In the ever-evolving landscape of the actuarial profession, a standout Actuary resume is your ticket to success. Our collection of tailored resume examples for Actuary is designed to equip you with the tools you need to showcase your unique skills and experiences.

Whether you’re a seasoned professional or just starting out, these examples will help you craft a compelling narrative that captures employers’ attention. Don’t just blend in—build yours today and take the first step towards landing your ideal position!

8 Actuary Resume Examples

Crafting a strong actuary resume requires more than listing job duties. You must present your technical skills, analytical mindset, and actuarial impact in a way that hiring managers and applicant tracking systems can quickly understand.

The following 8 actuary resume examples will guide you through building an effective resume for different levels in the actuarial field, including actuarial analyst, life and health insurance roles, property and casualty positions, and even chief actuary.

Actuarial Analyst Resume Sample

Jonathan M. Carter

Actuarial Analyst

Chicago, IL (312) 584-9210 jonathan.carter@email.com

LinkedIn: linkedin.com/in/jonathancarter

Professional Summary

Actuarial Analyst with 5+ years of experience in health insurance pricing, risk analysis, and predictive modeling. Skilled in R, Python, SQL, and advanced Excel with a proven ability to build accurate models, support rate filings, and turn complex data into clear, actionable insights for stakeholders.

Professional Experience

Actuarial Analyst

- Analyze claims and membership data for a portfolio of 200K+ policyholders to support pricing and reserving decisions.

- Build and maintain predictive models in R and Python, improving loss prediction accuracy by 18% and reducing manual analysis time by 30%.

- Automate monthly performance reports using SQL and Excel, cutting reporting time from 12 hours to 4 hours per cycle.

- Assist with state rate filings for 3+ major product lines, contributing to on-time approvals with no resubmission needed.

Education

Bachelor of Science in Actuarial Science

University of Wisconsin–Madison — Madison, WI

Graduated: 2020

Certifications

- SOA Exam P – Probability

- SOA Exam FM – Financial Mathematics

- Working toward Associate of the Society of Actuaries (ASA)

Technical Skills

R Python SQL Excel (Advanced) VBA SAS (Basic) Power BI / Tableau Statistical & Predictive Modeling Loss Reserving Risk Forecasting

Soft Skills

Analytical thinking Problem-solving Communication Collaboration Attention to detail Time management Stakeholder reporting

Why This Resume Works

- The resume maintains a clean and structured layout, allowing hiring managers to quickly scan key information without visual clutter or distractions.

- The professional summary is concise yet impactful, clearly highlighting 5+ years of experience, core technical capabilities, and actuarial expertise relevant to data-driven decision making.

- The experience section includes measurable achievements (18% accuracy improvement, 30% time reduction, 200K+ members analyzed), which strengthens credibility and demonstrates real business impact.

- Skills are categorized into technical and soft skills, making it easy for recruiters and ATS systems to identify core competencies instantly.

- The one-page layout is well-balanced, ensuring all essential details—summary, experience, education, certifications, and skills—fit neatly without overwhelming the reader.

- The content is tailored to actuarial roles, using industry-specific terms like risk forecasting, predictive modeling, reserving, and rate filings, increasing relevance for actuarial employers.

- The tone remains direct and professional, avoiding unnecessary fluff, which makes the resume appear confident, polished, and job-ready.

- The resume is mobile-friendly and responsive, ensuring a consistent viewing experience whether opened on a laptop, tablet, or smartphone.

If you want to explore formatting inspiration beyond actuarial profiles, you may also check out this detailed guide on Loan Officer Resume Templates for layout and structure ideas.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

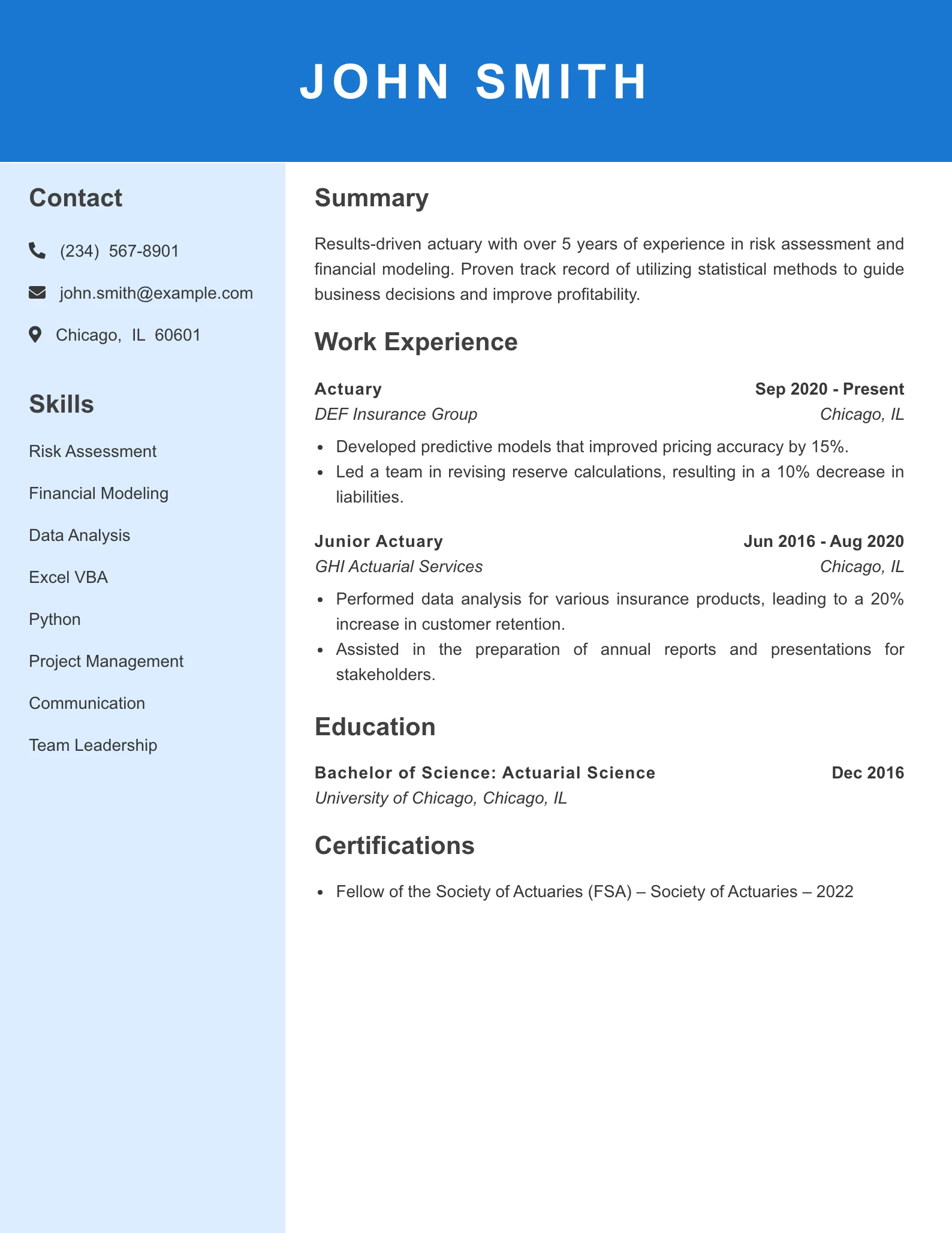

Mid Level Actuary Resume Example

Why This Resume Works

- The summary clearly outlines John’s qualifications, emphasizing his results-driven approach and relevant experience in risk assessment and financial modeling, making it evident that he is well-suited for a marketing role that requires analytical skills.

- The skills listed are highly relevant to the marketing field, particularly in data analysis and project management, which are crucial for driving marketing strategies and understanding consumer behavior.

- John’s work history demonstrates impactful contributions, such as improving pricing accuracy and customer retention, showcasing his ability to drive business results and enhance profitability, which aligns well with marketing objectives.

- The resume reflects a mid-level professional profile, with over 5 years of experience and a progression from Junior Actuary to a leadership role, indicating readiness for a managerial position in marketing.

- The clarity and tone of the resume are professional and focused, using quantifiable achievements that convey John’s effectiveness and potential value to prospective employers in the marketing sector.

For further reference on professionally structured resumes in finance roles, you can also explore this Credit Analyst Resume Template to observe formatting, skill placement, and achievement-driven bullet styles.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Chief Actuary Resume Sample

Michael R. Bennett

Chief Actuary

New York, NY (212) 447-8932 michael.bennett@email.com

LinkedIn: linkedin.com/in/michaelrbennett

Professional Summary

Strategic and forward-thinking Chief Actuary with 5+ years of actuarial leadership, specializing in enterprise risk strategy, capital optimization, and multi-line insurance pricing. Known for building high-performing actuarial teams, steering complex valuation initiatives, and strengthening solvency metrics through rigorous forecasting and regulatory alignment. Adept at turning complex financial data into clear insights for executive and board-level decision-making.

Professional Experience

Chief Actuary

- Direct actuarial strategy across individual life, group benefits, and annuity segments, contributing to a 14% improvement in portfolio profitability through refined pricing and reserve methodologies.

- Lead a team of 22 actuaries and analysts, implementing review standards and workflow tools that cut model development cycles by 40% and reduced rework across projects.

- Oversee annual statutory and GAAP valuation on reserves exceeding $4.6B, ensuring full alignment with ASOPs, NAIC guidance, GAAP, and IFRS reporting requirements.

- Champion modernization of forecasting and scenario testing using Python-based risk models and interactive dashboards, increasing projection reliability by 22% and accelerating planning timelines.

- Advise senior leadership on capital allocation and reinsurance strategy, supporting $310M in surplus distribution while maintaining target risk capital ratios and rating-agency expectations.

Education

Master of Science in Actuarial Science

Columbia University — New York, NY

Graduated: 2017

Bachelor of Science in Mathematics & Statistics

University of Michigan — Ann Arbor, MI

Graduated: 2015

Certifications

- Fellow of the Society of Actuaries (FSA)

- Member, American Academy of Actuaries (MAAA)

Technical Skills

Enterprise Risk Management (ERM) Economic Capital Modeling Prophet Actuarial Software Stochastic Scenario Testing Asset-Liability Management (ALM) Pricing Optimization Financial Reporting (GAAP/IFRS/Statutory) ORSA & Solvency Planning Predictive Analytics Python R SQL Power BI

Soft Skills

Executive leadership Strategic planning Stakeholder influence Board-level communication Cross-functional collaboration Judgment under uncertainty Change management Coaching & mentoring

Why This Resume Works

- The achievements are measurable and result-focused (e.g., 14% profitability growth, 22 actuaries managed, $310M surplus strategy), which proves real impact rather than just listing duties.

- The layout is clean, ATS-friendly, and structured clearly into summary, experience, education, and skills—making it easy for hiring managers to scan key strengths quickly.

- High-level skills, certifications (FSA & MAAA), and executive responsibilities match the seniority of a Chief Actuary role, positioning the candidate as a credible leader in actuarial strategy.

For those preparing formal applications or emails to accompany such senior resumes, this guide on Short Cover Letters for Email Applications provides excellent examples to pair with a Chief Actuary profile.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

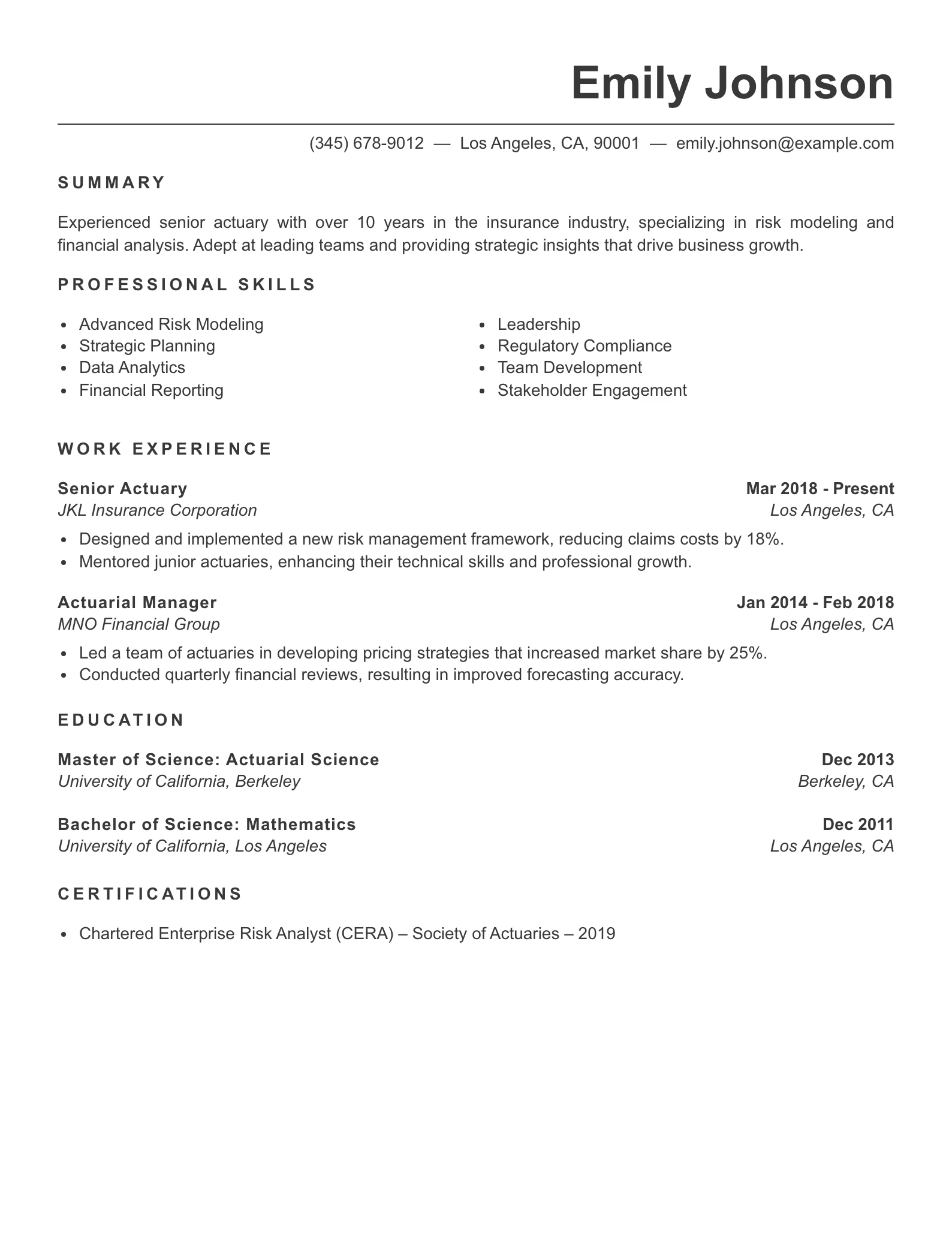

Senior Level Actuary Resume Example

Why This Resume Works

- The summary is clear and concise, effectively highlighting Emily’s extensive experience and specific expertise in risk modeling and financial analysis, making it easy for hiring managers to understand her qualifications at a glance.

- Relevant skills are prominently listed, showcasing a blend of technical and leadership abilities that align well with the responsibilities expected of a senior actuary, indicating she is well-equipped for the role.

- The work history includes impactful achievements, such as reducing claims costs by 18% and increasing market share by 25%, demonstrating her ability to drive significant business results and adding quantifiable value to her previous employers.

- Emily’s job fit is appropriate for a senior-level position, as evidenced by her leadership roles and the strategic nature of her contributions, which are crucial for higher-level actuarial positions.

- The clarity and tone of the resume are professional and focused, using active language and specific metrics to effectively communicate her accomplishments and capabilities, making it engaging for potential employers.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Life Insurance Actuary Resume Sample

Emily J. Harlan

Life Insurance Actuary

Seattle, WA (206) 913-8274 emily.harlan@email.com

LinkedIn: linkedin.com/in/emilyjharlan

Professional Summary

Life Insurance Actuary with 6+ years of experience in mortality modeling, premium rate development, and product valuation. Skilled in building actuarial assumptions, leading pricing reviews, and enhancing portfolio performance through risk-based forecasting. Known for improving model precision and supporting profitable product launches while maintaining regulatory compliance.

Professional Experience

Life Insurance Actuary

- Developed pricing structures for whole life, term life, and final expense products, increasing premium revenue by 17% YoY.

- Built mortality and lapse projection models using R and Prophet, improving reserve accuracy by 15% during valuations.

- Led quarterly experience studies and assumption updates, reducing forecasting variance by 9% for life products.

- Prepared state filing memoranda and actuarial support documents with 100% approval success over multiple filings.

- Collaborated with underwriting & finance to design risk-responsive product features, reducing claims volatility by 6%.

Education

Master of Actuarial Science

Boston University — Boston, MA

Graduated: 2017

Bachelor of Science in Applied Mathematics

University of California, Los Angeles (UCLA)

Graduated: 2015

Certifications

- Associate of the Society of Actuaries (ASA)

- FSA Life Track Modules in Progress

Technical Skills

Life Product Pricing Mortality & Lapse Modeling Prophet / R / SQL Premium Development Cash Flow Projections Experience Studies Reserving Methods State Filing Support Excel VBA Automation Predictive Analytics Model Validation

Soft Skills

Collaboration Analytical Reasoning Business Communication Attention to Detail Problem Solving Time Prioritization Presentation Skills Stakeholder Coordination

Why This Resume Works

- Shows measurable results such as growth in premium revenue, improved reserve accuracy, reduced claims volatility, and successful state filing approvals, proving real impact instead of generic duties.

- Content is industry-specific to life insurance — focusing on mortality modeling, premium pricing, lapse assumptions, experience studies, and filing compliance — which increases relevance for actuary recruiters.

- One-company experience is concise yet strong, backed by education, certifications, and technical skills that align clearly with professional expectations for a Life Insurance Actuary role.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Health Insurance Actuary Resume Sample

Olivia M. Sanderson

Health Insurance Actuary

Denver, CO (303) 719-8421 olivia.sanderson@email.com

LinkedIn: linkedin.com/in/oliviasanderson

Professional Summary

Health Insurance Actuary with 7+ years of experience in medical claims forecasting, premium rating strategy, and healthcare cost modeling. Skilled in pricing for Medicare Advantage, ACA Marketplace, and employer-sponsored plans. Known for improving trend accuracy and supporting compliant, profitable plan structures through data-driven analysis.

Professional Experience

Health Insurance Actuary

- Designed pricing methodologies for Medicare Advantage & ACA plans, improving loss ratios by 11% YoY.

- Developed medical claim projection models using Python/SAS/SQL, enhancing trend accuracy by 19%.

- Performed HCC risk adjustment analysis, increasing annual revenue capture by $42M.

- Partnered with product & underwriting teams on benefit design optimization reducing adverse selection by 7%.

- Prepared CMS bid submission documentation securing approvals without revision delays.

Education

Master of Public Health (MPH) – Health Economics

University of North Carolina at Chapel Hill

Graduated: 2016

Bachelor of Science in Statistics

Purdue University — West Lafayette, IN

Graduated: 2014

Certifications

- Associate of the Society of Actuaries (ASA)

- Pursuing FSA – Health Track

Technical Skills

Medical Claims Forecasting Premium Rating Models HCC Risk Adjustment SQL / Python / SAS CMS Bid Support Cost Trend Analytics ACA & Medicare Products Stop-Loss Analysis Provider Contract Evaluation Predictive Analytics VBA Modeling Model Validation

Soft Skills

Analytical Judgment Communication Collaboration Critical Thinking Accuracy & Precision Time Management Stakeholder Alignment Decision Support

Why This Resume Works

- Each bullet point includes measurable results (11% loss ratio improvement, 19% better trend accuracy, $42M revenue capture), proving real business impact instead of listing tasks.

- The content is targeted specifically to the health insurance domain—Medicare Advantage, ACA pricing, HCC risk, CMS filings—showcasing strong role-fit for health actuarial positions.

- The resume balances experience with credentials, highlighting relevant education, ASA certification, technical tools (Python, SQL, SAS), and soft skills that support collaborative decision-making.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Risk Analyst Resume Sample

Daniel R. Whitmore

Risk Analyst

Austin, TX (512) 680-9342 daniel.whitmore@email.com

LinkedIn: linkedin.com/in/danielrwhitmore

Professional Summary

Risk Analyst with 6+ years of experience in credit exposure evaluation, financial risk measurement, and portfolio sensitivity assessment. Skilled in designing risk models, automating analytics, and improving risk reporting accuracy. Adept at delivering data-backed insights that strengthen governance and guide sound business decisions.

Professional Experience

Risk Analyst

- Conducted credit & market risk assessments for $2.3B commercial lending portfolios, reducing high-risk exposure by 12%.

- Built automated stress testing models using Python/SQL, cutting analysis time from 18 hours to 5 hours.

- Designed Tableau dashboards improving risk reporting transparency & reducing manual errors by 28%.

- Led SOX/Basel III compliance reviews achieving zero audit issues consistently.

- Adjusted credit scoring criteria with underwriting, improving approval accuracy and lowering delinquency by 8% YoY.

Education

Master of Science in Financial Risk Management

University of Connecticut — Hartford, CT

Graduated: 2017

Bachelor of Business Administration – Finance

University of Texas at Austin

Graduated: 2015

Certifications

- Financial Risk Manager (FRM) — GARP

- Certified Risk and Compliance Management Professional (CRCMP)

Technical Skills

Risk Modeling Stress Testing Credit Exposure Analysis Basel III & SOX Compliance SQL Python Tableau Monte Carlo Simulation R Programming Scenario Analytics Portfolio Monitoring Data Validation

Soft Skills

Analytical Thinking Stakeholder Communication Critical Reasoning Problem Solving Team Collaboration Time Management Attention to Detail Strategic Risk Awareness

Why This Resume Works

- Each bullet uses measurable metrics—12% risk reduction, 28% fewer reporting errors, analysis time cut from 18 to 5 hours—proving direct business impact rather than listing responsibilities.

- The resume is highly targeted to risk analysis roles, showcasing relevant regulatory frameworks (Basel III, SOX), risk tools (Python, SQL, Tableau), and real portfolio exposure scale ($2.3B).

- The structure is clean and ATS-friendly, clearly presenting experience, education, certifications, and skills needed for risk analyst hiring decisions.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Insurance Underwriter Resume Sample

Sophia L. Kensington

Insurance Underwriter

Phoenix, AZ (480) 771-4529 sophia.kensington@email.com

LinkedIn: linkedin.com/in/sophiakensington

Professional Summary

Insurance Underwriter with 6+ years of experience evaluating commercial and personal line applications, assessing risk exposure, and setting competitive policy terms. Skilled in applying data-driven underwriting criteria, analyzing loss histories, and collaborating with agents to maintain profitable books of business. Recognized for improving approval accuracy and reducing underwriting turnaround times.

Professional Experience

Insurance Underwriter

- Underwrite 350+ commercial and personal policies per year, increasing approval efficiency by 21% through streamlined review workflows.

- Perform loss ratio and exposure analysis leveraging SQL-based checks, reducing avoidable high-risk approvals by 14% YoY.

- Negotiate terms with agents to balance risk and pricing, contributing to $5.6M in premium retention across renewal cycles.

- Introduce a structured documentation checklist that shortened policy processing time from 3.5 days to 1.9 days.

- Lead periodic underwriting audits, achieving 98% compliance accuracy with internal guidelines and state regulations.

Education

Bachelor of Business Administration – Risk Management & Insurance

Georgia State University — Atlanta, GA

Graduated: 2017

Certifications

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Commercial Underwriting (AU)

Technical Skills

Underwriting Risk Assessment Policy Review & Issuance Commercial & Personal Lines SQL Data Checks Premium Evaluation Regulatory Compliance Loss Ratio Monitoring Renewal Analysis Expected Loss Estimation Documentation Quality Control Advanced Excel CRM & Underwriting Platforms

Soft Skills

Decision-Making Negotiation Analytical Thinking Client Communication Accuracy Time Prioritization Problem Solving Professional Judgment Team Collaboration

Why This Resume Works

- Clear, quantified achievements such as 21% efficiency improvement and $5.6M premium retention show measurable impact rather than generic job duties.

- The resume is tightly targeted to underwriting roles with relevant skills like policy review, regulatory compliance, loss ratio monitoring, and decision-making authority.

- One company experience is concise yet strong, supported by certifications (CPCU & AU) and a solid academic background, presenting a credible mid-level underwriter profile.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

How to Craft a Strong Actuary Resume

Creating a standout actuary resume goes far beyond listing responsibilities — it should communicate measurable achievements, relevant actuarial skills, exam progress, tools used, and real business impact. Hiring managers scan resumes quickly and rely on Applicant Tracking Systems (ATS), so using relevant keywords, actuarial software, statistical analysis, risk assessment, and financial modeling terms will immediately increase your chances of being shortlisted for an actuarial position.

Rather than only stating what you did, frame bullet points to show how your work contributed to risk management, cost savings, predictive models, or financial reporting improvements. Use specific metrics wherever possible:

Weak: Performed risk assessment for insurance policies

Strong: Assessed risk exposure for 500+ life insurance products using predictive models, reducing underwriting loss by 18% YoY

This shift helps your actuary resume demonstrate analytical thinking, technical expertise, and a proven track record of results.

Write a Professional Summary That Shows Impact — Not Just Duties

A powerful professional summary should act like a mini pitch — who you are, what you’ve achieved, and how you can bring value.

Instead of saying “Actuary with experience in data analysis”, try:

Example for an entry-level actuarial analyst resume:

Recent actuarial science university graduate with strong skills in statistical analysis, financial mathematics, and predictive models. Completed 3 actuarial exams and academic projects involving claims data modeling using R & Excel, improving forecasting accuracy by 22%. Seeking an actuarial analyst role to contribute analytical capabilities to risk management and pricing teams.

Example for experienced actuary resume:

Certified Actuarial Analyst with 5+ years in the insurance industry, specializing in risk assessment, financial reporting, and developing pricing models for property and casualty insurance. Skilled in SQL, Python, R, and industry actuarial software with a record of delivering 12% average cost savings through model optimization. Strong communicator experienced in presenting insights to senior management & chief actuary teams.

Key tip: tailor the summary to match the job description instead of using generic lines.

Skills & Qualifications

Highlighting the right mix of core and soft skills is crucial for actuaries. Essential skills may include statistical analysis, risk assessment, and financial modeling, while soft skills like communication, teamwork, and problem-solving are equally important. To identify the most relevant skills, analyze job descriptions and note keywords that align with your experience.

To enhance your resume’s compatibility with Applicant Tracking Systems (ATS), use specific terminology found in the job listings. This strategy increases the likelihood of your resume being noticed by hiring managers.

- Statistical analysis

- Risk assessment

- Financial modeling

- Data interpretation

- Communication skills

- Attention to detail

- Problem-solving

- Project management

Top ATS Keywords for Actuary

Work History

In the work history section, focus on relevant experiences that demonstrate your capabilities as an actuary. Highlight metrics that showcase your impact, such as projects completed, cost savings achieved, or analysis performed. Depending on your career level, emphasize leadership roles or specialized areas of expertise.

Use a reverse-chronological format for clarity, starting with your most recent position. When listing your responsibilities, utilize quantified bullet points to illustrate your achievements effectively.

Show Key Achievements Using Responsibility-Backed Impact Examples

Turn everyday job duties into achievement-driven bullet points:

Use this formula:

Action Verb + Task + Tools Used + Outcome (with numbers if possible)

Examples to plug into your own resume:

- Conducted risk management studies for P&C portfolios, identifying trends that decreased claim payouts by 10%

- Streamlined annual financial reporting processes, enabling senior management to make faster decisions

- Collaborated with underwriting teams to assess risk and optimize premium pricing on 3 new product launches

- Utilized data analysis and actuarial software to evaluate property and casualty actuary risk exposure

- Presented monthly insights to professional organizations such as the Casualty Actuarial Society

Academic or fresher examples work too:

- Completed relevant coursework in regression analysis, financial mathematics, and loss models

- Developed a pricing model using claims data for university capstone project predicting future events with 87% accuracy

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Education

A solid educational foundation is vital for actuaries. Most positions require at least a bachelor’s degree in actuarial science, mathematics, statistics, or a related field. It’s essential to format your degree and institution clearly, including graduation dates.

When listing your education, consider including any relevant coursework or projects that may set you apart. This section underscores your academic preparedness for the challenges of an actuary role.

Quick Optimization Tips to Make Your Resume Job-Ready

| Tip | Why It Matters |

|---|---|

| Keep it a one-page resume (unless senior-level) | Hiring managers skim fast |

| Use achievement-first bullet points | Shows business impact |

| Include relevant keywords from job listings | Improves ATS ranking |

| Use a clean resume template & professional email address | Enhances credibility |

| Highlight transferable skills & leadership skills | Helps in career progression |

| Add professional organizations & workshops | Shows professional development |

Do’s and Don’ts

Here are some practical tips to keep in mind when crafting your actuary resume:

Do’s:

– Tailor your resume for ATS compatibility.

– Clearly demonstrate your impact with actionable results.

– Use industry-specific terms to enhance relevance.

Don’ts:

– Use generic statements that lack specificity.

– Ignore the importance of soft skills.

– Overuse buzzwords that may dilute your message.

For those looking to improve their resume design, exploring resume templates can provide a great starting point. If you prefer working in Word, consider checking out resume templates word to find user-friendly options. Alternatively, you can choose a Google docs resume template that can be easily edited online. Whether you’re searching for inspiration or a specific tax preparer resume sample, having examples on hand can guide you in crafting your own standout resume. Similarly, if you’re in the finance sector, you might find a mortgage underwriter resume sample particularly helpful as you format your experience.