of your work history; it is a critical marketing tool that showcases your skills, achievements, and potential value to prospective employers. Finance professionals are often competing for limited positions, making a polished and targeted resume essential for standing out among applicants. Hiring managers typically look for specific qualifications and experiences that demonstrate a candidate’s ability to navigate the complexities of financial analysis, investment strategies, or account management.

On this page, you will find a wealth of resources tailored to the finance industry, including curated resume examples, essential tips for crafting a standout document, and insights into the skills and certifications that can elevate your application. Whether you are a seasoned finance executive or an entry-level analyst, we are here to guide you on how to effectively present your financial expertise.

Employment Trends and Statistics

- The finance industry is projected to grow approximately 5% from 2021 to 2031, creating nearly 750,000 new jobs.

- High-demand roles include financial analysts, personal financial advisors, and compliance officers, reflecting the industry’s evolving regulatory landscape.

- The average salary for a financial analyst in the United States is around $83,000 per year, with entry-level positions starting at approximately $58,000.

- The demand for Certified Financial Planners (CFP) is on the rise, with a projected job growth rate of 22% over the next decade.

- The finance sector is increasingly valuing technology skills, with proficiency in financial modeling software and data analytics becoming essential for many roles.

Resume Tips for Finance Professionals

To create a compelling finance resume, consider the following must-have elements:

- Quantify Achievements: Use numbers to demonstrate your impact, such as highlighting cost savings you achieved or revenue growth you facilitated.

- Relevant Certifications: Include any certifications (e.g., CFA, CPA, CFP) that are relevant to the finance roles you are targeting, as they can set you apart from other candidates.

- Tailored Skills Section: Emphasize skills that are in demand, such as financial analysis, risk management, and proficiency in financial software (e.g., Excel, QuickBooks).

- Concise Formatting: Utilize clear headings and bullet points to make your resume easy to read and visually appealing, ensuring that critical information is easily accessible.

- Professional Summary: Start with a strong professional summary that encapsulates your experience, skills, and what you bring to the table, tailored to the finance sector.

- Use Action Verbs: Begin each bullet point with strong action verbs (e.g., “analyzed,” “developed,” “managed”) to convey your contributions effectively and make your resume dynamic.

By implementing these tips, you will be well on your way to creating a finance resume that not only gets noticed but also opens doors to exciting career opportunities.

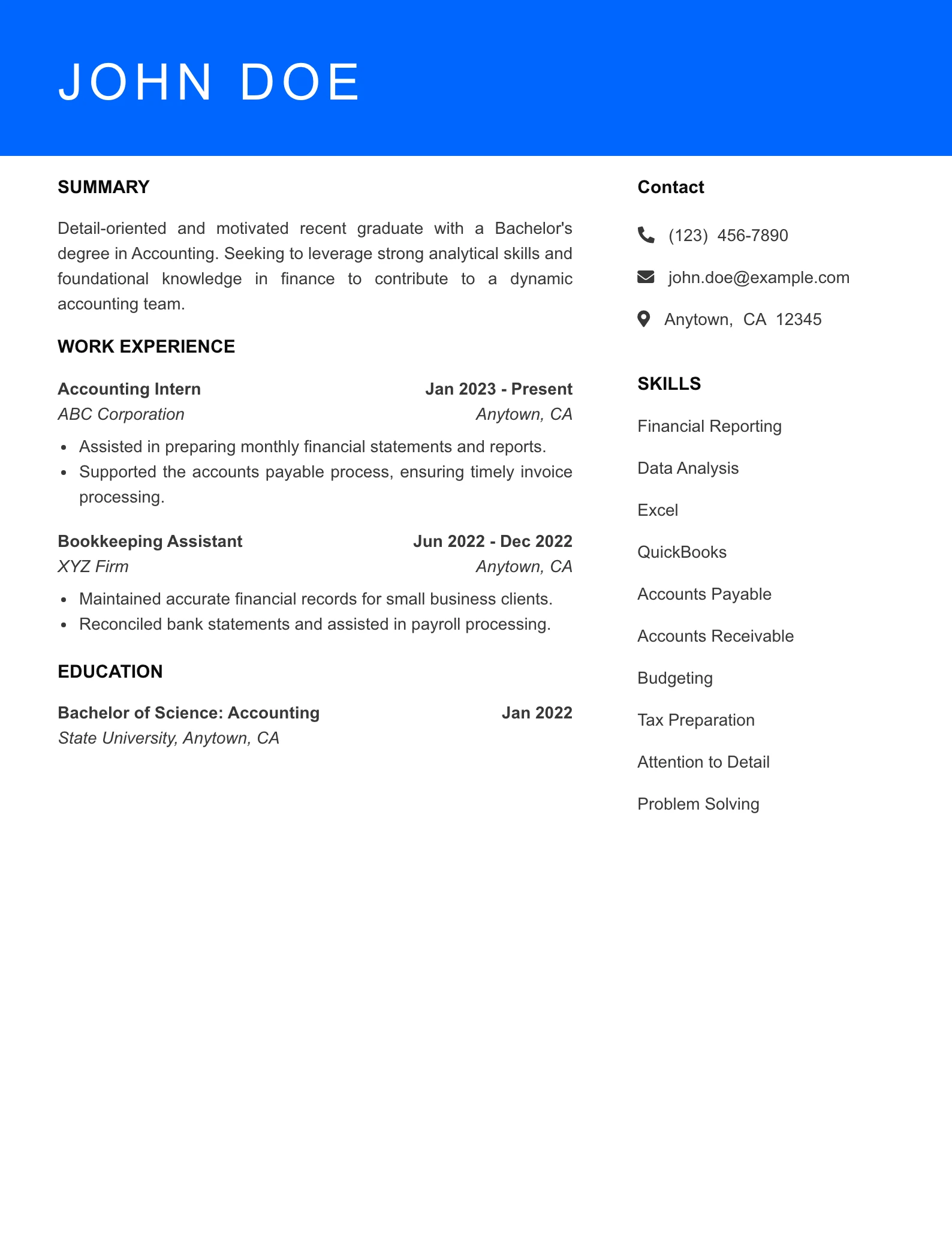

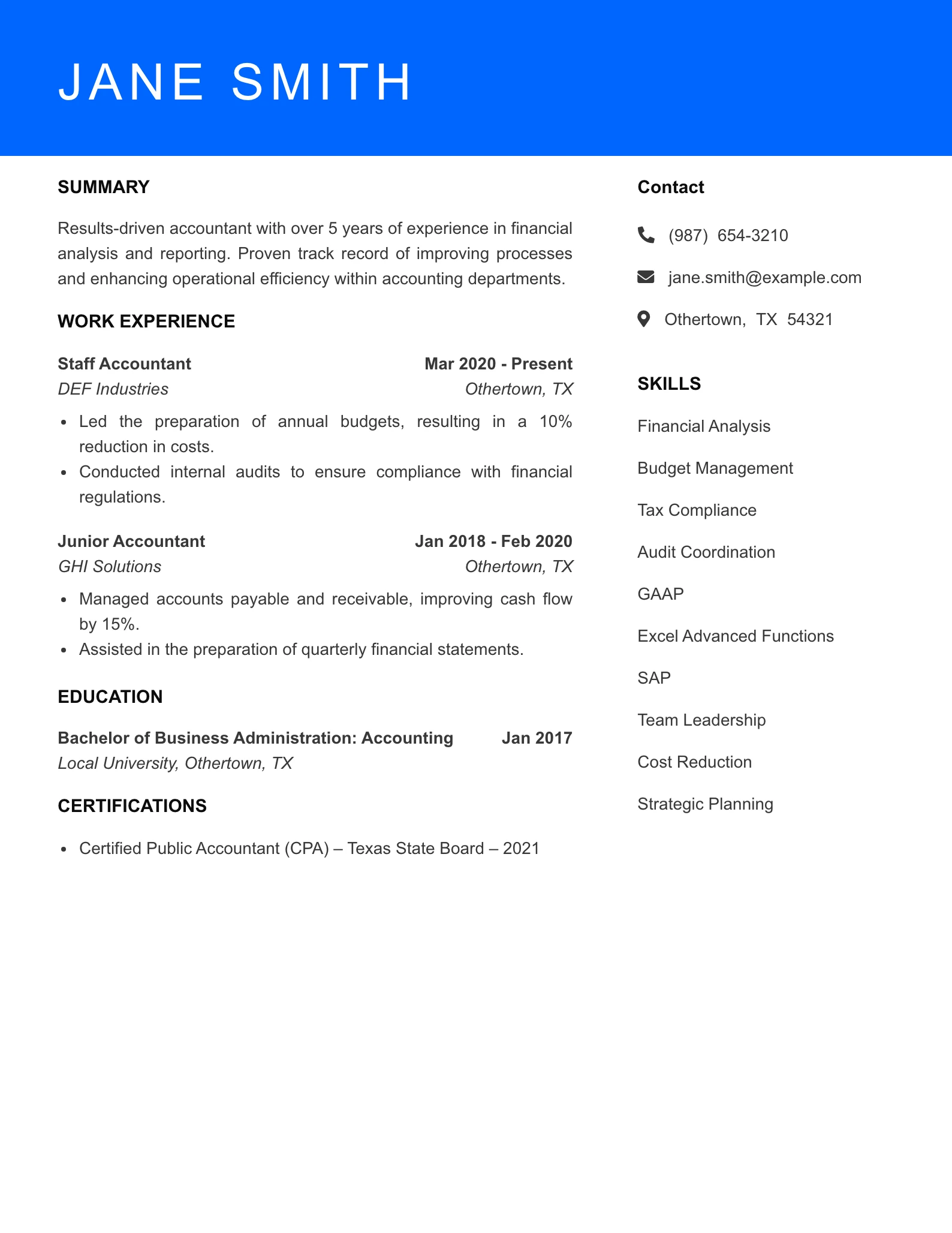

Accountant Resume Examples

Accountant Resume Examples

Your pathway to a standout accounting career

Crafting a compelling resume is crucial for accountants seeking to land their ideal positions in a competitive job market. Explore our tailored accountant resume examples to ensure your qualifications shine.

The Importance of Resumes in the Accounting Sector

In the accounting field, where precision and professionalism are paramount, a well-structured resume serves as your first impression to potential employers. Resumes not only showcase your technical skills and qualifications but also reflect your attention to detail and ability to communicate effectively. As hiring managers sift through numerous applications, a strong resume can set you apart, highlighting your expertise and suitability for the role.

Hiring managers in the accounting industry typically look for specific skills and attributes that indicate a candidate’s potential to succeed in their organization. Key factors include relevant educational background, certifications (such as CPA), technical proficiency in accounting software, and experience in financial analysis or reporting. A comprehensive understanding of tax regulations and compliance is also highly valued. This page provides examples of successful accountant resumes and valuable insights to help you create a standout application.

Within this resource, you will find various resume examples tailored for different accounting roles, from entry-level positions to seasoned professionals, along with tips on what to include and how to format your resume effectively. Whether you’re applying for a role in public accounting, corporate finance, or auditing, we’ve got you covered.

Employment Trends and Statistics

- The employment of accountants and auditors is projected to grow 6% from 2021 to 2031, faster than the average for all occupations.

- As of 2023, the average salary for accountants in the United States is approximately $77,000 per year, with potential for higher earnings in specialized areas.

- Demand for accountants with expertise in tax preparation and compliance is particularly high as businesses navigate complex tax laws.

- A significant percentage (over 50%) of job postings for accountants require proficiency in accounting software such as QuickBooks, SAP, or Oracle.

- The rise of remote work has opened new opportunities for accountants, with many companies offering flexible positions in an increasingly digital landscape.

Resume Tips for Accountant Resume Examples Professionals

To create a resume that captures the attention of hiring managers in the accounting field, consider the following essential elements:

- Relevant Certifications: Highlight certifications such as CPA (Certified Public Accountant), CMA (Certified Management Accountant), or CFP (Certified Financial Planner) to demonstrate your expertise.

- Tailored Skills Section: Include skills that are in high demand, such as proficiency in accounting software, analytical thinking, attention to detail, and knowledge of tax laws.

- Quantifiable Achievements: Use specific examples and metrics to showcase your accomplishments, such as improving financial processes or reducing audit discrepancies by a percentage.

- Professional Formatting: Utilize a clean, organized layout that makes it easy for hiring managers to quickly scan your resume. Use clear headings and bullet points for readability.

- Experience with Financial Statements: Ensure to detail your experience in preparing and analyzing financial statements, as this is a critical aspect of most accounting roles.

- Continuous Education: Mention any ongoing professional development or courses taken related to emerging trends in accounting, such as blockchain or data analytics.

By implementing these strategies, you can craft an accountant resume that effectively markets your qualifications and aligns with industry expectations.

See More Accountant Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

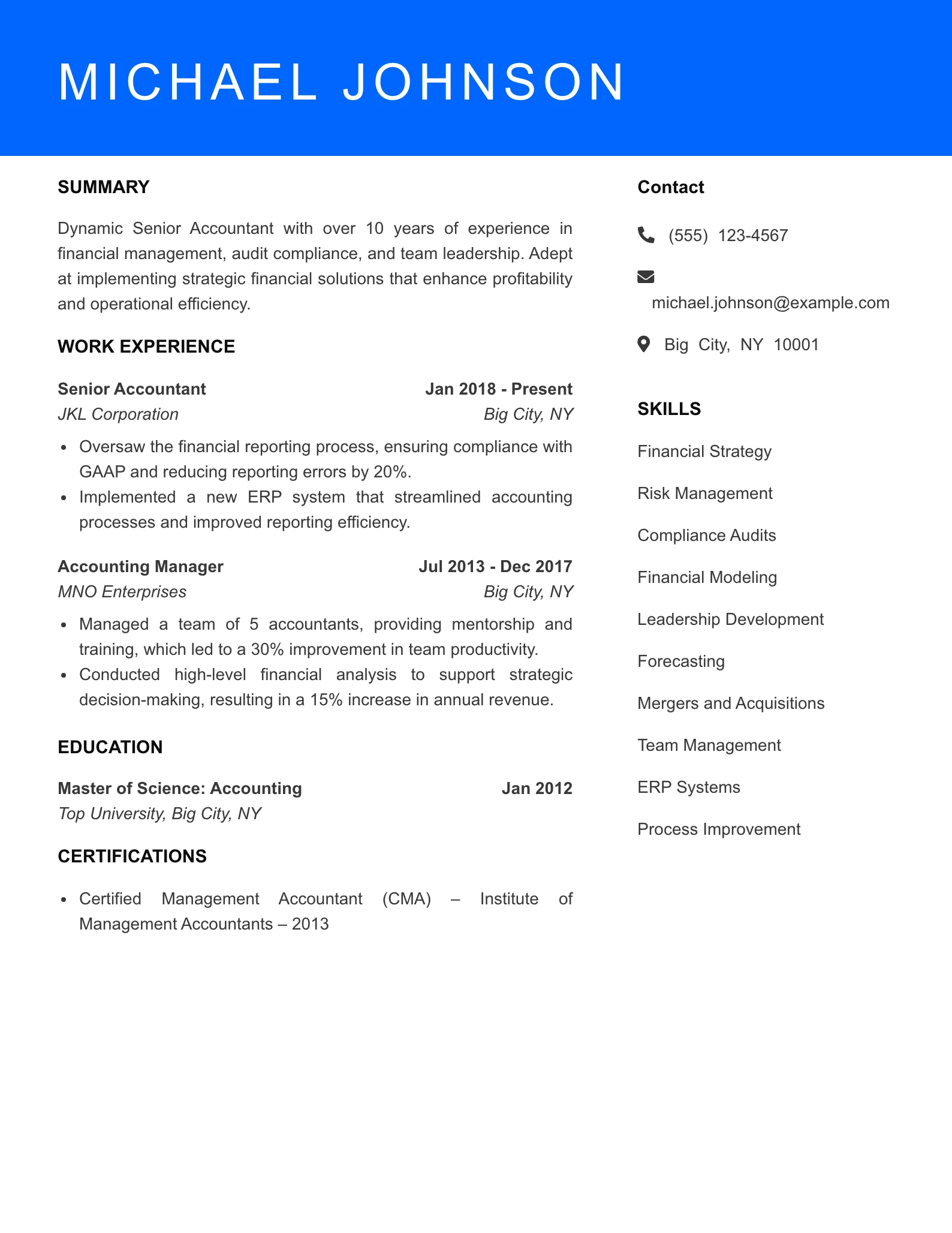

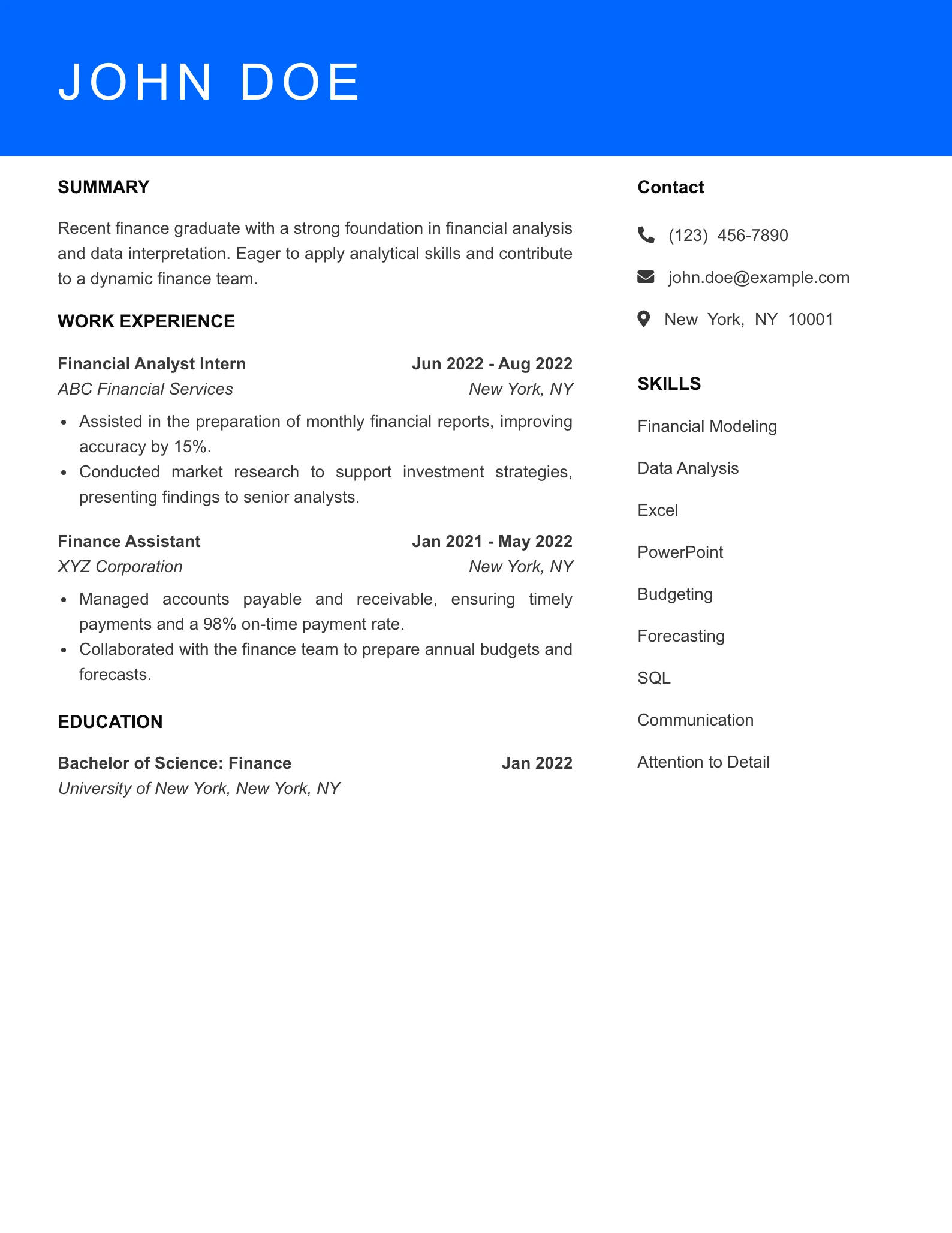

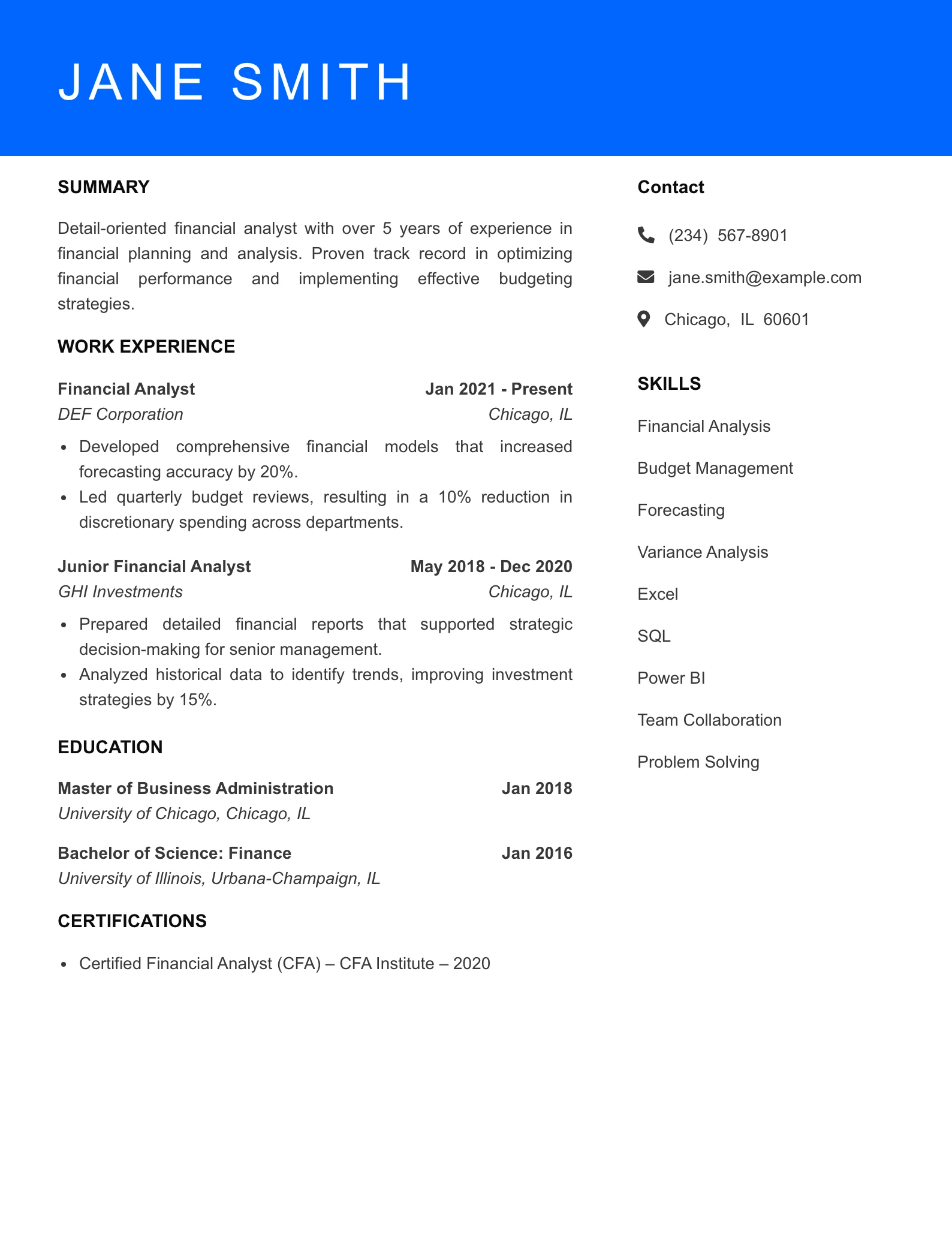

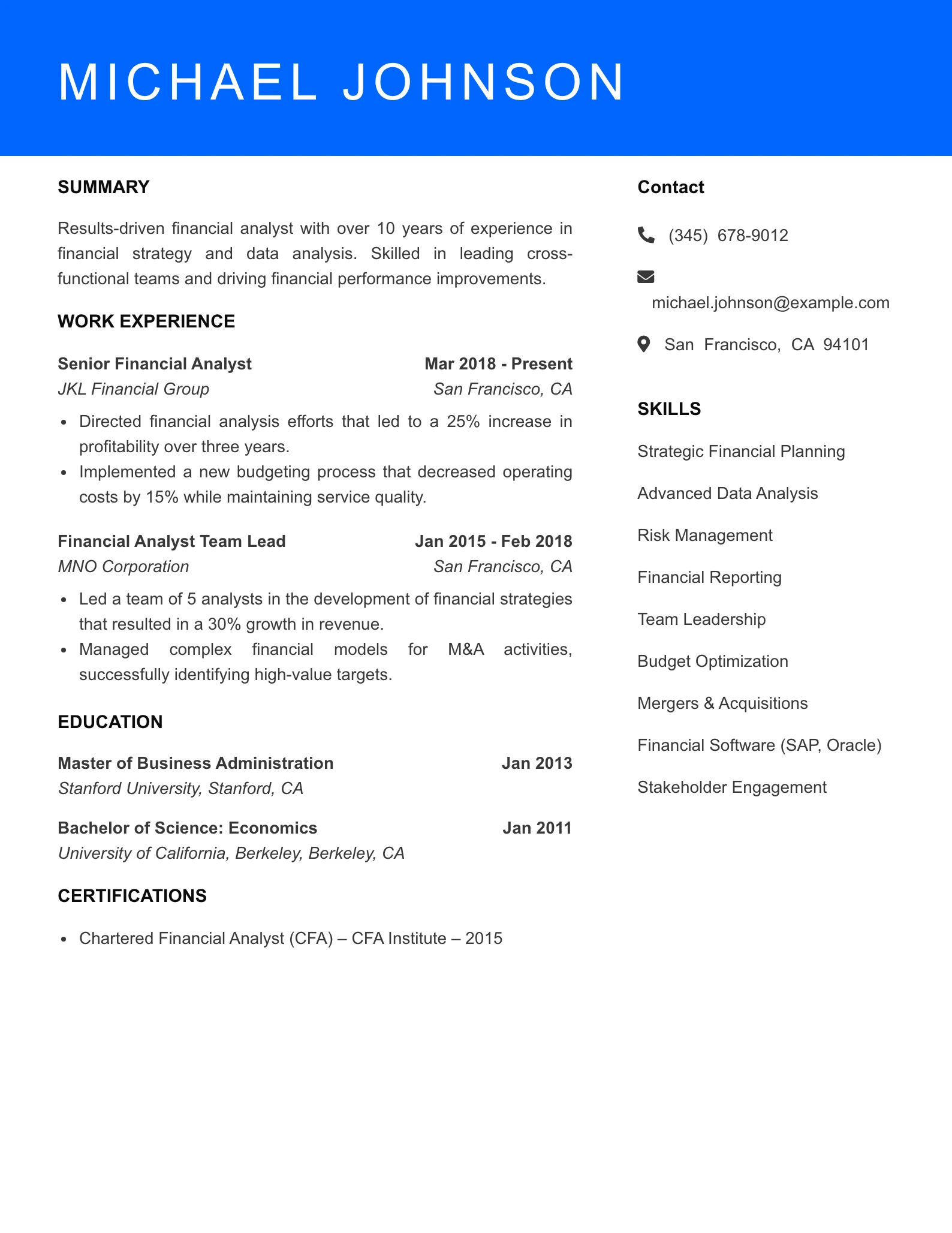

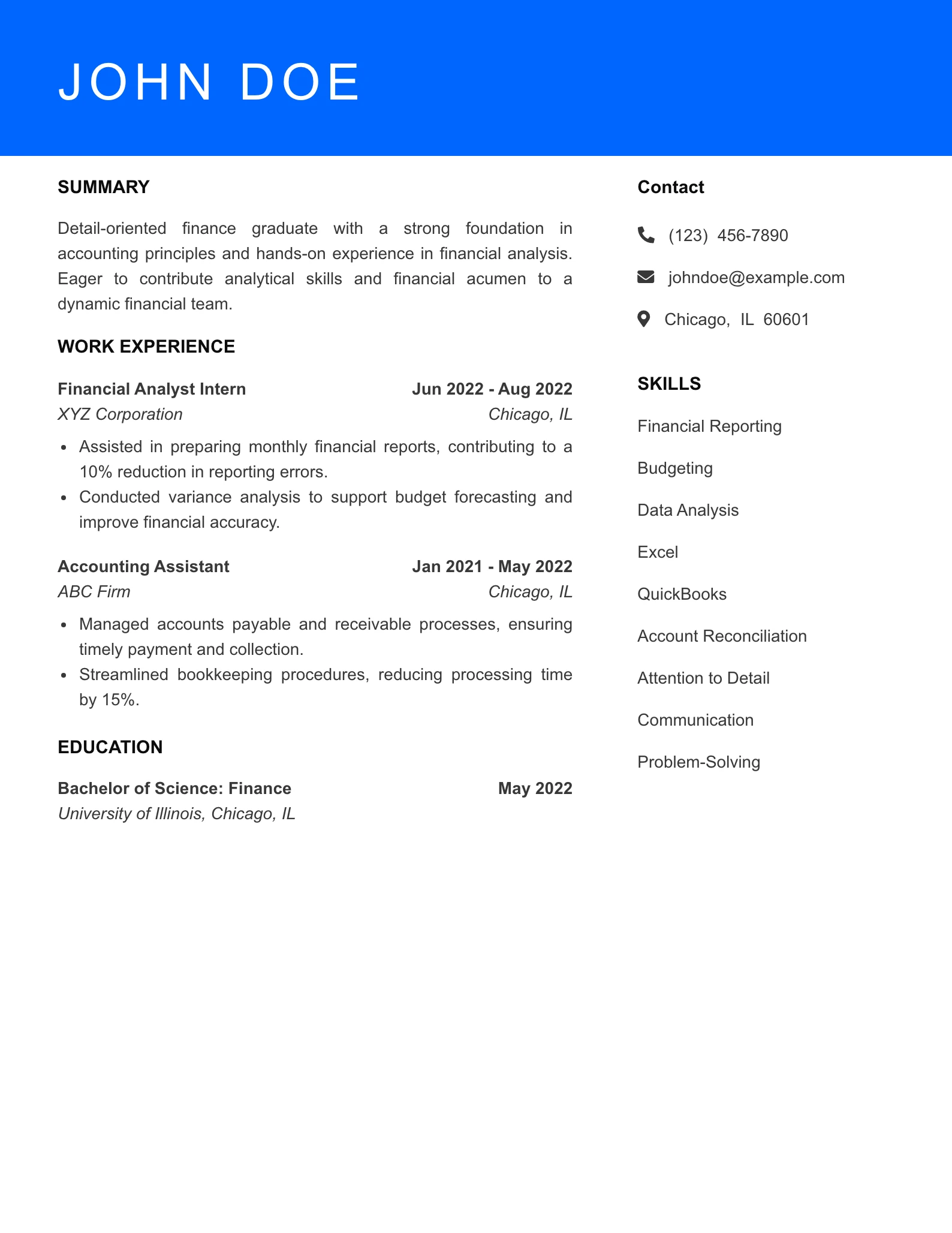

Financial Analyst Resume Examples

Your Guide to Crafting a Winning Financial Analyst Resume

Unlock your potential in the financial sector with expertly crafted resume examples designed to impress hiring managers and land your dream job as a Financial Analyst.

Understanding the Financial Analyst Job Sector

In the competitive realm of finance, a well-structured resume is your ticket to standing out among a sea of candidates. Hiring managers sift through countless applications, and a polished resume that clearly highlights your qualifications, experience, and skills is crucial for making a lasting impression. As a Financial Analyst, your ability to analyze data, forecast trends, and provide strategic insights is of paramount importance, and your resume must effectively convey these capabilities.

Hiring managers typically look for candidates who not only have a strong educational background in finance, accounting, or a related field but also possess relevant experience and certifications, like the CFA or CPA. They seek candidates who can demonstrate proficiency in data analysis tools and software, effective communication skills, and a proven ability to provide actionable recommendations based on financial data. On this page, you’ll find a variety of resume examples tailored for Financial Analysts, along with insights into what makes each resume effective.

Employment Trends and Statistics

- Job Growth: The employment of financial analysts is projected to grow 6% from 2021 to 2031, faster than the average for all occupations.

- High Demand: As companies seek to navigate an increasingly complex financial landscape, demand for skilled financial analysts remains high, particularly in sectors like healthcare, technology, and investment services.

- Average Salary: The median annual wage for financial analysts was approximately $95,570 as of May 2022, with top earners in the field making well over $150,000.

- Diverse Opportunities: Financial analysts can specialize in various roles, including investment banking, risk analysis, and portfolio management, providing a wide range of career paths within the industry.

- Remote Work Trends: The rise of remote work has also opened up new opportunities for financial analysts, allowing professionals to seek employment from companies nationwide, regardless of location.

Resume Tips for Financial Analyst Professionals

To ensure your resume captures the attention of hiring managers in the finance field, consider the following essential elements:

- Education: Clearly list your degree(s) in finance, accounting, economics, or business administration, along with any relevant coursework.

- Certifications: Highlight any certifications such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant), as these credentials can set you apart from other candidates.

- Technical Skills: Include proficiency in financial software (like Excel or SQL), data visualization tools (such as Tableau), and any relevant programming languages (like Python or R).

- Quantifiable Achievements: Use numbers and statistics to demonstrate your impact in previous roles—e.g., “Increased forecasting accuracy by 20% through data analysis.”

- Format Matters: Keep your resume clean and professional with clear headings, bullet points for easy reading, and consistent formatting to enhance readability.

- Tailored Content: Customize your resume for each job application, incorporating keywords from the job description to align your skills and experiences with the specific requirements of the position.

By following these tips and utilizing the resume examples provided, you can create a compelling resume that highlights your strengths and aligns with the expectations of hiring managers in the financial sector.

See More Financial Analyst Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

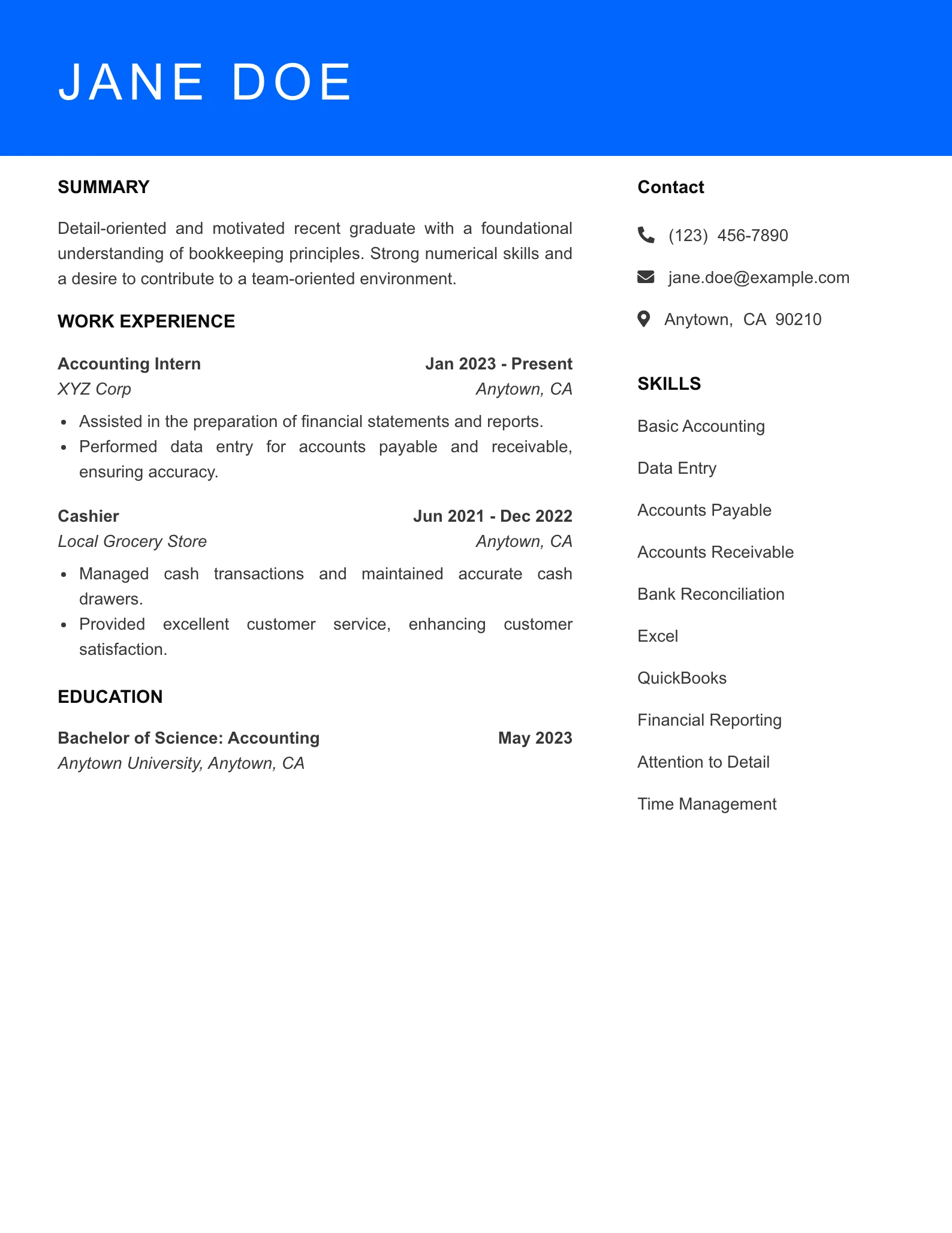

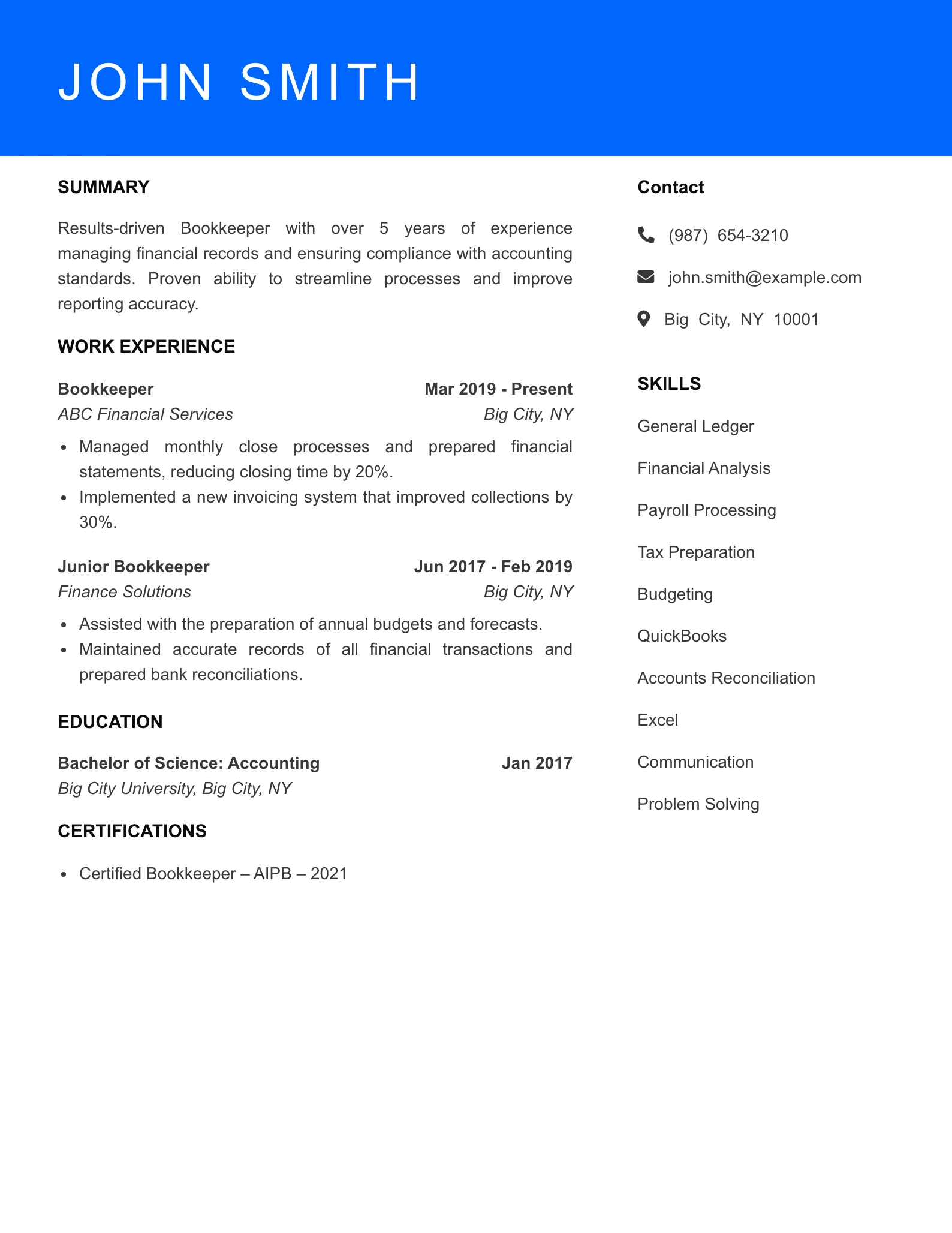

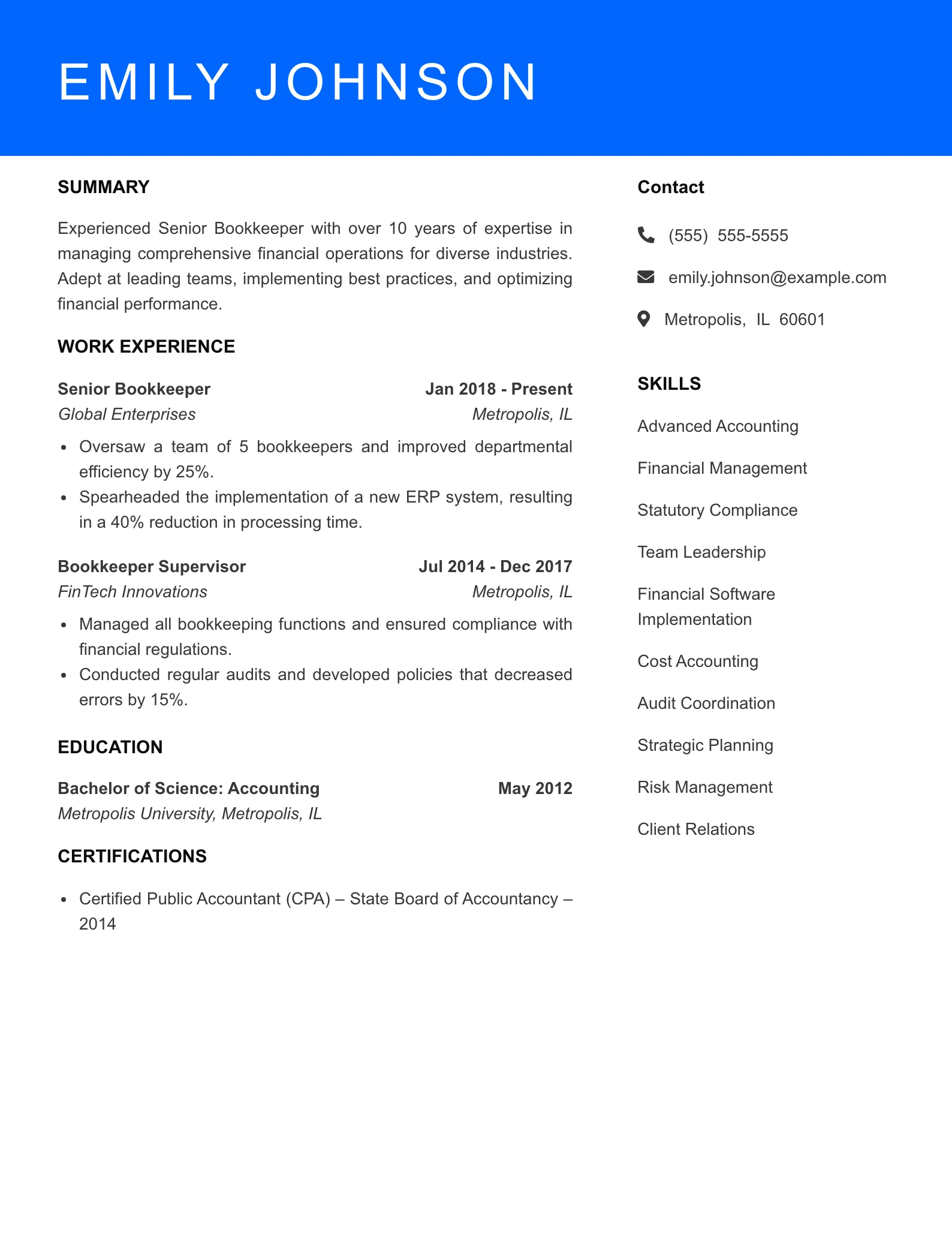

Bookkeeper Resume Examples

Bookkeeper Resume Examples

Unlock your potential in the bookkeeping field with expertly crafted resume examples tailored to your career goals.

Introduction to the Job Sector

In the competitive landscape of accounting and finance, a strong resume is paramount for aspiring bookkeepers. With companies increasingly relying on accurate financial records, the demand for skilled bookkeepers is on the rise. A well-structured resume not only highlights your qualifications and experience but also demonstrates your attention to detail—a critical trait for any bookkeeping professional. Hiring managers meticulously review resumes to identify candidates who possess both the technical skills and the soft skills necessary for success in this role.

When evaluating potential hires, employers typically seek candidates who exhibit proficiency in accounting software, an understanding of tax regulations, and a commitment to maintaining financial accuracy. Additionally, attributes such as strong organizational skills and effective communication capabilities often stand out. On this page, you will find a variety of resume examples tailored specifically for bookkeepers, along with insights into effective strategies for crafting your resume to catch the eye of hiring managers.

Employment Trends and Statistics

- The employment of bookkeeping, accounting, and auditing clerks is projected to grow by 6% from 2021 to 2031, which is faster than the average for all occupations.

- The median annual wage for bookkeepers in the United States was approximately $45,560 in May 2022, making it a viable career option for many.

- Job openings for bookkeeping professionals are expected to arise from the need to replace workers who transfer to different occupations or retire.

- Industries such as healthcare, educational services, and retail are witnessing increased demand for skilled bookkeeping professionals to manage their financial records effectively.

Resume Tips for Bookkeeper Resume Examples Professionals

To create a compelling resume in the bookkeeping field, consider incorporating these essential elements:

- Core Competencies: Highlight key skills such as proficiency in accounting software (e.g., QuickBooks, Xero), financial reporting, and tax preparation.

- Certifications: Include relevant certifications, such as Certified Bookkeeper (CB), which demonstrate your expertise and commitment to the field.

- Tailored Experience: Clearly outline your bookkeeping experience, detailing specific achievements, such as reducing discrepancies by a certain percentage or managing budgets.

- Formatting: Use a clean, professional format with clear headings and bullet points, ensuring that your resume is easy to read and navigate.

- Soft Skills: Don’t overlook the importance of soft skills; mentioning your attention to detail, problem-solving abilities, and communication skills can give you an edge.

- Continued Education: If applicable, include any ongoing education or training that adds value to your profile, such as workshops in accounting principles or software updates.

By following these resume tips, you can effectively showcase your qualifications and stand out in the competitive bookkeeping job market.

See More Bookkeeper Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

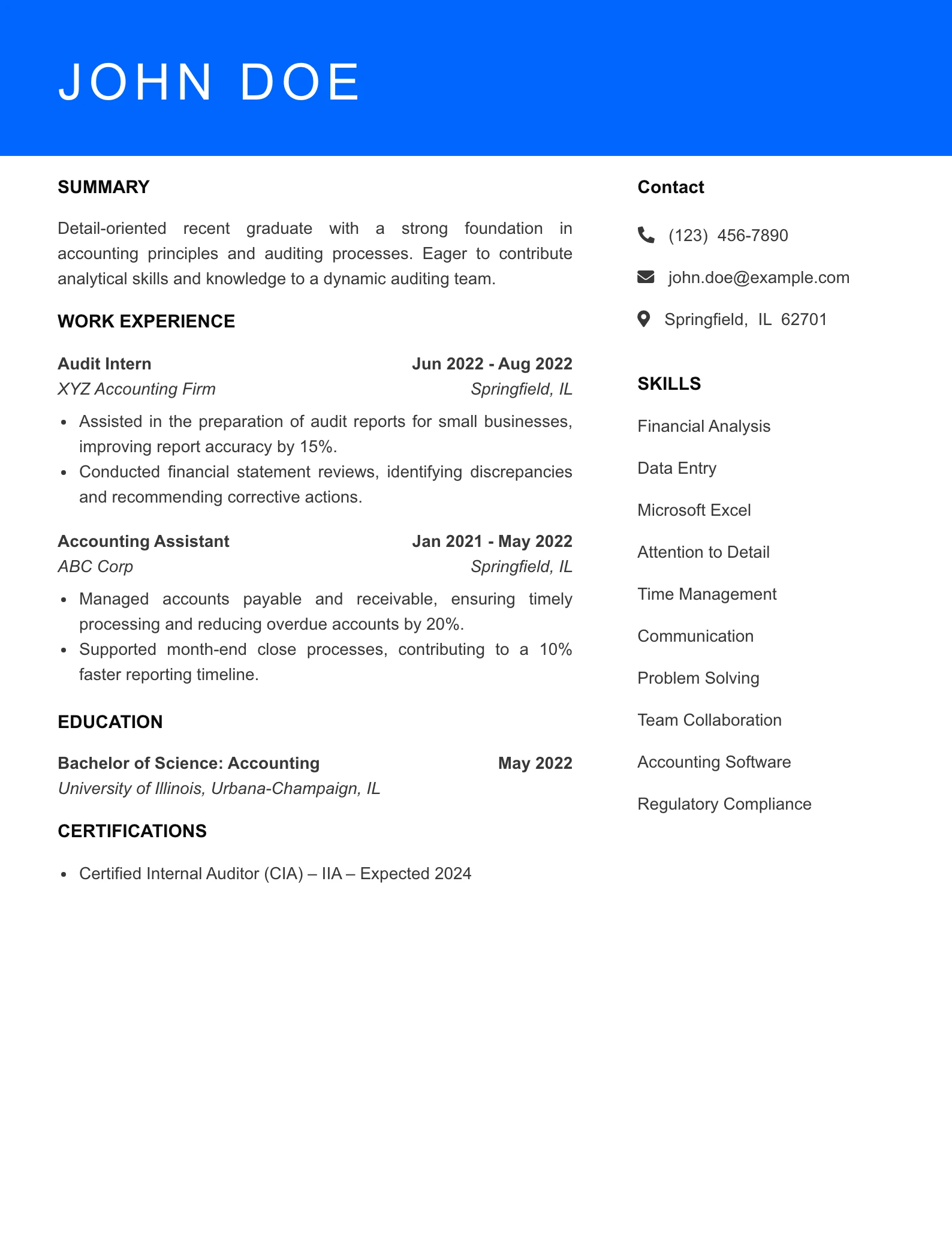

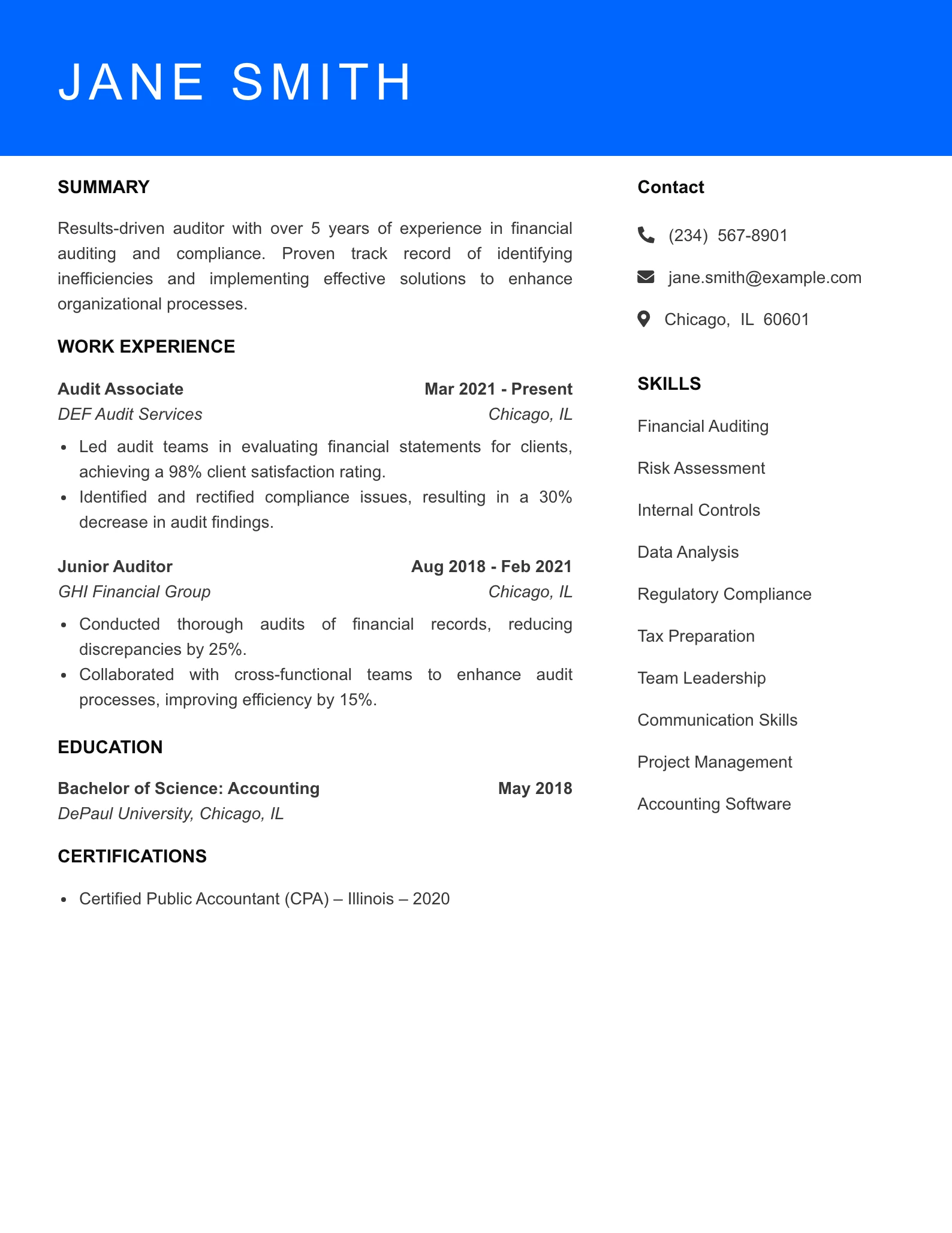

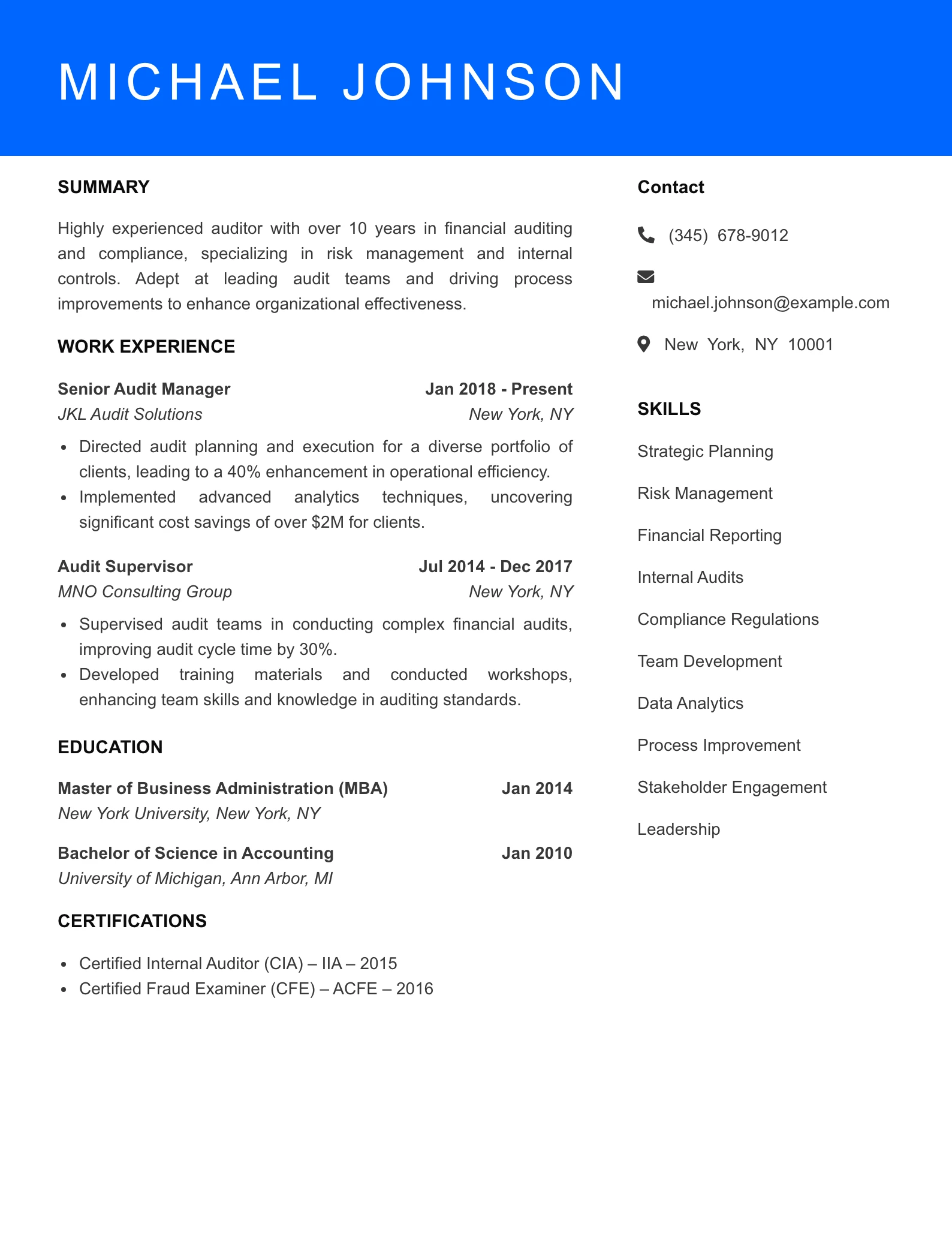

Auditor Resume Examples

Your Path to a Successful Auditor Resume: Crafting Standout Applications

Unlock your potential in the auditing industry with tailored resume examples that highlight your skills and experiences, ensuring you capture the attention of hiring managers.

Understanding the Auditor Job Sector

In the fast-paced world of finance and compliance, a well-crafted resume is essential for aspiring auditors. Given the competitive nature of this field, a standout resume can make a significant difference in securing interviews and job offers. Hiring managers are often inundated with applications, making it crucial to present a clear, concise, and impactful resume that reflects your qualifications and expertise in the auditing domain.

When reviewing resumes, hiring managers typically look for relevant qualifications, including educational background, certifications such as CPA or CIA, and practical experience. They seek candidates who demonstrate strong analytical skills, attention to detail, and the ability to communicate complex financial concepts clearly. On this page, you’ll find a variety of auditor resume examples designed to help you understand how to effectively showcase your unique qualifications and experiences.

Employment Trends and Statistics

- The Bureau of Labor Statistics projects a 10% job growth for auditors and accountants from 2021 to 2031, which is faster than the average for all occupations.

- The median annual wage for auditors as of May 2022 was approximately $77,250, with top earners making over $100,000 yearly.

- Demand for auditors in sectors such as healthcare, technology, and environmental compliance continues to rise, driven by regulatory requirements and the need for transparency.

- Many companies are seeking candidates with specialized skills in data analytics and technology to adapt to evolving audit processes and methodologies.

- Remote and flexible work options are increasingly common in the auditing field, reflecting broader employment trends post-pandemic.

Resume Tips for Auditor Resume Examples Professionals

Crafting an impactful auditor resume requires attention to detail and an understanding of what employers prioritize. Here are essential elements to include:

- Certifications: Highlight relevant certifications such as Certified Public Accountant (CPA), Certified Internal Auditor (CIA), or Certified Information Systems Auditor (CISA) to demonstrate your qualifications.

- Tailored Skills: Emphasize technical skills (e.g., proficiency in audit software like ACL or IDEA), analytical abilities, and soft skills, such as communication and teamwork, that are crucial in auditing roles.

- Quantifiable Achievements: Use metrics to showcase your accomplishments, such as “Reduced audit processing time by 20% through the implementation of new software tools.”

- Professional Formatting: Use a clean, professional layout with clear headings, bullet points, and consistent font styles to enhance readability.

- Relevant Experience: Focus on experiences that directly relate to auditing, such as internships, previous jobs, or volunteer work that demonstrates your auditing capabilities and knowledge of accounting principles.

- Customized Content: Tailor your resume for each application to reflect the specific requirements and keywords listed in the job description, increasing your chances of passing applicant tracking systems (ATS).

By following these guidelines and exploring our curated auditor resume examples, you’ll be well on your way to crafting an impressive application that stands out in the competitive job market.

See More Auditor Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

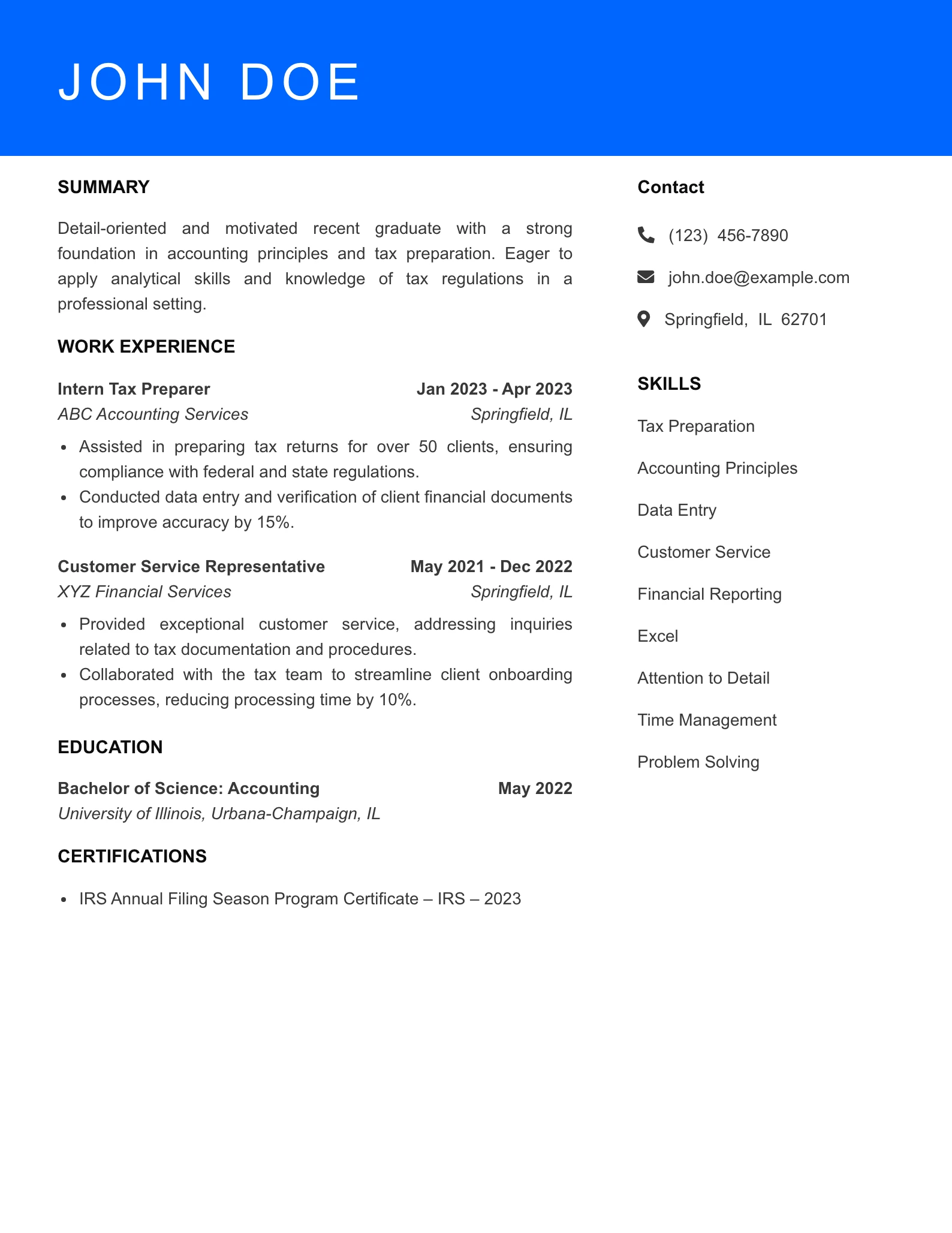

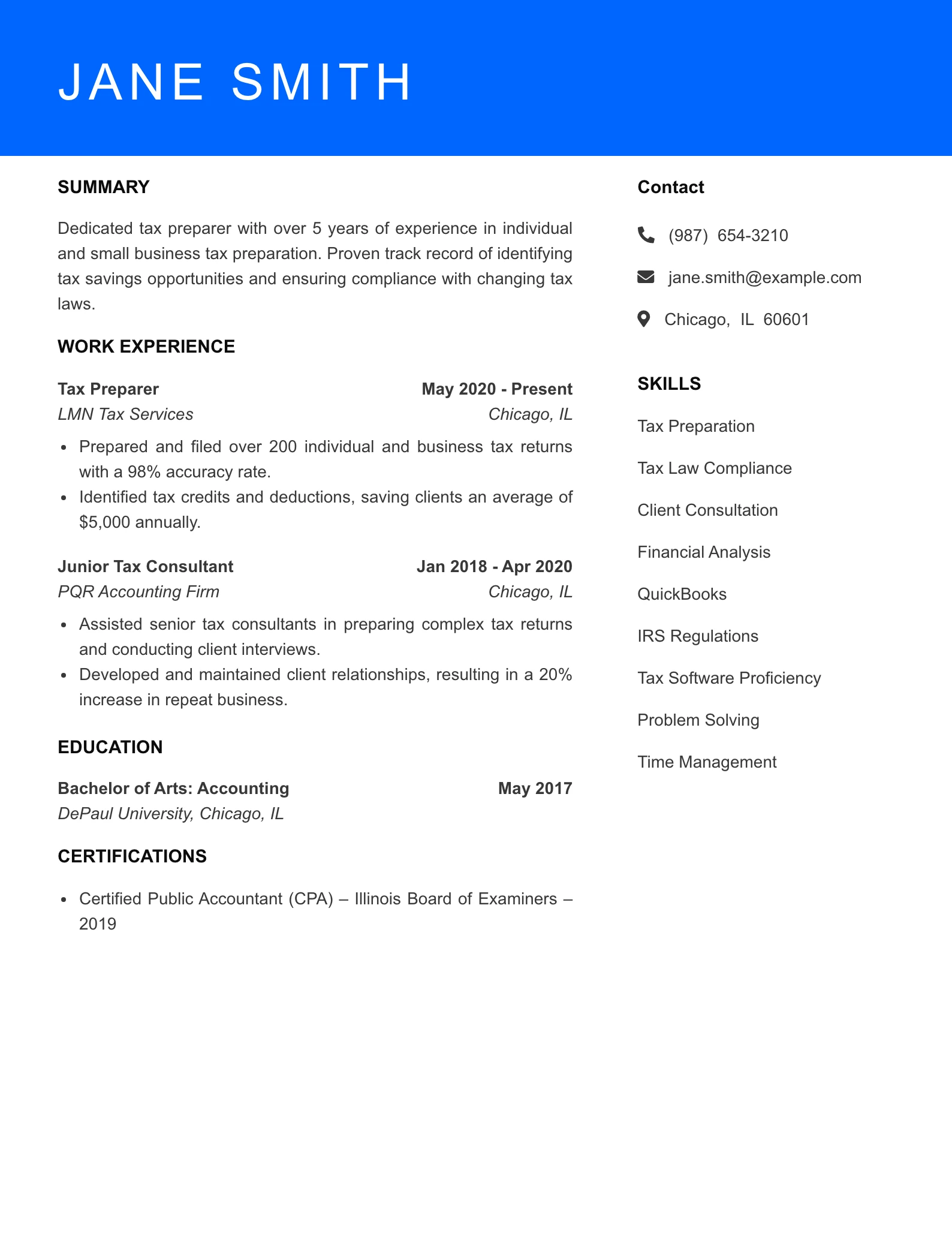

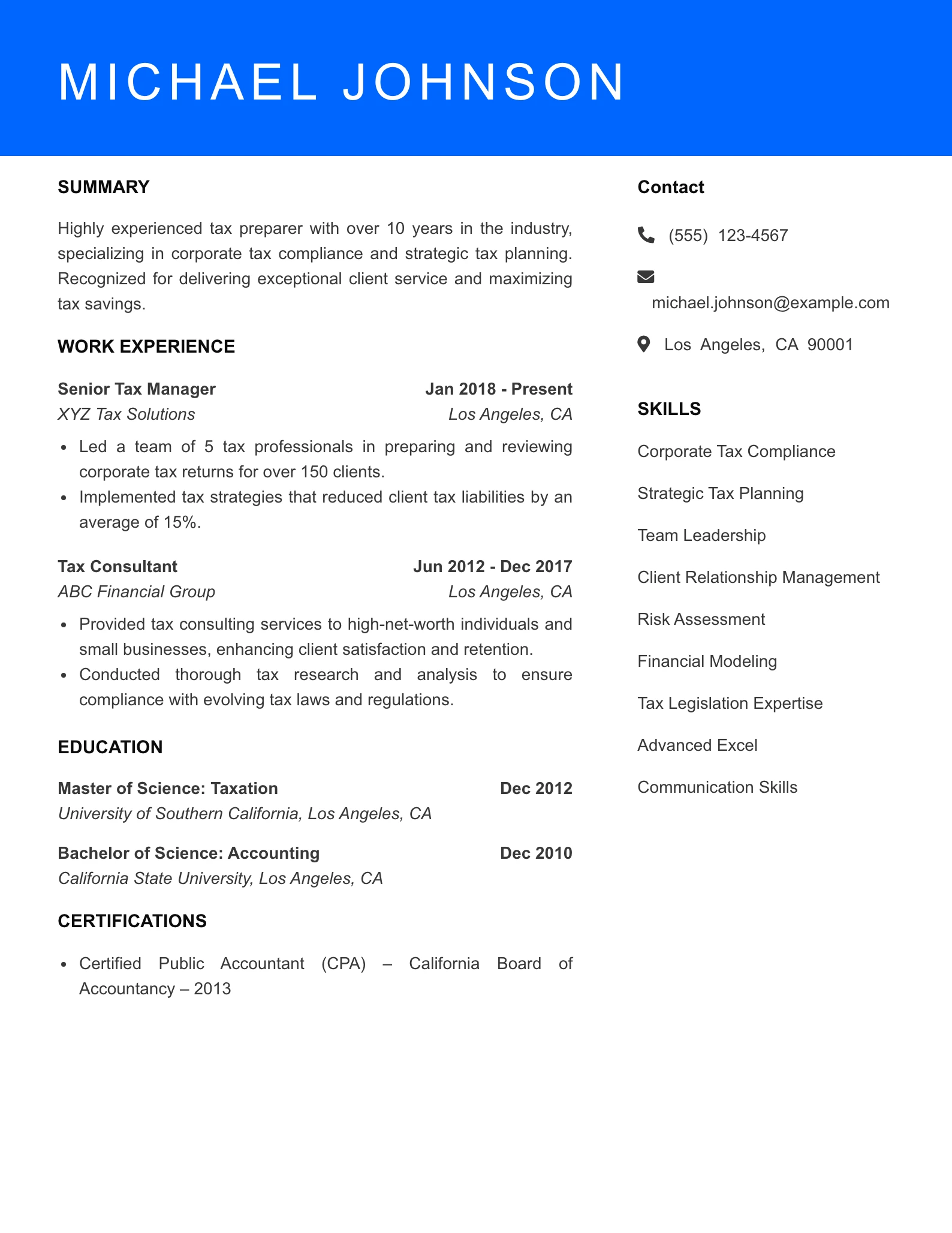

Tax Preparer Resume Examples

Unlock Your Potential as a Tax Preparer

Your resume is your first opportunity to make a lasting impression in the competitive field of tax preparation. Stand out with tailored examples that highlight your skills and experiences.

Understanding the Tax Preparer Job Sector

In the world of tax preparation, a well-crafted resume is essential not just for securing interviews but also for demonstrating your expertise and professionalism. Hiring managers in this field are looking for candidates who possess a blend of technical knowledge, attention to detail, and strong interpersonal skills. A persuasive resume should effectively showcase your qualifications, relevant experience, and any certifications that reinforce your credibility as a tax preparer.

As you explore this page, you will find a variety of resume examples that cater specifically to tax preparers at different levels—ranging from entry-level positions to seasoned professionals. Each example is designed to help you understand how to structure your resume, what information to include, and how to present your skills in a way that appeals to potential employers.

Employment Trends and Statistics

- The Bureau of Labor Statistics projects a growth rate of approximately 4% for tax preparers from 2021 to 2031, reflecting the continued demand for tax-related services.

- The average salary for tax preparers in the United States is around $50,000 per year, but this can vary based on experience, location, and the complexity of the tax services offered.

- Seasonal hiring peaks in January through April, with many firms offering temporary positions for the tax season, providing ample opportunities for both new and experienced tax preparers.

- Approximately 60% of tax preparers are self-employed, allowing for flexible work arrangements and the potential for higher earnings through an established client base.

- Professionals with specialized certifications, such as CPA or EA, often see increased job prospects and higher salaries compared to those without these credentials.

Resume Tips for Tax Preparer Professionals

To create a compelling resume that stands out in the tax preparer industry, consider including the following essential elements:

- Certifications: Highlight any relevant certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA), which can significantly enhance your credibility.

- Technical Skills: Include proficiency in tax software (like TurboTax or H&R Block), as well as knowledge of tax laws and regulations.

- Detail Orientation: Demonstrate your ability to manage complex datasets and provide accurate financial reporting, showcasing your attention to detail.

- Professional Experience: Clearly outline your experience in tax preparation roles, emphasizing specific achievements or successful client outcomes.

- Continuing Education: Mention any ongoing education or training relevant to tax preparation, as this shows your commitment to staying current in the field.

- Strong Communication: Highlight your interpersonal skills, as effective communication with clients is critical in guiding them through the tax preparation process.

By following these tips and utilizing the examples provided, you’ll be well on your way to crafting a resume that effectively showcases your qualifications and sets you apart in the competitive landscape of tax preparation.

See More Tax Preparer Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

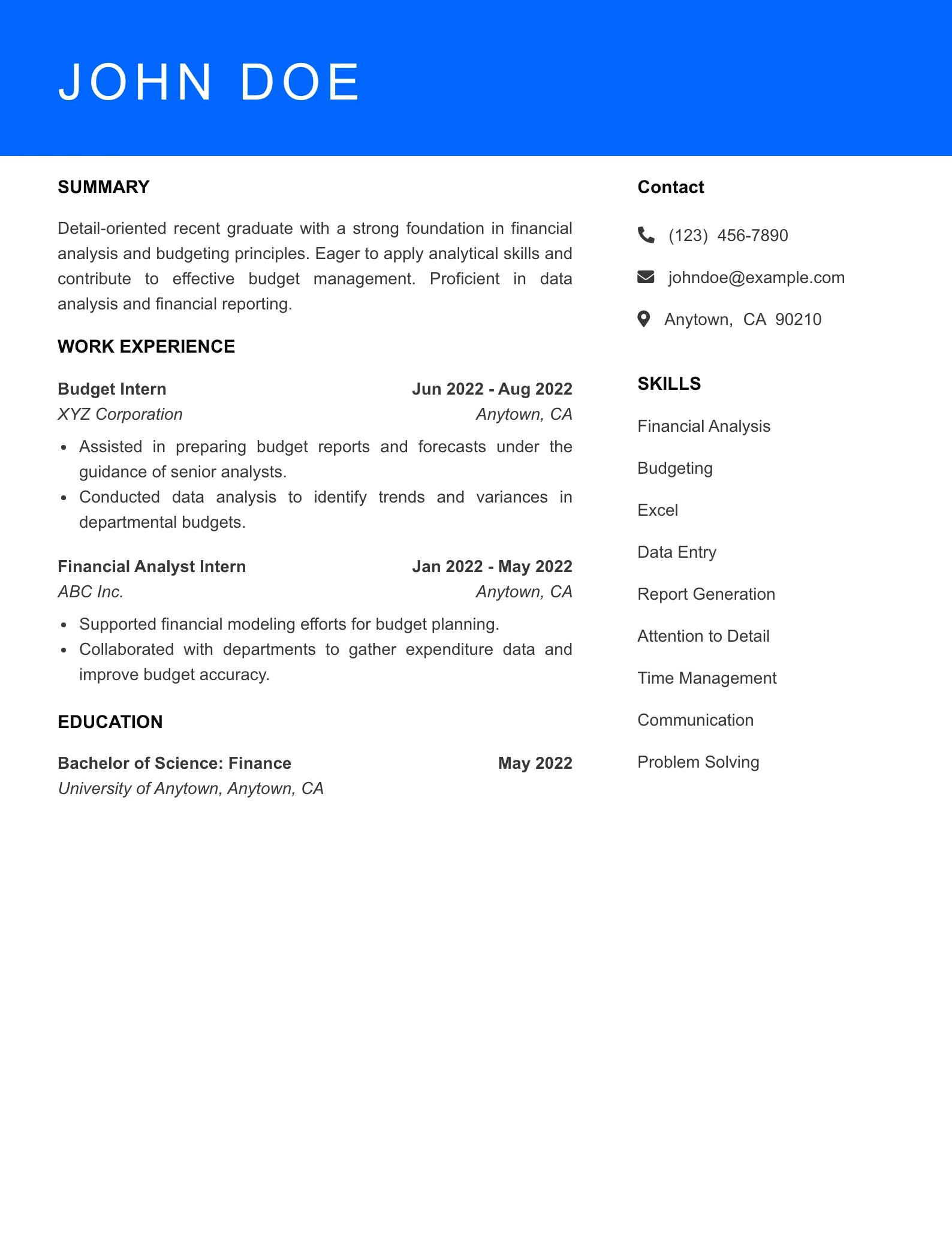

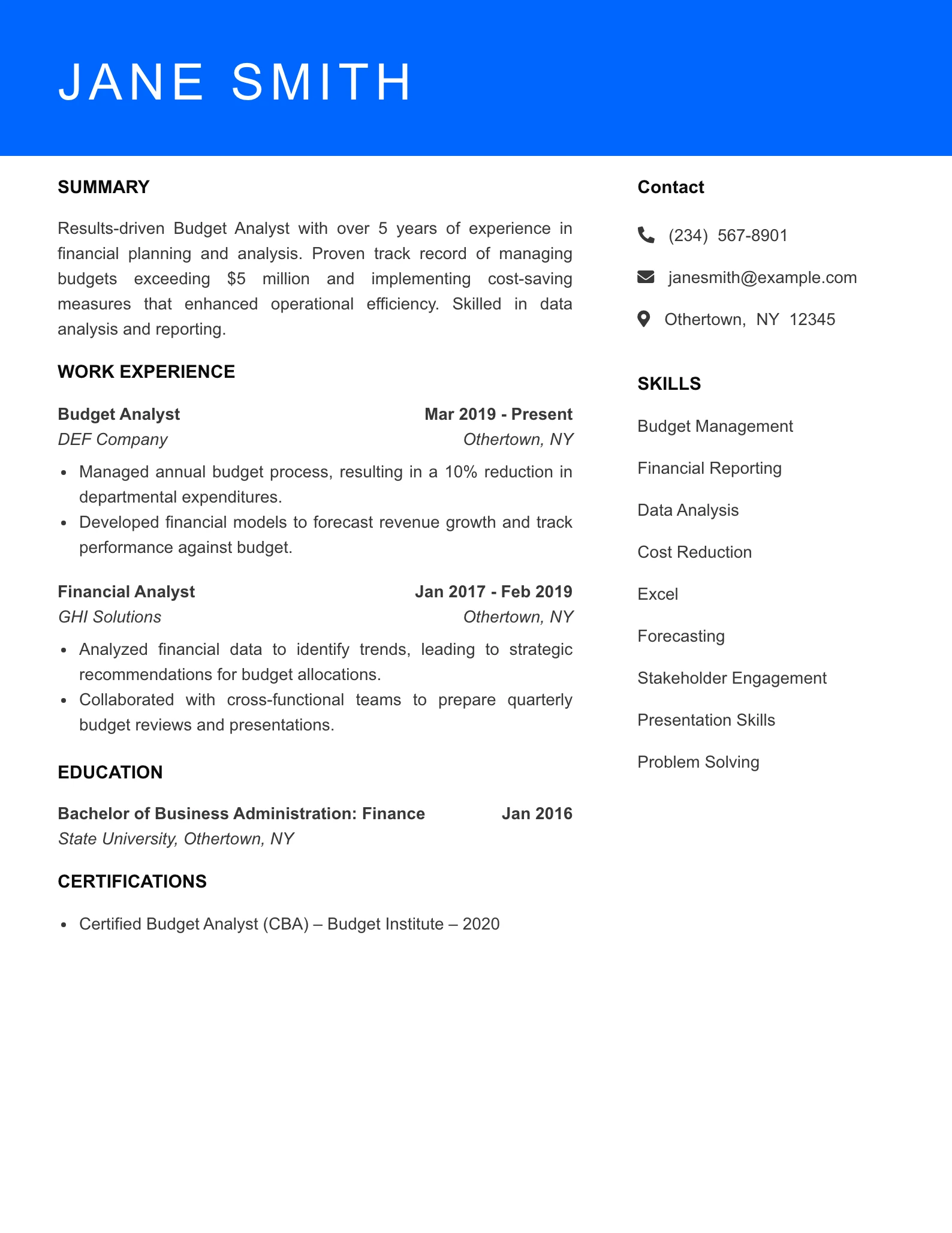

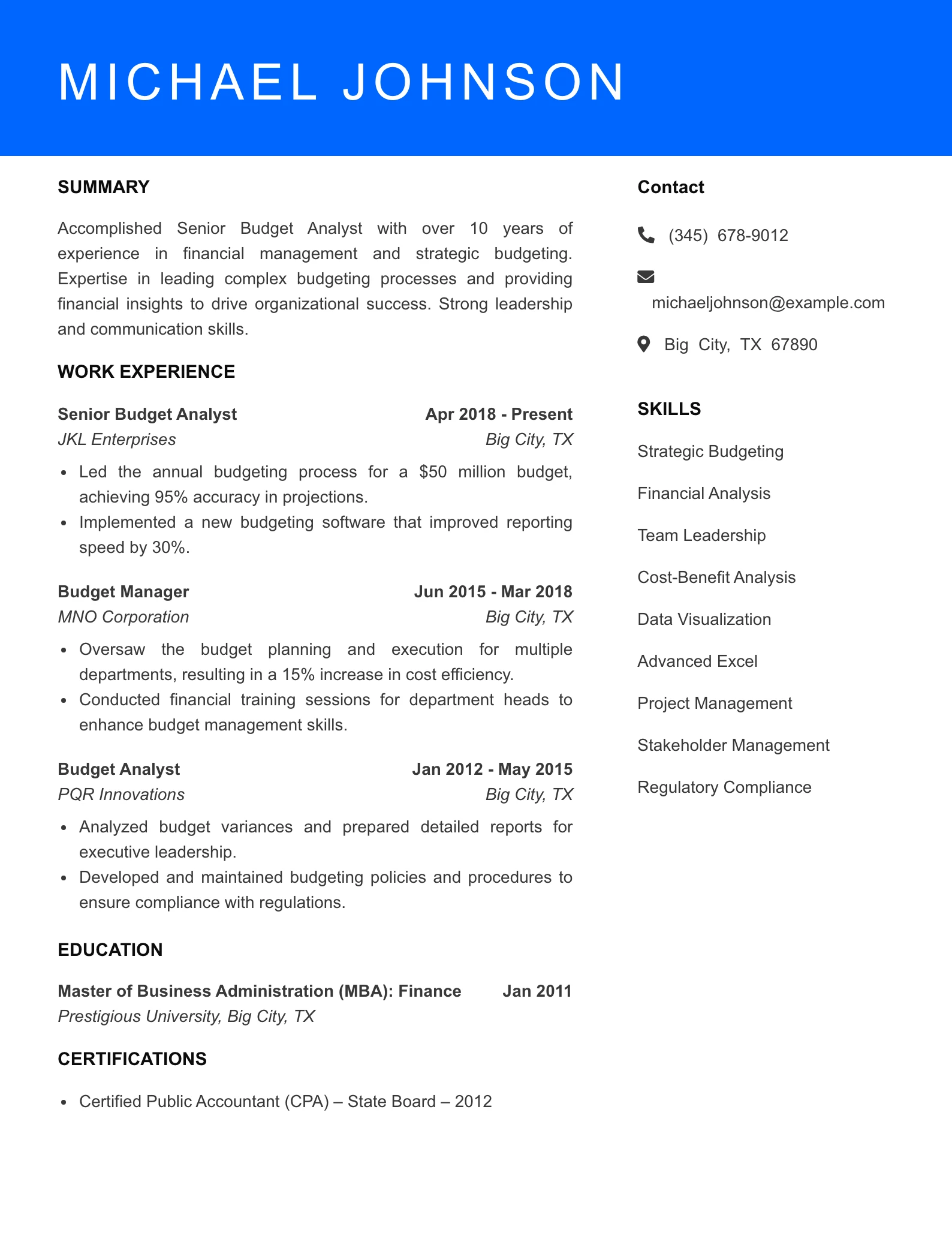

Budget Analyst Resume Examples

Your Guide to Crafting an Effective Budget Analyst Resume

Unlock the potential of your career with expertly crafted Budget Analyst resume examples that showcase your skills and achievements.

Introduction to the Job Sector

In the competitive field of budget analysis, a well-crafted resume is crucial for securing interviews and landing job offers. Hiring managers sift through dozens, if not hundreds, of applications, making it essential for candidates to stand out. A strong resume doesn’t just list qualifications; it tells a compelling story of how your skills and experiences make you the ideal fit for the role. In the world of finance and budgeting, clarity and precision are paramount—not only in the numbers but also in how you present your professional narrative.

Hiring managers typically look for candidates who not only possess strong analytical skills but also have a solid understanding of financial principles and budgeting processes. They seek individuals who can demonstrate proficiency in data analysis, proficiency in software tools like Excel or financial modeling applications, and excellent communication skills to convey complex financial information clearly. This page will guide you through a wealth of resume examples specifically tailored for Budget Analysts, highlighting the key components that will set you apart in the job market.

Employment Trends and Statistics

- According to the Bureau of Labor Statistics, employment for budget analysts is projected to grow by 3% from 2021 to 2031, reflecting a steady demand for financial professionals.

- The median annual salary for budget analysts in the United States is approximately $78,970, with top earners making over $112,000.

- Government agencies, healthcare organizations, and educational institutions are among the highest employers in the budget analysis field, accounting for a significant portion of job openings.

- With the rise of data-driven decision-making, candidates proficient in financial software and analytics tools are more sought after than ever.

- The increasing complexity of financial regulations has driven demand for skilled budget analysts who can navigate compliance effectively.

Resume Tips for Budget Analyst Resume Examples Professionals

To create a standout resume in the budget analyst field, consider including the following essential elements:

- Key Skills: Highlight your proficiency in financial analysis, budget forecasting, and cost management. Be sure to mention specific software tools such as Excel, SAP, or Oracle.

- Certifications: List relevant certifications such as Certified Government Financial Manager (CGFM) or Certified Management Accountant (CMA) to validate your expertise.

- Quantifiable Achievements: Instead of simply stating your duties, quantify your impact. For example, “Developed a budget forecasting model that reduced costs by 15% over two years.”

- Tailored Content: Customize your resume for each job application by incorporating keywords from the job description. This will help you pass Applicant Tracking Systems (ATS) and catch the hiring manager’s attention.

- Professional Formatting: Use a clean, professional layout with consistent fonts and clear headings. This enhances readability and ensures key information stands out.

- Continuous Learning: Showcase any ongoing education or training relevant to budgeting and financial analysis; this signals your commitment to professional growth and adaptability in a rapidly changing field.

With these guidelines and examples, you’re well-equipped to create a compelling resume that captures the attention of hiring managers in the budget analyst sector.

See More Budget Analyst Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

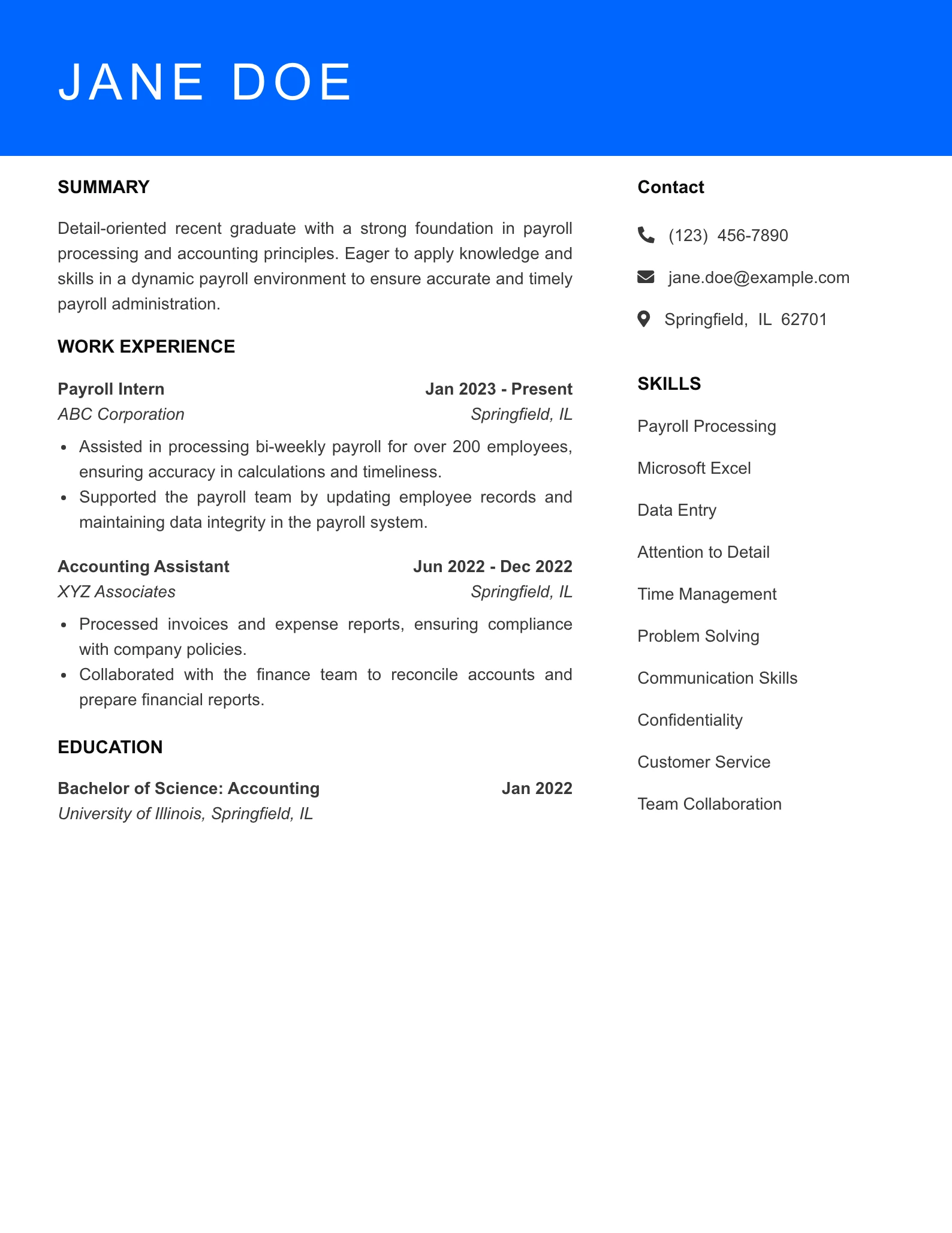

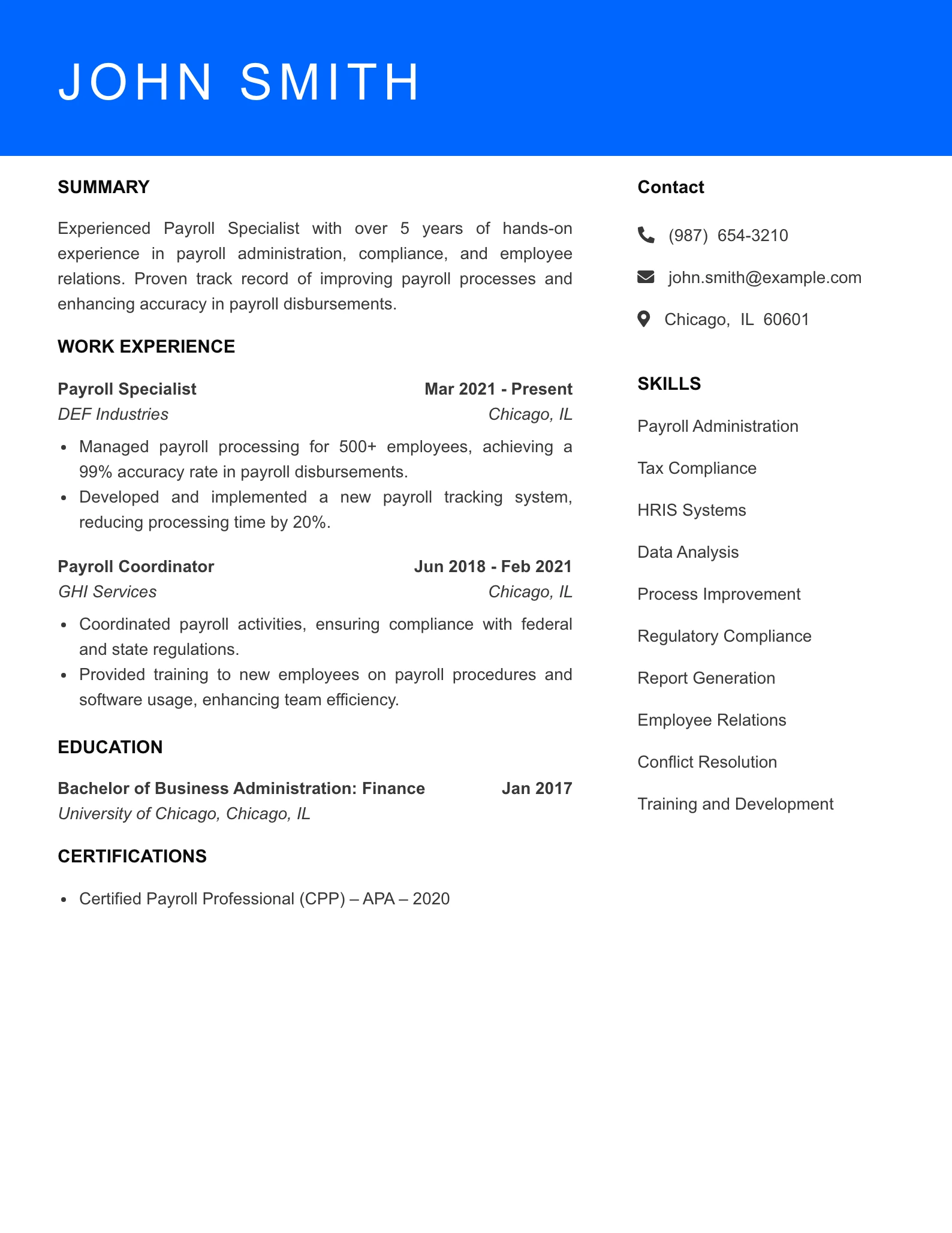

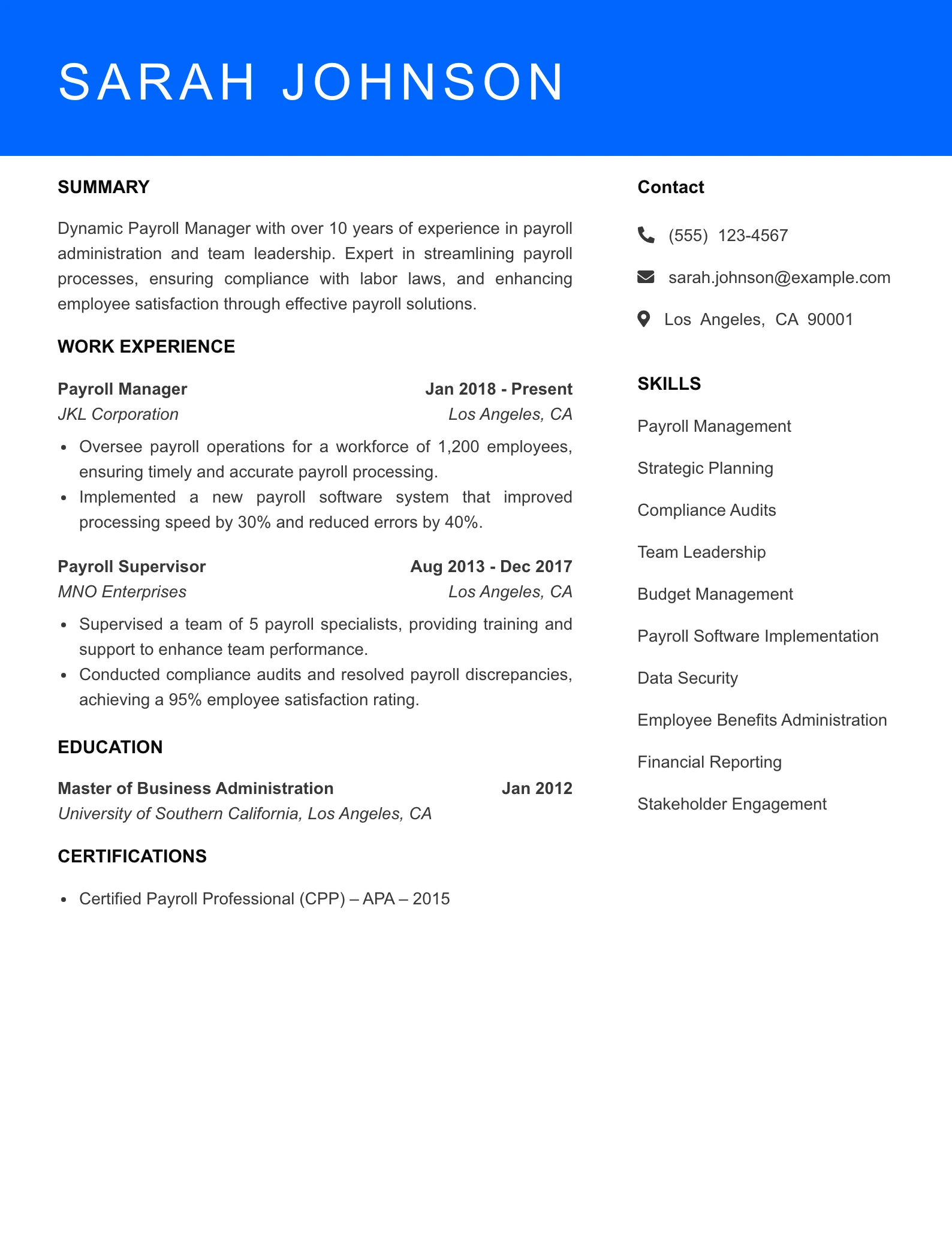

Payroll Specialist Resume Examples

Unlock Your Career Potential with Payroll Specialist Resume Examples

Discover expert-crafted resume examples designed specifically for Payroll Specialists, showcasing your unique skills and experiences to stand out in the competitive job market.

Understanding the Payroll Specialist Sector

As the backbone of any organization’s financial operations, Payroll Specialists play a critical role in ensuring employees are compensated accurately and on time. A well-crafted resume is essential in this hiring process as it not only highlights relevant skills and experiences but also conveys professionalism and attention to detail—traits that hiring managers prioritize. Given the complexity of payroll systems and regulations, a comprehensive resume can set candidates apart from the competition.

Hiring managers typically seek candidates who possess a robust understanding of payroll software, tax regulations, and compliance standards. They look for individuals who can analyze payroll data, handle discrepancies, and effectively communicate with employees regarding their compensation. This page provides a variety of resume examples tailored to meet the specific needs of Payroll Specialists, along with actionable insights to help job seekers craft their own standout resumes.

Employment Trends and Statistics

- The Bureau of Labor Statistics (BLS) projects a 5% job growth rate for Payroll Specialists from 2021 to 2031, indicating steady demand in this essential role.

- As of 2023, the average salary for a Payroll Specialist in the United States is approximately $54,000 annually, with variations based on experience and location.

- More than 90% of Payroll Specialists report using automated payroll systems, making proficiency in software a key asset for candidates.

- Companies increasingly value candidates with certifications such as the Certified Payroll Professional (CPP) designation, enhancing job prospects and career advancement.

Resume Tips for Payroll Specialists

To create an impactful resume that captures the attention of hiring managers, consider including the following essential elements:

- Certifications: Highlight any relevant certifications, such as the CPP or Fundamental Payroll Certification (FPC), to demonstrate your expertise and commitment to the field.

- Technical Skills: Clearly list your proficiency in payroll software (e.g., ADP, Paychex) and any accounting software (e.g., QuickBooks), as these are critical for the role.

- Key Achievements: Use quantifiable metrics to showcase accomplishments, such as “Managed payroll for over 200 employees, ensuring 100% accuracy over 3 years.”

- Attention to Detail: Mention experiences that showcase your meticulous nature, such as conducting audits or handling payroll discrepancies efficiently.

- Formatting: Use a clean, professional layout with clear headings and bullet points to ensure easy readability, making it simple for hiring managers to find key information quickly.

By following these guidelines and utilizing the examples provided on this page, you can craft a resume that not only reflects your qualifications but also positions you as a strong contender in the payroll profession.

See More Payroll Specialist Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

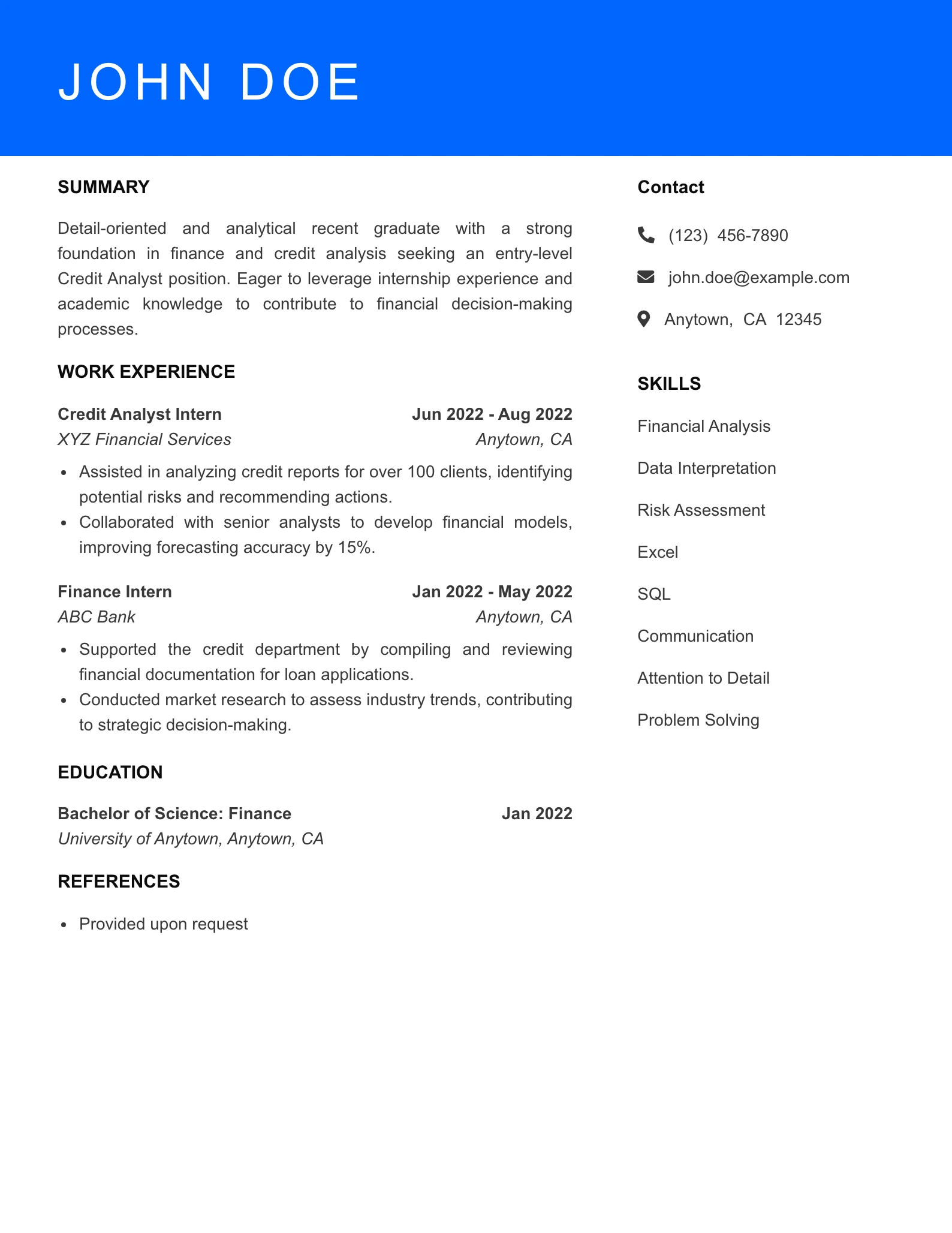

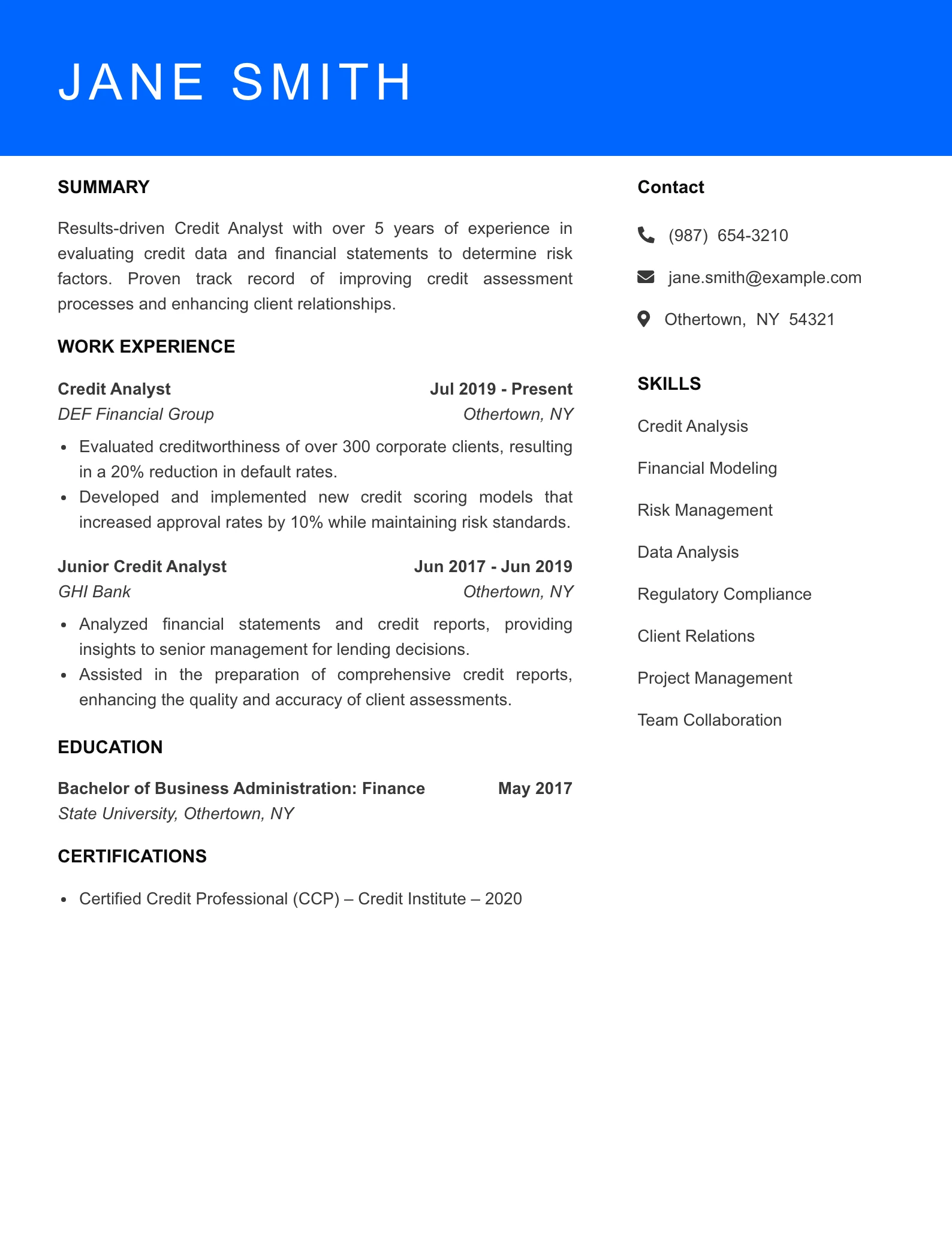

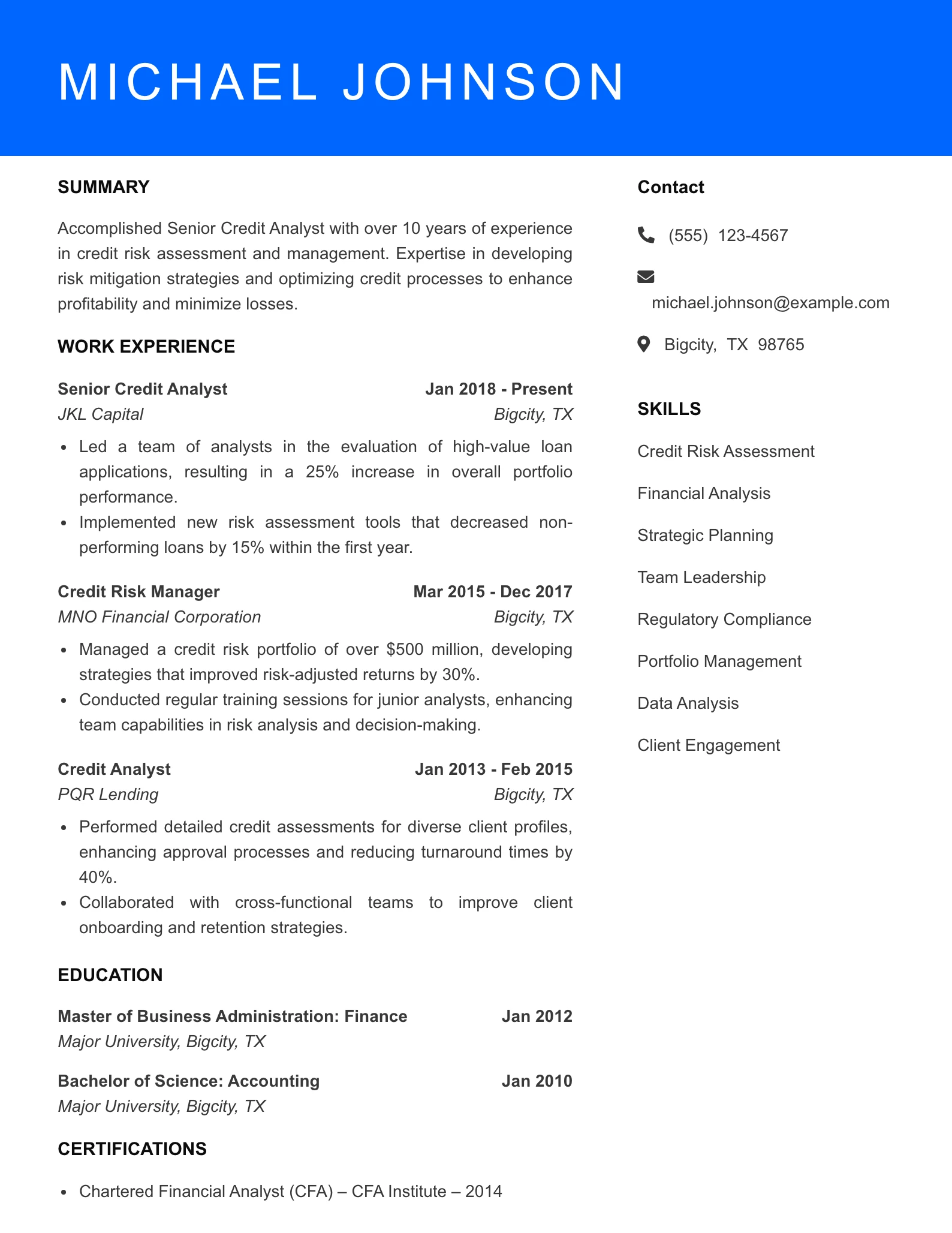

Credit Analyst Resume Examples

Unlock Your Career Potential with Our Credit Analyst Resume Examples

Crafting an impactful resume is crucial in the competitive field of credit analysis. Explore tailored resume examples that will help you stand out to hiring managers and secure your desired position.

Introduction to the Job Sector

In the dynamic world of finance, resumes play a pivotal role in the hiring process for credit analysts. These professionals are tasked with assessing the creditworthiness of individuals and businesses, making their analytical skills and financial acumen invaluable. A well-structured resume not only showcases your qualifications but also tells your unique story, helping you resonate with potential employers.

Hiring managers are typically on the lookout for candidates who demonstrate strong analytical skills, attention to detail, and a solid understanding of financial principles. They seek individuals who can effectively communicate complex financial information and exhibit proficiency in relevant software and databases. This page provides you with a comprehensive collection of resume examples tailored specifically for credit analysts, along with insights into what makes an application stand out.

As you navigate through this resource, you will discover various resume formats, key qualifications, and industry-specific terminologies that can elevate your application. Whether you are a seasoned professional or just starting your career, our curated examples will guide you in crafting a compelling resume.

Employment Trends and Statistics

- Job Growth: The Bureau of Labor Statistics projects a 6% growth rate for financial analysts, including credit analysts, from 2021 to 2031, highlighting a steady demand for these roles.

- High Demand: Industries such as banking, insurance, and investment are continually seeking skilled credit analysts to assess risk and make informed financial decisions.

- Average Salary: As of 2023, the median annual wage for credit analysts ranges from $70,000 to $90,000, depending on experience and geographic location.

- Education Requirements: Most employers prefer candidates with a bachelor’s degree in finance, accounting, or a related field, coupled with relevant internships or work experience.

- Certification: Earning certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) can significantly enhance your job prospects and earning potential.

Resume Tips for Credit Analyst Resume Examples Professionals

Crafting an effective resume as a credit analyst involves highlighting your analytical skills, financial expertise, and attention to detail. Here are essential resume elements to consider:

- Certifications: Include relevant certifications such as CFA or FRM to demonstrate your expertise and commitment to the field.

- Technical Skills: Highlight your proficiency with financial modeling software, databases (like SQL), and advanced Excel functions, as these are critical in credit analysis.

- Quantifiable Achievements: Use metrics to demonstrate your impact in previous roles, such as reduction in default rates or improvements in credit assessment processes.

- Tailored Summary: Write a professional summary that reflects your unique qualifications and aligns with the specific credit analyst position you are applying for.

- Clear Formatting: Utilize a clean, professional format that enhances readability. Use bullet points for clarity and ensure consistency in font and headings.

- Continuous Learning: Mention ongoing education or training in emerging financial technologies or regulations to showcase your dedication to staying current in the industry.

By following these tips and reviewing our resume examples, you can create a polished resume that effectively markets your skills and positions you as a strong candidate in the credit analysis field.

See More Credit Analyst Resume Examples →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

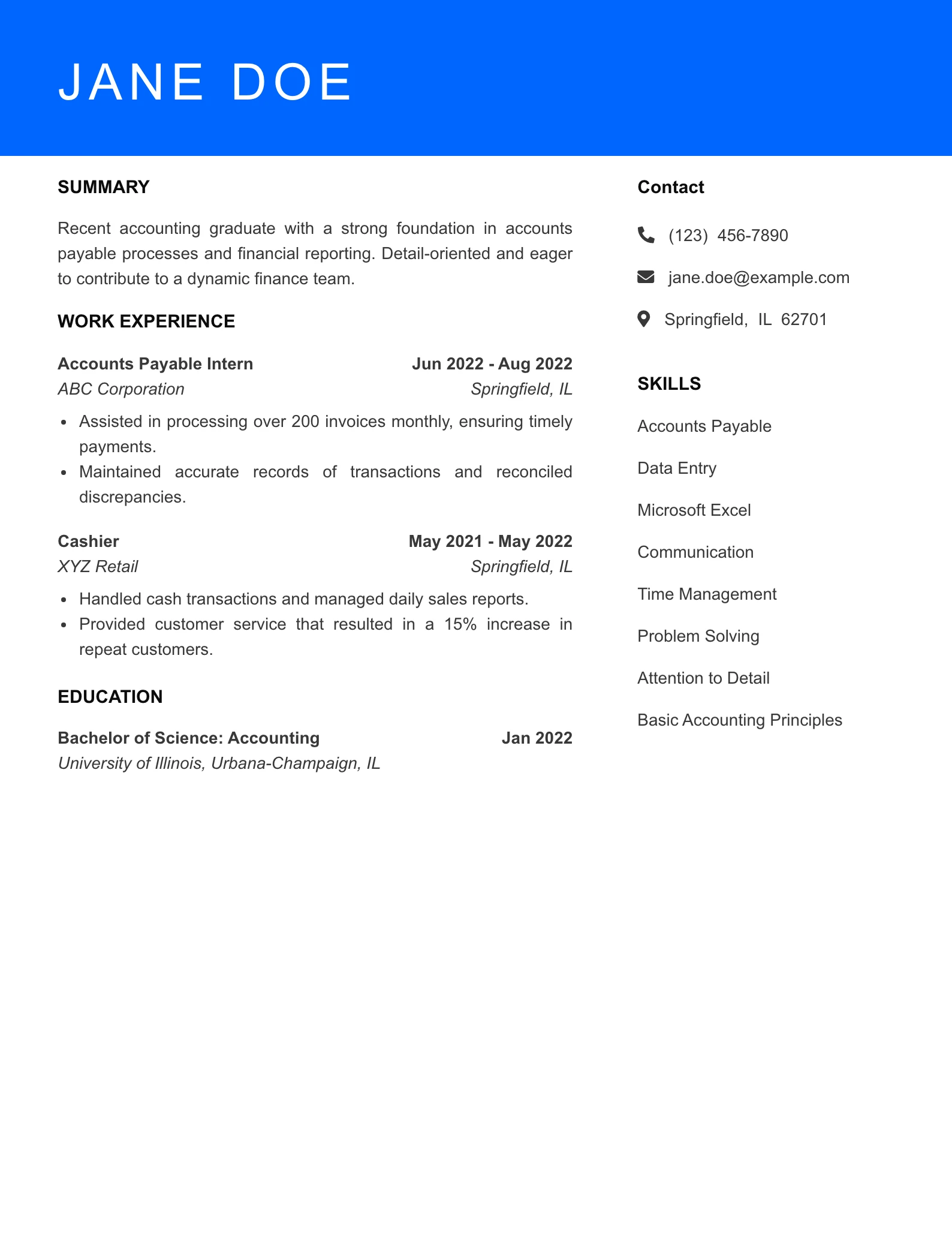

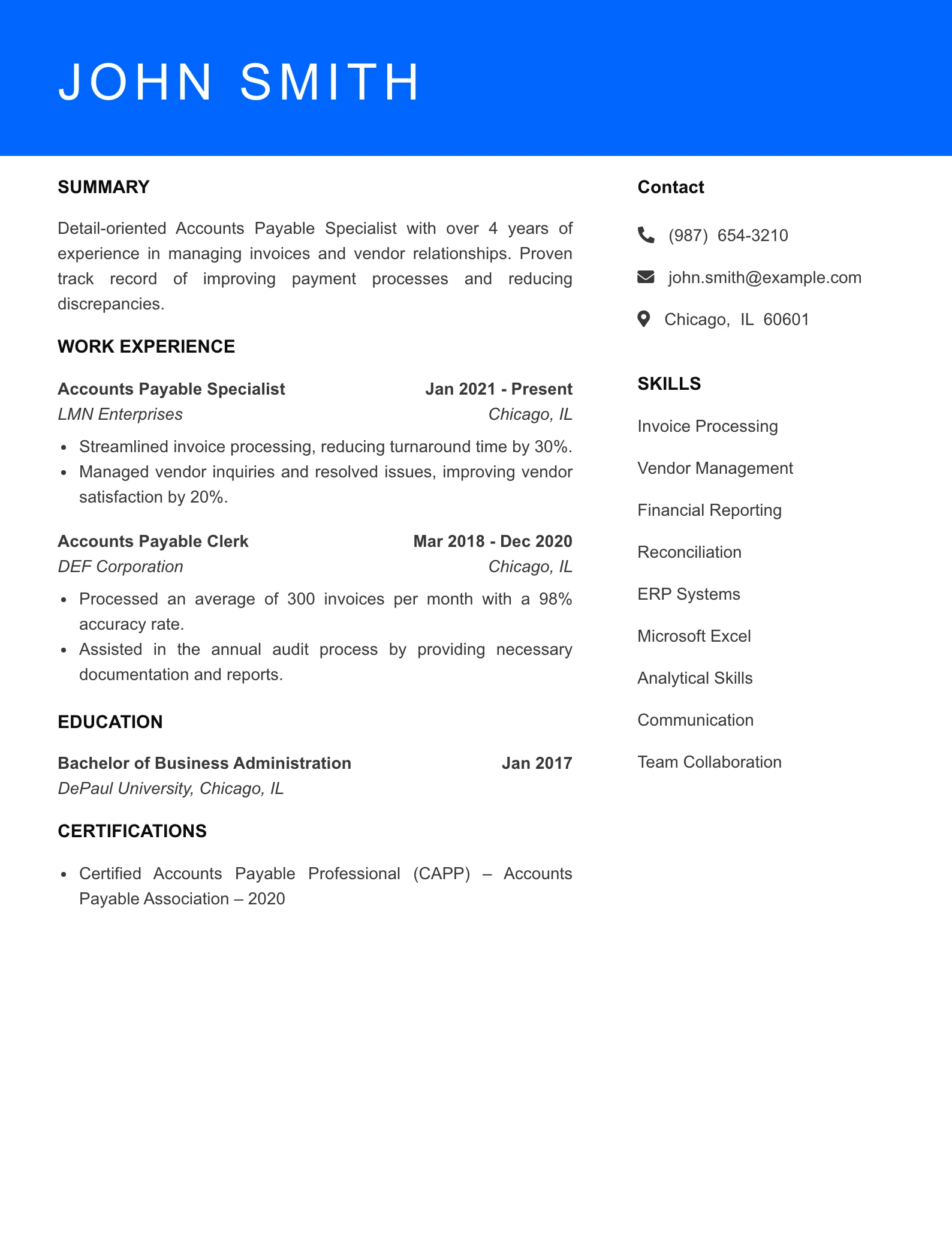

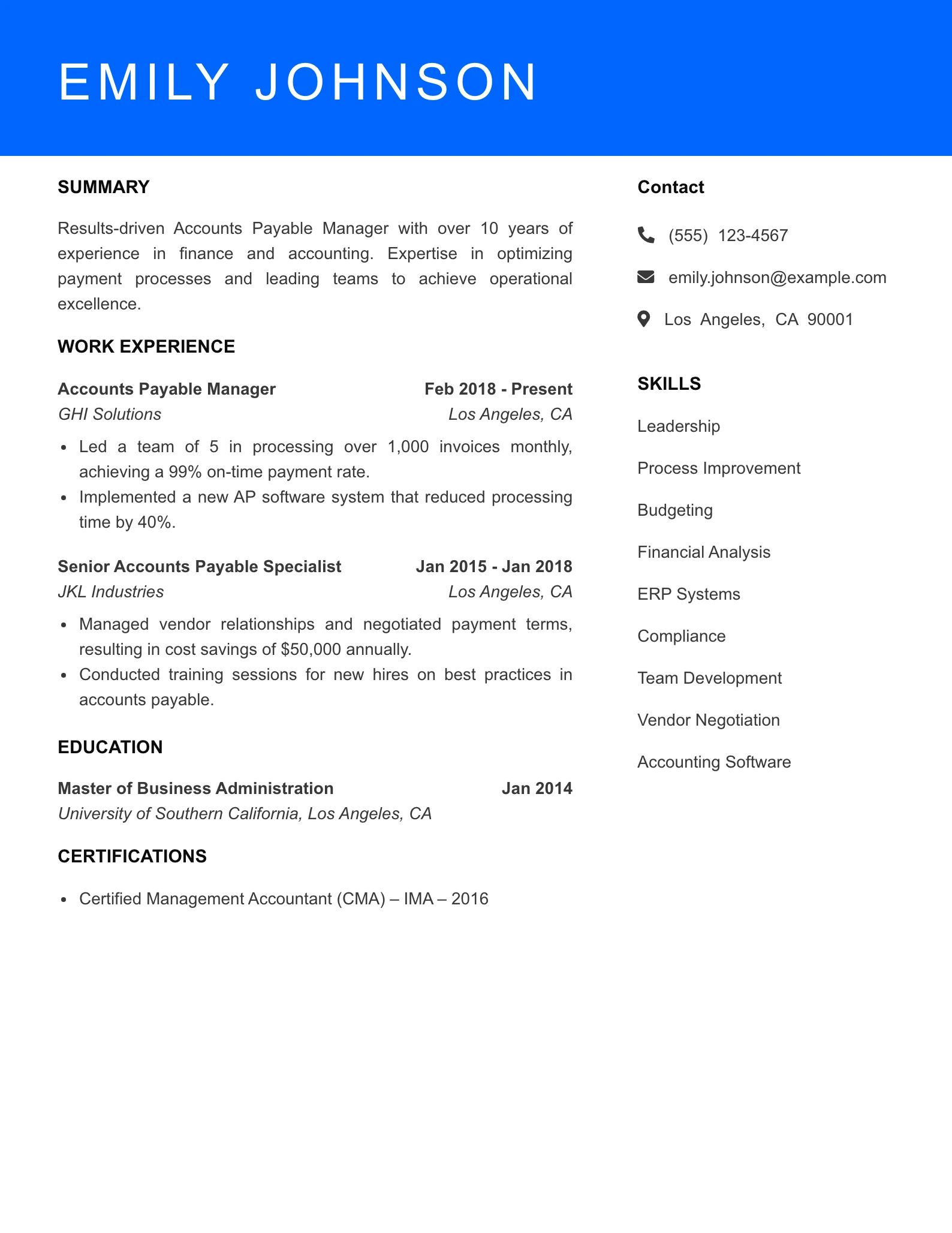

Accounts Payable Resume Example

Accounts Payable Resume Example

Elevate Your Career with a Compelling Accounts Payable Resume

In the fast-paced world of finance, a well-crafted resume is your ticket to landing the ideal position in accounts payable.

Introduction to the Job Sector

In the accounts payable sector, resumes serve as critical tools that determine a candidate’s visibility to hiring managers. A well-structured resume not only highlights a candidate’s relevant skills and experiences but also conveys their understanding of financial processes and compliance regulations, all of which are essential in this field. Given the integral role that accounts payable plays in a company’s financial health, hiring managers prioritize resumes that demonstrate both technical proficiency and a strong attention to detail.

Hiring managers typically look for candidates who possess a solid foundation in financial principles, strong organizational skills, and the ability to manage multiple tasks efficiently. They value certifications like Certified Accounts Payable Professional (CAPP) and familiarity with accounting software such as QuickBooks or SAP. On this page, you’ll find tailored resume examples, valuable tips on crafting your own resume, and insights into what makes an effective presentation of your qualifications in the accounts payable landscape.

Employment Trends and Statistics

- Job Growth: The employment of accounts payable clerks is projected to grow by 4% from 2021 to 2031, according to the U.S. Bureau of Labor Statistics.

- High-Demand Roles: Positions for accounts payable specialists are particularly in demand, especially in industries such as healthcare and finance, where accuracy in financial transactions is crucial.

- Average Salary: As of 2023, the median annual wage for accounts payable clerks is approximately $45,000, with experienced professionals earning up to $60,000 or more.

- Key Skills in Demand: Proficiency in accounting software and data entry is among the top skills sought by employers, alongside strong analytical capabilities and attention to detail.

- Remote Work Opportunities: The rise of remote positions in finance has increased flexibility for accounts payable roles, making it easier for candidates to find jobs that fit their lifestyle.

Resume Tips for Accounts Payable Resume Example Professionals

When crafting a resume for an accounts payable position, consider the following essential elements:

- Relevant Certifications: Highlight certifications like Certified Accounts Payable Professional (CAPP) or any relevant financial courses completed.

- Quantifiable Achievements: Use metrics to explain your previous successes, such as the volume of invoices processed or improvements in payment processing times.

- Technical Skills: List software proficiency in accounting tools such as QuickBooks, SAP, or Oracle, which are highly valued in the hiring process.

- Attention to Detail: Emphasize your ability to maintain accuracy in financial documentation and transactions.

- Professional Formatting: Ensure your resume is neatly organized, with clear headings and bullet points for easy readability.

- Tailored Experience: Customize your resume for each job application by aligning your experience with the specific requirements of the position.

Utilizing these tips and insights will help you create a standout resume that resonates with potential employers in the accounts payable field.

See More Accounts Payable Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

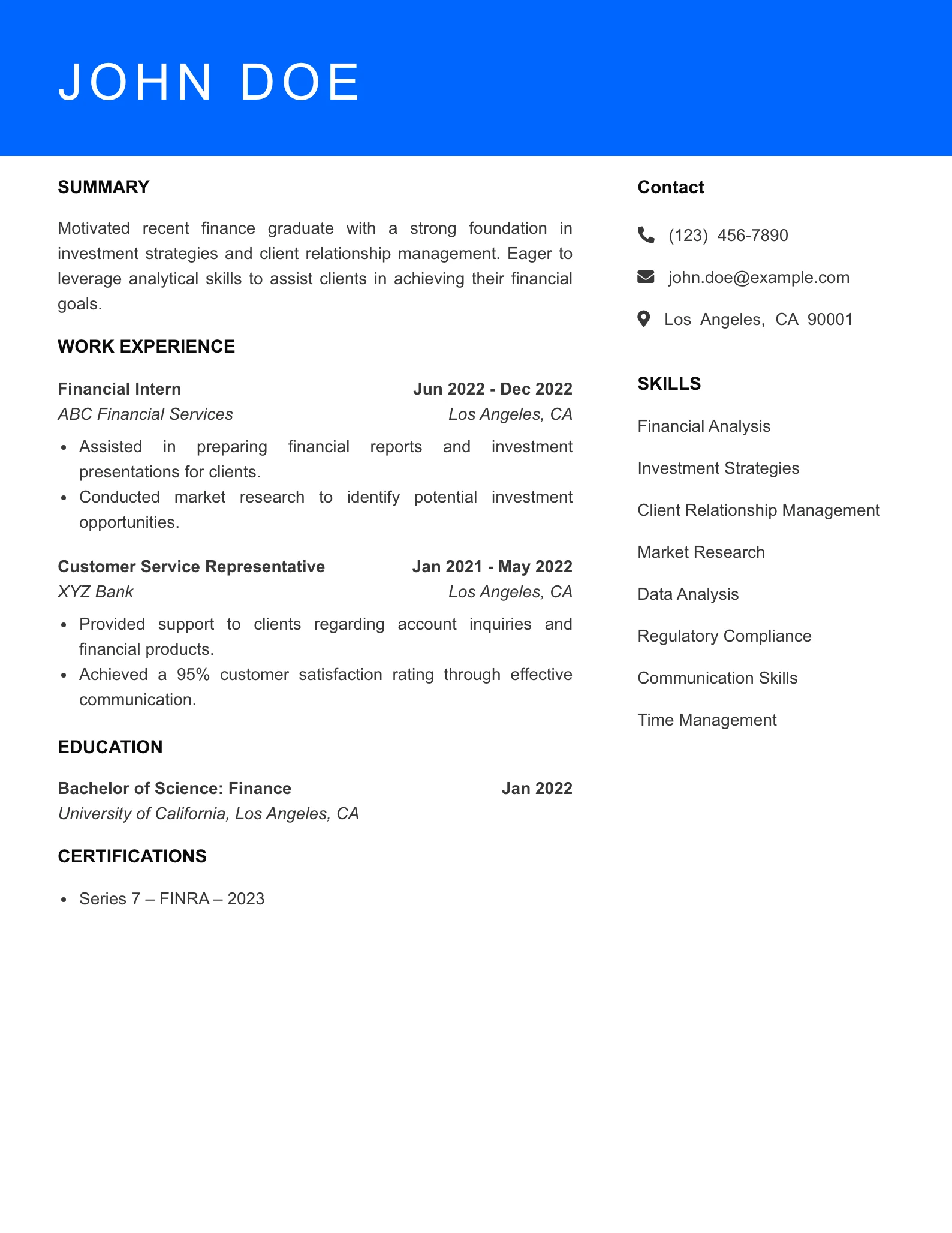

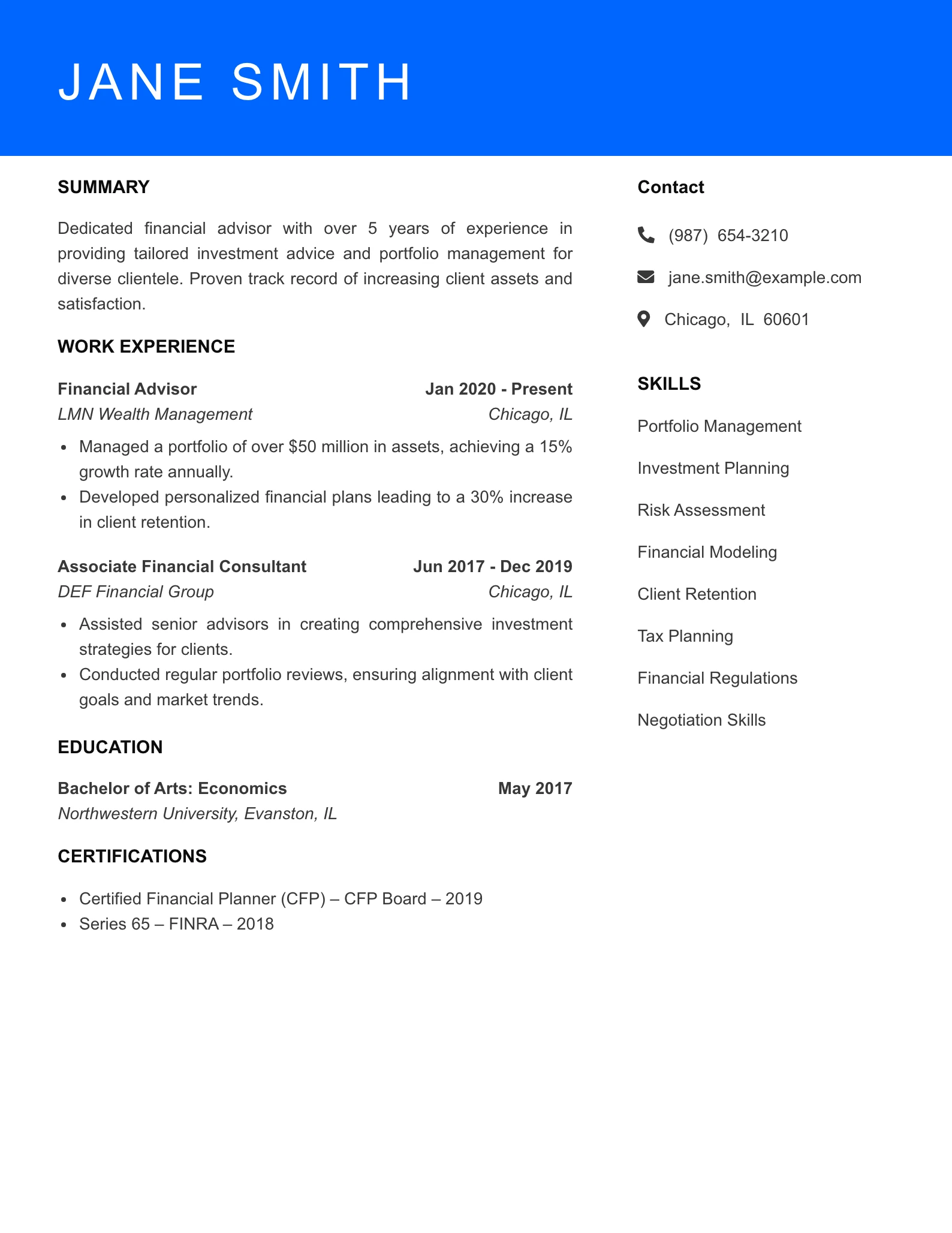

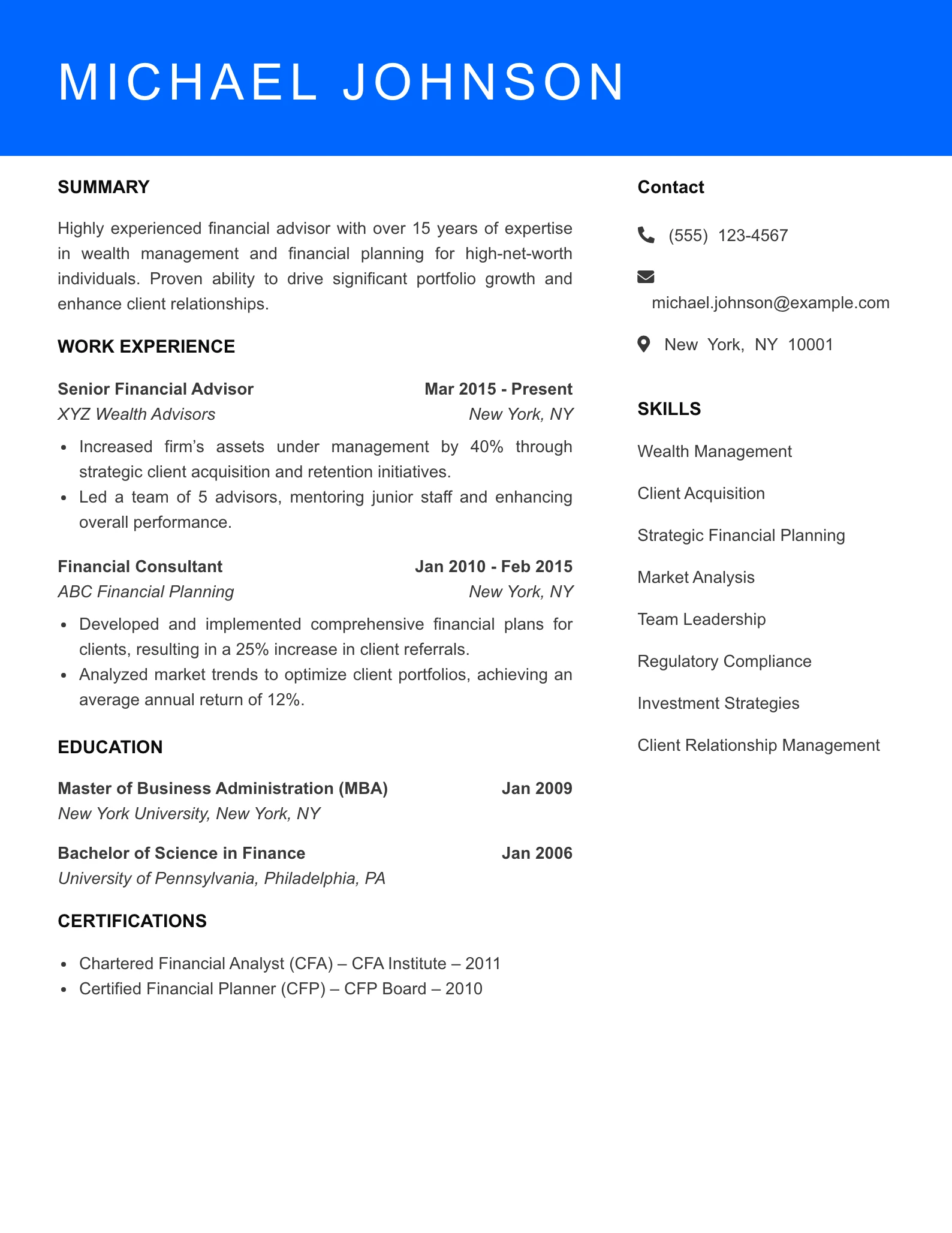

Financial Advisor Resume Example

Financial Advisor Resume Example

Elevate Your Career with a Winning Resume

Crafting a compelling resume is crucial for aspiring financial advisors aiming to stand out in a competitive job market.

Introduction to the Job Sector

In the financial advisory world, a well-crafted resume serves as your first impression to potential employers. It highlights your skills, experiences, and qualifications that make you a fit for the role. As hiring managers sift through numerous applications, they seek candidates who not only possess technical expertise but also exhibit soft skills such as communication, trustworthiness, and strategic thinking. Your resume is an essential tool that can differentiate you from other applicants, showcasing your unique professional narrative and attracting the attention of recruiters.

Hiring managers typically look for specific qualities in financial advisors, such as a strong foundation in finance, investment knowledge, and regulatory compliance. They also value candidates who demonstrate an ability to build client relationships and offer tailored financial solutions. This page will guide you through various resume examples tailored for financial advisors, outlining key components to include that resonate with hiring standards in the industry.

Here, you’ll find a collection of effective resume examples, industry insights, and tips tailored for financial advisors. Whether you’re an experienced professional or just starting your career, this resource will help you develop a resume that effectively showcases your capabilities and aligns with what employers are looking for.

Employment Trends and Statistics

- According to the U.S. Bureau of Labor Statistics, employment for financial advisors is projected to grow 5% from 2023 to 2033, faster than the average for all occupations.

- The average annual salary for financial advisors in the United States is approximately $95,000, with top earners making over $200,000 depending on experience and client base.

- The demand for financial planning services is expected to rise due to an aging population and increased awareness of financial literacy, creating a robust job market for aspiring advisors.

- Approximately 30% of financial advisors are self-employed, indicating a growing trend toward entrepreneurial career paths within the industry.

- Certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) significantly enhance job prospects and earning potential in the field.

Resume Tips for Financial Advisor Resume Example Professionals

To effectively showcase your qualifications as a financial advisor, your resume should include the following essential elements:

- Certifications: Highlight relevant certifications such as CFP, CFA, or CPA, as these can significantly boost your credibility.

- Skills: Emphasize both hard skills (financial analysis, investment strategies) and soft skills (relationship management, communication).

- Tailored Summary: Start with a strong professional summary that outlines your key achievements, areas of expertise, and career goals tailored to the financial advisory field.

- Quantifiable Achievements: Include bullet points that quantify your successes, such as “Increased client portfolio performance by 20% year-over-year.”

- Client Management Experience: Showcase your experience in client relationship management, detailing how you’ve developed and maintained client trust.

- Professional Formatting: Use a clean, professional layout with clear headings and bullet points, ensuring easy readability for hiring managers.

By integrating these key components, your resume can effectively communicate your capabilities and intentions to potential employers, positioning you as a leading candidate in the financial advisory sector.

See More Financial Advisor Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

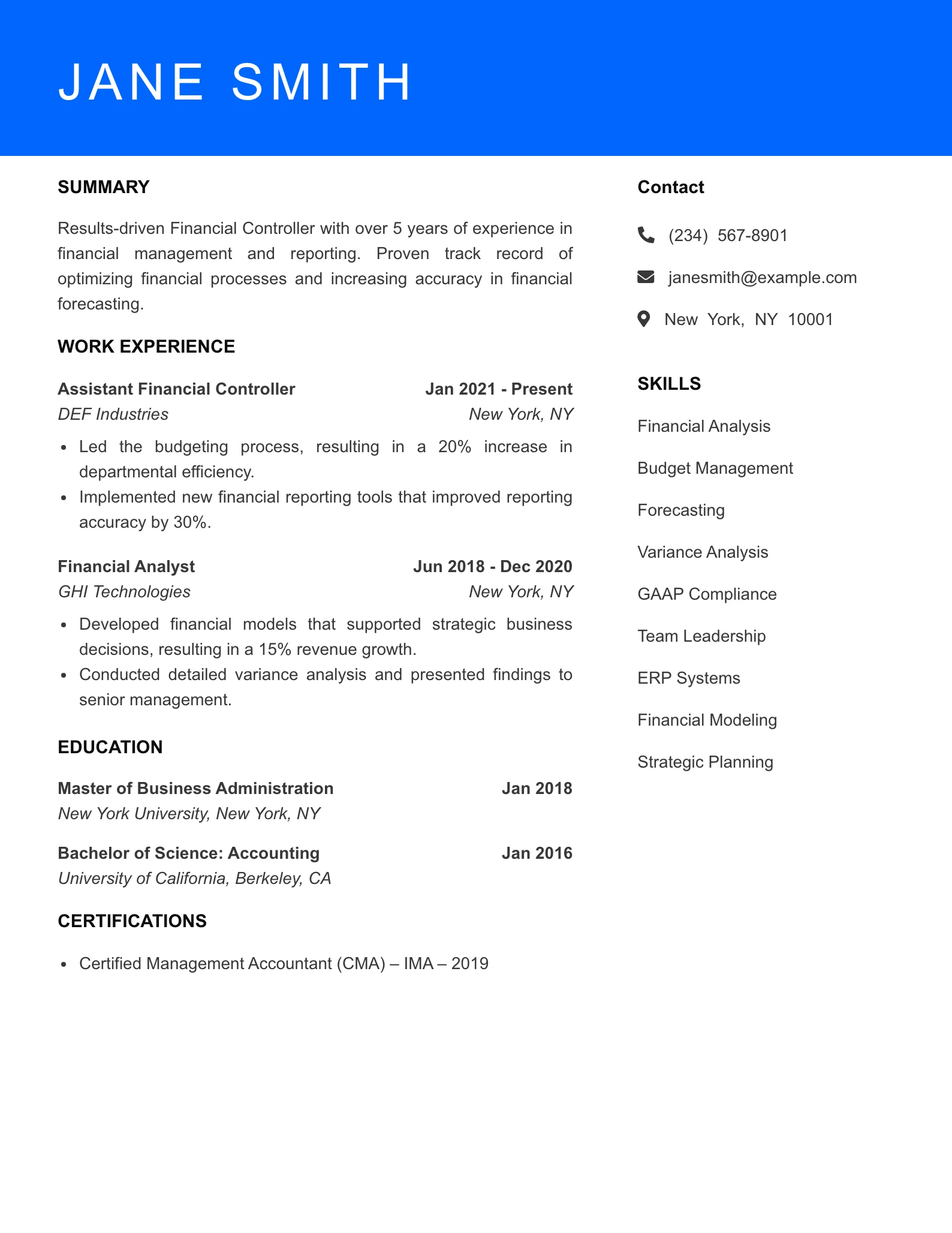

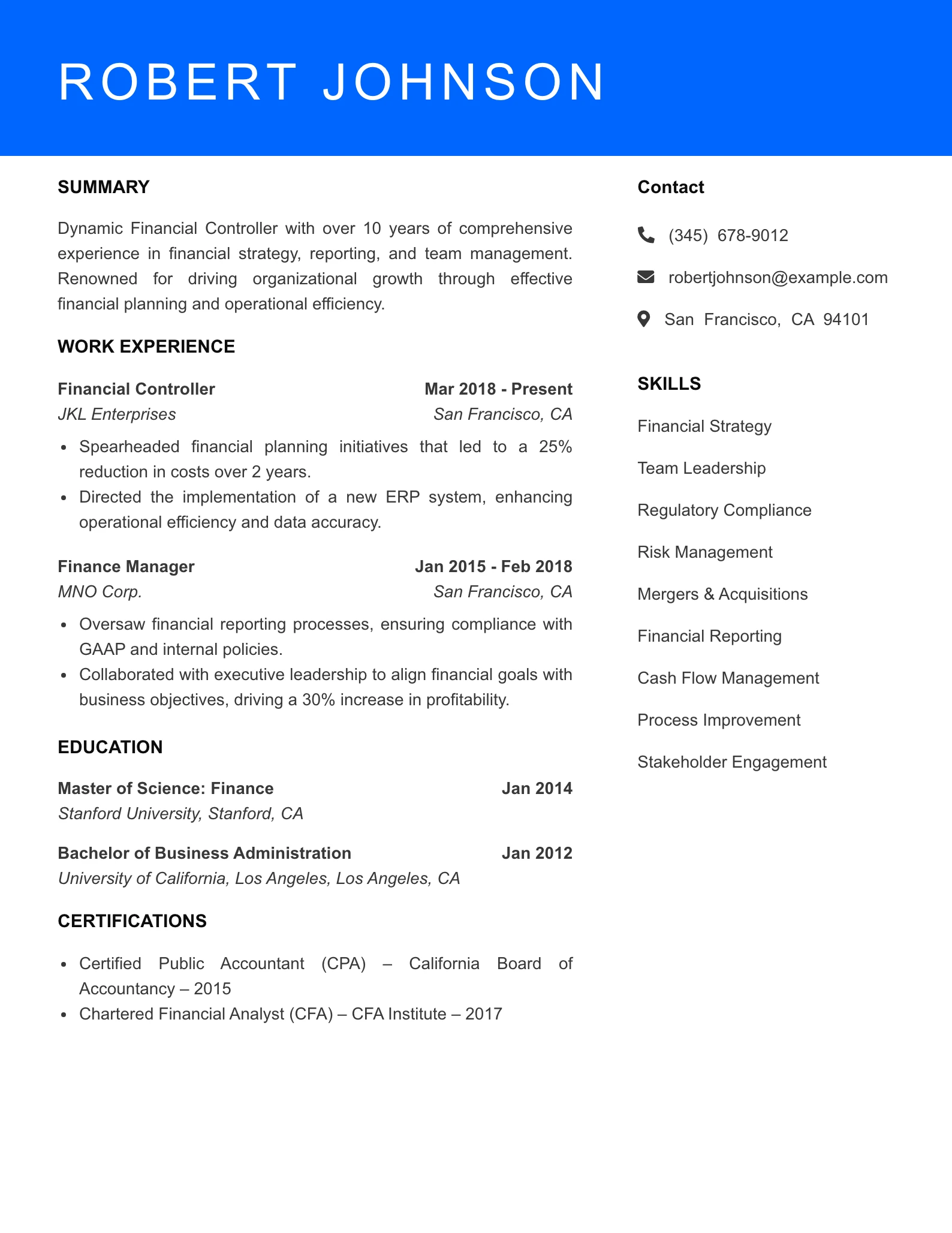

Controller Resume Example

Explore Controller Resume Examples

Unlock your potential in the finance sector with expertly crafted Controller resume examples, designed to help you stand out in a competitive job market.

Introduction to the Job Sector

In the finance industry, a well-crafted resume can be the key to unlocking opportunities as a Controller. This pivotal role involves overseeing financial reporting, managing budgets, and ensuring compliance with regulations, making it essential for candidates to present their experience and qualifications effectively. Resumes serve not only as a summary of your skills and achievements but also as a first impression that can significantly impact your chances of securing an interview.

When it comes to hiring, decision-makers look for candidates who demonstrate a strong balance of technical expertise and leadership capabilities. Hiring managers typically seek evidence of experience in financial management, proficiency with accounting software, and a solid understanding of regulatory standards. Additionally, highlighting your ability to drive strategic financial planning and manage a team can set you apart from other applicants. On this page, you will find tailored resume examples, expert tips, and industry insights that will equip you to create an outstanding Controller resume.

Employment Trends and Statistics

- The employment of financial managers, including Controllers, is projected to grow by 17% from 2021 to 2031, much faster than the average for all occupations.

- As of 2023, the average annual salary for a Controller in the United States is approximately $105,000, with top earners making over $150,000.

- Companies are increasingly seeking Controllers with expertise in digital financial tools and data analytics, reflecting a shift towards tech-driven finance practices.

- The demand for Controllers is particularly high in sectors like healthcare, technology, and manufacturing, where financial oversight is critical for operational success.

- According to the Bureau of Labor Statistics, approximately 300,000 financial management positions are expected to open each year, driven by retirements and the growing economy.

Resume Tips for Controller Resume Example Professionals

To craft a compelling resume that resonates with hiring managers in the Controller field, consider the following essential elements:

- Certifications: Include relevant certifications, such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), as they demonstrate your expertise and commitment to the profession.

- Quantifiable Achievements: Highlight your accomplishments with specific metrics, such as percentage improvements in budget accuracy or cost reductions achieved under your management.

- Technical Skills: Showcase your proficiency in accounting software (like QuickBooks, SAP, or Oracle) and data analysis tools, as these are vital for modern Controllers.

- Leadership Experience: Emphasize any leadership roles you’ve held, detailing how you have managed teams or projects and contributed to strategic decision-making.

- Tailored Professional Summary: Start your resume with a strong summary that reflects your career goals and relevant experience, tailored specifically to the Controller role you’re applying for.

- Formatting: Use a professional, clean format with clear headings and bullet points to enhance readability and ensure that key information stands out.

By incorporating these elements into your resume, you’ll be better positioned to attract attention from hiring managers and land that coveted Controller role.

See More Controller Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

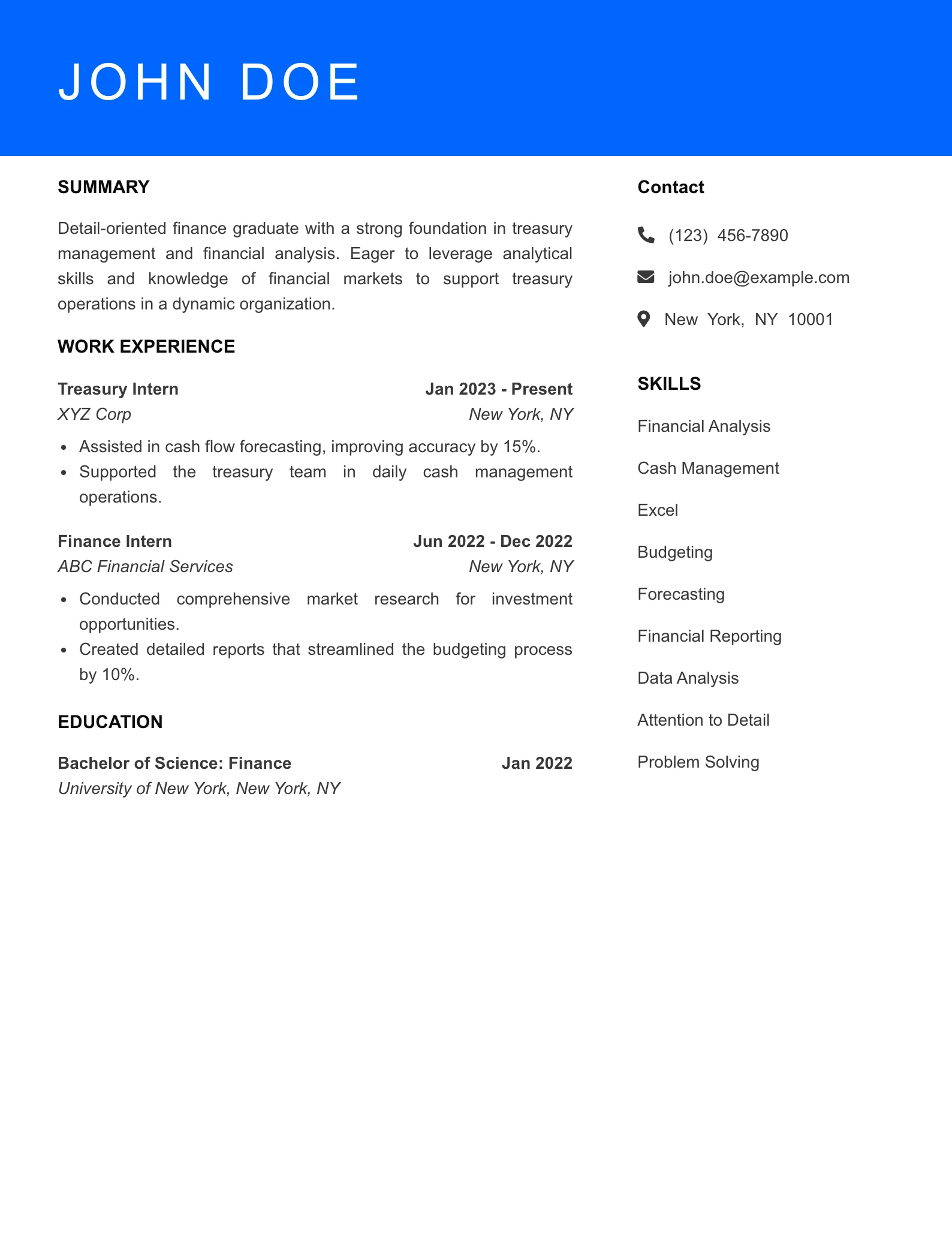

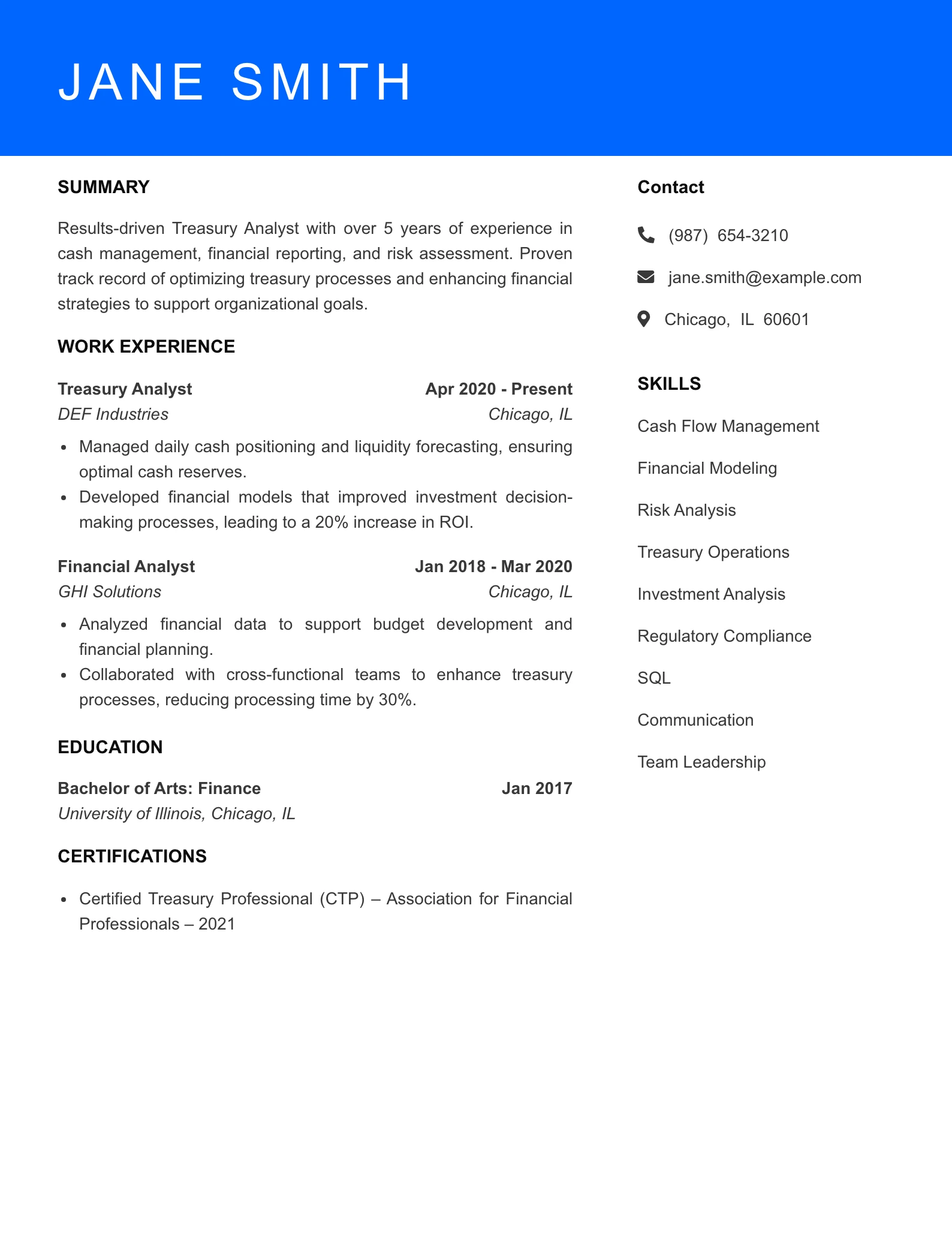

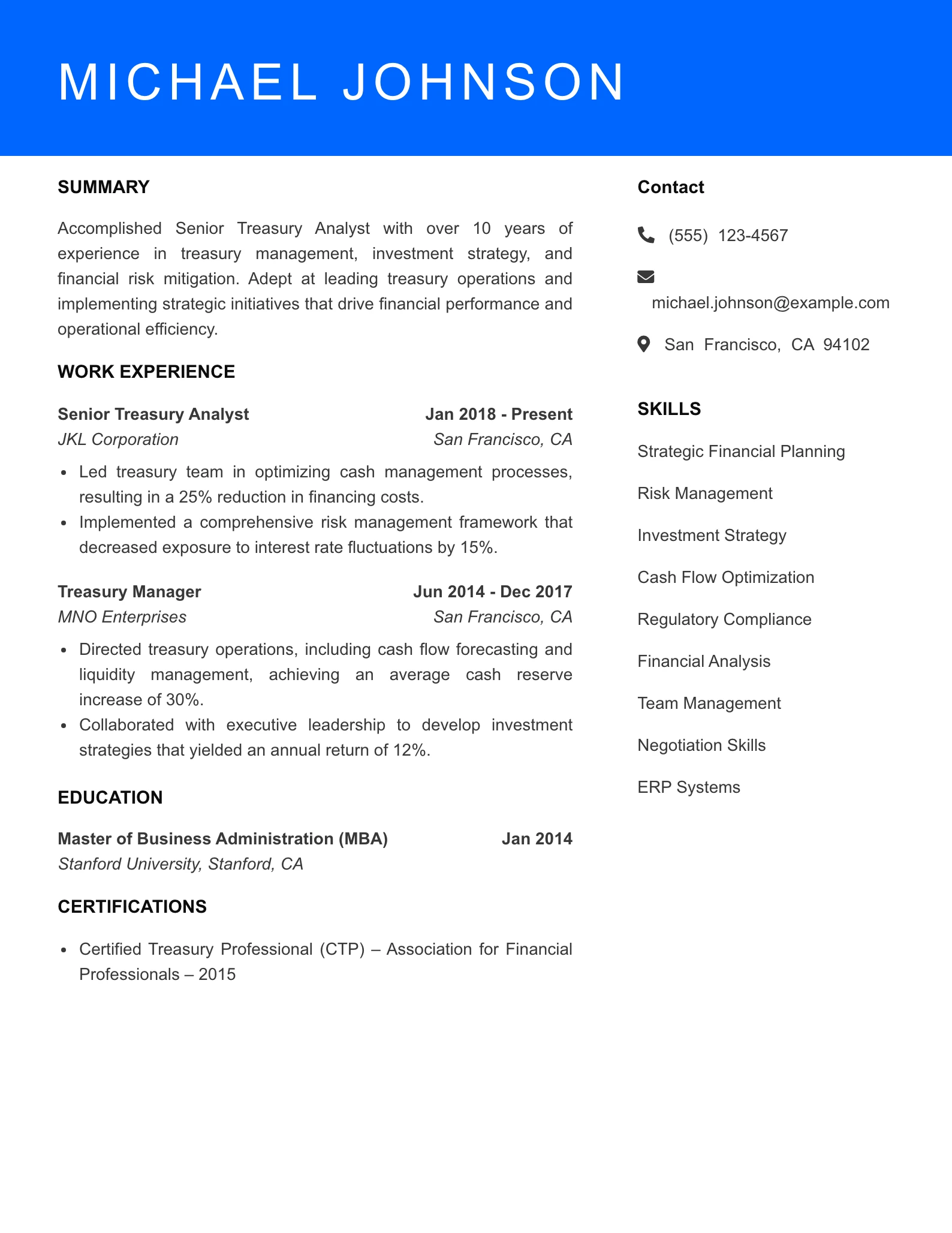

Treasury Analyst Resume Example

Unleashing Your Potential as a Treasury Analyst

Crafting a strong resume is crucial for aspiring Treasury Analysts looking to make their mark in the financial sector. This page provides comprehensive resources and examples to help you stand out in a competitive job market.

Introduction to the Job Sector

In the realm of finance, the role of a Treasury Analyst is pivotal for ensuring the effective management of an organization’s cash flow, investments, and financial risks. A well-structured resume is essential in conveying the expertise and analytical skills that hiring managers seek. With the increasing complexity of financial landscapes, a Treasury Analyst’s ability to analyze market trends, manage liquidity, and optimize investment strategies has never been more critical. A polished resume serves as your first impression, often determining whether you advance to interviews in a field where attention to detail is paramount.

Hiring managers typically look for candidates who possess a blend of technical skills and financial acumen, often seeking out qualifications such as experience in cash management, financial modeling, and risk assessment. Additionally, certifications like the Chartered Financial Analyst (CFA) or Certified Treasury Professional (CTP) can significantly enhance your attractiveness as a candidate. On this page, you will discover a range of tailored resume examples, essential tips, and industry insights that will assist you in showcasing your skills effectively.

Employment Trends and Statistics

- Job Growth: The employment of Treasury Analysts is projected to grow by 6% from 2021 to 2031, which is faster than the average for all occupations.

- High-Demand Roles: As organizations navigate financial uncertainty, demand for skilled Treasury Analysts is particularly high in sectors such as healthcare, technology, and financial services.

- Average Salary: According to the Bureau of Labor Statistics, the median annual wage for Financial Analysts, which includes Treasury Analysts, was $83,660 in May 2022.

- Industry Variation: Treasury Analysts working in investment banking typically earn higher salaries, often exceeding $100,000 annually, due to the high-stakes nature of their work.

- Geographic Trends: Major metropolitan areas such as New York City, Chicago, and San Francisco offer the most job opportunities for Treasury Analysts, accompanied by higher salary ranges.

Resume Tips for Treasury Analyst Resume Example Professionals

To create a compelling resume as a Treasury Analyst, consider including the following essential elements:

- Relevant Certifications: Highlight certifications such as CFA or CTP, which demonstrate your commitment to financial excellence and professional development.

- Technical Skills: Emphasize proficiency in financial analysis software (e.g., Excel, SAP), financial modeling, and data analysis tools.

- Professional Experience: Detail your previous roles with a focus on quantifiable achievements, such as managing cash flow improvements or optimizing investment portfolios.

- Analytical Abilities: Showcase your analytical skills by discussing specific projects or responsibilities that involved risk assessment or financial forecasting.

- Education: Include your degree in finance, accounting, or a related field, as well as any relevant coursework or honors that set you apart.

- Formatting Tips: Use a clean, professional layout with consistent fonts and bullet points for easy readability. Tailor your resume to each job application by incorporating keywords from the job description.

By focusing on these components, you’ll be well-equipped to create a resume that effectively communicates your qualifications and helps you secure a position as a Treasury Analyst.

See More Treasury Analyst Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

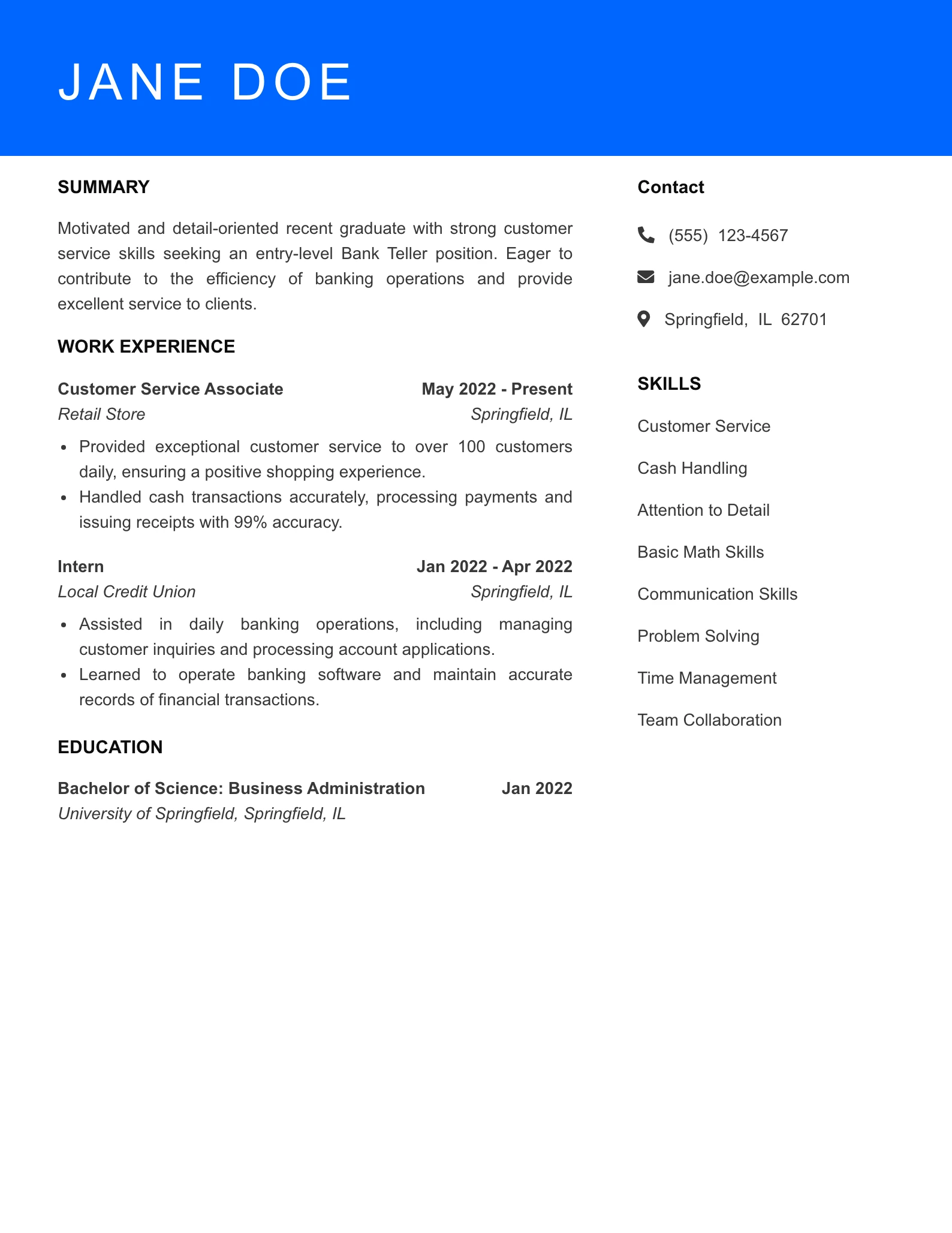

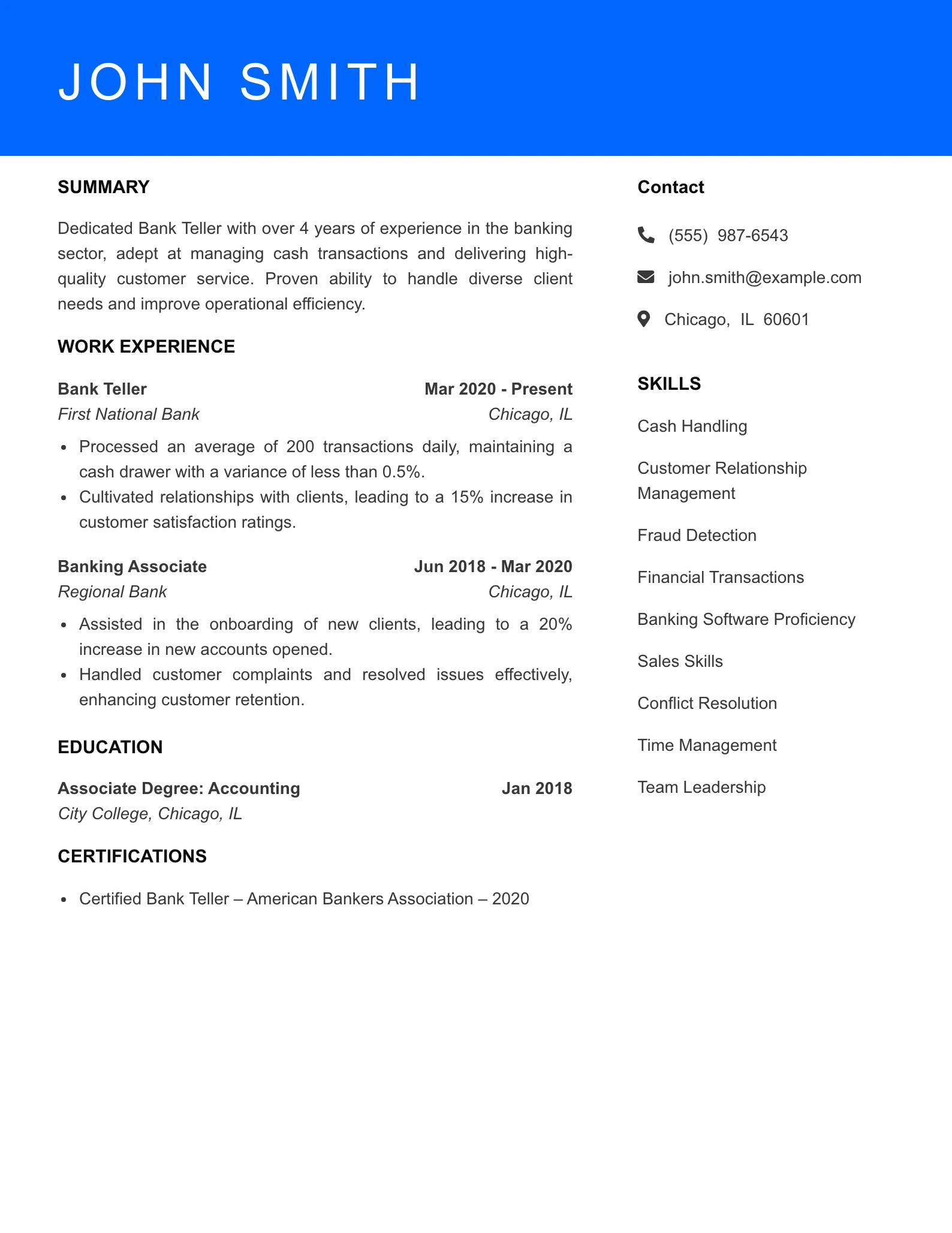

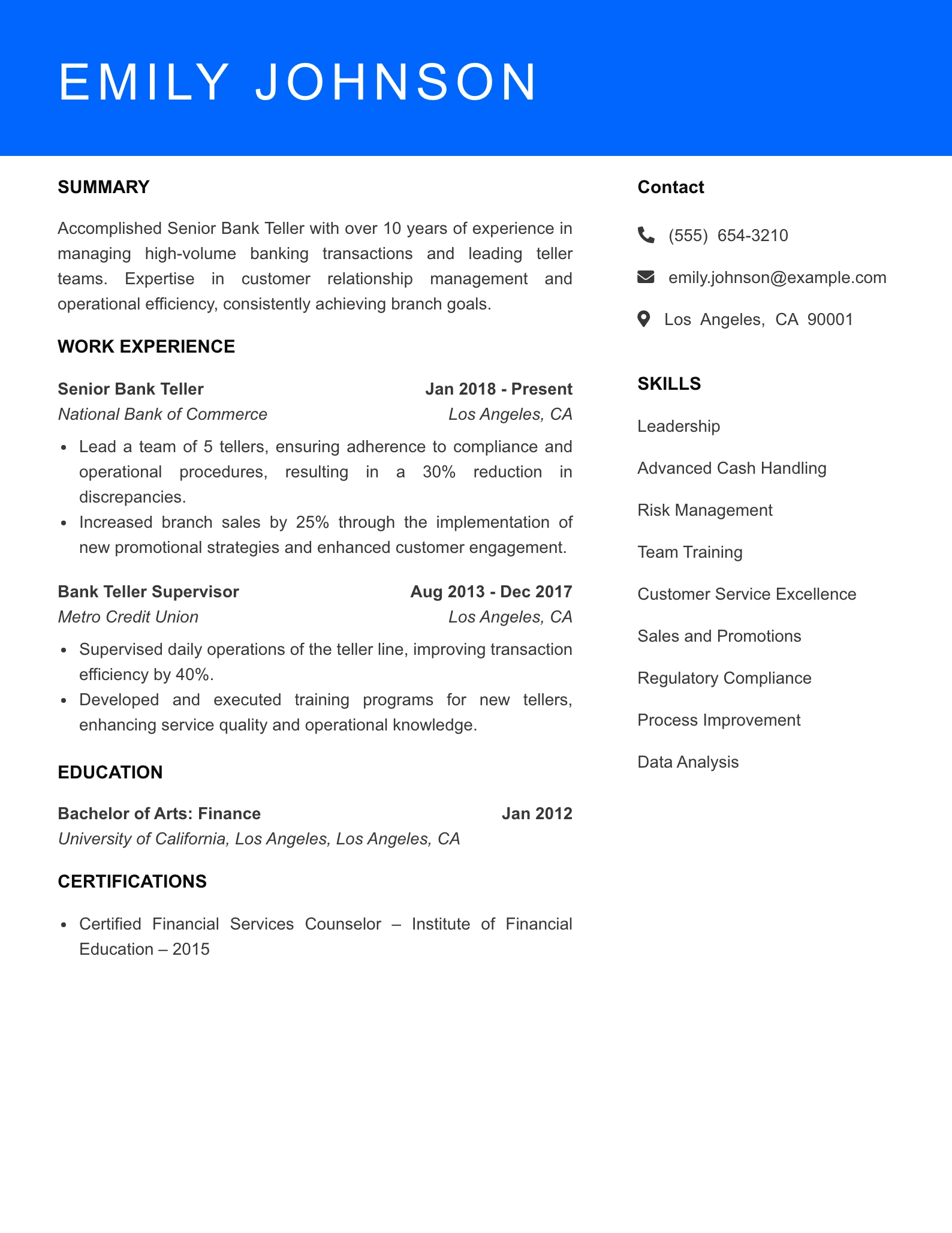

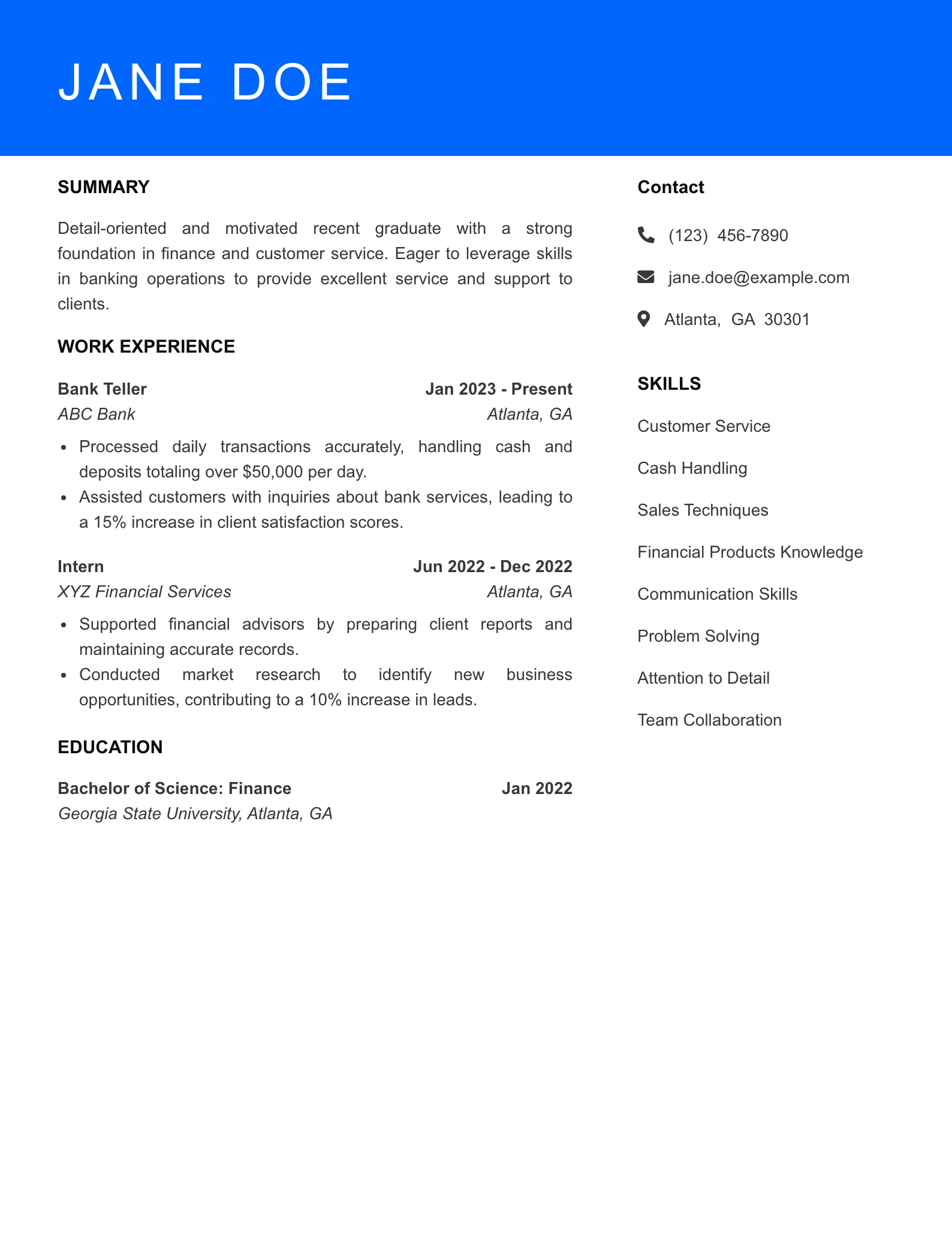

Bank Teller Resume Example

Unlock Your Potential as a Bank Teller

Crafting a standout resume is essential for landing the coveted position of a bank teller. This page offers tailored resume examples and insights to help you shine in a competitive job market.

Understanding the Bank Teller Role

In the bustling world of finance, bank tellers serve as the frontline representatives of financial institutions. Their resumes play a crucial role in the hiring process, acting as the first impression candidates make on potential employers. An effective resume not only highlights relevant skills and experiences but also reflects the candidate’s understanding of customer service, attention to detail, and reliability—qualities that are paramount in this sector.

Hiring managers typically seek candidates who exhibit strong communication abilities, a knack for problem-solving, and proficiency in financial transactions. They are also keen on assessing candidates’ familiarity with banking software and regulations. On this page, you will find various resume examples tailored specifically for bank tellers, along with tips and insights to help you create a compelling application that resonates with hiring teams.

Employment Trends and Statistics

- Job Growth: The employment of bank tellers is projected to decline by 7% from 2022 to 2032, primarily due to the increasing automation of banking services.

- Average Salary: As of May 2023, the median annual wage for bank tellers is approximately $36,000, with the potential for increases based on experience and location.

- High-Demand Roles: Despite the overall decline, there is still a consistent need for skilled tellers in areas with growing populations and new bank branches.

- Skills in Demand: Employers are increasingly prioritizing candidates with strong digital literacy and customer service skills, as banks enhance their digital offerings.

- Career Advancement: Many bank tellers can progress to roles such as customer service representatives, loan officers, or branch managers with additional training and experience.

Resume Tips for Bank Teller Professionals

To create a compelling resume as a bank teller, consider the following essential elements:

- Tailored Objective Statement: Clearly state your career goals and how they align with the bank’s mission.

- Relevant Experience: Highlight your previous roles in customer service or financial transactions, focusing on specific achievements.

- Key Skills: Include important skills such as cash handling, familiarity with banking software, and excellent communication abilities.

- Certifications: Mention any relevant certifications, such as those in financial services or customer relations, to enhance your credibility.

- Professional Formatting: Use a clean, easy-to-read format with clear headings and bullet points for better readability.

- Quantifiable Achievements: Where possible, include metrics that showcase your contributions, such as increased customer satisfaction rates or cash accuracy records.

By incorporating these tips, you can elevate your bank teller resume and increase your chances of making a lasting impression on hiring managers.

See More Bank Teller Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

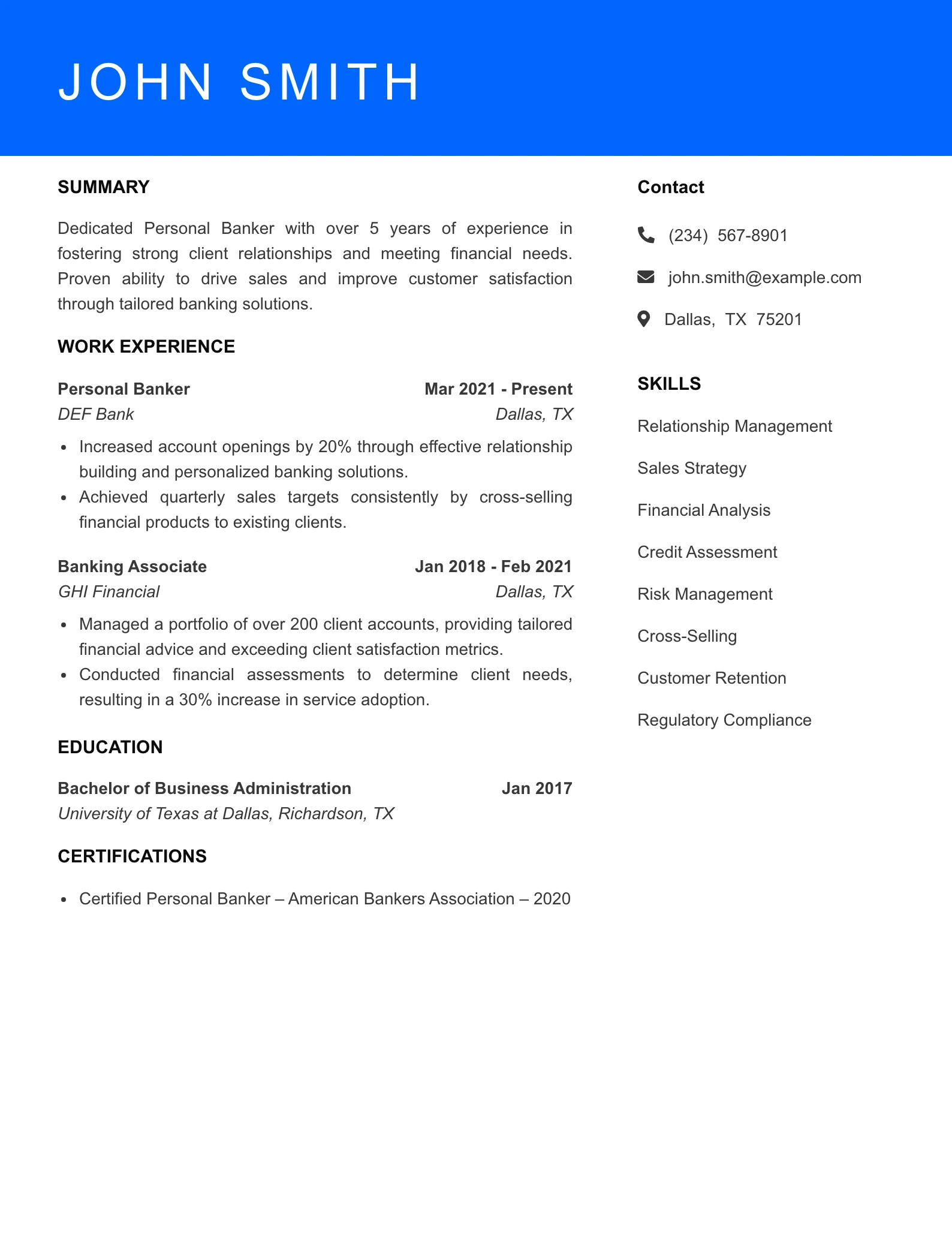

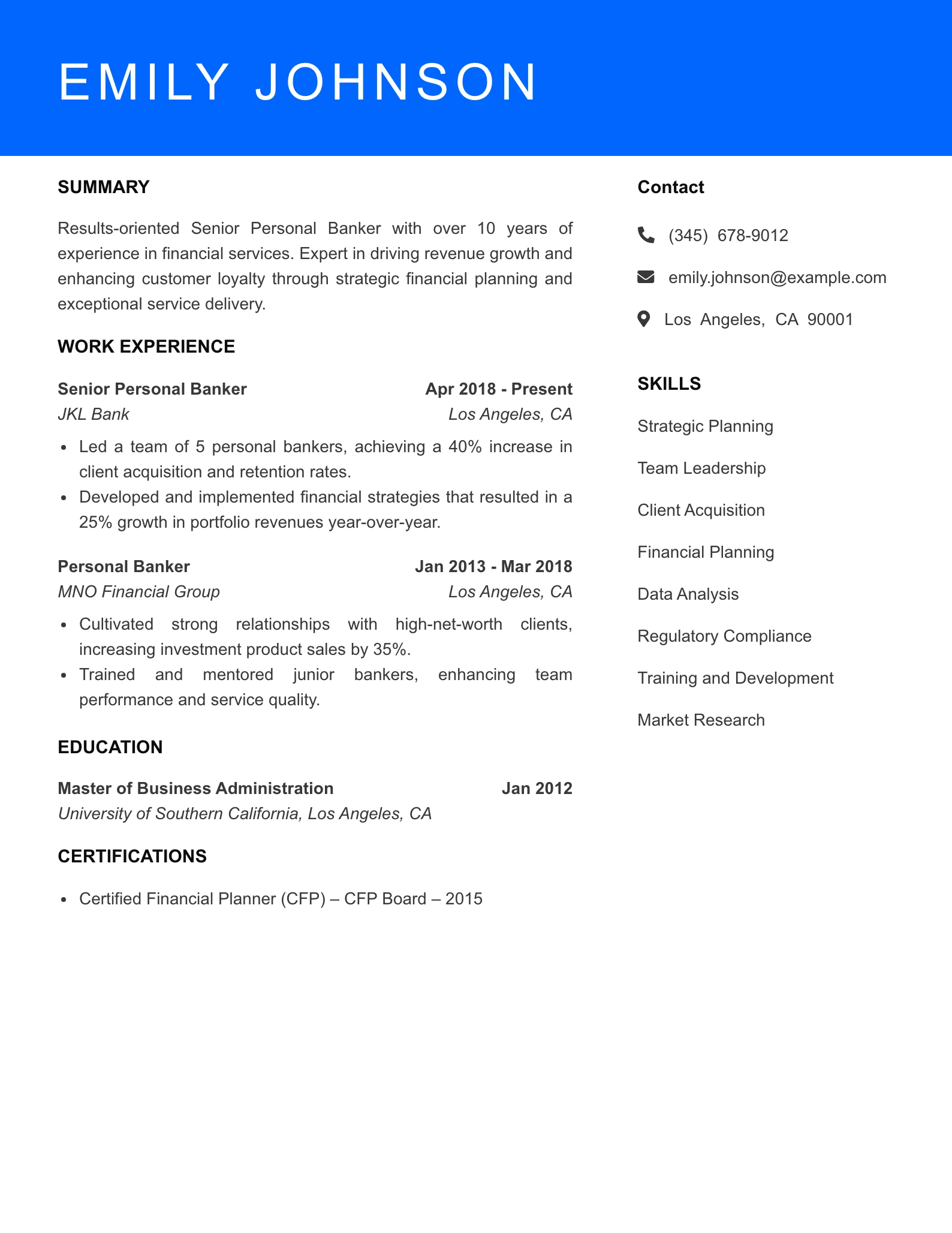

Personal Banker Resume Example

Personal Banker Resume Example

Craft a Winning Resume to Stand Out in the Personal Banking Sector

Introduction to the Job Sector

In the competitive world of personal banking, a well-crafted resume serves as your first opportunity to make a lasting impression on hiring managers. Personal bankers are critical in building and maintaining client relationships, advising on financial products, and achieving sales targets. Therefore, your resume must effectively showcase your relevant skills, experience, and accomplishments to demonstrate your value to potential employers.

Hiring managers typically look for candidates who not only possess strong financial acumen but also excel in customer service and communication. They seek individuals who can articulate their accomplishments clearly, particularly in areas such as client acquisition, retention rates, and sales achievements. Exploring this page will provide you with essential insights, resume examples, and tips tailored specifically for aspiring personal bankers to help you secure your ideal position in this dynamic industry.

Employment Trends and Statistics

- Job Growth: The Bureau of Labor Statistics projects a 5% growth rate for personal banking positions over the next decade, indicating a steady demand for skilled professionals in this field.

- High-Demand Roles: Personal bankers are among the top roles sought after in retail banking, with many institutions focusing on expanding their customer-facing services.

- Average Salary: As of 2023, the average annual salary for personal bankers in the United States is approximately $45,000, with potential earnings increasing significantly based on experience and performance metrics.

- Skill Gaps: According to industry surveys, there is a growing need for personal bankers who are proficient in digital banking solutions and customer relationship management (CRM) software.

- Diverse Opportunities: Many personal bankers transition into higher-level roles, such as financial advisors or branch managers, thanks to the comprehensive skill set gained in this position.

Resume Tips for Personal Banker Resume Example Professionals

To create a compelling resume that captures the attention of hiring managers in the personal banking sector, consider including the following essential elements:

- Tailored Summary: Start with a strong resume summary that highlights your experience in the banking sector, emphasizing your skills in customer service and financial advising.

- Quantifiable Achievements: Use specific metrics to showcase your accomplishments, such as “Increased client portfolio by 20% in one year through targeted sales strategies.”

- Relevant Skills: Include a skills section that features both soft skills (like communication and problem-solving) and hard skills (such as knowledge of banking regulations and financial products).

- Certifications: Highlight any relevant certifications, such as the Certified Financial Planner (CFP) or Series 7 license, which can provide a competitive edge in the hiring process.

- Professional Formatting: Utilize a clean, professional format with clear headings and bullet points for easy readability, ensuring that your most important information stands out.

- Continuous Learning: Show your commitment to professional development by mentioning any ongoing training or workshops you have attended related to financial services.

By adhering to these tips and utilizing the resources available on this page, you can craft a personal banker resume that not only showcases your qualifications but also positions you as a standout candidate in the banking industry.

See More Personal Banker Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

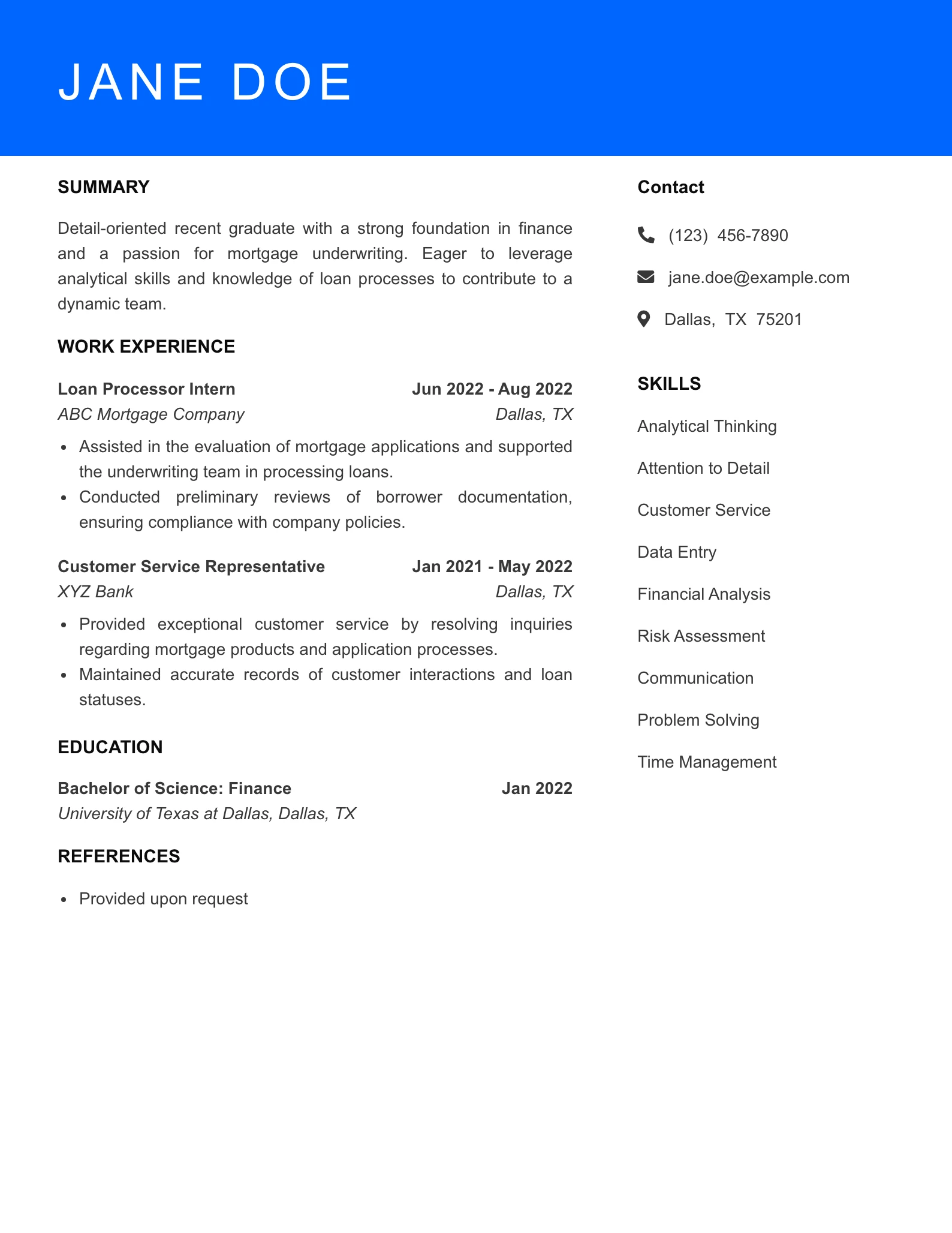

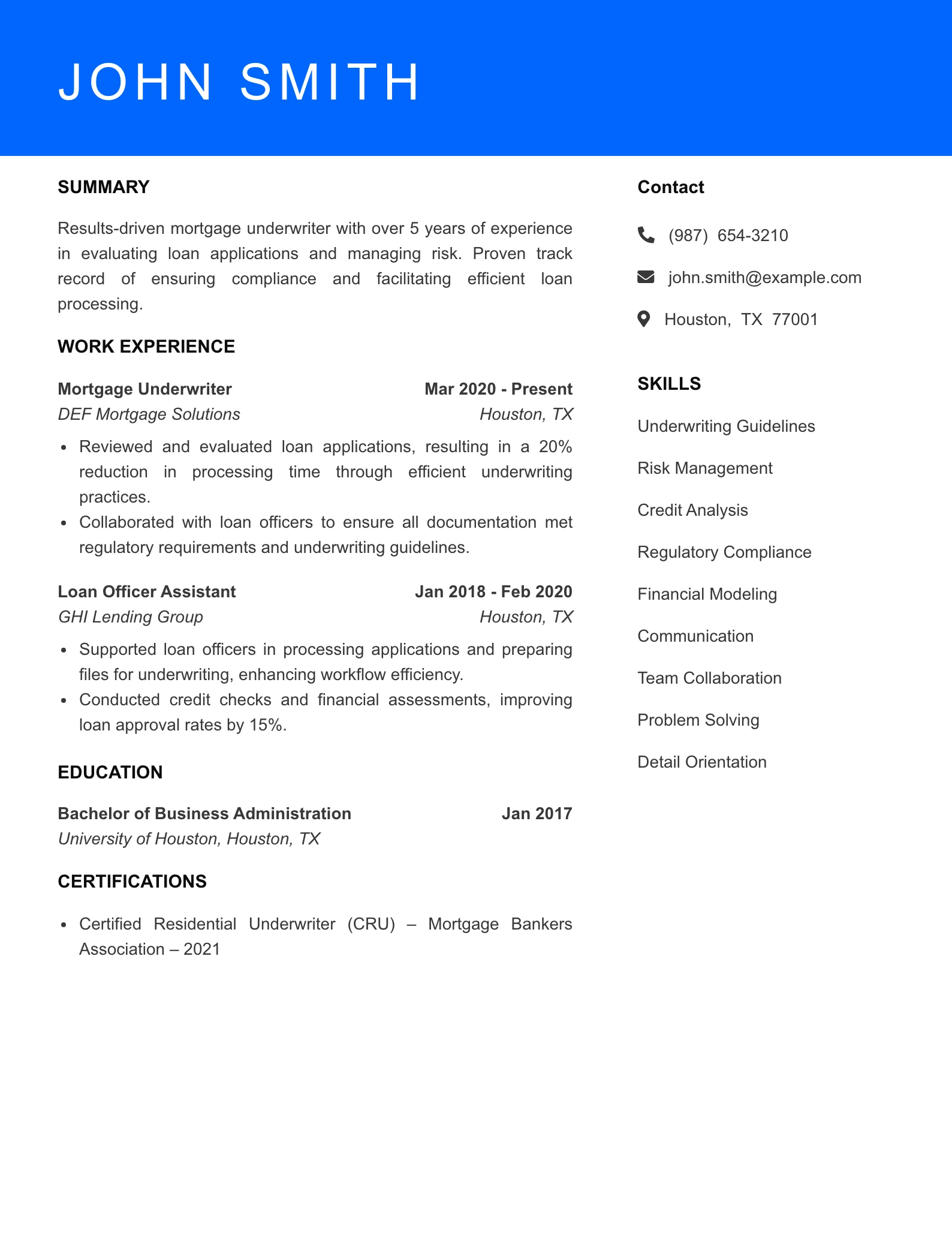

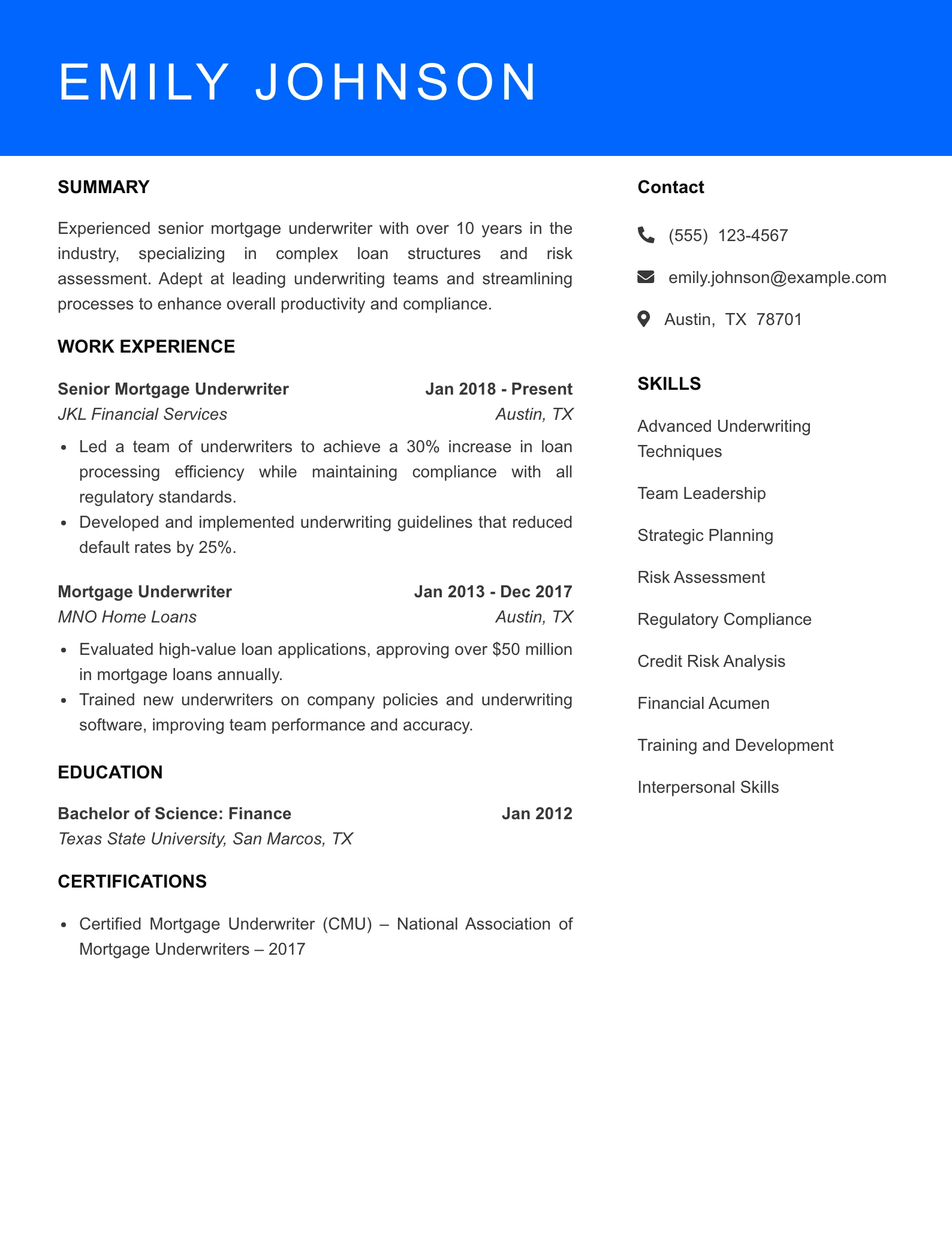

Mortgage Underwriter Resume Example

Crafting a Winning Mortgage Underwriter Resume

Your resume is your first impression in the competitive field of mortgage underwriting. It’s crucial to present a clear and compelling snapshot of your qualifications.

Understanding the Mortgage Underwriting Sector

In the mortgage industry, resumes serve as key marketing tools for professionals seeking opportunities as mortgage underwriters. These documents distill your experience, skills, and accomplishments into a format that allows hiring managers to quickly assess your fit for the role. Given the complexity and risks involved in mortgage lending, hiring managers diligently review resumes to find candidates who possess not only the necessary qualifications but also a keen understanding of financial principles and regulatory compliance.

What do hiring managers typically prioritize when reviewing resumes for mortgage underwriters? They look for a blend of technical skills, such as expertise in credit analysis and risk assessment, along with soft skills like attention to detail and effective communication. Prospective candidates should also highlight relevant certifications, such as the Certified Mortgage Underwriter (CMU) designation. On this page, you will find valuable resume examples tailored to the mortgage underwriting field, alongside tips for crafting a powerful resume that will stand out in your job search.

Employment Trends and Statistics

- Job Growth: The demand for mortgage underwriters is projected to grow by 3% from 2021 to 2031, reflecting the ongoing need for professionals in residential and commercial lending.

- High-Demand Roles: Many employers are actively seeking underwriters with experience in automated underwriting systems and alternative credit assessment methods.

- Average Salary: As of 2023, the average salary for a mortgage underwriter is approximately $76,000 per year, with potential for higher earnings in metropolitan areas.

- Job Stability: The mortgage industry tends to experience stability, even during economic downturns, as home buying and refinancing activities persist.

- Remote Opportunities: An increasing number of mortgage underwriters enjoy remote work arrangements, expanding job opportunities beyond geographical limitations.

Resume Tips for Mortgage Underwriter Professionals

Creating a standout resume in the mortgage underwriting sector requires careful attention to detail and strategic presentation of your qualifications. Here are essential elements to include in your resume:

- Certifications: Highlight any relevant certifications, such as the Certified Residential Underwriter (CRU) or Certified Mortgage Underwriter (CMU).

- Technical Skills: Emphasize your proficiency with underwriting software, compliance regulations, and risk assessment methodologies.

- Quantifiable Achievements: Use metrics to demonstrate your impact, such as “reduced loan processing time by 25% through efficient workflow management.”

- Formatting: Keep your resume clean and professional, using clear headings, bullet points, and a readable font. Limit your document to one or two pages.

- Tailored Content: Customize your resume for each application by incorporating keywords from the job description to align your experience with the employer’s needs.

By following these guidelines and utilizing the provided resume examples, you’ll be well-prepared to create a compelling representation of your skills and experience in the mortgage underwriting field.

See More Mortgage Underwriter Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

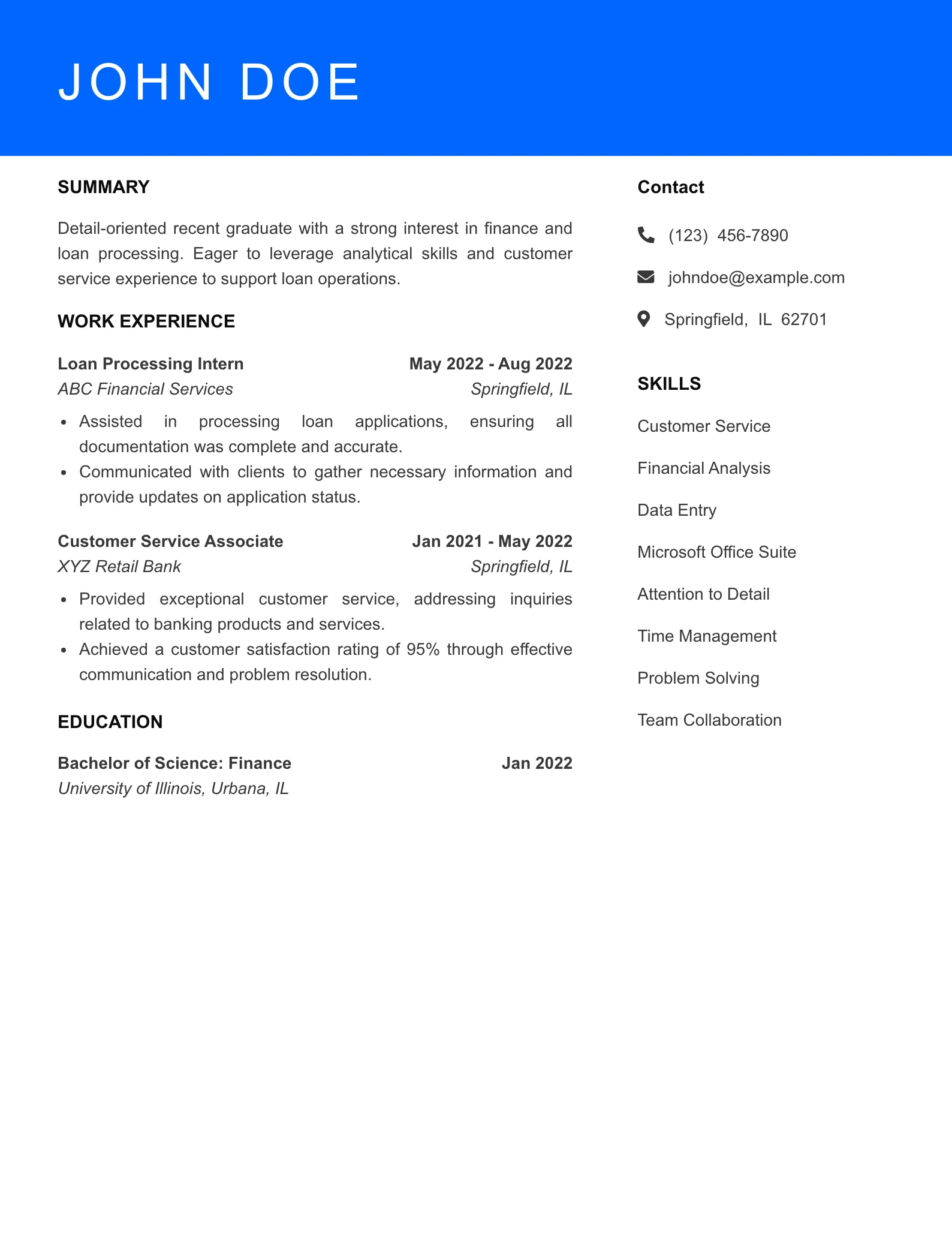

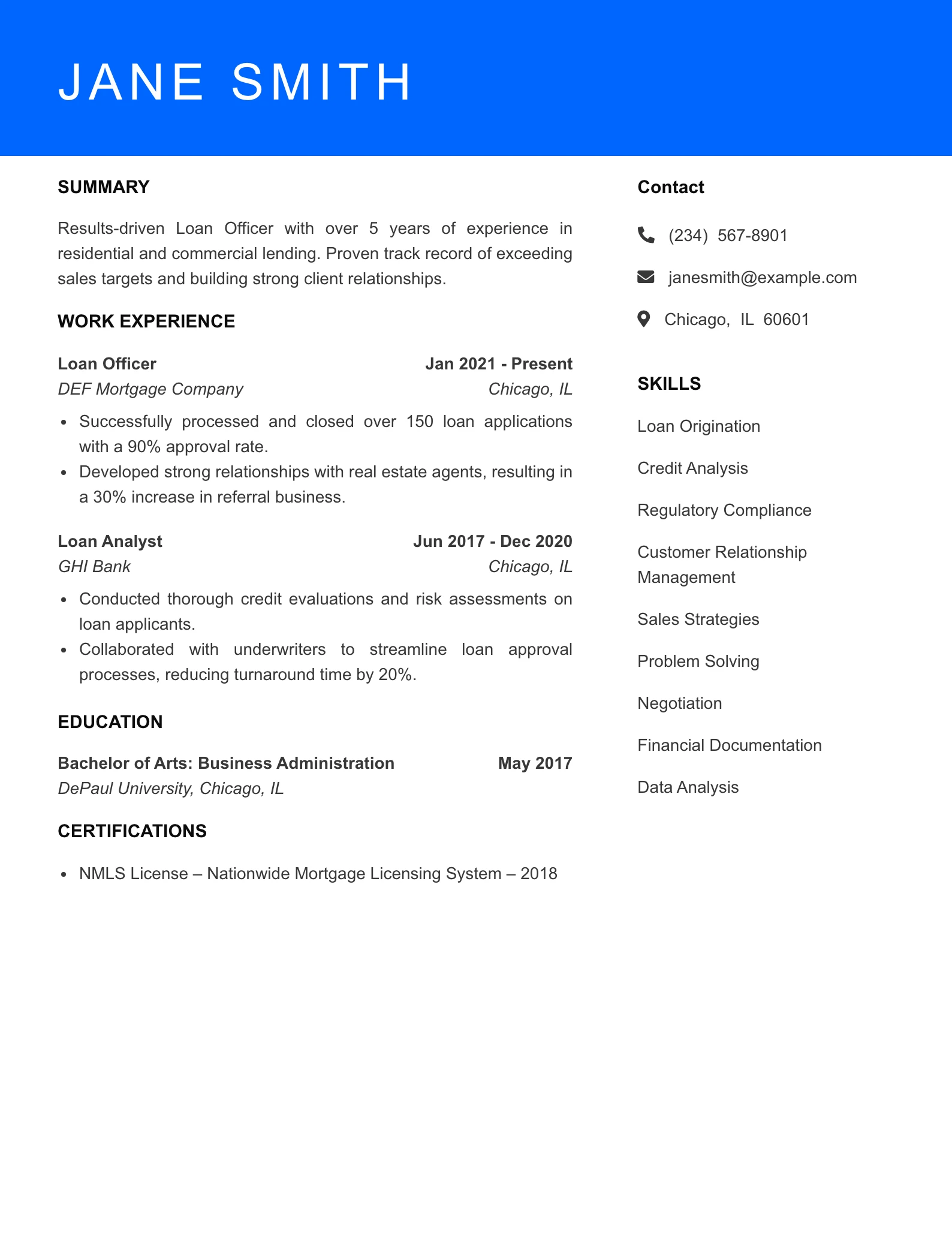

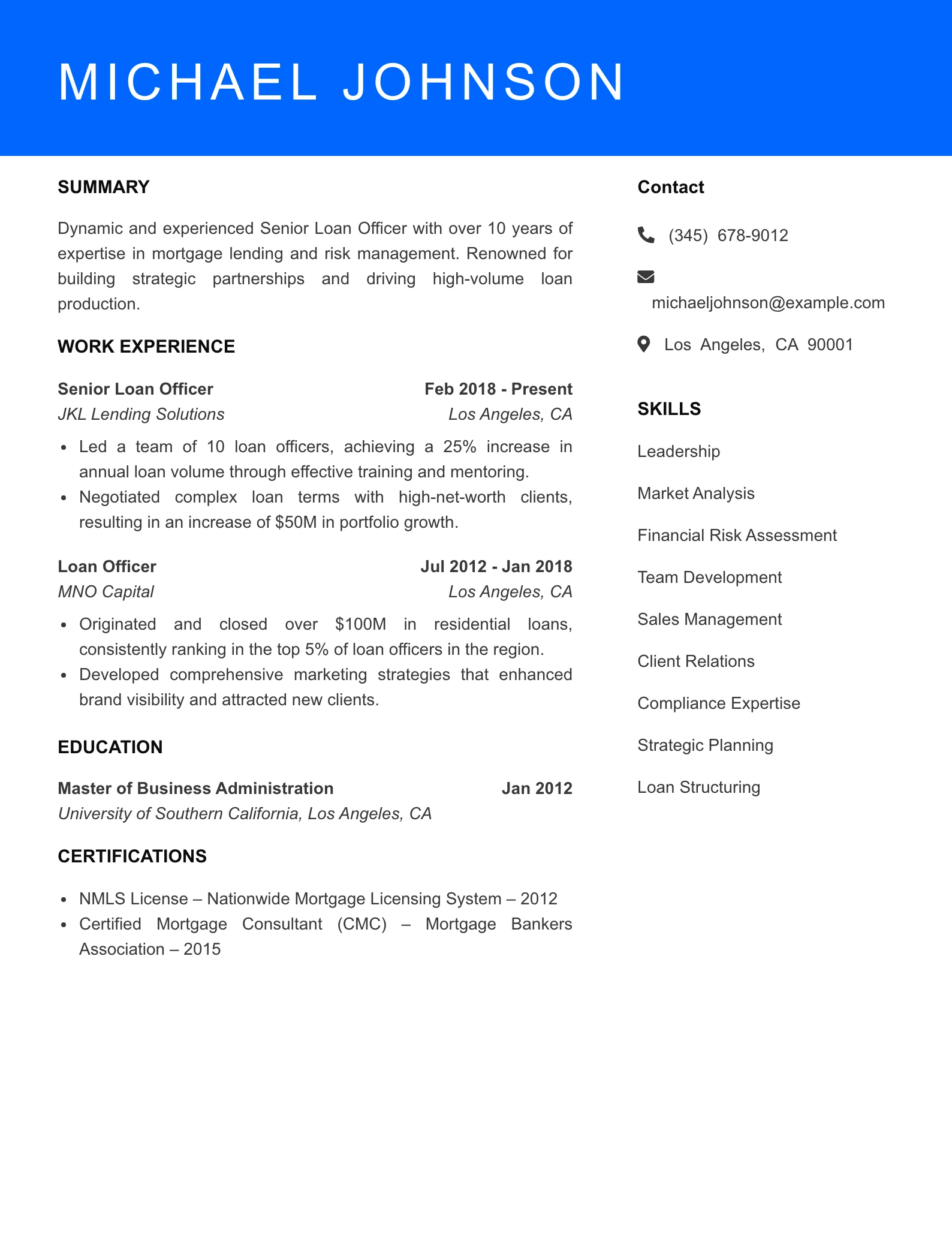

Loan Officer Resume Example

Your Path to Success: Crafting a Standout Loan Officer Resume

Unlock your potential as a Loan Officer with a resume that showcases your skills and experience. Explore tailored examples and expert tips to help you land your dream job in the competitive financial sector.

Understanding the Loan Officer Sector

In the fast-paced world of finance, a well-crafted resume is not just a formality; it is a critical tool that can make or break your chances of entering the loan officer profession. As financial institutions seek candidates who can effectively assess, evaluate, and manage loan applications, your resume must clearly articulate your qualifications and accomplishments. Hiring managers in this field are looking for individuals who possess strong analytical skills, a deep understanding of lending regulations, and exceptional communication abilities.

This page serves as a comprehensive guide to help you navigate the nuances of crafting a compelling loan officer resume. Here, you will find tailored resume examples, insights into the skills and qualifications that hiring managers prioritize, and key strategies to effectively present your experiences to make a positive impression in the competitive job market.

Employment Trends and Statistics

- The Bureau of Labor Statistics projects a 3% growth rate for loan officer positions between 2021 and 2031, reflecting steady demand in the industry.

- Average annual salaries for loan officers are around $76,000, with top earners making over $130,000, depending on experience and location.

- With the rise of online lending platforms, there is increasing demand for loan officers who are tech-savvy and can navigate digital loan processes.

- As housing markets fluctuate, loan officers specializing in residential loans are particularly sought after, especially in urban areas with growing populations.

- Job opportunities are abundant in states like California, Texas, and New York, which have some of the highest employment levels for loan officers.

Resume Tips for Loan Officer Professionals

Creating a standout resume as a loan officer requires careful attention to detail. Here are essential elements to include:

- Contact Information: Ensure your name, phone number, email, and LinkedIn profile (if applicable) are clearly stated at the top.

- Professional Summary: Craft a brief summary that highlights your expertise in assessing loan applications, understanding credit risk, and delivering exceptional customer service.

- Key Skills: Include a section that lists relevant skills such as financial analysis, risk assessment, regulatory compliance, and proficiency with loan processing software.

- Certifications: Mention any certifications that enhance your qualifications, such as Licensed Mortgage Loan Originator (MLO) or Certified Residential Mortgage Specialist (CRMS).

- Work Experience: Focus on quantifiable achievements in previous positions, such as the number of loans processed, customer satisfaction rates, or sales performance.

- Formatting: Use a clean, professional layout with consistent fonts and spacing to ensure readability and a polished appearance.

By following these guidelines and leveraging the resume examples provided, you can craft a compelling document that effectively showcases your qualifications and sets you apart in the competitive loan officer job market.

See More Loan Officer Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

Fintech Product Manager Resume

Your Gateway to Fintech Product Manager Success

Crafting an impactful Fintech Product Manager resume is crucial for standing out in today’s rapidly evolving financial technology landscape. Let us guide you through the essentials of showcasing your skills and experience effectively.

Introduction to the Fintech Sector

In the competitive world of financial technology, a well-crafted resume is not just a document; it is your ticket to landing the job of your dreams. For Fintech Product Managers, resumes play a pivotal role in conveying a unique blend of technical prowess, market insight, and leadership ability. Hiring managers are on the lookout for individuals who can navigate complex product lifecycles while maintaining a strong focus on user experience and regulatory requirements. They favor candidates who demonstrate analytical thinking, collaboration skills, and a robust understanding of both technology and finance.

This page serves as a comprehensive resource for Fintech Product Manager resumes, offering tailored examples and expert tips that align with industry standards. Whether you are entering the job market or seeking career advancement, you will find valuable insights to optimize your resume for success.

Employment Trends and Statistics

- The Fintech industry is projected to grow at a CAGR of 25.4% from 2023 to 2030, indicating a strong demand for skilled professionals.

- The average salary for a Fintech Product Manager in the United States is around $120,000 annually, with top companies offering salaries exceeding $150,000.

- Over 60% of Fintech companies report difficulty finding qualified candidates, emphasizing the need for well-structured resumes.

- Job postings for Fintech Product Managers have increased by 30% year-over-year, showcasing the sector’s rapid expansion.

- Nearly 45% of Fintech firms are prioritizing candidates with experience in Agile methodologies and UX/UI design.

Resume Tips for Fintech Product Manager Professionals

To stand out as a Fintech Product Manager, your resume must effectively communicate your qualifications. Here are essential elements to include:

- Tailored Summary: Start with a compelling summary that highlights your key achievements and areas of expertise in fintech and product management.

- Quantifiable Achievements: Use metrics to showcase your impact, such as revenue growth, user acquisition rates, or successful product launches.

- Relevant Certifications: Include industry-specific certifications such as Certified Scrum Product Owner (CSPO) or Product Management Professional (PMP).

- Technical Skills: Highlight your proficiency in tools and technologies commonly used in fintech, such as Agile project management software, SQL, and data analysis tools.

- Format and Design: Utilize a clean, professional layout with clear headings and bullet points for easy readability, ensuring that your resume is ATS-friendly to enhance visibility.

By following these guidelines, you can craft a Fintech Product Manager resume that not only reflects your qualifications but also resonates with hiring managers in the industry.

See More Fintech Product Manager Resume →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

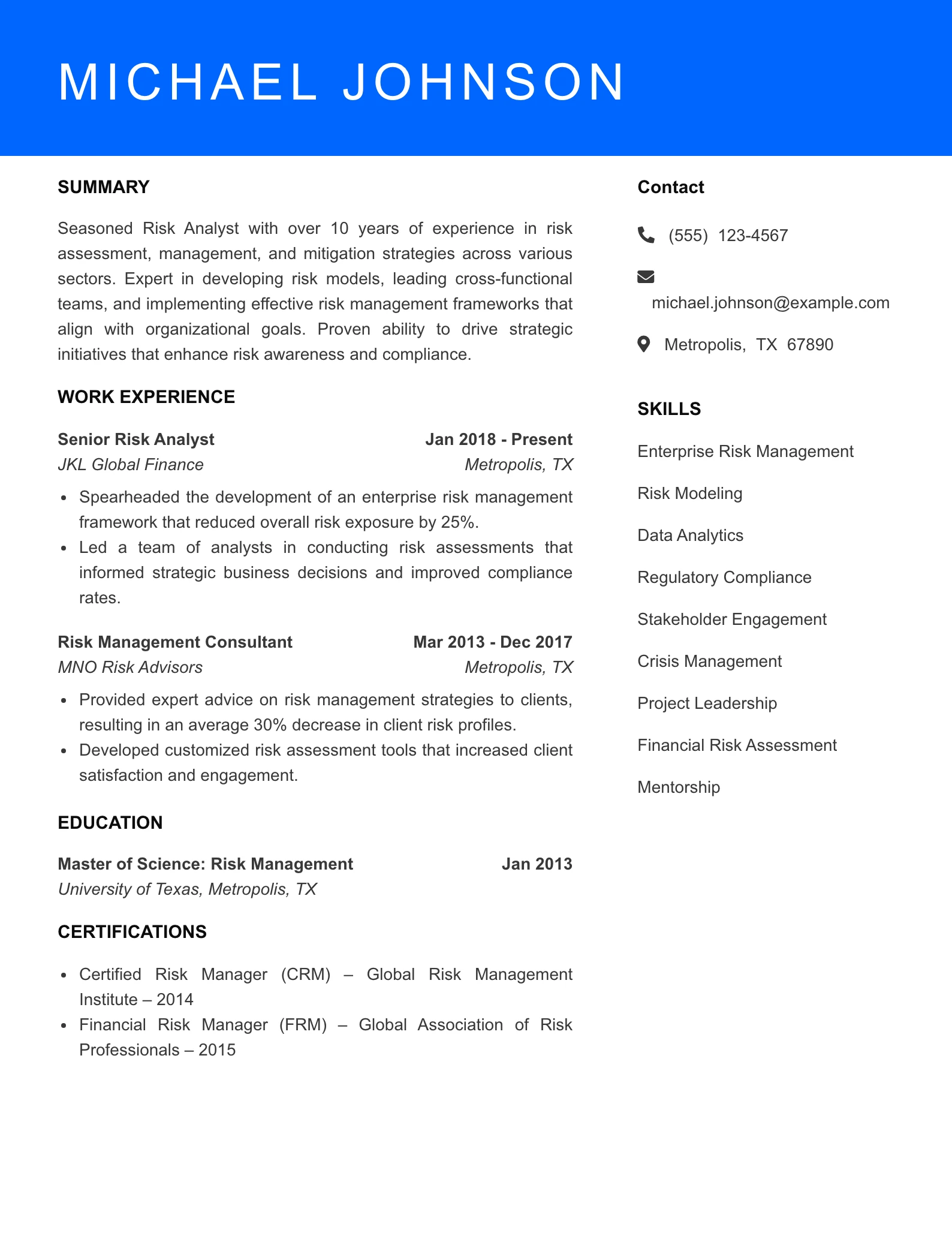

Risk Analyst Resume Example

Crafting a Winning Risk Analyst Resume

The role of a Risk Analyst is critical in today’s ever-evolving corporate landscape, where informed decision-making is paramount. This page serves as a comprehensive resource to help you create an impactful resume tailored specifically for the Risk Analyst position.

Understanding the Risk Analyst Sector

In the competitive field of risk analysis, a well-crafted resume is your ticket to standing out among a pool of candidates. Hiring managers prioritize resumes that not only demonstrate relevant skills and experiences but also reflect an understanding of the complexities involved in risk management. They are searching for candidates who can effectively analyze data, identify potential risks, and devise strategies to mitigate these threats.

A successful Risk Analyst resume should convey your analytical thinking, problem-solving abilities, and familiarity with risk assessment methodologies. As you explore this page, you’ll find a variety of resume examples tailored for Risk Analyst positions, insights into industry requirements, and actionable tips to enhance your application.

Employment Trends and Statistics

- The demand for risk analysts is projected to grow by 20% from 2021 to 2031, significantly faster than the average for all occupations.

- The average salary for risk analysts in the United States is approximately $80,000 per year, with entry-level positions starting around $55,000.

- Sectors experiencing high demand for risk analysts include finance, insurance, and healthcare, particularly as organizations increasingly prioritize compliance and risk management.

- 70% of hiring managers report that certifications (such as FRM or CFA) enhance a candidate’s appeal in the risk analysis field.

- 85% of risk analysts hold at least a bachelor’s degree in finance, economics, or a related field, underscoring the importance of formal education in this profession.

Resume Tips for Risk Analyst Professionals

To create a compelling resume as a Risk Analyst, consider incorporating the following elements:

- Relevant Certifications: Highlight any pertinent certifications, such as Financial Risk Manager (FRM) or Chartered Financial Analyst (CFA), to demonstrate your expertise.

- Key Skills: List essential skills such as statistical analysis, data modeling, risk assessment techniques, and proficiency in software tools like SQL or R.

- Quantifiable Achievements: Include metrics that showcase your impact, such as reduced risk exposure by a certain percentage or improved analysis processes that led to significant cost savings.

- Professional Formatting: Use a clean, professional format that enhances readability. Stick to standard fonts and sizes, and ensure consistent spacing and alignment.

- Tailored Experience: Customize your work experience section to align with the job description, emphasizing relevant projects and responsibilities that demonstrate your suitability for the role.

- Education Credentials: Clearly state your educational background, particularly degrees in finance, economics, statistics, or related fields, to establish your foundational knowledge in risk analysis.

By following these guidelines and leveraging the examples on this page, you can craft a resume that not only captures attention but also opens doors in the competitive world of risk analysis.

See More Risk Analyst Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

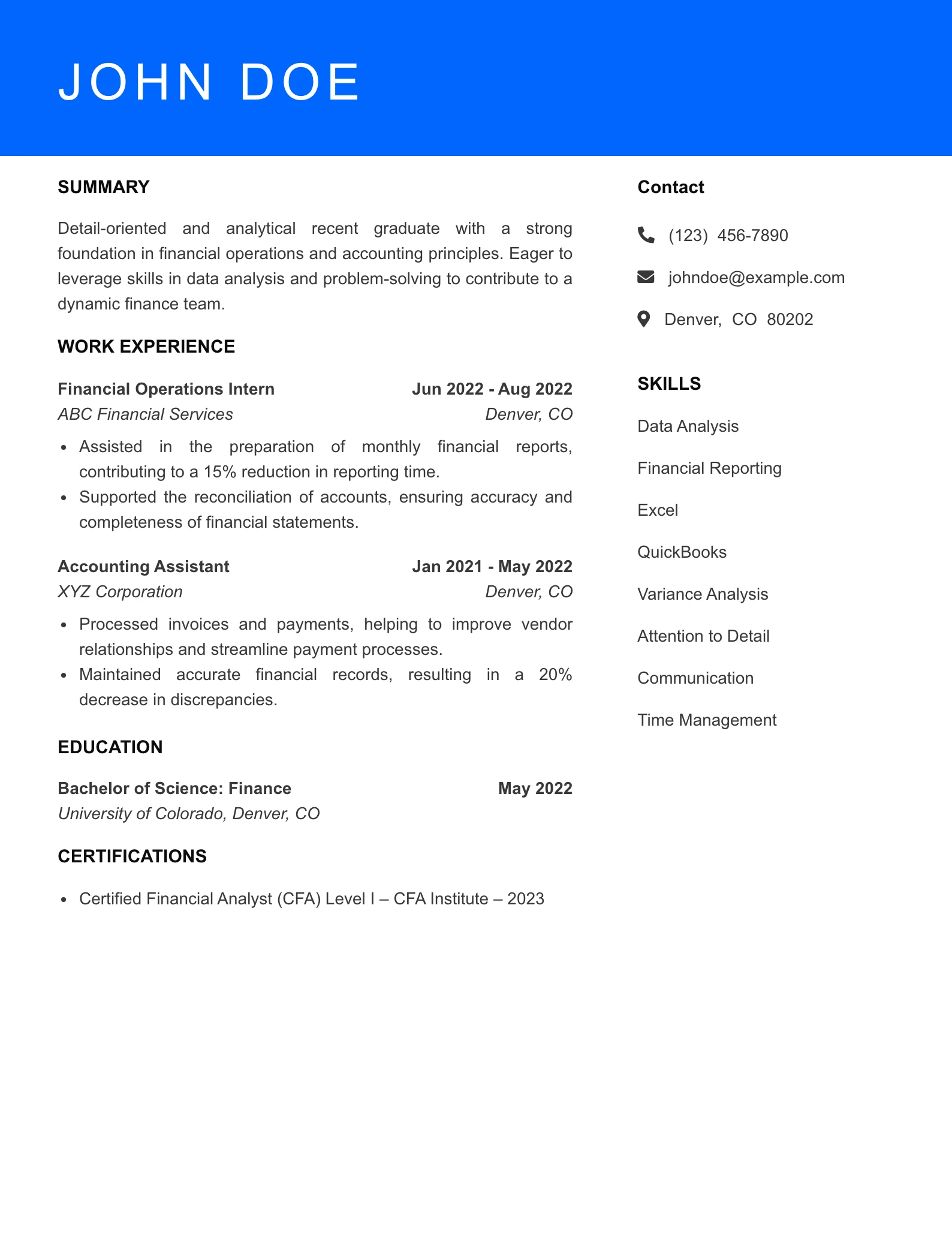

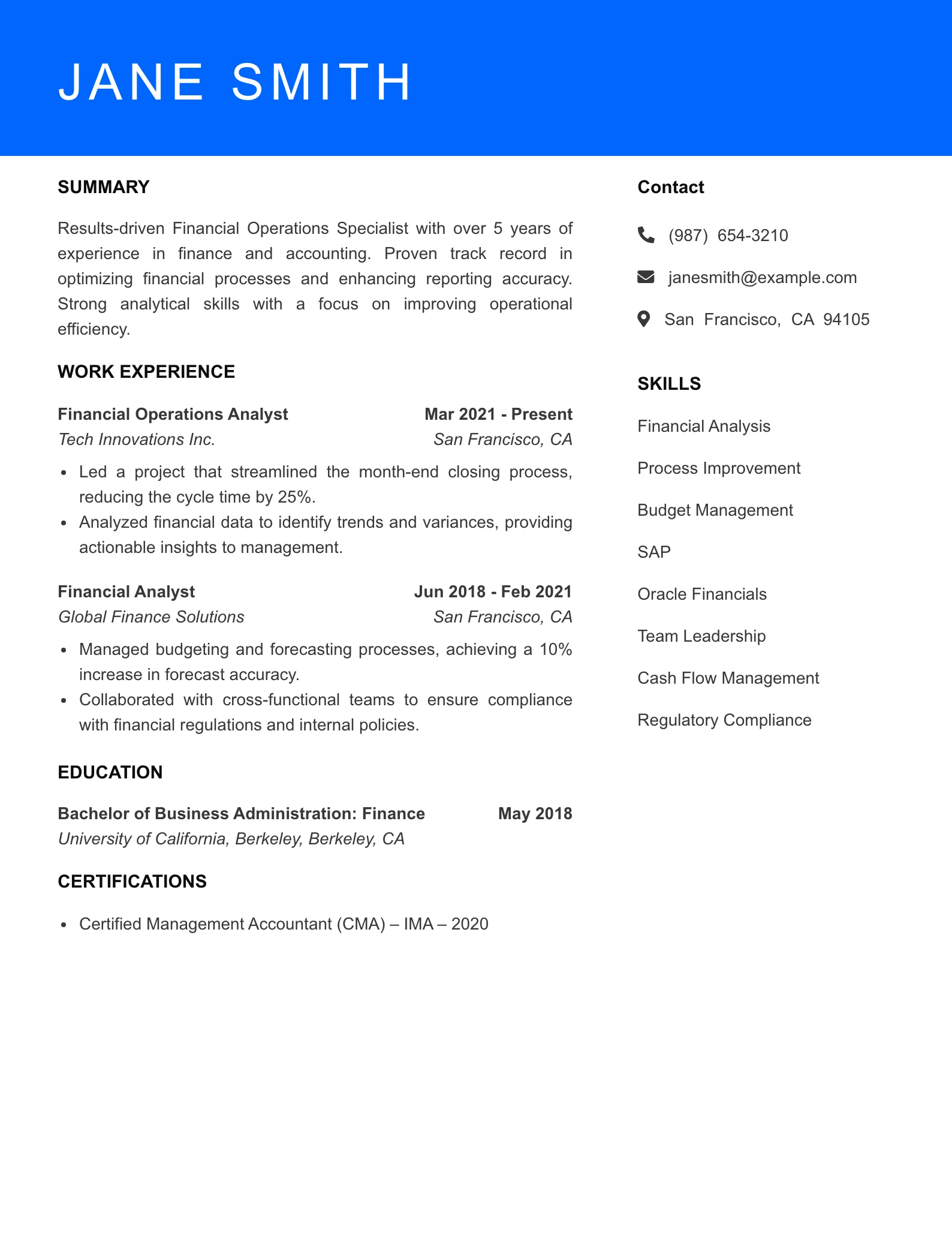

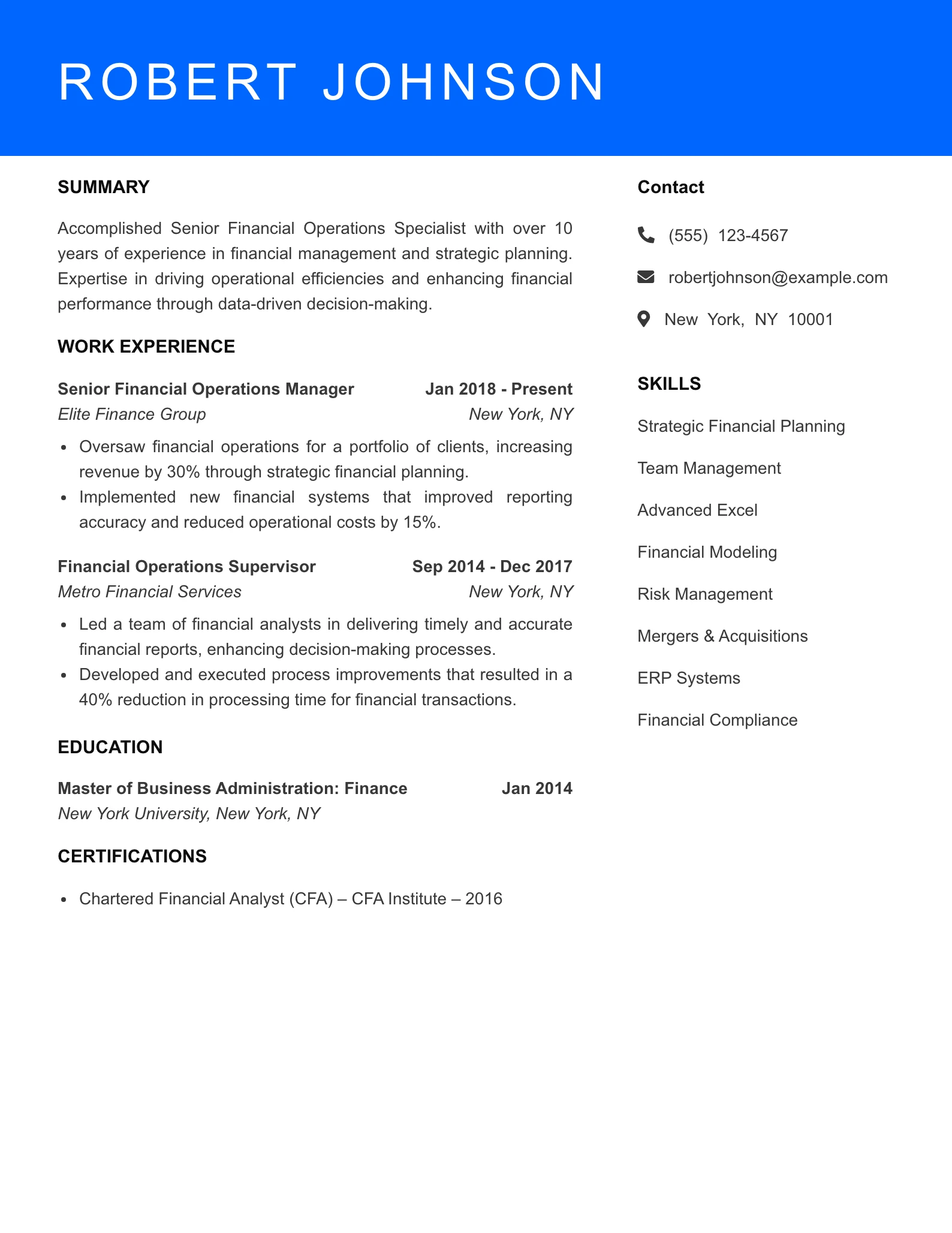

Financial Operations Resume Example

Financial Operations Resume Example

Unlock your potential in the financial operations sector with a compelling resume that stands out to hiring managers.

Introduction to the Job Sector

In the competitive arena of financial operations, a well-crafted resume is your ticket to securing an interview. Hiring managers in this field are inundated with applications and often rely on resumes to quickly identify candidates who not only possess the necessary skills but also demonstrate a clear understanding of the financial landscape. A strategically tailored resume can showcase your expertise in managing financial processes, analyzing data, and optimizing operational efficiency, setting you apart from other applicants.

When reviewing resumes, hiring managers typically look for a blend of technical skills and soft skills. Proficiency in financial software, attention to detail, analytical thinking, and effective communication are paramount. Additionally, candidates with relevant certifications like CPA or CMA often hold an advantage, as these credentials signify a commitment to professionalism and industry standards. This page offers a wealth of resources, including resume examples tailored specifically for roles in financial operations, tips on how to enhance your application, and insights into what employers are seeking.

Employment Trends and Statistics

- The Bureau of Labor Statistics projects a 10% job growth for financial analysts from 2021 to 2031, indicating a steady demand for professionals in the financial operations sector.

- Average salaries in financial operations vary widely, with financial analysts earning a median annual wage of about $83,000, while financial managers can earn upwards of $134,000.

- The rise of fintech and automation in finance has created new roles and opportunities within the sector, such as financial technology consultants and risk management specialists.

- 70% of hiring managers in finance prioritize candidates with advanced degrees or certifications, reinforcing the importance of continuous education in this field.

- Companies increasingly value data-driven decision-making, highlighting the need for candidates who can leverage analytics tools and methodologies.

Resume Tips for Financial Operations Resume Example Professionals

When crafting a resume for a position in financial operations, consider including these essential elements:

- Relevant Certifications: Highlight any certifications such as CPA, CMA, or CFA that showcase your expertise and commitment to the field.

- Technical Skills: Emphasize your proficiency in financial software (e.g., QuickBooks, SAP) and data analysis tools (e.g., Excel, Tableau) that are critical for success in the role.

- Quantifiable Achievements: Use specific metrics to illustrate your accomplishments, such as cost savings, efficiency improvements, or revenue increases you’ve contributed to in previous roles.

- Tailored Summary Statement: Craft a compelling summary that captures your professional journey, key skills, and what you bring to the table, tailored specifically to the financial operations role.

- Clean Formatting: Use a professional layout with clear headings, bullet points, and consistent font styles to ensure readability and impact.

- Soft Skills: Don’t forget to include soft skills like teamwork, problem-solving, and communication, as these are equally valued by employers in addition to technical capabilities.

Emphasizing these elements can help you create a strong impression and significantly enhance your chances of landing a role in financial operations.

See More Financial Operations Resume Example →

Ready to create an outstanding resume? Use our resume builder to create an outstanding resume in 15 min.

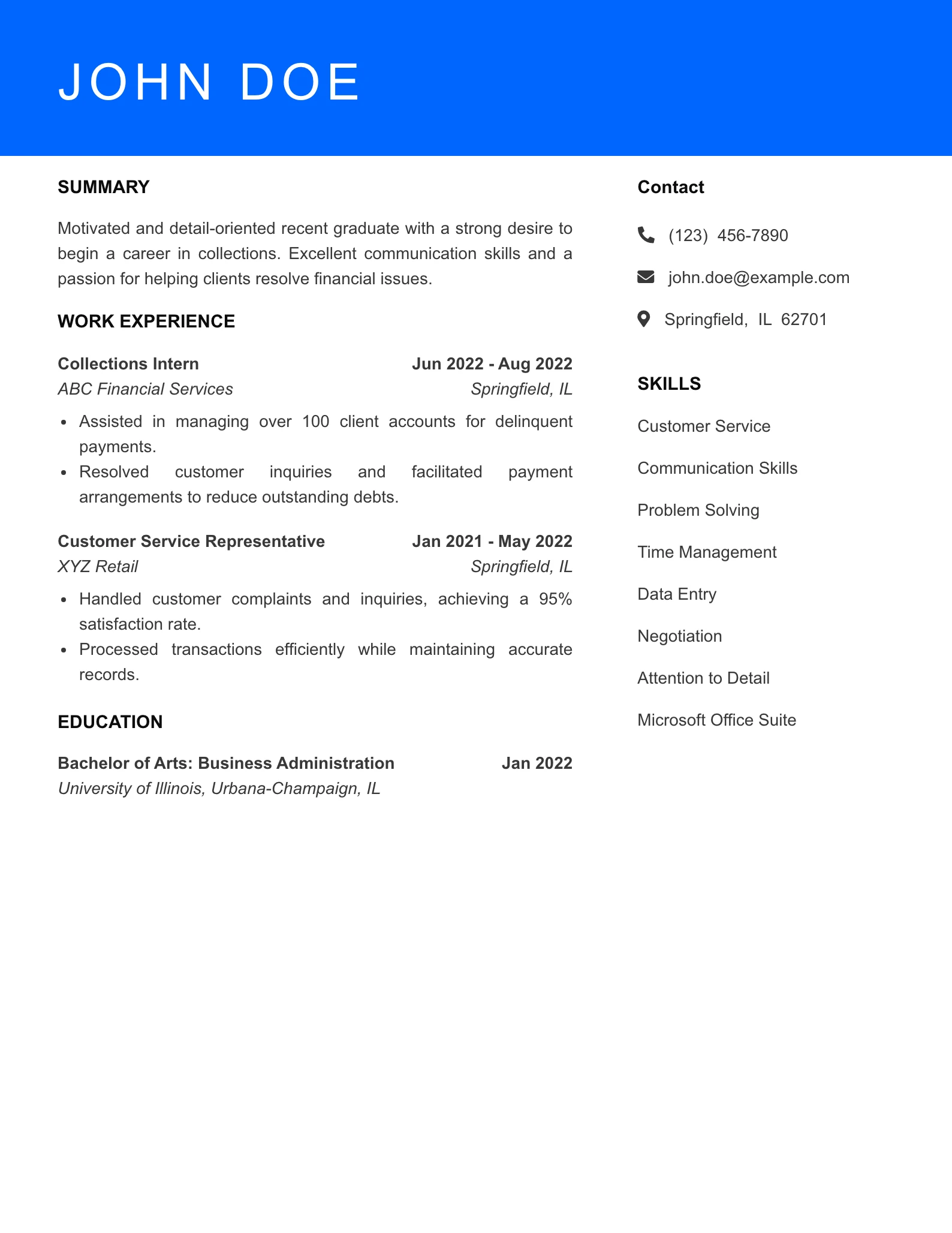

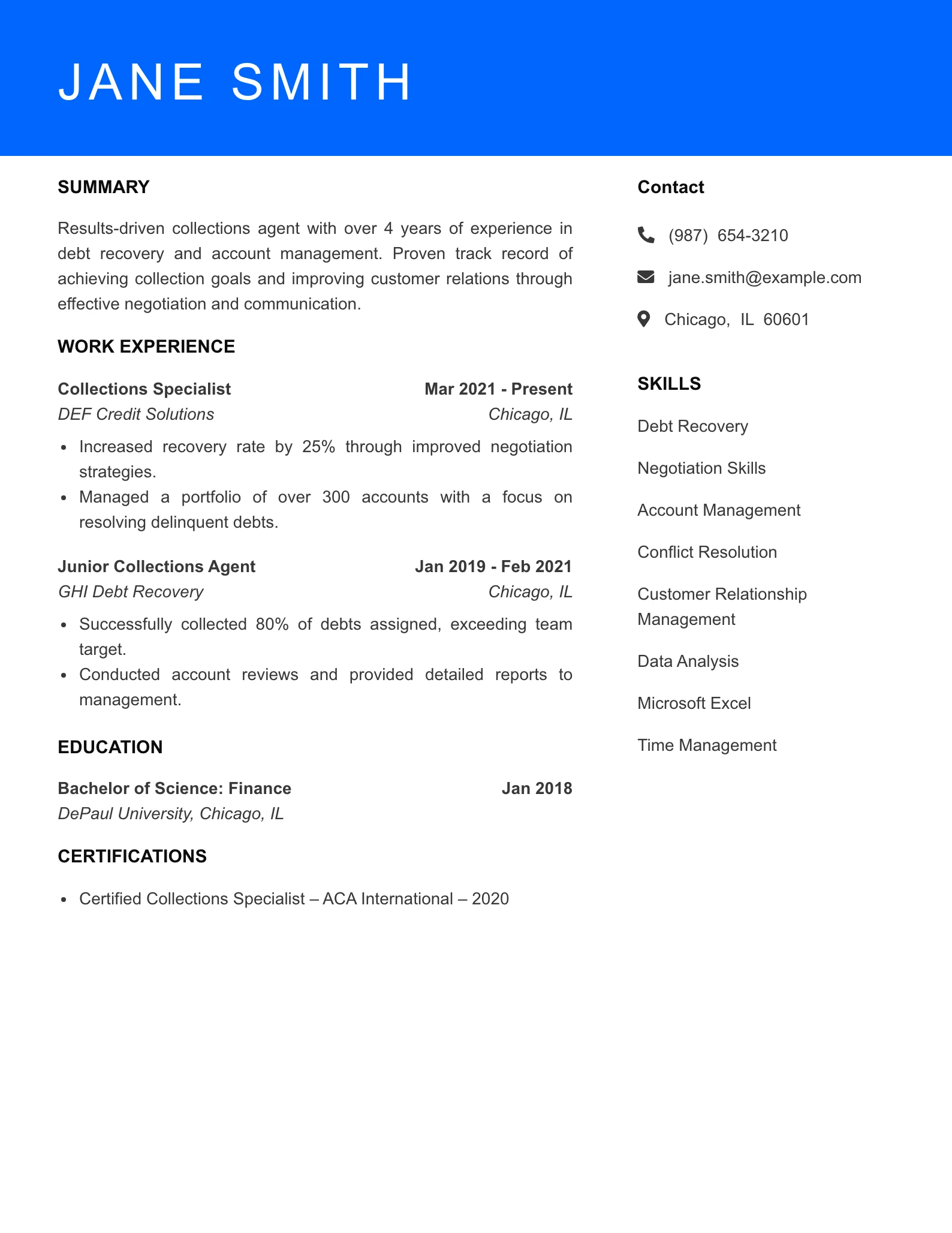

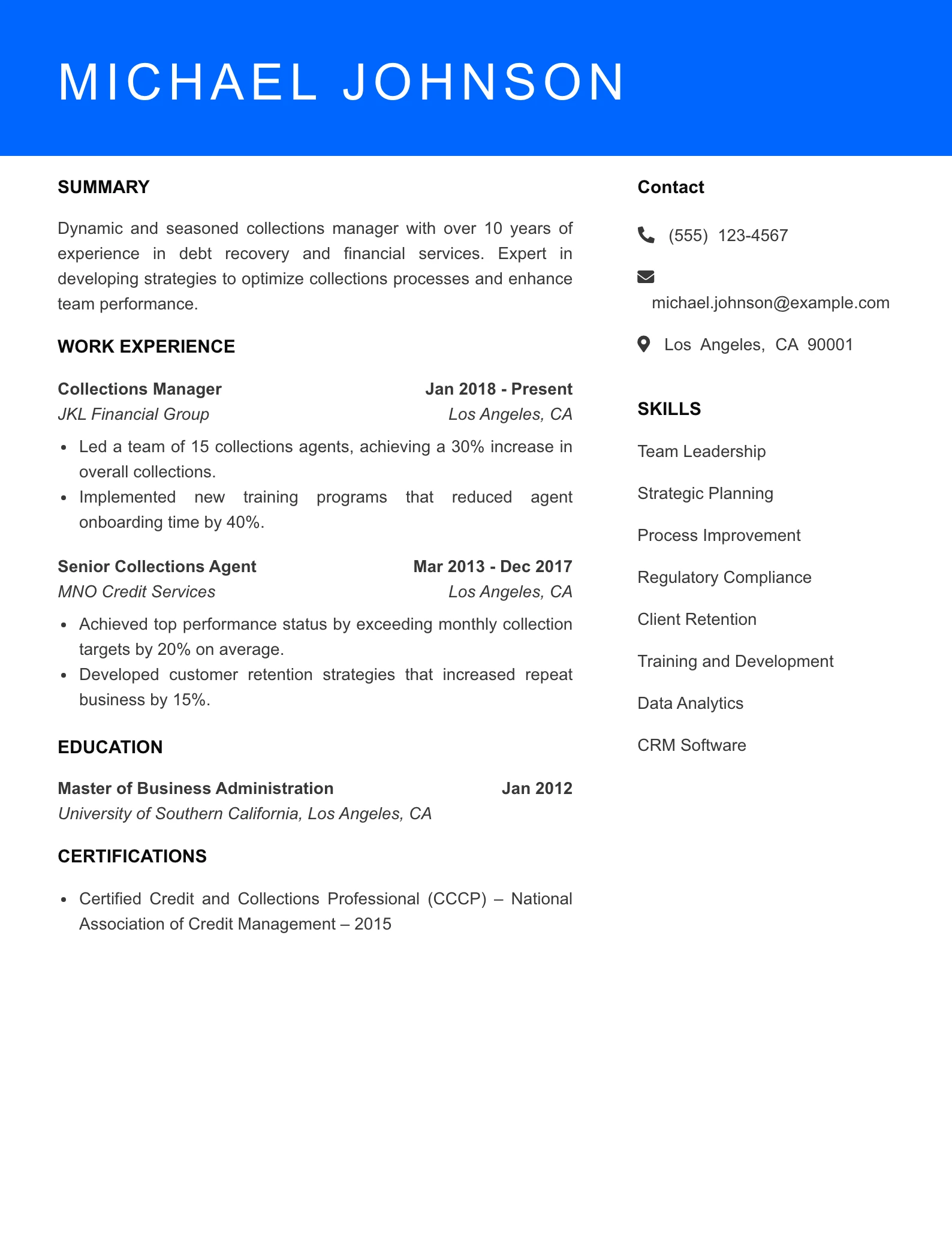

Collections Agent Resume Example

A Strong Foundation for Your Career in Collections

Crafting an effective resume is crucial for collections agents seeking to stand out in a competitive job market. Explore our comprehensive guide to develop a winning resume tailored for success in the collections industry.

The Importance of Resumes in the Collections Agent Hiring Process

In the fast-paced world of collections, having a polished resume is not just beneficial—it’s essential. Hiring managers in this field are inundated with applications, making it critical for your resume to showcase your relevant experience, skills, and achievements clearly and concisely. A well-structured resume can be the deciding factor that elevates you from numerous candidates vying for the same position.

When reviewing applications, hiring managers typically look for candidates who demonstrate strong communication abilities, problem-solving skills, and a proven track record in debt recovery. They also value familiarity with industry regulations and technologies, along with relevant certifications. On this page, you will find curated resume examples specifically designed for collections agents, along with tips and insights to help you create an impactful resume that resonates with potential employers.

Employment Trends and Statistics

- The Bureau of Labor Statistics predicts a 6% job growth for collections agents and specialists from 2021 to 2031, highlighting a steady demand in the industry.

- The average salary for a collections agent in the United States is approximately $42,000 annually, with top earners exceeding $58,000 based on experience and location.

- Over 75% of collections agents hold at least a high school diploma, but many employers prefer candidates with post-secondary education or specialized training.

- The rise of digital collections methods is reshaping the industry, creating higher demand for agents who are tech-savvy and familiar with electronic communication tools.

Resume Tips for Collections Agent Professionals

To make your resume stand out in the collections industry, consider including the following key elements:

- Targeted Objective Statement: Begin with a clear, concise objective statement that aligns with the specific role you are applying for.

- Relevant Skills: Highlight essential skills such as negotiation, conflict resolution, and proficiency in debt collection software.

- Quantifiable Achievements: Use metrics to demonstrate your success, such as the percentage of debts recovered or targets met, to provide concrete evidence of your contributions.