Discover an array of credit analyst resume templates designed to help you stand out. Our editable Word resume templates are modern, ATS friendly, and easy to customize. Download free resume templates today and take the next step in your career.

Why Use Our Templates

- ATS Friendly: Ensure your resume passes through Applicant Tracking Systems with our modern resume templates.

- Editable Formats: Customize your experience easily with our editable Google Docs resume template.

- Variety of Styles: Choose from a selection of free resume templates that fit your professional style.

- User-Friendly: Our templates are designed for quick downloads and straightforward customization.

How to Choose Your Level

When selecting a resume template, consider your experience level:

- Entry-Level: Ideal for recent graduates or those transitioning careers.

- Mid-Career: Best for professionals with several years of experience looking to advance.

- Senior: Tailored for seasoned credit analysts aiming for top-tier positions.

Entry-Level Credit Analyst Resume Templates

- (123) 456-7890

- jane.doe@example.com

- Atlanta, GA 30301

- Financial Analysis

- Credit Risk Assessment

- Data Interpretation

- Excel

- Financial Modeling

- Attention to Detail

- Problem Solving

- Communication

- Team Collaboration

- Time Management

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

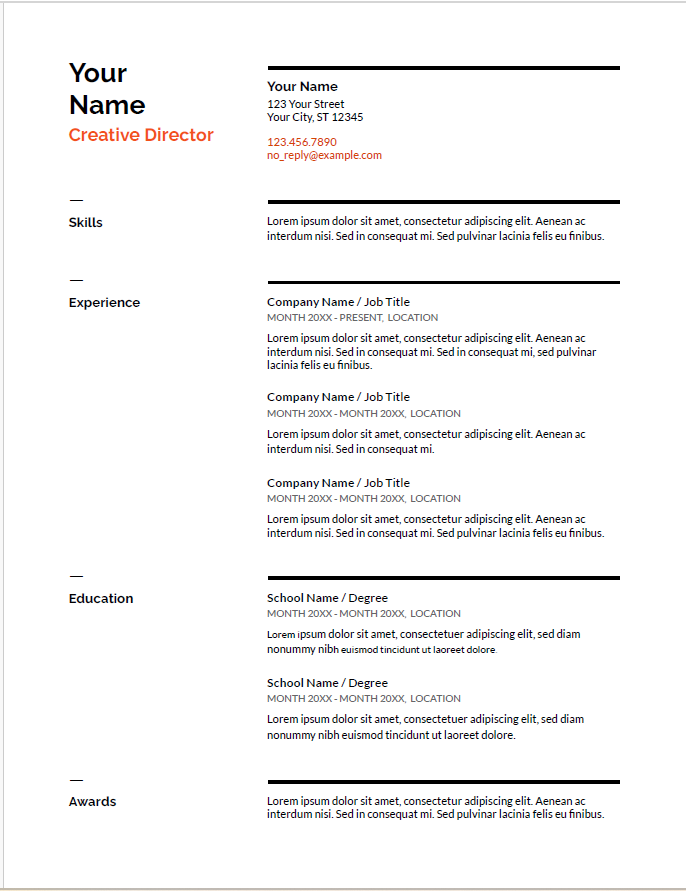

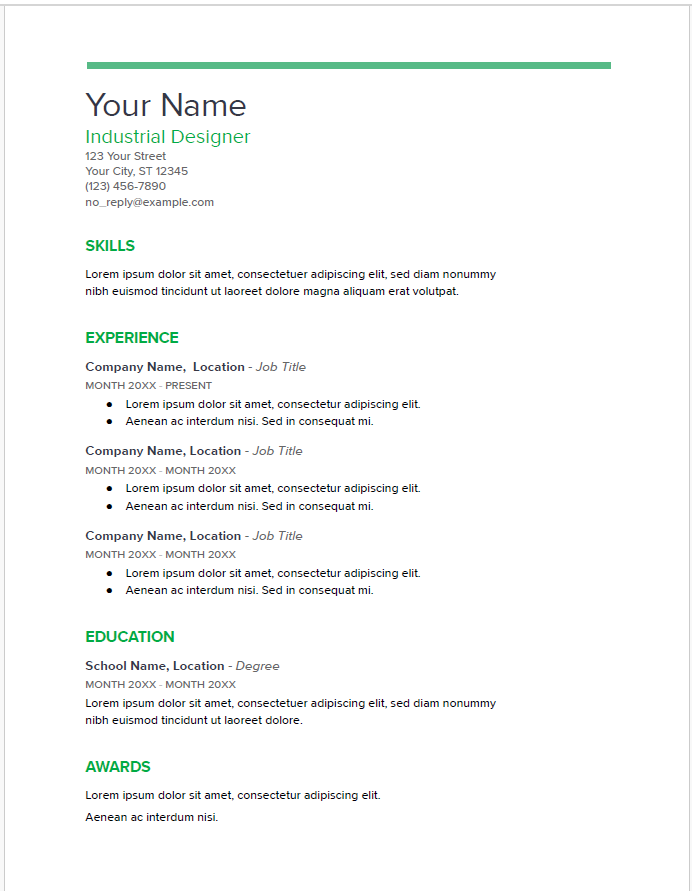

Steel Blue ModernProfessionalTwo-Column

A clean and modern two-column resume template featuring a deep steel blue header with white text for the candidate’s name. The left sidebar contains contact details and skills on a light grey background, while the main content area showcases summary, work experience, and education with clear section headings and ample white space.

Why This Template

Steel Blue provides a professional and organized layout that balances visual appeal with readability. The strong header draws immediate attention to your name, while the sidebar enables quick scanning of contact and skills. Its clear hierarchy guides recruiters smoothly through your career highlights.

Key Features

- Bold steel blue header for name visibility

- Two-column layout for organized content

- Sidebar for quick access to contact and skills

- Clear section headings for easy navigation

- Generous white space for readability

- ATS friendly format

- Editable in Microsoft Word and exportable to DOCX, PDF, TXT

- (123) 456-7890

- jane.doe@example.com

- Atlanta, GA 30301

- Financial Analysis

- Credit Risk Assessment

- Data Interpretation

- Excel

- Financial Modeling

- Attention to Detail

- Problem Solving

- Communication

- Team Collaboration

- Time Management

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

- (123) 456-7890

- jane.doe@example.com

- Atlanta, GA, 30301

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

- Financial Analysis

- Data Interpretation

- Financial Modeling

- Problem Solving

- Team Collaboration

- Credit Risk Assessment

- Excel

- Attention to Detail

- Communication

- Time Management

- (123) 456-7890

- Atlanta, GA, 30301

- jane.doe@example.com

- Financial Analysis

- Data Interpretation

- Financial Modeling

- Problem Solving

- Team Collaboration

- Credit Risk Assessment

- Excel

- Attention to Detail

- Communication

- Time Management

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

- (123) 456-7890

- jane.doe@example.com

- Atlanta, GA, 30301

- Financial Analysis

- Credit Risk Assessment

- Data Interpretation

- Excel

- Financial Modeling

- Attention to Detail

- Problem Solving

- Communication

- Team Collaboration

- Time Management

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

- (123) 456-7890

- jane.doe@example.com

- Atlanta, GA, 30301

- Financial Analysis

- Credit Risk Assessment

- Data Interpretation

- Excel

- Financial Modeling

- Attention to Detail

- Problem Solving

- Communication

- Team Collaboration

- Time Management

- Assisted in the analysis of client credit reports to assess risk profiles.

- Collaborated with senior analysts to prepare credit reports for approval.

- Managed customer transactions and provided financial insights on product financing options.

- Achieved top sales performance in the department, contributing to a 15% increase in monthly sales.

Mid-Career Credit Analyst Resume Templates

- (987) 654-3210

- john.smith@example.com

- Chicago, IL, 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

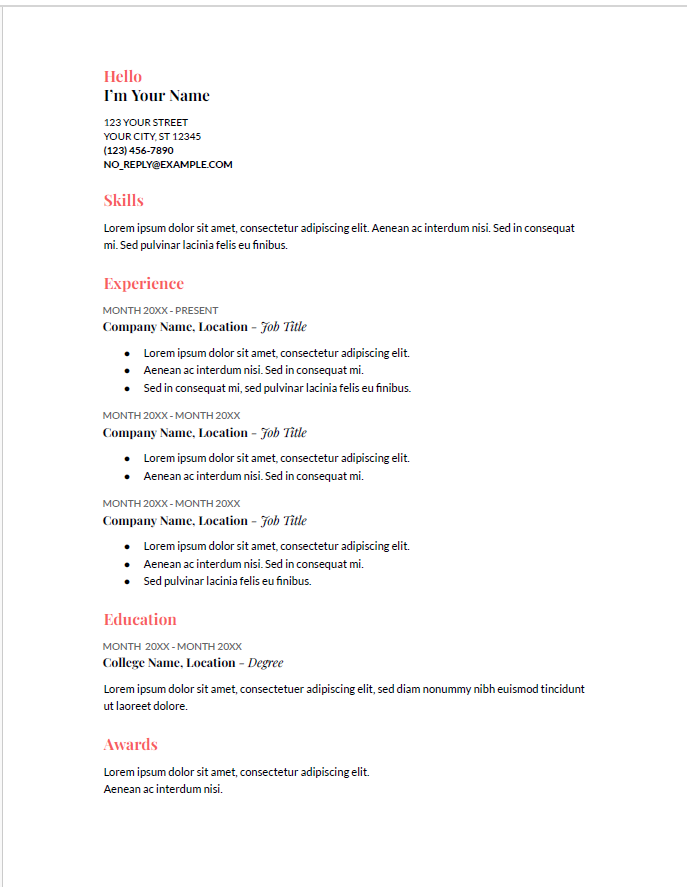

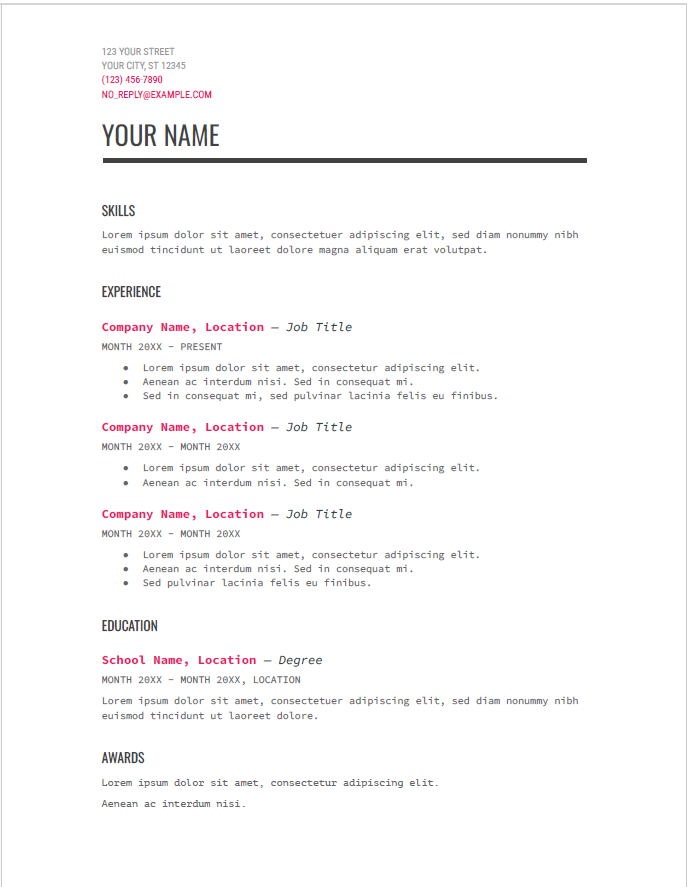

Slate Vertical ProfessionalTwo-ColumnClean

A professional two-column resume template featuring a clean vertical sidebar on the left with skills clearly listed, and a spacious right main section for summary, work experience, and education. The candidate’s name is prominently displayed in a light gray header spanning the top, with contact details arranged neatly alongside icons in the sidebar for easy scanning.

Why This Template

Slate Vertical provides a balanced, easy-to-navigate layout that highlights your skills and experience effectively. The sidebar’s vertical alignment of key skills and contact info lets recruiters quickly assess your qualifications, while the main content area offers plenty of room for detailed work history and education.

Key Features

- Vertical sidebar for skills and contact information

- Light gray header with bold candidate name

- Clear section headers and bullet points in main content

- Use of icons for contact details for visual clarity

- Well-organized content for easy recruiter scanning

- Suitable for administrative, clerical, and office roles

- Fully editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility

- (987) 654-3210

- john.smith@example.com

- Chicago, IL, 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

- (987) 654-3210

- john.smith@example.com

- Chicago, IL 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

- (987) 654-3210

- john.smith@example.com

- Chicago, IL, 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

- (987) 654-3210

- john.smith@example.com

- Chicago, IL 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

- (987) 654-3210

- john.smith@example.com

- Chicago, IL, 60601

- Credit Analysis

- Risk Management

- Financial Reporting

- Data Analysis

- Portfolio Management

- Regulatory Compliance

- SQL

- Communication

- Negotiation

- Problem Solving

- Evaluated over 200 credit applications monthly, resulting in a 30% reduction in loan defaults.

- Developed and implemented new credit assessment strategies that improved approval rates by 25%.

- Conducted thorough credit analysis and risk assessments for small business clients.

- Assisted in the training of new team members on credit evaluation procedures.

- Certified Credit Professional (CCP) – Credit Institute – 2021

Senior Credit Analyst Resume Templates

- Credit Risk Analysis

- Portfolio Management

- Strategic Planning

- Regulatory Compliance

- Project Management

- Financial Modeling

- Data Analytics

- Leadership

- Advanced Excel

- Client Relationship Management

- Managed a portfolio of over $500 million in corporate credit, reducing risk exposure by 40%.

- Led a team of analysts in developing predictive models for credit risk assessment, enhancing accuracy by 35%.

- Developed and implemented risk assessment frameworks that decreased loan defaults by 20%.

- Presented credit risk reports to senior management, influencing strategic business decisions.

- Chartered Financial Analyst (CFA) – CFA Institute – 2015

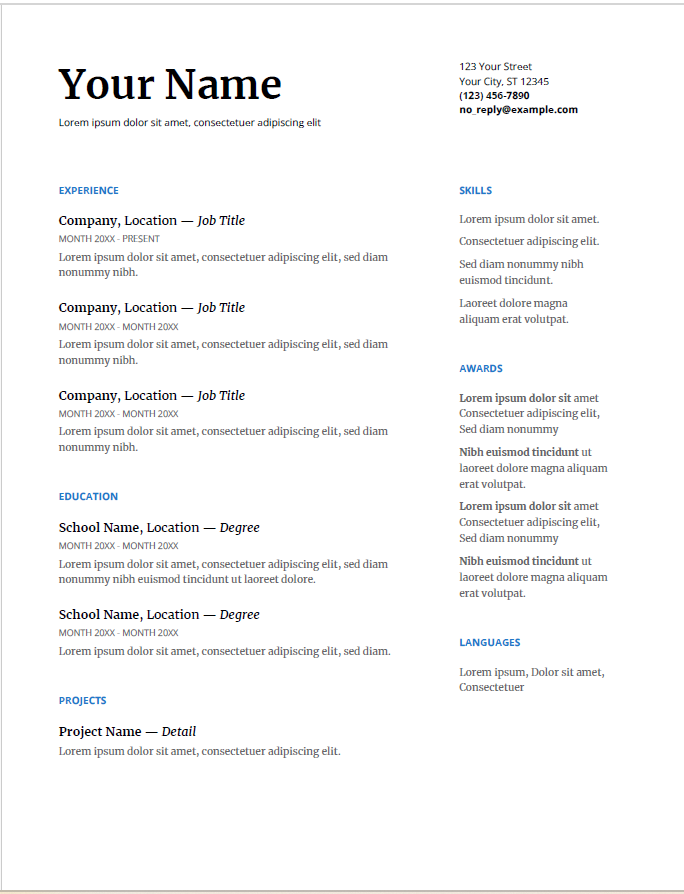

Golden Accent ElegantProfessionalSingle-Column

An elegant and professional single-column resume template featuring a clean white background with gold accent highlights for section headers and the candidate’s last name. The layout emphasizes clarity and structure with well-defined sections for summary, professional skills, work experience, and education. This template balances sophistication with readability.

Why This Template

Golden Accent offers a refined resume design that combines subtle luxury with professional simplicity. The gold highlights create visual interest without overwhelming content, while the clean layout ensures recruiters can easily navigate your qualifications. Ideal for professionals aiming to convey both competence and style.

Key Features

- Single-column layout for focused and linear reading

- Gold accent color highlights candidate’s last name and section headers

- Clear typography and spacing for enhanced readability

- Well-organized sections with bullet points for skills and experience

- Professional and sophisticated aesthetic

- Suitable for business, administrative, and corporate roles

- Editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility in mind

- Credit Risk Analysis

- Portfolio Management

- Strategic Planning

- Regulatory Compliance

- Project Management

- Financial Modeling

- Data Analytics

- Leadership

- Advanced Excel

- Client Relationship Management

- Managed a portfolio of over $500 million in corporate credit, reducing risk exposure by 40%.

- Led a team of analysts in developing predictive models for credit risk assessment, enhancing accuracy by 35%.

- Developed and implemented risk assessment frameworks that decreased loan defaults by 20%.

- Presented credit risk reports to senior management, influencing strategic business decisions.

- Chartered Financial Analyst (CFA) – CFA Institute – 2015

- (555) 123-4567

- New York, NY, 10001

- emily.johnson@example.com

- Credit Risk Analysis

- Portfolio Management

- Strategic Planning

- Regulatory Compliance

- Project Management

- Financial Modeling

- Data Analytics

- Leadership

- Advanced Excel

- Client Relationship Management

- Managed a portfolio of over $500 million in corporate credit, reducing risk exposure by 40%.

- Led a team of analysts in developing predictive models for credit risk assessment, enhancing accuracy by 35%.

- Developed and implemented risk assessment frameworks that decreased loan defaults by 20%.

- Presented credit risk reports to senior management, influencing strategic business decisions.

- Chartered Financial Analyst (CFA) – CFA Institute – 2015

- (555) 123-4567

- emily.johnson@example.com

- New York, NY, 10001

- Credit Risk Analysis

- Financial Modeling

- Portfolio Management

- Data Analytics

- Strategic Planning

- Leadership

- Regulatory Compliance

- Advanced Excel

- Project Management

- Client Relationship Management

- Managed a portfolio of over $500 million in corporate credit, reducing risk exposure by 40%.

- Led a team of analysts in developing predictive models for credit risk assessment, enhancing accuracy by 35%.

- Developed and implemented risk assessment frameworks that decreased loan defaults by 20%.

- Presented credit risk reports to senior management, influencing strategic business decisions.

- Chartered Financial Analyst (CFA) – CFA Institute – 2015

- (555) 123-4567

- New York, NY, 10001

- emily.johnson@example.com

- Credit Risk Analysis

- Portfolio Management

- Strategic Planning

- Regulatory Compliance

- Project Management

- Financial Modeling

- Data Analytics

- Leadership

- Advanced Excel

- Client Relationship Management

- Managed a portfolio of over $500 million in corporate credit, reducing risk exposure by 40%.

- Led a team of analysts in developing predictive models for credit risk assessment, enhancing accuracy by 35%.

- Developed and implemented risk assessment frameworks that decreased loan defaults by 20%.

- Presented credit risk reports to senior management, influencing strategic business decisions.

- Chartered Financial Analyst (CFA) – CFA Institute – 2015

Editable Word & PDF Templates

Editable Google Docs Templates

Customizing your resume in Word is simple: download the template, open it in Microsoft Word, and edit the text to match your qualifications and experience.

Tips & FAQs

Design & ATS Tips

- Keep it simple: Use clear fonts and avoid excessive graphics for ATS compatibility.

- Use keywords: Incorporate industry-specific terms to enhance your visibility in applicant tracking systems.

- Tailor your resume: Customize each resume to align with the job description you are applying for.

FAQs

Are all the resume templates free?

Can I edit the templates in Google Docs?

What should I include in my credit analyst resume?

Start Building Your Resume Today

Ready to create a standout credit analyst resume? Use our resume builder to get started.

Build Your Resume NowView more resume templates: Explore Templates

If you’re specifically looking for auditor resume templates, we have tailored options that meet the requirements of the finance industry.

For those interested in financial roles, check out our financial analyst resume templates, which offer modern designs to highlight your skills effectively.