In the competitive landscape of tax preparation, having a standout resume is crucial for success. Our extensive collection of resume examples for Tax Preparer in 2025 is designed to help you showcase your skills and experiences effectively. Whether you’re an experienced professional or just starting out, these examples provide the inspiration and guidance you need to create a compelling resume that captures the attention of hiring managers.

Tax Preparer Resume Examples – Free Download

Tax Preparer Resume Examples

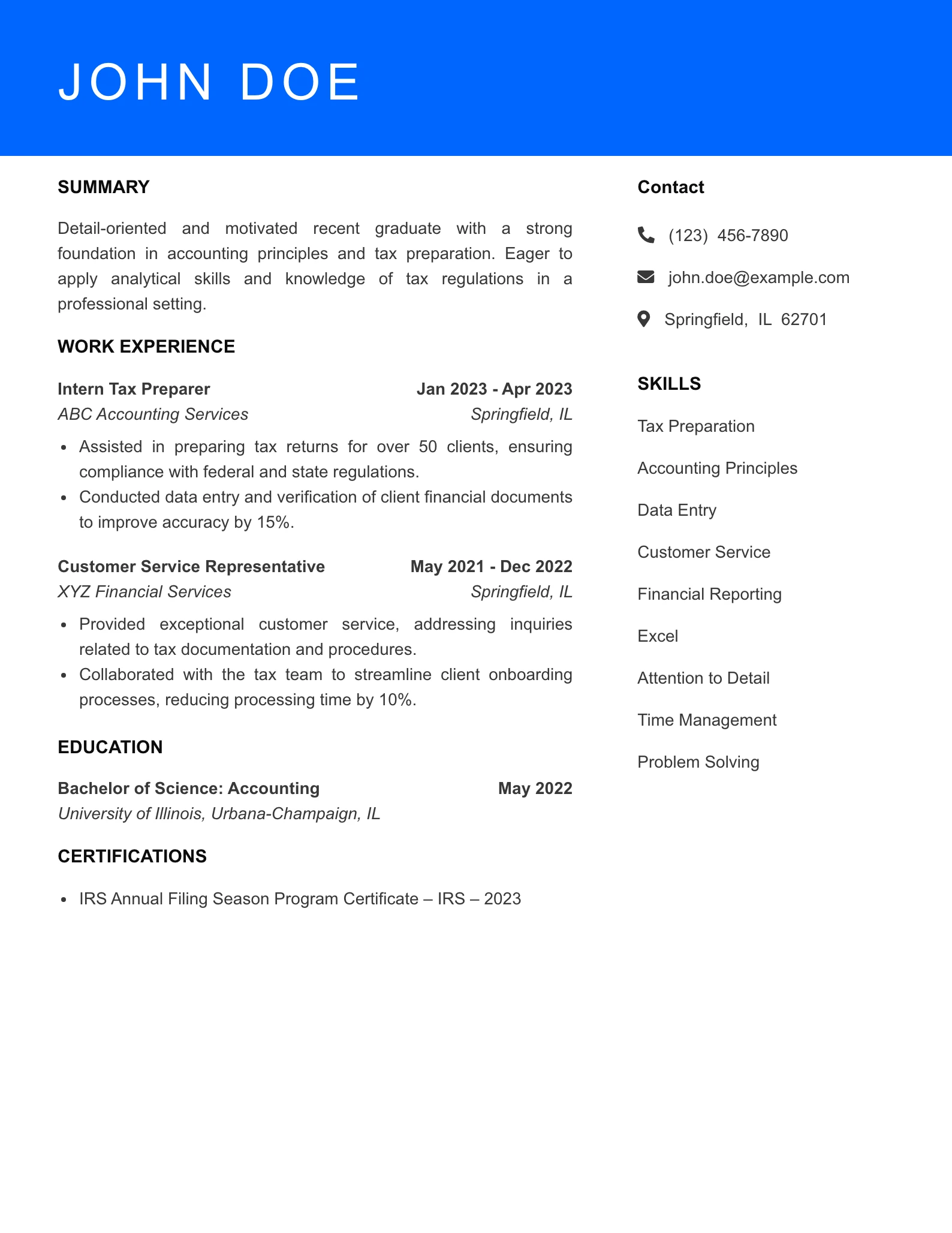

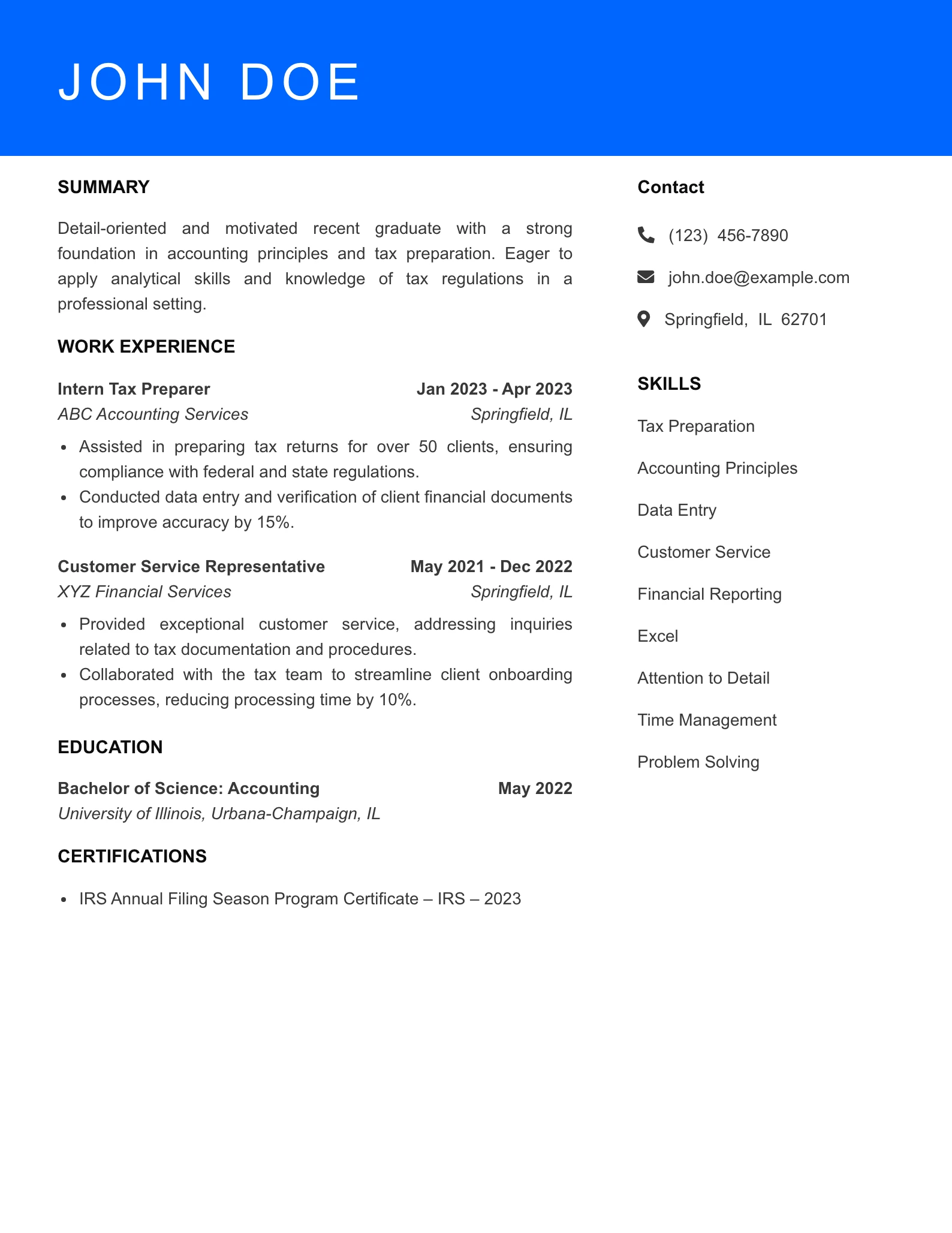

Entry Level Tax Preparer Resume Example

Why This Resume Works

- The summary clearly articulates John’s recent graduation and eagerness to apply his foundational skills in tax preparation, aligning well with entry-level roles in the field.

- Relevant skills are well-highlighted, showcasing a mix of technical abilities (Tax Preparation, Microsoft Excel) and soft skills (Customer Service, Communication), which are essential for a tax preparer.

- The work history demonstrates impactful contributions, such as a quantifiable increase in client satisfaction and improved accuracy in financial reporting, which strengthens his candidacy.

- The resume is well-suited for an entry-level position, with appropriate experiences that reflect a solid understanding of the industry and the necessary qualifications for a Tax Preparer role.

- Clarity and tone are maintained throughout the resume, with concise language and a professional tone that effectively communicates John’s qualifications and readiness for the job.

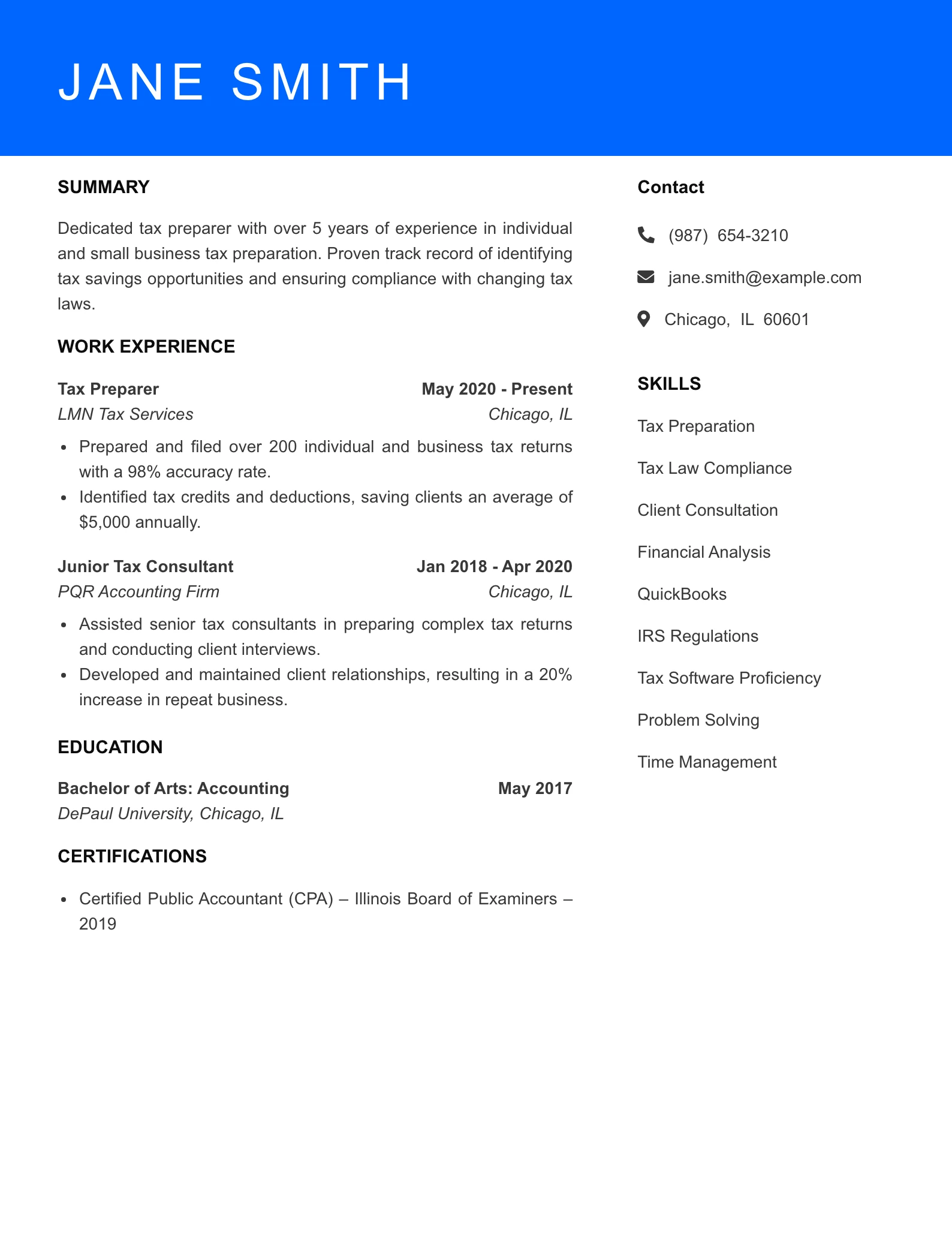

Mid Level Tax Preparer Resume Example

Why This Resume Works

- The summary clearly outlines Jane’s experience in tax preparation, highlighting her expertise and commitment to client service, which sets a strong foundation for her qualifications.

- The skills section includes relevant competencies that align with the tax preparation field, showcasing a well-rounded expertise that is essential for the role.

- The work history features impactful accomplishments, such as a high accuracy rate and significant client savings, demonstrating tangible results that enhance her candidacy.

- The resume reflects a mid-level job fit with over five years of experience and a relevant certification, indicating she is well-prepared for a tax preparation role.

- The clarity and professional tone throughout the resume create a positive impression, making it easy for hiring managers to assess her qualifications quickly.

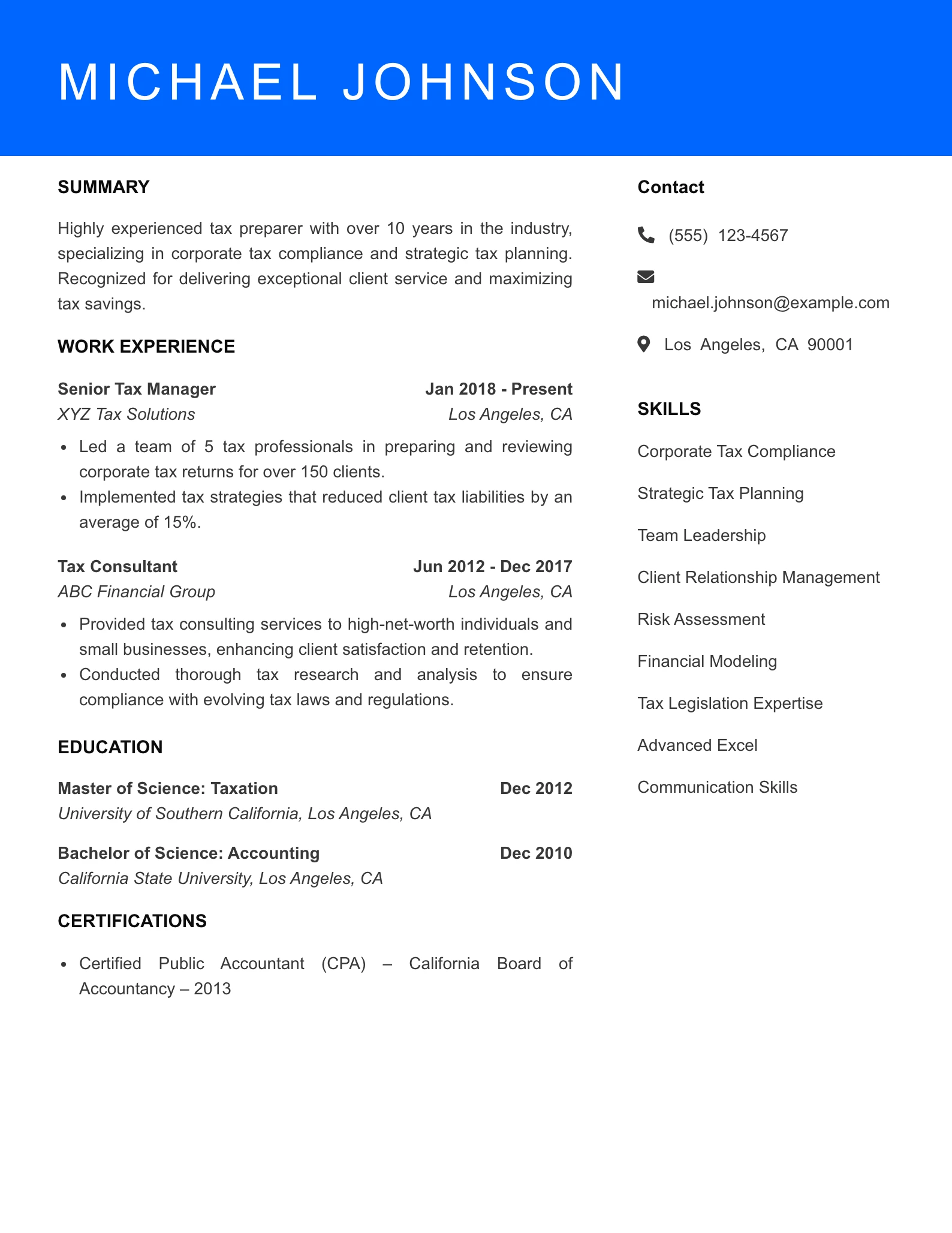

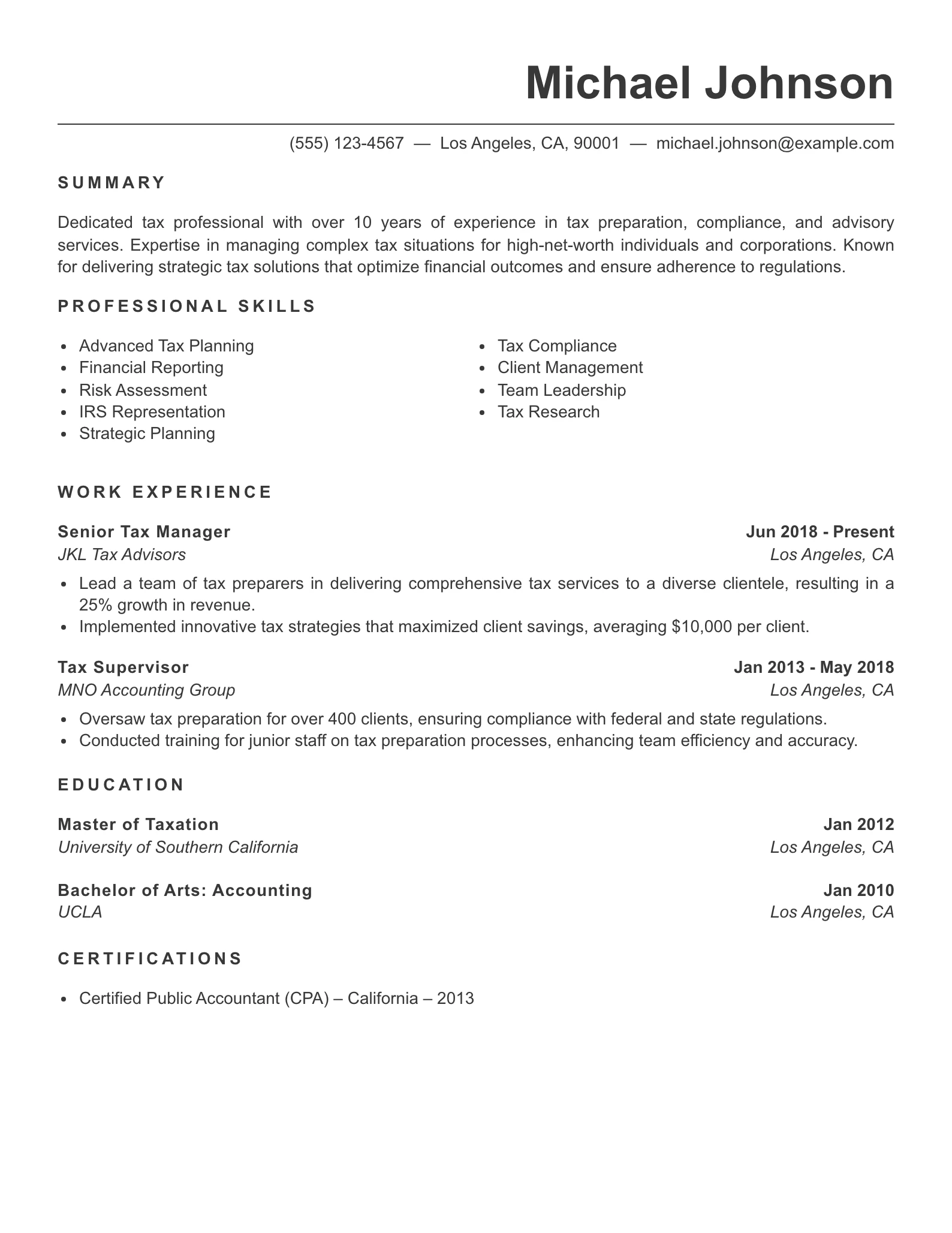

Senior Level Tax Preparer Resume Example

Why This Resume Works

- The summary clearly outlines Michael’s extensive experience and expertise in tax services, effectively positioning him as a knowledgeable professional in the field, which is appealing to potential employers.

- Relevant skills are prominently listed, showcasing a comprehensive range of competencies that align well with the responsibilities of a Senior Tax Manager, making it easy for hiring managers to identify his qualifications.

- The work history includes impactful achievements, such as leading a team to a 25% revenue growth and implementing strategies that saved clients significant amounts, demonstrating a track record of success and strategic thinking.

- Michael’s experience level is appropriate for a senior role, with a progression from Tax Supervisor to Senior Tax Manager, indicating professional growth and readiness for increased responsibilities.

- The clarity and tone of the resume are professional and focused, using industry-specific language that conveys confidence and competence, which can resonate well with hiring managers in the accounting and tax sectors.

How to Craft a Strong Tax Preparer Resume

In the competitive world of tax preparation, a well-crafted resume is essential for standing out among applicants. Hiring managers typically seek candidates who not only possess technical skills and knowledge but also demonstrate strong attention to detail and customer service abilities. This guide will help you effectively highlight your strengths and make a lasting impression with your tax preparer resume.

Summary Statement

A strong summary statement is crucial as it serves as your first impression on hiring managers. This section should succinctly convey your overall experience, specialization in tax preparation, relevant certifications, and key soft skills that make you an ideal candidate.

When crafting your summary, focus on a confident and tailored tone that emphasizes your unique qualifications. A result-focused approach can help underline your achievements in previous roles, which is likely to resonate with prospective employers.

Detail-oriented tax preparer with recent certification in tax preparation and hands-on experience in tax software. Eager to provide exceptional service to clients while ensuring compliance with tax regulations.

Mid-Level:

Driven tax preparer with over 5 years of experience in individual and corporate tax preparation. Proven track record of maximizing client tax refunds while ensuring compliance with all regulatory requirements.

Skills & Qualifications

Highlighting the right skills is essential for a tax preparer resume. Core skills may include proficiency in tax software, knowledge of tax regulations, and analytical abilities. On the other hand, soft skills such as communication, problem-solving, and time management are equally important for maintaining client relationships and managing workloads.

To identify the most relevant skills, analyze job descriptions and ATS requirements. Tailoring your skills section to match the specific qualifications that employers are seeking will increase your chances of passing through automated screening processes.

- Tax software proficiency (e.g., TurboTax, H&R Block)

- Knowledge of federal and state tax regulations

- Attention to detail

- Client communication

- Analytical skills

- Time management

- Problem-solving

- Team collaboration

Top ATS Keywords for Tax Preparer

Work History

In the work history section, focus on your quantitative achievements and relevant experience. Depending on your level of expertise, you may want to highlight your contributions to client satisfaction, efficiency improvements, or team leadership. For entry-level candidates, showcasing internships or volunteer experiences can demonstrate your capabilities.

Formatting is key: use a reverse-chronological layout and employ quantified bullet points to clearly outline your accomplishments. This clarity not only aids readability but also makes it easier for hiring managers to quickly assess your qualifications.

Tax Intern, ABC Tax Services, Chicago, IL, Jan 2023 – Apr 2023

– Assisted with tax preparation for individual clients

– Conducted research on tax regulations

– Maintained accurate records of client information

Mid-Level:

Senior Tax Preparer, XYZ Accounting Firm, Los Angeles, CA, May 2018 – Present

– Managed the tax preparation process for over 200 clients annually

– Led a team of junior preparers to ensure compliance and accuracy

– Developed training materials for new staff on tax preparation best practices

Education

A relevant educational background is typically essential for a tax preparer. Most employers prefer candidates with a degree in accounting, finance, or a related field. Additionally, any certifications in tax preparation or related coursework can significantly enhance your resume.

When formatting your education, include the degree, school name, city, state, and graduation year. This clear and organized layout will help hiring managers quickly review your qualifications.

Degree, School Name, City, State, Graduation Year

Example:

Bachelor of Science in Accounting, University of California, Los Angeles, CA, 2018

Additional Sections

Consider including optional sections in your resume that can set you apart, such as Certifications, Languages, and Awards. For tax preparers, certifications can be particularly beneficial, showcasing your commitment to professional development.

Here are two examples of certification formats that are specific to tax preparers: – IRS Enrolled Agent (EA) – Internal Revenue Service – 2023 – Certified Public Accountant (CPA) – State Board of Accountancy – 2022

- IRS Enrolled Agent (EA) – Internal Revenue Service – 2023

- Certified Public Accountant (CPA) – California Board of Accountancy – 2022

Do’s and Don’ts

To finalize your resume, here are some practical do’s and don’ts:

- Do: Tailor your resume for ATS, highlight your impact, and use relevant industry terms.

- Don’t: Include generic statements, overlook the importance of soft skills, or overuse buzzwords that may dilute your message.

For those looking to enhance their resume further, exploring resume templates can provide valuable inspiration and structure. Whether you need resume templates word or a specific Google Docs resume template, these resources are designed to help you create an impactful application. Don’t forget to look at accountant resume samples and financial analyst resume samples to guide your writing!

Text Resume Samples

John Doe

Level: Entry-Level

Location: Springfield, IL 62701

Phone: (123) 456-7890

Email: john.doe@example.com

Professional Summary

Detail-oriented and motivated recent graduate with a strong foundation in tax preparation and accounting principles. Eager to leverage skills in a dynamic tax preparation environment to assist clients in maximizing their tax returns.

Skills

- Tax Preparation

- Accounting Principles

- Data Entry

- Customer Service

- Microsoft Excel

- Attention to Detail

- Analytical Skills

- Communication

- Problem-Solving

Education

Bachelor of Science in Accounting, University of Illinois, Urbana, IL, 2022

Work Experience

Tax Intern – ABC Tax Services

Springfield, IL | Jan 2023 – Present

- Assisted senior tax preparers in preparing individual and small business tax returns, leading to a 15% increase in client satisfaction.

- Conducted initial client interviews to gather necessary financial information for tax filings.

Accounting Assistant – XYZ Accounting Firm

Springfield, IL | Jun 2022 – Dec 2022

- Supported the accounting team by processing invoices and maintaining accurate financial records.

- Helped prepare monthly financial reports, enhancing the accuracy of financial data by 20%.

References

Provided upon request

Certifications

- Certified Tax Preparer – National Association of Tax Professionals – 2023