In the world of finance, credibility is everything — and your resume is the first proof of it.

A Loan Officer Resume should balance numbers with nuance, showing that you can handle both client trust and financial precision. Whether you help customers secure their first home or guide businesses through complex lending processes, your resume needs to show that you’re not just processing loans — you’re building financial solutions.

This guide will help you craft a resume that stands out to banks, mortgage firms, and credit institutions by combining measurable results, compliance expertise, and strong client relationships. Inside, you’ll find:

- Real Loan Officer Resume Examples for different experience levels

- Proven formatting tips to make your resume ATS-compliant

- Action verbs and resume keywords that attract hiring managers in the finance industry

- Strategies to make your resume reflect the same trust and precision you bring to every client meeting

Let’s start by looking at real-world examples that show what makes a professional loan officer resume succeed in 2025.

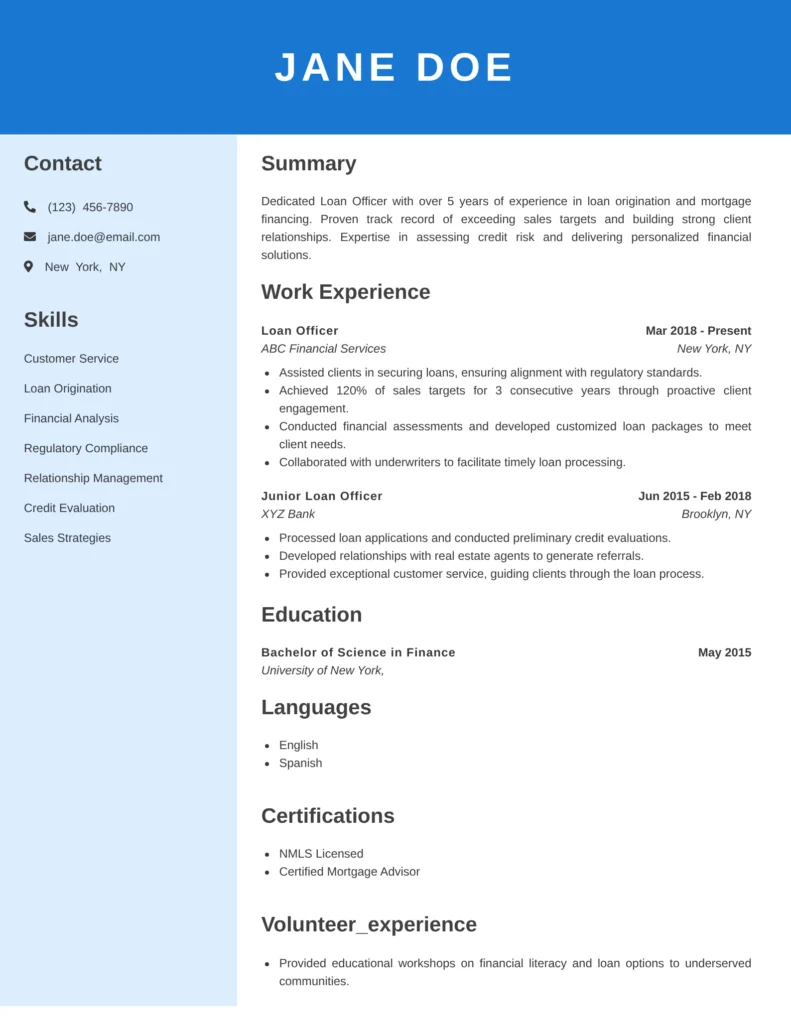

Loan Officer Resume Template

Why this resume is Good:

This resume effectively showcases relevant skills, a comprehensive work history with measurable achievements, and educational background pertinent to the role of a Loan Officer. The inclusion of certifications underscores expertise and dedication to the field, while the optional sections add depth to the candidate’s profile, making it appealing to potential employers.

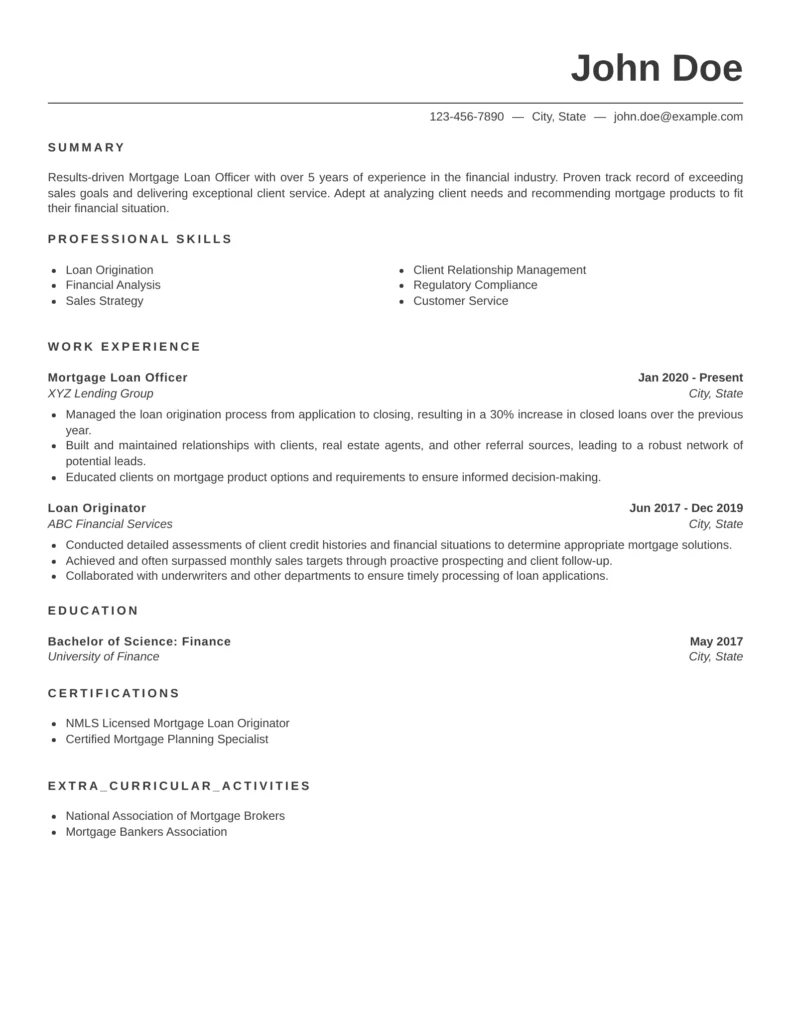

Mortgage Loan Officer Resume Template

Why this resume is Good:

This resume is effective because it provides a clear summary of qualifications, organized work experience with quantifiable achievements, and relevant education and certifications. It showcases a balance of technical skills and personal attributes important for a Mortgage Loan Officer, making it appealing to potential employers.

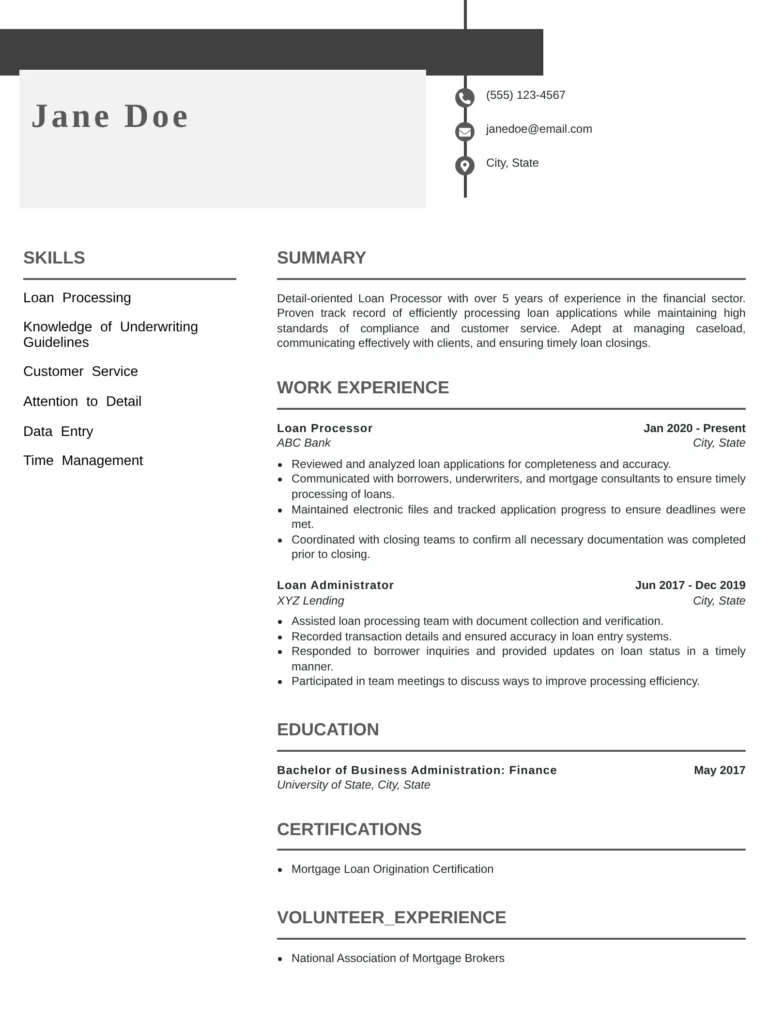

Loan Processor Resume Template

Why this resume is Good:

This resume effectively highlights relevant experience and skills tailored for the Loan Processor position. It includes measurable achievements within the work experience section, demonstrating the candidate’s contributions to loan processing efficiency and customer satisfaction. Additionally, the professional summary establishes a strong impression by showcasing industry experience and commitment to compliance.

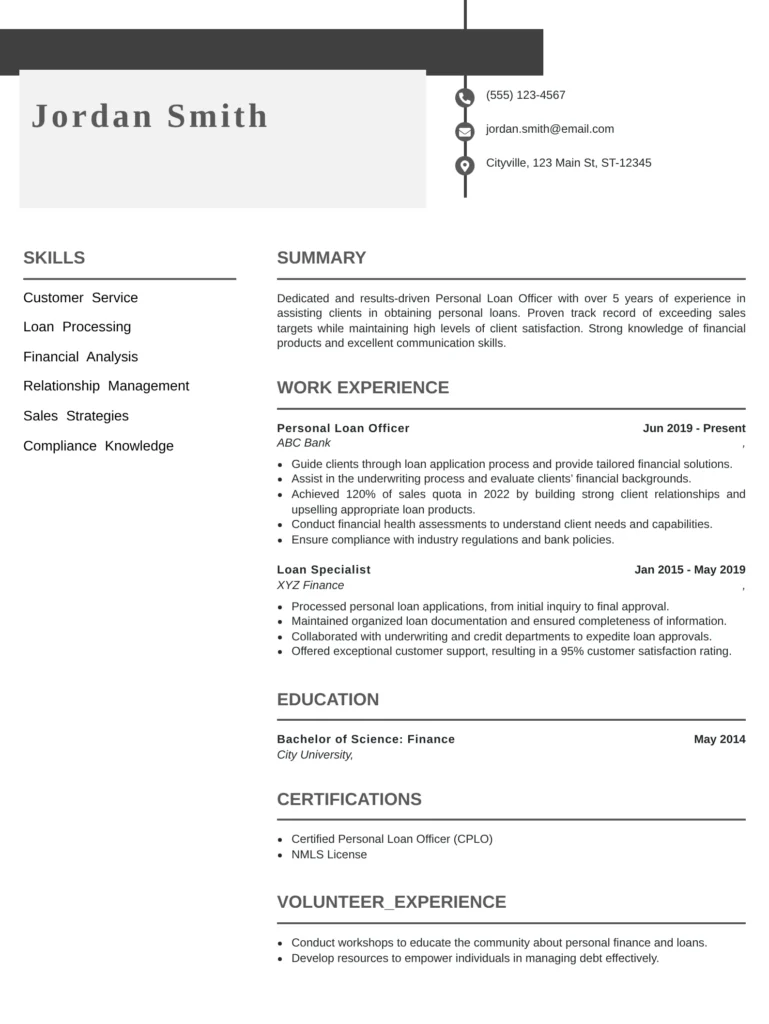

Personal Loan Officer Resume Template

Why this resume is Good:

This resume is effective for a Personal Loan Officer as it combines a strong summary with quantifiable achievements and relevant skills. The structured format clearly outlines professional experience and education, making it easy for hiring managers to assess the candidate’s qualifications quickly. Additionally, including optional sections like certifications and volunteer experience adds depth to the candidate’s profile.

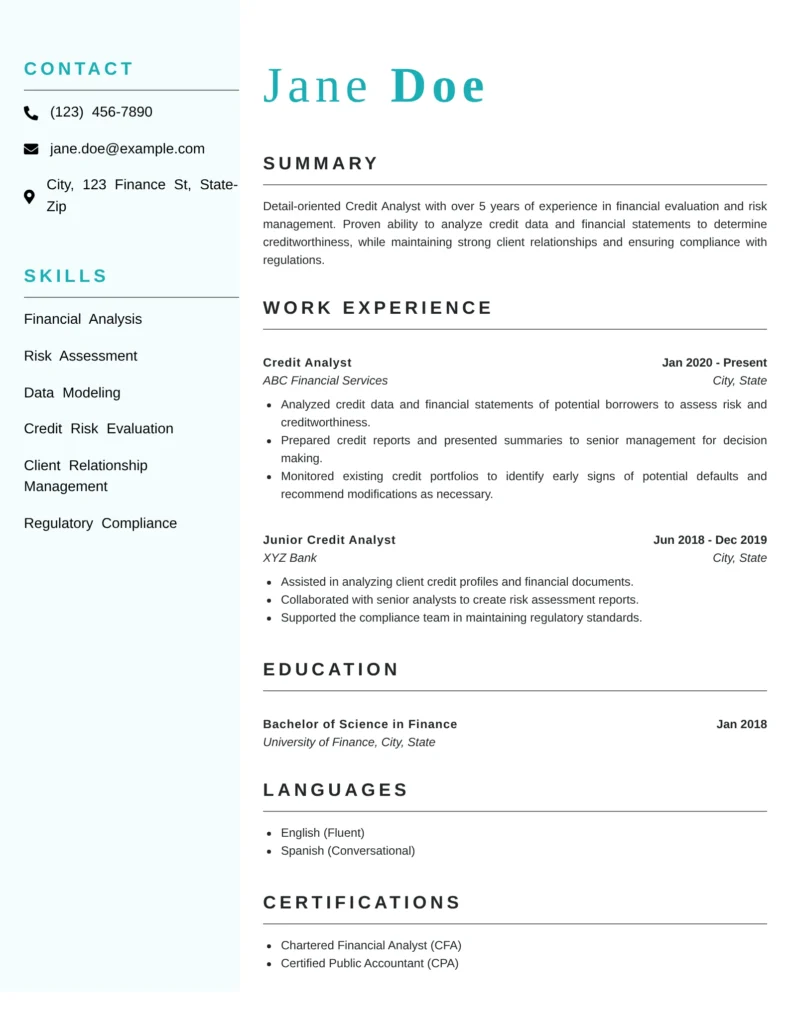

Credit Analyst Resume Template

Why this resume is Good:

This resume effectively highlights Jane’s experience and skills relevant to credit analysis, showcasing her analytical abilities and specific achievements. The clear structure and targeted summary ensure it captures the attention of hiring managers while the optional sections enhance her qualifications, making her a standout candidate.

Formatting Your Loan Officer Resume

In finance, structure signals reliability — and your resume format should reflect that. A clean, data-driven layout makes it easier for recruiters and applicant tracking systems (ATS) to scan your qualifications quickly.

Choose the Right Resume Format

For most loan officers, the reverse-chronological format works best because it shows steady growth in banking or finance roles.

If you’re transitioning from another field like customer service or sales, a hybrid format helps highlight transferable skills such as communication, compliance, and client handling.

Avoid dense blocks of text or flashy templates. Employers in banking prefer clarity and numbers over design flair.

Formatting Guidelines

- Font: Calibri, Lato, or Helvetica (10–12 pt body, 14–16 pt headers)

- Margins: 1 inch on all sides for a professional look

- Line spacing: 1.15–1.5 for readability

- Sections: Summary, Skills, Experience, Education, Certifications

- File type: PDF for submission; Word (.docx) only if specified by the employer

- Length: 1 page for professionals with under 5 years’ experience; 2 pages for senior or management-level loan officers

Resume Format Recommendation by Experience Level

| Experience Level | Recommended Format | Why It Works |

|---|---|---|

| Entry-Level Loan Officer / Loan Processor | Hybrid Format | Emphasizes financial education, skills, and internship experience before work history. |

| Mid-Level Loan Officer / Mortgage Consultant | Reverse-Chronological | Highlights consistent performance, loan portfolio achievements, and compliance record. |

| Senior Loan Officer / Credit Analyst | Two-Column Executive Format | Balances analytical expertise with leadership, mentoring, and regulatory compliance. |

Pro Tip:

Numbers are your visual design — use them generously. Instead of saying “Handled loan applications,” write “Processed $3M+ in loans monthly with 97% accuracy.”

Loan Officer Resume Examples | Text Sample

Daniel Foster

Dallas, TX • daniel.foster@email.com • (214) 589-2437

LinkedIn: linkedin.com/in/danielfosterfinance

Professional Summary

Licensed Loan Officer with 6+ years of experience managing mortgage and personal loan portfolios worth over $12M. Proven record in loan origination, underwriting support, and compliance with NMLS and CFPB standards. Known for delivering accurate documentation and transparent financial guidance to clients while exceeding lending targets.

Key Skills

- Loan Origination & Underwriting Support

- Credit & Risk Analysis

- Mortgage and Consumer Lending

- FHA, VA & Conventional Loan Processing

- Client Consultation & Relationship Building

- NMLS & Fair Lending Compliance

- Loan Documentation & Audit Accuracy

- CRM & LOS Tools (Encompass, Calyx Point, BytePro)

Work Experience

Senior Loan Officer — Wells Fargo Bank

Dallas, TX | 2020–Present

- Manage a personal and mortgage loan portfolio exceeding $10M with 98% documentation accuracy.

- Originate 40+ new loans monthly while maintaining full compliance with federal lending regulations.

- Achieved “Top Loan Producer” award in 2023 for surpassing quarterly revenue goals by 25%.

- Train and supervise junior loan officers on compliance and customer communication.

Loan Officer — Bank of America

Houston, TX | 2016–2020

- Processed 35+ mortgage and consumer loan applications monthly with 99% accuracy.

- Collaborated with underwriting teams to reduce loan approval turnaround time by 18%.

- Built long-term relationships with 150+ clients, resulting in 30% growth through referrals.

- Ensured strict compliance with FHA, VA, and NMLS standards.

Education

Bachelor of Science in Finance

University of Texas at Dallas — 2016

- Coursework: Financial Management, Risk Analysis, Mortgage Lending Principles

Certifications

- NMLS License — Active since 2017

- Certified Mortgage Advisor (CMA) — Mortgage Bankers Association, 2022

- Fair Lending Compliance Certification — American Bankers Association, 2020

Why This Resume Example Is Good:

- Quantified achievements — clear metrics (loan volume, accuracy, revenue growth) instantly build credibility.

- Compliance-oriented language — includes essential keywords like NMLS, CFPB, FHA, VA, improving ATS ranking.

- Balanced layout — combines analytical skills and client service strengths without clutter.

- Consistent format — clear headings and professional spacing reflect financial discipline and organization.

Mortgage Loan Officer Resume Examples | Text Sample

Olivia Grant

Denver, CO • olivia.grant@email.com • (303) 771-9825

LinkedIn: linkedin.com/in/oliviagrantfinance

Professional Summary

Certified Mortgage Loan Officer with 7+ years of experience guiding clients through FHA, VA, and conventional loans. Proven record of generating over $15M in closed mortgage volume annually, while maintaining strict compliance with NMLS and CFPB standards. Skilled at building long-term relationships through transparency, accuracy, and consistent follow-through.

Key Skills

- Mortgage Loan Origination & Processing

- FHA, VA, and Conventional Loan Expertise

- Credit & Risk Assessment

- Loan Underwriting Coordination

- Client Consultation & Pre-Qualification

- Regulatory & Compliance Reporting

- CRM & Loan Origination Systems (Encompass, Calyx Point, LOS)

- Sales Target Achievement & Customer Retention

Work Experience

Senior Mortgage Loan Officer — Guild Mortgage Company

Denver, CO | 2020–Present

- Originate and close $1.5M+ in residential mortgages monthly, maintaining a 99% compliance record.

- Conduct client credit evaluations, rate negotiations, and loan structuring for FHA and VA programs.

- Achieved “Top 10% Loan Officers in Region” in 2023 for consistent sales and client retention.

- Partner with underwriting and appraisal teams to improve closing timelines by 25%.

Mortgage Consultant — U.S. Bank

Boulder, CO | 2016–2020

- Assisted 200+ clients annually with mortgage pre-approvals and refinancing solutions.

- Reduced document processing errors by 30% through streamlined verification workflows.

- Increased customer satisfaction by implementing post-closing follow-up calls and feedback surveys.

Education

Bachelor of Business Administration in Finance

University of Colorado, Boulder — 2015

- Coursework: Mortgage Lending Principles, Credit Analysis, Financial Markets

Certifications

- NMLS Mortgage License — Active since 2016

- Certified Mortgage Advisor (CMA) — Mortgage Bankers Association, 2023

- FHA Direct Endorsement Certification — HUD, 2022

- Compliance & Ethics in Mortgage Lending — ABA, 2021

Why This Resume Example Is Good:

- Highly niche-targeted: Focuses on mortgage lending programs (FHA, VA, Conventional) that banks actively search for.

- Metrics and compliance combined: Balances measurable success with NMLS and CFPB adherence.

- Readable and ATS-friendly: Uses clear formatting and finance-specific keywords for visibility.

- Shows client empathy: Highlights communication, transparency, and retention — vital traits in mortgage sales.

Loan Processor Resume Examples | Text Sample

Ethan Collins

Phoenix, AZ • ethan.collins@email.com • (602) 987-6423

LinkedIn: linkedin.com/in/ethancollinsloan

Professional Summary

Detail-oriented Loan Processor with 5+ years of experience in verifying borrower information, preparing loan documentation, and ensuring compliance with federal and institutional lending policies. Skilled in coordinating with loan officers, underwriters, and clients to maintain fast, accurate, and compliant processing for mortgage and personal loans.

Key Skills

- Loan Application & Documentation Review

- Credit & Income Verification

- Underwriting Support

- Compliance & Risk Analysis

- FHA, VA, and Conventional Loan Processing

- Data Accuracy & Financial Reporting

- Encompass, LOS, and Calyx Point Systems

- Customer Service & Cross-Department Collaboration

Work Experience

Senior Loan Processor — Chase Bank

Phoenix, AZ | 2020–Present

- Process 50+ loan applications monthly with a 99.5% documentation accuracy rate.

- Coordinate between underwriters and loan officers to meet strict 48-hour approval deadlines.

- Standardized borrower documentation workflow, reducing loan rework by 25%.

- Maintain up-to-date compliance with CFPB and RESPA guidelines.

Loan Processing Assistant — Wells Fargo

Scottsdale, AZ | 2017–2020

- Supported loan officers in managing and verifying customer data for consumer and mortgage loans.

- Reduced data errors by implementing double-verification procedures during application review.

- Contributed to a 20% faster loan turnaround through better coordination between branches and underwriting departments.

Education

Associate Degree in Business Administration

Phoenix College — 2016

- Concentration in Banking Operations and Financial Documentation

Certifications

- Certified Loan Processor (CLP) — Mortgage Training Institute, 2021

- Encompass Loan Origination System Certification — 2020

- Fair Lending Compliance Certificate — American Bankers Association, 2019

Why This Resume Example Is Good:

- Process-driven clarity: Uses active verbs and measurable outcomes to highlight workflow efficiency.

- ATS-optimized: Includes banking systems (Encompass, LOS, Calyx Point) and compliance keywords that hiring software recognizes.

- Strong internal collaboration: Emphasizes coordination between underwriters and loan officers — key in real-world banking setups.

- Quantified reliability: Accuracy and turnaround metrics establish trust and precision.

Personal Loan Officer Resume Examples | Text Sample

Sophia Ramirez

Orlando, FL • sophia.ramirez@email.com • (407) 783-2294

LinkedIn: linkedin.com/in/sophiaramirezfinance

Professional Summary

Customer-focused Personal Loan Officer with 6+ years of experience in consumer lending, credit evaluation, and client consultation. Proven record of achieving 120% of annual sales targets while maintaining full NMLS and CFPB compliance. Dedicated to helping clients find practical and transparent financial solutions for personal, auto, and small-business loans.

Key Skills

- Consumer Loan Origination & Cross-Selling

- Credit Analysis & Income Verification

- Loan Structuring & Underwriting Coordination

- Customer Relationship Management (CRM)

- Regulatory & Compliance Standards

- Risk & Fraud Prevention

- Loan Software: Encompass, BytePro, Salesforce CRM

- Negotiation & Conflict Resolution

Work Experience

Personal Loan Officer — Regions Bank

Orlando, FL | 2020–Present

- Manage 40–50 active personal loan accounts monthly, maintaining 97% client satisfaction.

- Closed over $9M in personal loans in 2023, surpassing quarterly revenue goals by 30%.

- Designed referral-based sales campaigns that increased client acquisition by 25%.

- Ensured zero compliance violations through accurate financial documentation and audit reviews.

Loan Consultant — SunTrust Bank (Now Truist)

Tampa, FL | 2016–2020

- Advised clients on suitable lending options based on credit history and income analysis.

- Improved loan approval turnaround by 18% by streamlining verification processes.

- Collaborated with underwriting teams to reduce error rates during loan closure.

- Ranked among the Top 5 Loan Officers in the branch for client referrals and retention.

Education

Bachelor of Science in Business & Finance

University of Central Florida — 2016

- Coursework: Consumer Credit, Financial Counseling, and Loan Structuring

Certifications

- NMLS License — Active since 2017

- Certified Consumer Lending Specialist (CCLS) — 2021

- Fair Lending & Compliance Training — 2020

Why This Resume Example Is Good:

- Client-first positioning: Balances sales results with customer satisfaction metrics, showing both empathy and performance.

- Comprehensive coverage: Includes auto, small-business, and consumer loan experience — boosting versatility.

- Compliance-heavy details: Demonstrates accountability with NMLS and audit accuracy.

- Readable yet measurable: Each bullet includes an action verb, quantifiable number, or compliance term, strengthening recruiter trust.

Credit Analyst Resume Examples | Text Sample

Benjamin Carter

Boston, MA • benjamin.carter@email.com • (617) 902-4456

LinkedIn: linkedin.com/in/benjamincarterfinance

Professional Summary

Analytical Credit Analyst with 7+ years of experience assessing creditworthiness, conducting risk evaluations, and preparing detailed financial reports for consumer and commercial loan portfolios exceeding $25M. Adept at using financial modeling and credit scoring tools to optimize lending decisions while ensuring full compliance with FCRA and CFPB regulations.

Key Skills

- Credit & Risk Analysis

- Financial Statement Review

- Loan Portfolio Evaluation

- Underwriting Support & Forecasting

- Financial Modeling & Data Interpretation

- Credit Scoring Systems (FICO, Experian, Moody’s RiskCalc)

- Compliance & Regulatory Reporting

- Advanced Excel, Tableau, and SQL

Work Experience

Senior Credit Analyst — Citizens Bank

Boston, MA | 2020–Present

- Evaluate and monitor commercial and personal loan portfolios worth over $30M.

- Prepare credit reports, debt-to-income analyses, and collateral evaluations for underwriting teams.

- Collaborate with risk management to identify early warning signs, reducing loan defaults by 12%.

- Streamlined documentation workflow, cutting report preparation time by 20%.

Credit Analyst — Santander Bank

Providence, RI | 2016–2020

- Reviewed borrower financial statements, credit histories, and cash flow data for loan approvals.

- Worked closely with underwriting to improve risk assessment models, increasing accuracy by 18%.

- Managed over 100 active credit files monthly while maintaining full regulatory compliance.

- Assisted in periodic audits to ensure adherence to federal reporting standards.

Education

Bachelor of Science in Finance and Risk Management

Boston University — 2016

- Coursework: Corporate Finance, Quantitative Risk Analysis, and Investment Management

Certifications

- Certified Credit Analyst (CCA) — Global Academy of Finance & Management, 2021

- Financial Risk Manager (FRM) Level I — GARP, 2020

- Credit Risk Management Certificate — Moody’s Analytics, 2019

Why This Resume Example Is Good:

- Strong quantitative credibility: Uses clear metrics (loan volume, risk reduction, audit compliance) to highlight analytical impact.

- Tool and system inclusion: Mentions real platforms (FICO, Moody’s, SQL) to boost ATS keyword strength.

- Balance of compliance and efficiency: Emphasizes adherence to laws while showing workflow optimization.

- Professional tone: Reads like a real finance resume — concise, structured, and trust-driven.

Professional Summary Examples

Your professional summary is your first impression — a concise snapshot of your expertise, credibility, and financial acumen.

In banking and lending roles, hiring managers look for trust, numbers, and consistency. Keep your summary focused on loan volume, client relationships, and compliance knowledge — not just duties.

Below are real example summaries for different experience levels.

Resume Summary For Entry-Level Loan Officer

Analytical and motivated finance graduate with internship experience in loan processing and customer support. Skilled in data verification, credit documentation, and customer consultation. Eager to apply strong quantitative and communication skills to support lending operations in a growth-oriented bank.

Resume Summary For Experienced Loan Officer

Licensed loan officer with over 5 years of experience managing mortgage and personal loan portfolios exceeding $5M. Proven record in client acquisition, loan origination, and regulatory compliance. Adept at balancing sales targets with responsible lending practices.

Senior Loan Officer Resume Summary

Strategic and detail-oriented senior loan officer with 8+ years in mortgage, commercial, and consumer lending. Known for maintaining 98% accuracy in loan approvals and achieving top-quartile customer satisfaction ratings. Skilled in credit risk assessment, underwriting coordination, and team mentorship.

Mortgage Loan Officer Resume Summary

Certified mortgage loan officer with strong knowledge of FHA, VA, and conventional loan guidelines. Consistently meet quarterly sales targets while maintaining full compliance with NMLS and CFPB standards. Dedicated to guiding clients through transparent, stress-free mortgage processes.

Resume Summary For Personal Loan Officer

Customer-focused loan officer with 4+ years in personal lending and financial advisory. Expertise in loan origination, cross-selling financial products, and maintaining long-term client relationships. Known for empathetic communication and ethical loan practices.

Read More :- Resume Summary Examples

Pro Tip:

Begin with your license or experience level, follow with your specialization (e.g., mortgage, commercial, personal), and close with measurable impact — this formula creates a summary that feels both credible and confident.

Key Skills Section

A loan officer’s success depends on balancing numbers with relationships — understanding credit data while earning client trust.

Your resume should showcase both analytical expertise and interpersonal skills, along with up-to-date knowledge of compliance and lending laws.

To make this section ATS-friendly, organize your skills into categories that reflect your professional strengths.

Analytical & Technical Skills

- Loan Origination and Underwriting Support

- Credit and Risk Analysis

- Financial Documentation Review

- Loan Portfolio Management

- Debt-to-Income and Ratio Calculations

- Loan Processing Software (Encompass, Calyx Point, BytePro)

- Data Entry Accuracy and Financial Reporting

Client-Focused & Sales Skills

- Client Consultation and Relationship Building

- Customer Retention and Cross-Selling

- Communication and Empathy

- Negotiation and Loan Closing Coordination

- Problem-Solving and Conflict Resolution

- Team Collaboration in Branch or Remote Settings

Compliance & Professional Skills

- NMLS and CFPB Compliance

- Fair Lending and Anti-Discrimination Standards

- FHA, VA, and Conventional Loan Guidelines

- Confidentiality and Data Protection

- Time Management and Attention to Detail

- Ethical Decision-Making

Pro Tip:

In finance, precision builds trust. Use keywords like “compliance,” “risk,” “loan portfolio,” and “client satisfaction” to make your resume resonate with both human recruiters and ATS filters.

Work Experience Section

Your work experience is where numbers do the talking.

Recruiters in finance want to see measurable outcomes — loan volume handled, approval accuracy, client satisfaction, and your ability to meet or exceed lending goals.

Every bullet point should show the balance between analytical skill and ethical responsibility.

How to Format It

[Job Title] — [Company Name], [City] | [Start Date] – [End Date]

Follow with 3–5 bullet points that highlight quantifiable achievements and compliance excellence.

Example 1: Senior Loan Officer — Wells Fargo Bank, Chicago, IL | 2020–Present

- Manage a $10M+ mortgage and personal loan portfolio with a 97% client satisfaction rate.

- Originate and process 40–50 loans monthly while maintaining 100% adherence to NMLS and CFPB compliance standards.

- Trained and mentored 5 junior officers, improving loan approval accuracy by 15%.

- Recognized as “Top Loan Producer” in 2023 for exceeding quarterly sales goals by 25%.

Example 2: Loan Officer — Bank of America, Dallas, TX | 2017–2020

- Processed 30+ residential and commercial loan applications monthly with less than 1% documentation error rate.

- Collaborated with underwriting and risk teams to streamline approval timelines by 20%.

- Consistently met lending quotas while ensuring full compliance with FHA and VA guidelines.

- Built and maintained long-term relationships with 150+ clients, generating repeat business through referrals.

Example 3: Loan Processor — Chase Bank, Houston, TX | 2015–2017

- Reviewed credit reports, income documents, and collateral information to verify applicant eligibility.

- Assisted in closing over $2M in personal and auto loans monthly.

- Maintained digital loan files in Encompass and ensured all records met federal audit standards.

- Supported the underwriting team in achieving a 98% loan completion rate within SLA timelines.

Pro Tip:

Start every bullet with strong financial verbs like analyzed, originated, processed, verified, advised, and approved.

Numbers prove credibility — a recruiter reading “$10M portfolio” trusts your impact more than “handled multiple loans.”

Education Section

Employers in the financial sector value formal education that demonstrates your analytical foundation and ethical awareness.

Most loan officers hold a degree in finance, business administration, or economics, while others start with certifications and work experience before advancing into managerial roles.

How to Format It

List your degree, institution, and graduation year. Include relevant coursework or academic achievements if you’re an entry-level candidate.

Example Entries

Bachelor of Science in Finance

University of Illinois at Urbana–Champaign — 2016

- Coursework: Financial Management, Risk Analysis, Corporate Accounting, and Consumer Credit

Associate Degree in Business Administration

Dallas College, TX — 2014

- Emphasis on Banking Operations, Customer Relations, and Data Analytics

Professional Development

- Online Certification in Mortgage Lending — Coursera (2022)

- Workshop: Advanced Loan Origination Techniques — American Bankers Association (2023)

Pro Tip:

If you’re new to the field, place your education section above work experience to highlight your finance foundation.

For experienced officers, keep it concise — hiring managers care more about your loan performance metrics and compliance history.

Certifications Section

Certifications validate your financial knowledge, compliance awareness, and credibility with lenders and clients.

They also help your resume stand out in regulated fields like banking, mortgage lending, and credit analysis.

Many resume builders merge certifications with education — but MyResumeStar provides a dedicated Certifications section so your credentials gain the visibility they deserve.

This separation improves both ATS scanning and employer perception.

Example (Real Resume Format)

Certifications

- Nationwide Mortgage Licensing System (NMLS) License — Active since 2018

- Certified Mortgage Advisor (CMA) — Mortgage Bankers Association, 2022

- FHA Direct Endorsement Certification — U.S. Department of Housing and Urban Development, 2021

- Fair Lending Compliance Certificate — American Bankers Association, 2020

- Credit Risk Management Certification — Global Association of Risk Professionals (GARP), 2019

Pro Tip:

Always include the issuing body and year — it signals credibility and keeps your resume verifiable.

If you’re working across multiple states, mention multi-state licensing or compliance training to strengthen your profile.

Resume Keywords & Action Verbs

In the financial industry, keywords are the foundation of visibility — both for Applicant Tracking Systems (ATS) and human recruiters.

Using the right terms communicates that you understand the language of lending, risk, and client trust.

Include these keywords naturally across your summary, skills, and experience sections for maximum search and hiring visibility.

Common Loan Officer Resume Keywords

| Category | Keywords & Phrases |

|---|---|

| Core Functions | Loan Origination, Credit Analysis, Underwriting, Financial Documentation, Loan Processing, Client Consultation, Portfolio Management |

| Specializations | Mortgage Lending, Consumer Loans, Commercial Loans, Personal Loans, FHA Loans, VA Loans, Refinance Loans |

| Compliance & Risk | NMLS Compliance, Fair Lending, Risk Assessment, Loan Audit, Regulatory Reporting, Fraud Prevention, CFPB Standards |

| Analytical & Technical | Financial Ratios, Data Review, Loan Software (Encompass, Calyx, LOS), Credit Evaluation, KPI Tracking, Financial Modeling |

| Client & Sales | Customer Relationship Management, Cross-Selling, Client Retention, Referral Generation, Negotiation, Upselling Financial Products |

Action Verbs for Loan Officer Resumes

Every bullet point should begin with a strong, finance-specific verb that demonstrates accountability and measurable outcomes.

| Analytical & Credit | Client & Sales | Compliance & Risk | Leadership & Growth |

|---|---|---|---|

| Analyzed | Advised | Audited | Trained |

| Processed | Consulted | Verified | Mentored |

| Evaluated | Guided | Ensured | Developed |

| Originated | Recommended | Monitored | Improved |

| Assessed | Negotiated | Complied | Led |

| Approved | Supported | Reviewed | Achieved |

Pro Tip:

Pair each action verb with a result or metric.

For example:

“Originated and closed $5M+ in mortgage loans annually with 98% compliance accuracy.”

“Consulted with 100+ clients, improving loan conversion rates by 25%.”

Tips to Make Your Loan Officer Resume Stand Out

In the financial industry, small details create big trust.

To stand out among hundreds of applicants, your resume should demonstrate not only technical knowledge but also credibility, ethics, and client success.

- Use numbers to build credibility.

Replace vague phrases like “handled many loans” with concrete results — e.g., “Processed $8M in consumer and mortgage loans with 99% documentation accuracy.” - Highlight compliance confidence.

Mention NMLS certification, Fair Lending adherence, and audit accuracy. These keywords instantly communicate reliability and integrity. - Show client and sales impact.

Loan officers are financial advisors and sales professionals. Quantify conversion rates, client satisfaction, or referral growth. - Mention tools and technologies.

Include software proficiency in Encompass, Calyx Point, BytePro, LOS systems, or CRM tools — many banks filter resumes for these keywords. - Show cross-functional collaboration.

Employers value officers who coordinate with underwriting, credit, and legal teams. Phrases like “Worked with underwriters to reduce loan turnaround by 15%” demonstrate teamwork and efficiency. - Add awards or recognitions.

If you’ve received Top Producer, Best Loan Consultant, or Employee of the Quarter, list them briefly to create a competitive edge. - Keep your layout conservative and clean.

Finance recruiters favor simplicity and professionalism. Use clear headers, white space, and metrics — avoid flashy colors or overly creative designs.

Pro Tip:

Recruiters spend less than 10 seconds on an initial scan. Start strong, keep each bullet results-driven, and let numbers tell your success story.

Loan Officer Cover Letter Example

Daniel Foster

1831 Willowbrook Avenue

Dallas, TX 75204

daniel.foster@email.com • (214) 589-2437

LinkedIn: linkedin.com/in/danielfosterfinance

March 12, 2025

Hiring Manager

Wells Fargo Bank

2000 McKinney Avenue

Dallas, TX 75201

Subject: Application for Loan Officer Position

Dear Hiring Manager,

As a licensed Loan Officer with over six years of experience in mortgage and consumer lending, I’m excited to apply for the Loan Officer position at Wells Fargo Bank. My background in credit analysis, compliance, and customer relationship management has consistently helped clients secure financing solutions that align with their goals while meeting every regulatory requirement.

At Bank of America, I managed a portfolio of more than $12 million in personal and mortgage loans, maintaining a 98% documentation accuracy rate and exceeding quarterly lending goals by 20%. I specialize in guiding applicants through complex credit decisions with transparency and trust — two principles I know Wells Fargo upholds across its lending operations.

Beyond metrics, I take pride in the human side of finance. I’ve earned multiple “Top Service” awards for creating strong referral networks and simplifying the loan process for first-time buyers and small-business owners alike. I’m eager to bring that same level of service, diligence, and integrity to your Dallas branch.

I would welcome the opportunity to discuss how my loan-origination expertise and compliance knowledge can contribute to Wells Fargo’s continued reputation for excellence and client satisfaction.

Thank you for your time and consideration.

Warm regards,

Daniel Foster

Tips for Writing a Loan Officer Cover Letter

- Start with measurable trust.

Lead your opening line with a result — “Closed $10M+ in loans with 98% compliance accuracy” grabs more attention than generic introductions. - Tailor to the lender.

Mention the bank or institution by name and briefly show you understand their lending focus — mortgage, small business, or personal loans. - Show compliance confidence.

Highlight your knowledge of NMLS, FHA/VA regulations, or CFPB standards — these reassure employers of your reliability. - Keep tone formal yet personal.

Address the hiring manager directly and express genuine interest in their team or client philosophy. - Add quantifiable achievements.

Use metrics such as approval rate, loan volume, error reduction, or portfolio growth to add substance and credibility. - Keep it brief — one page only.

A concise, one-page letter mirrors financial professionalism.

If you prefer an ultra-compact option, check our guide on the Short Email Cover Letter format. - Use a clean, modern template.

Choose a design consistent with your resume style for brand alignment.

You can easily customize layouts with our Cover Letter Template Google Docs collection. - Match tone with resume language.

Align your verbs, metrics, and keywords with those in your How to Write a Cover Letter guide to ensure consistency and ATS readability. - End with action.

Conclude confidently by requesting a discussion or interview — not just stating appreciation.

Conclusion

A strong Loan Officer Resume isn’t just a record of your employment — it’s a financial statement of your credibility, performance, and trustworthiness.

In an industry built on precision and ethics, your resume should reflect both: quantifiable achievements and client-first integrity.

Use clear formatting, measurable results, and compliance-focused language to show that you don’t just manage loans — you manage confidence.

Highlight your certifications, software expertise, and consistent record of accuracy, and you’ll project the reliability banks and clients look for.

If you’re expanding your career within the finance domain, explore our related guides: Financial Analyst Resume, Credit Analyst Resume, and Bank Teller Resume — each designed to help you refine your professional brand in the competitive financial sector.

FAQs(People Also Ask)

You should include a clear summary, a skills section focused on loan origination, underwriting and client service, a quantified work-history showing loan volumes and approval rates, your education, and professional certifications like NMLS or mortgage licenses.

Focus on transferable skills (sales, customer service, attention to detail), highlight relevant coursework or internships in finance or business, and place your education section above work history to show your readiness.

Core skills include loan origination, credit analysis, underwriting support, financial documentation review, client consultation and relationship building, plus software proficiency and regulatory compliance.

If you have fewer than about five years of relevant experience, one page is sufficient. For senior roles or those with extensive portfolios or certifications, a two-page format may be acceptable—just ensure each line adds value.

Yes — sales and performance metrics (loan volume, approval percentages, growth in portfolio) matter. They demonstrate your ability to generate business and manage risk, which are key in this industry.

Relevant certifications include a state or national loan-originator license (e.g., NMLS), FHA/VA endorsements, and other credentials in risk management or compliance. These show you understand regulatory demands and lending standards.