Looking to create a standout resume templates? Our collection of free resume templates for tax preparers offers modern designs that are ATS friendly and fully editable. Download free resume templates today and take the first step towards your dream job.

Why Use Our Templates

- Professionally designed to help you stand out to employers.

- ATS friendly resume templates ensure your resume passes automated screenings.

- Editable Word resume templates allow for easy customization to fit your needs.

- Access a variety of modern resume templates tailored specifically for tax preparers.

How to Choose Your Level

Select the right template based on your career stage:

- Entry-Level: If you are just starting your career in tax preparation with little to no experience, choose an entry-level template.

- Mid-Career: For those with a few years of experience and a demonstrated history in the field, a mid-career template is ideal.

- Senior: If you have extensive experience and hold leadership or senior roles, opt for a senior template that showcases your achievements.

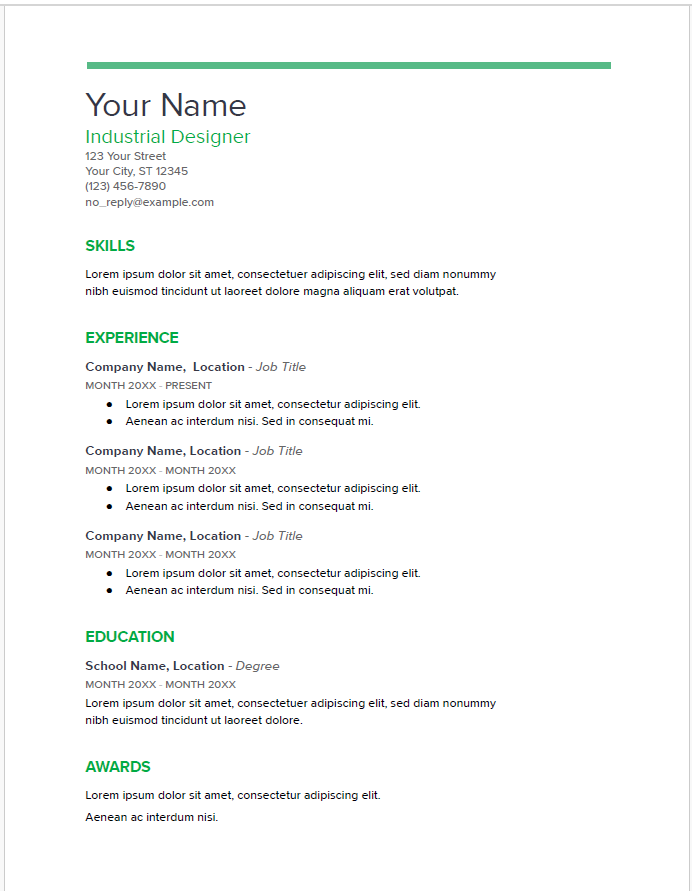

Entry-Level Tax Preparer Resume Templates

- (123) 456-7890

- john.doe@example.com

- Springfield, IL 62701

- Tax Preparation

- Customer Service

- Data Entry

- Attention to Detail

- Microsoft Excel

- Accounting Software

- Time Management

- Communication

- Problem Solving

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- IRS Annual Filing Season Program – IRS – 2023

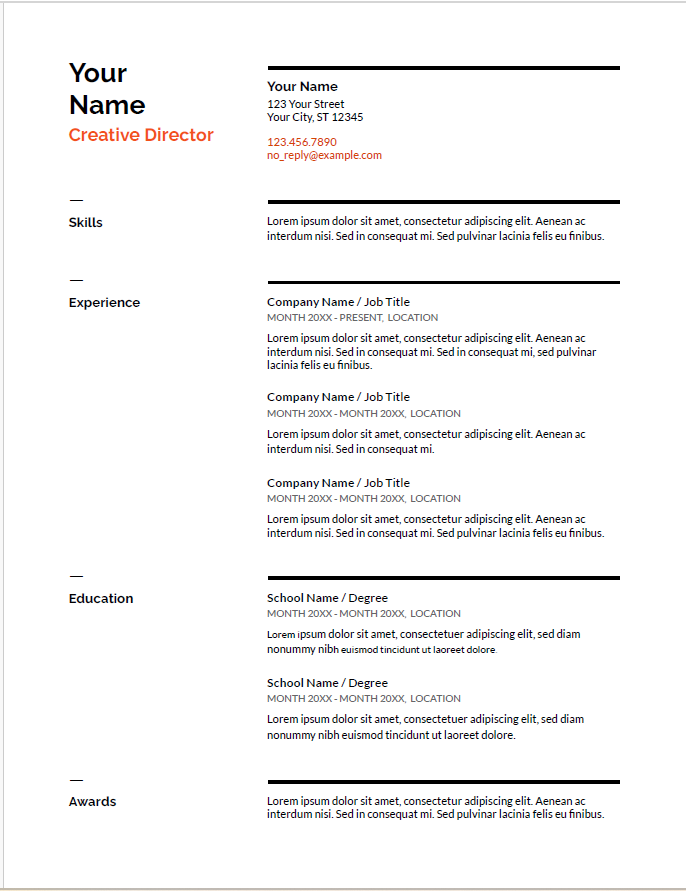

Steel Blue ModernProfessionalTwo-Column

A clean and modern two-column resume template featuring a deep steel blue header with white text for the candidate’s name. The left sidebar contains contact details and skills on a light grey background, while the main content area showcases summary, work experience, and education with clear section headings and ample white space.

Why This Template

Steel Blue provides a professional and organized layout that balances visual appeal with readability. The strong header draws immediate attention to your name, while the sidebar enables quick scanning of contact and skills. Its clear hierarchy guides recruiters smoothly through your career highlights.

Key Features

- Bold steel blue header for name visibility

- Two-column layout for organized content

- Sidebar for quick access to contact and skills

- Clear section headings for easy navigation

- Generous white space for readability

- ATS friendly format

- Editable in Microsoft Word and exportable to DOCX, PDF, TXT

- (123) 456-7890

- john.doe@example.com

- Springfield, IL 62701

- Tax Preparation

- Customer Service

- Data Entry

- Attention to Detail

- Microsoft Excel

- Accounting Software

- Time Management

- Communication

- Problem Solving

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- IRS Annual Filing Season Program – IRS – 2023

- (123) 456-7890

- john.doe@example.com

- Springfield, IL, 62701

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- Tax Preparation

- Data Entry

- Microsoft Excel

- Time Management

- Problem Solving

- Customer Service

- Attention to Detail

- Accounting Software

- Communication

- IRS Annual Filing Season Program – IRS – 2023

- (123) 456-7890

- Springfield, IL, 62701

- john.doe@example.com

- Tax Preparation

- Data Entry

- Microsoft Excel

- Time Management

- Problem Solving

- Customer Service

- Attention to Detail

- Accounting Software

- Communication

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- IRS Annual Filing Season Program – IRS – 2023

- (123) 456-7890

- john.doe@example.com

- Springfield, IL, 62701

- Tax Preparation

- Customer Service

- Data Entry

- Attention to Detail

- Microsoft Excel

- Accounting Software

- Time Management

- Communication

- Problem Solving

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- IRS Annual Filing Season Program – IRS – 2023

- (123) 456-7890

- john.doe@example.com

- Springfield, IL, 62701

- Tax Preparation

- Customer Service

- Data Entry

- Attention to Detail

- Microsoft Excel

- Accounting Software

- Time Management

- Communication

- Problem Solving

- Assisted in preparing over 100 individual tax returns under the supervision of senior tax preparers.

- Conducted preliminary client interviews to gather tax-related information and documentation.

- Supported the accounting team by entering financial data and reconciling accounts.

- Facilitated communication between clients and accountants to ensure accurate tax filing.

- IRS Annual Filing Season Program – IRS – 2023

Mid-Career Tax Preparer Resume Templates

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

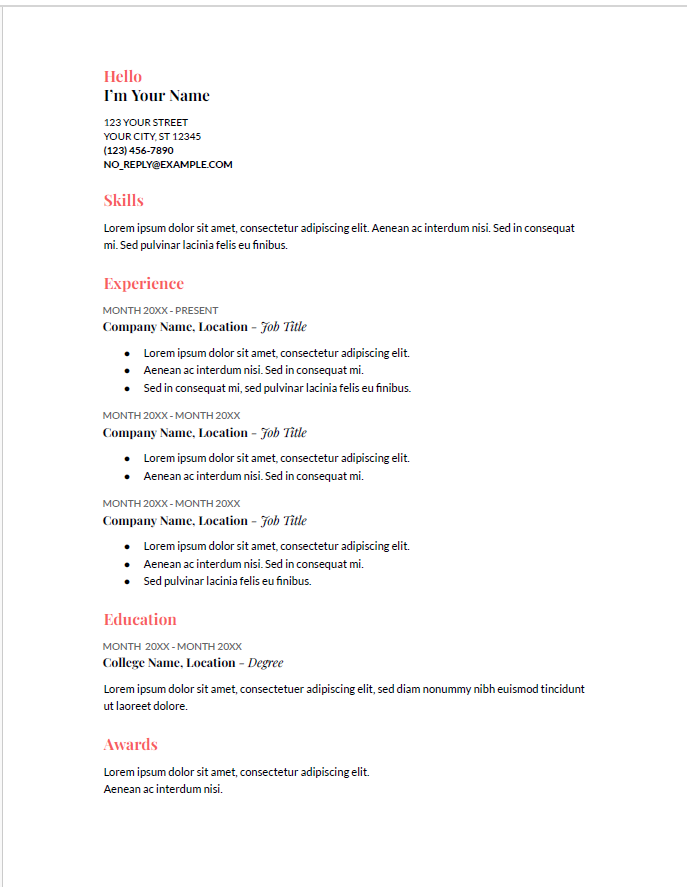

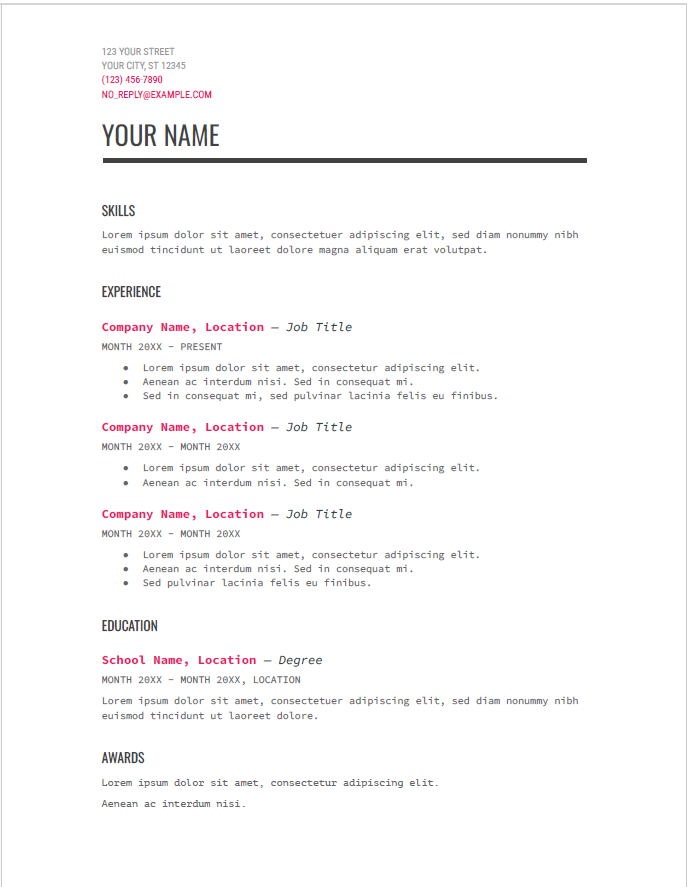

Slate Vertical ProfessionalTwo-ColumnClean

A professional two-column resume template featuring a clean vertical sidebar on the left with skills clearly listed, and a spacious right main section for summary, work experience, and education. The candidate’s name is prominently displayed in a light gray header spanning the top, with contact details arranged neatly alongside icons in the sidebar for easy scanning.

Why This Template

Slate Vertical provides a balanced, easy-to-navigate layout that highlights your skills and experience effectively. The sidebar’s vertical alignment of key skills and contact info lets recruiters quickly assess your qualifications, while the main content area offers plenty of room for detailed work history and education.

Key Features

- Vertical sidebar for skills and contact information

- Light gray header with bold candidate name

- Clear section headers and bullet points in main content

- Use of icons for contact details for visual clarity

- Well-organized content for easy recruiter scanning

- Suitable for administrative, clerical, and office roles

- Fully editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Tax Compliance

- Client Relations

- Tax Software Proficiency

- Financial Analysis

- Problem Resolution

- Attention to Detail

- Regulatory Knowledge

- Project Management

- Team Collaboration

- Prepared and filed over 300 individual and small business tax returns annually, achieving a 98% client satisfaction rate.

- Developed personalized tax strategies that led to an average 15% increase in client refunds.

- Collaborated with senior tax preparers to analyze financial data and identify deductions for clients.

- Provided training to new interns on tax preparation processes and software usage.

- Enrolled Agent – IRS – 2021

Senior Tax Preparer Resume Templates

- Strategic Tax Planning

- Client Management

- Risk Assessment

- Tax Law Expertise

- Mentorship

- Complex Tax Returns

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Led a team of 10 tax professionals in preparing and reviewing over 800 tax returns for individuals and corporations.

- Implemented tax planning strategies that resulted in an average savings of $2 million for clients annually.

- Provided expert consultation on tax compliance and strategic planning to a diverse portfolio of clients.

- Successfully negotiated with tax authorities to resolve disputes, resulting in reduced penalties for clients.

- Certified Public Accountant (CPA) – California Board of Accountancy – 2011

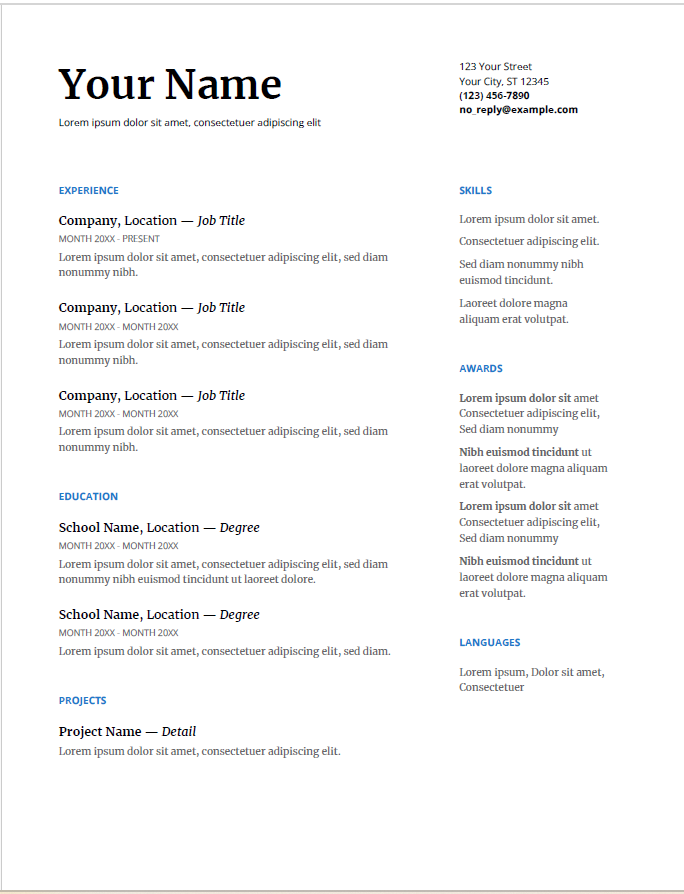

Golden Accent ElegantProfessionalSingle-Column

An elegant and professional single-column resume template featuring a clean white background with gold accent highlights for section headers and the candidate’s last name. The layout emphasizes clarity and structure with well-defined sections for summary, professional skills, work experience, and education. This template balances sophistication with readability.

Why This Template

Golden Accent offers a refined resume design that combines subtle luxury with professional simplicity. The gold highlights create visual interest without overwhelming content, while the clean layout ensures recruiters can easily navigate your qualifications. Ideal for professionals aiming to convey both competence and style.

Key Features

- Single-column layout for focused and linear reading

- Gold accent color highlights candidate’s last name and section headers

- Clear typography and spacing for enhanced readability

- Well-organized sections with bullet points for skills and experience

- Professional and sophisticated aesthetic

- Suitable for business, administrative, and corporate roles

- Editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility in mind

- Strategic Tax Planning

- Client Management

- Risk Assessment

- Tax Law Expertise

- Mentorship

- Complex Tax Returns

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Led a team of 10 tax professionals in preparing and reviewing over 800 tax returns for individuals and corporations.

- Implemented tax planning strategies that resulted in an average savings of $2 million for clients annually.

- Provided expert consultation on tax compliance and strategic planning to a diverse portfolio of clients.

- Successfully negotiated with tax authorities to resolve disputes, resulting in reduced penalties for clients.

- Certified Public Accountant (CPA) – California Board of Accountancy – 2011

- (555) 123-4567

- Los Angeles, CA, 90001

- michael.johnson@example.com

- Strategic Tax Planning

- Client Management

- Risk Assessment

- Tax Law Expertise

- Mentorship

- Complex Tax Returns

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Led a team of 10 tax professionals in preparing and reviewing over 800 tax returns for individuals and corporations.

- Implemented tax planning strategies that resulted in an average savings of $2 million for clients annually.

- Provided expert consultation on tax compliance and strategic planning to a diverse portfolio of clients.

- Successfully negotiated with tax authorities to resolve disputes, resulting in reduced penalties for clients.

- Certified Public Accountant (CPA) – California Board of Accountancy – 2011

- (555) 123-4567

- michael.johnson@example.com

- Los Angeles, CA, 90001

- Strategic Tax Planning

- Complex Tax Returns

- Client Management

- Regulatory Compliance

- Risk Assessment

- Team Leadership

- Tax Law Expertise

- Data Analysis

- Mentorship

- Led a team of 10 tax professionals in preparing and reviewing over 800 tax returns for individuals and corporations.

- Implemented tax planning strategies that resulted in an average savings of $2 million for clients annually.

- Provided expert consultation on tax compliance and strategic planning to a diverse portfolio of clients.

- Successfully negotiated with tax authorities to resolve disputes, resulting in reduced penalties for clients.

- Certified Public Accountant (CPA) – California Board of Accountancy – 2011

- (555) 123-4567

- Los Angeles, CA, 90001

- michael.johnson@example.com

- Strategic Tax Planning

- Client Management

- Risk Assessment

- Tax Law Expertise

- Mentorship

- Complex Tax Returns

- Regulatory Compliance

- Team Leadership

- Data Analysis

- Led a team of 10 tax professionals in preparing and reviewing over 800 tax returns for individuals and corporations.

- Implemented tax planning strategies that resulted in an average savings of $2 million for clients annually.

- Provided expert consultation on tax compliance and strategic planning to a diverse portfolio of clients.

- Successfully negotiated with tax authorities to resolve disputes, resulting in reduced penalties for clients.

- Certified Public Accountant (CPA) – California Board of Accountancy – 2011

Editable Word & PDF Templates

Our Google docs resume template is easy to customize. Simply download the template, open it in Microsoft Word, and make the necessary edits to fit your experience and qualifications.

Editable Google Docs Templates

Tips & FAQs

Design Tips

- Use a clean, professional font and maintain consistent formatting.

- Highlight key skills and achievements to catch the employer’s eye.

- Keep the layout simple; avoid cluttering the resume with unnecessary graphics.

FAQs

Are these resume templates really free?

Yes, we offer a selection of free resume templates for tax preparers, although some premium templates are also available.

Can I edit these templates in Google Docs?

Yes, we provide editable Google Docs templates that you can customize easily online.

How do I know which template is right for me?

Choose a template based on your career level—entry-level for newcomers, mid-career for those with experience, and senior for experienced professionals.

Start Building Your Resume Today

Ready to create your perfect tax preparer resume? Use our user-friendly resume builder to get started.

Build Your ResumeView more accountant resume templates that are tailored to help you land your dream job.