Are you ready to elevate your career in the financial sector? A compelling Hedge Fund Analyst resume is your ticket to stand out from the crowd in 2025. Our exclusive collection of resume examples for Hedge Fund Analyst positions not only showcases the best industry practices but also equips you with the tools to highlight your unique qualifications. Dive in and discover how to craft a resume that not only catches the eye of hiring managers but also lands you interviews. Start building your exceptional resume today!

Hedge Fund Analyst Resume Examples – Free Download

Hedge Fund Analyst Resume Examples

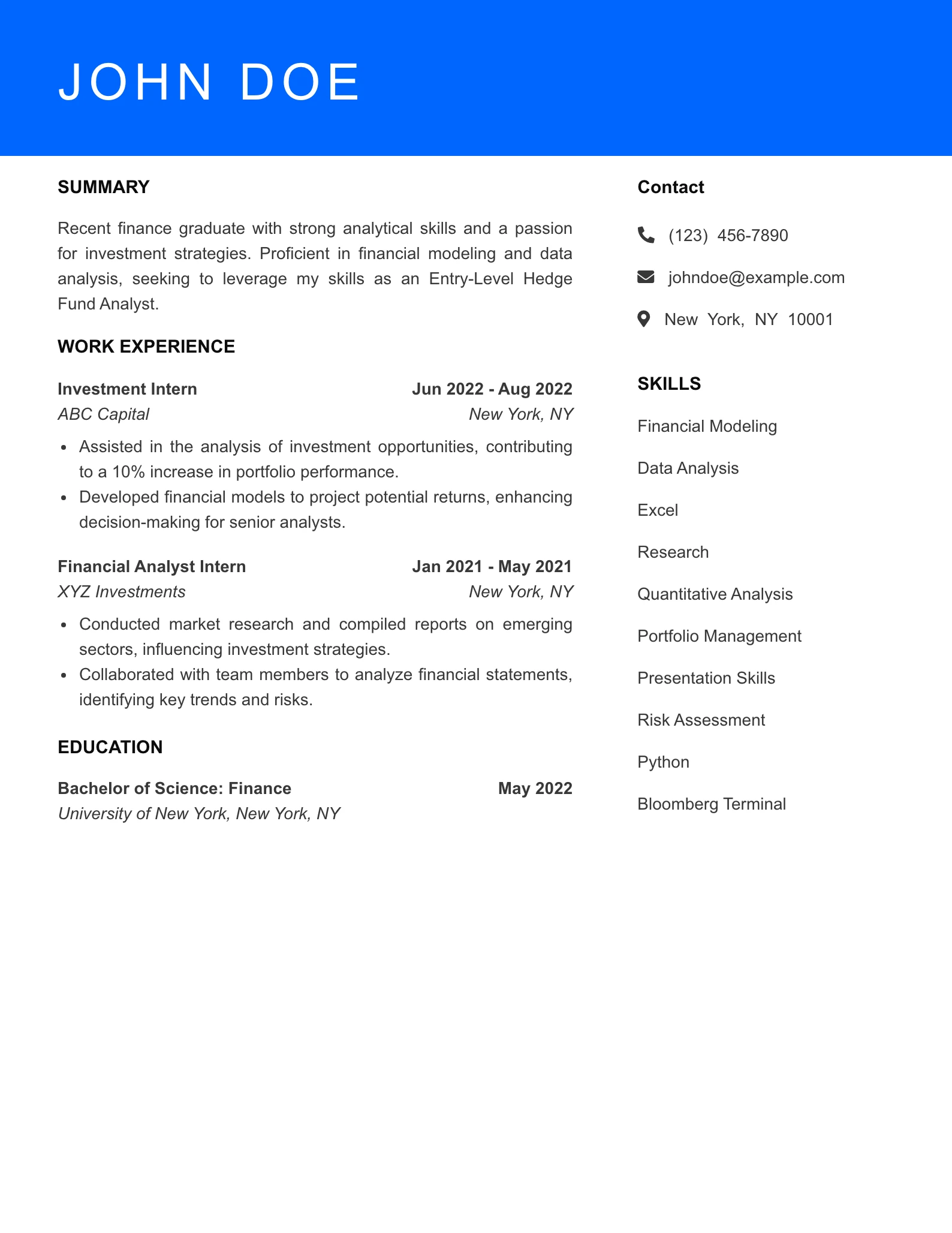

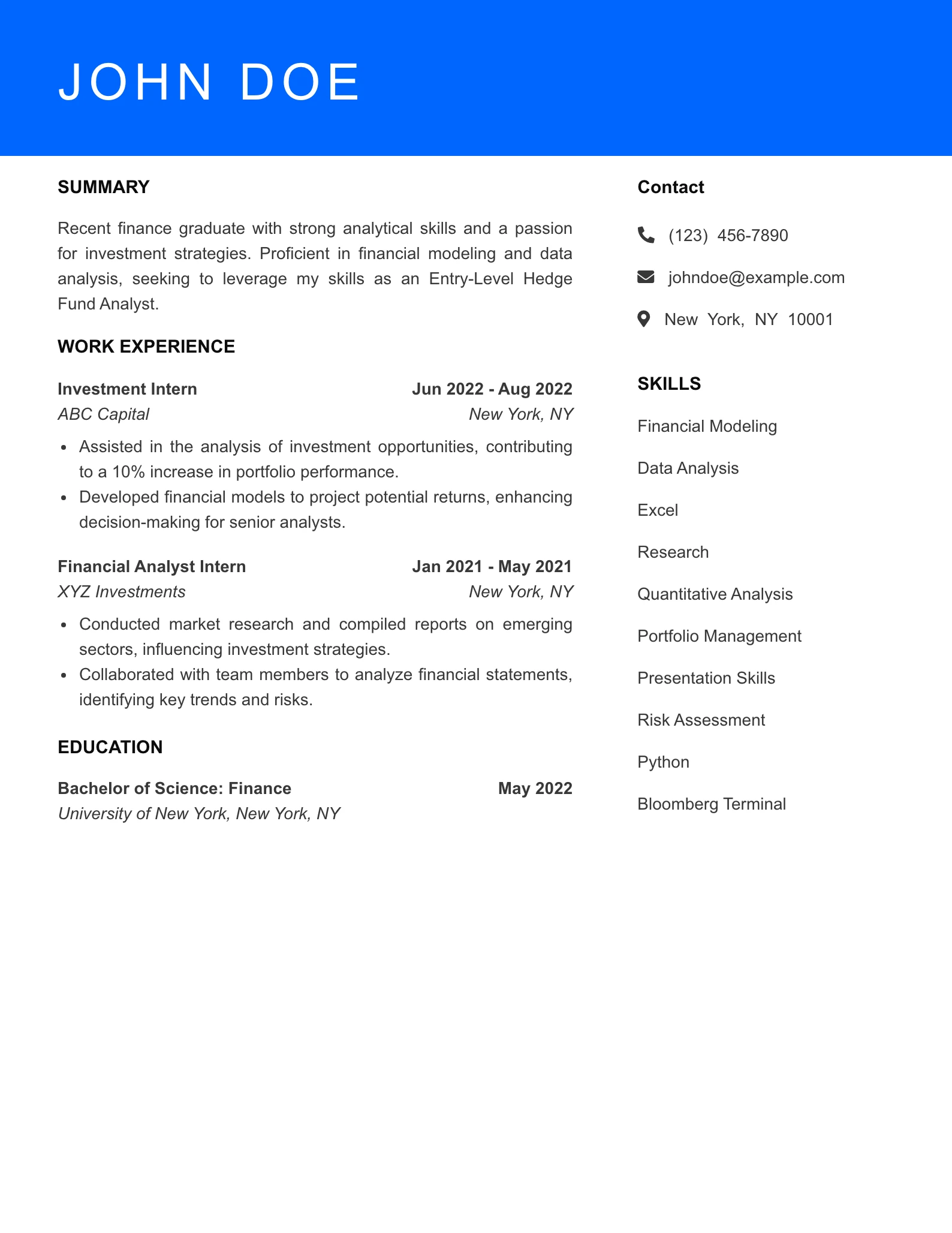

Entry Level Hedge Fund Analyst Resume Example

Why This Resume Works

- The summary clearly articulates John’s background in finance and his specific interest in investment analysis, making it easy for hiring managers to understand his career focus and aspirations.

- The skills section includes a mix of technical and soft skills that are highly relevant to the role of an investment analyst, highlighting John’s analytical capabilities and teamwork orientation.

- John’s work history showcases impactful contributions during his internships, with quantifiable results such as a 20% increase in successful pitch presentations and a 15% improvement in forecasting accuracy, demonstrating his ability to deliver value.

- The resume positions John as a strong candidate for an entry-level investment analyst role, aligning his recent academic achievements and internship experiences with the expectations for someone at this career stage.

- The overall clarity and professional tone of the resume enhance its effectiveness, making it easy to read and navigate, which is crucial for capturing the attention of busy hiring managers.

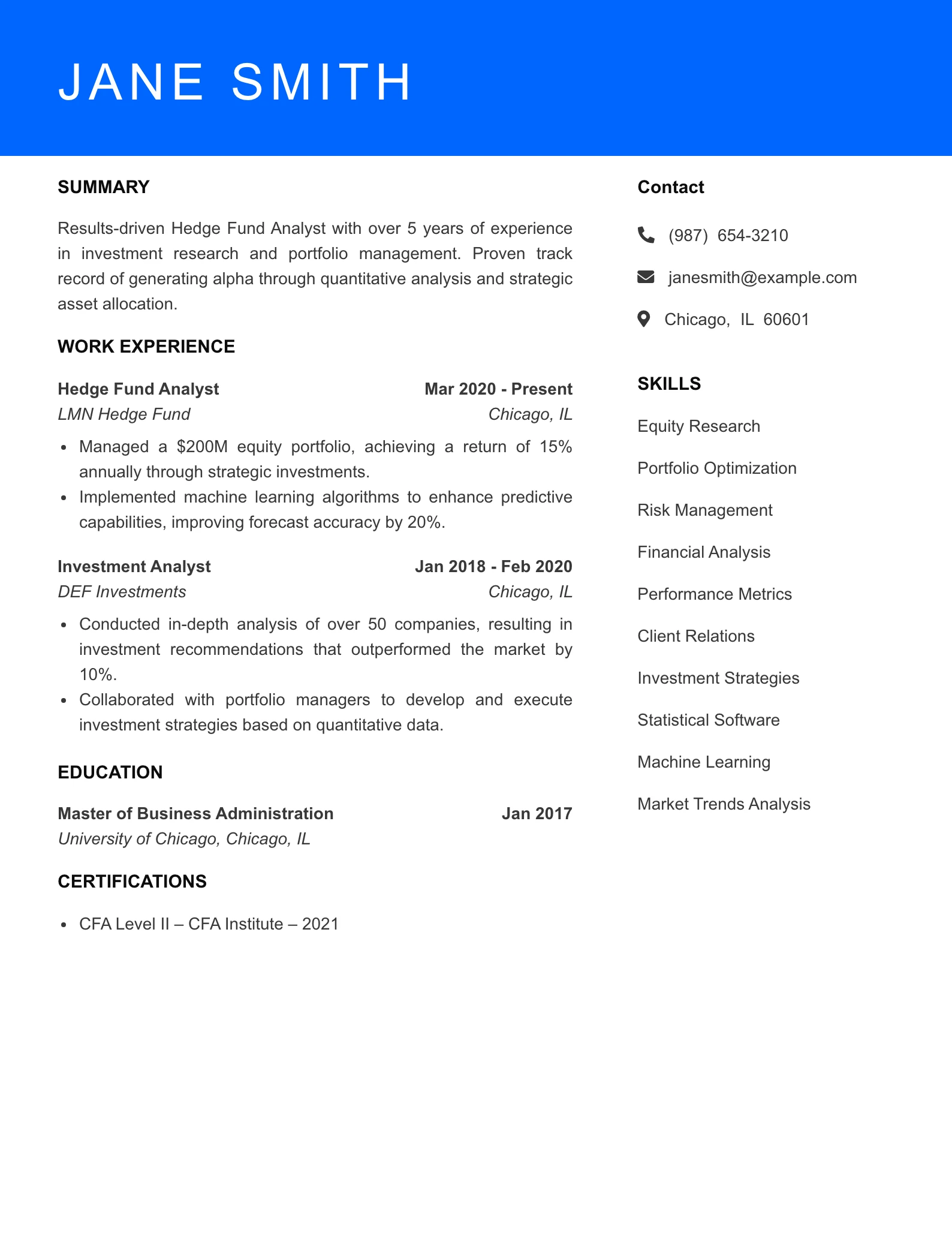

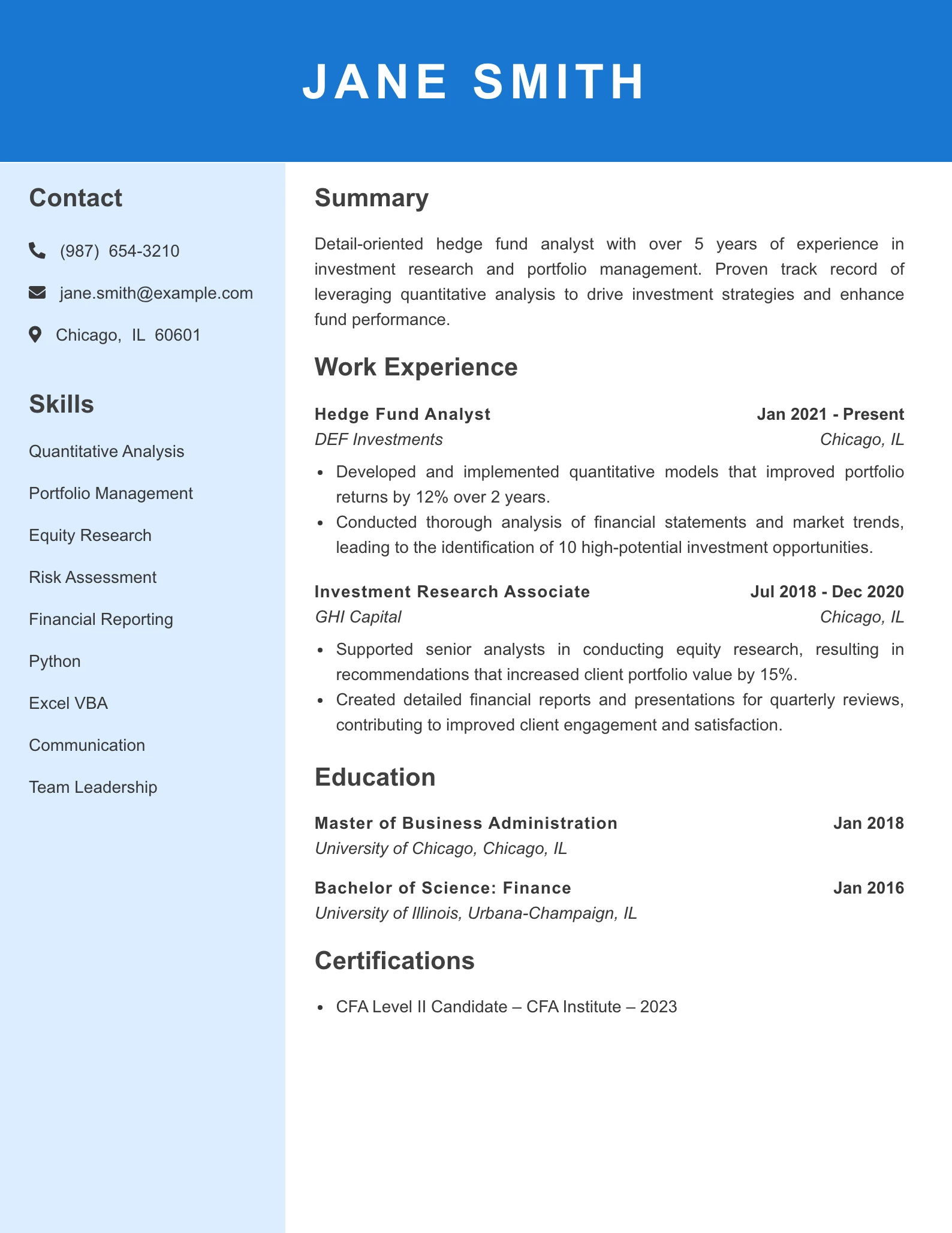

Mid Level Hedge Fund Analyst Resume Example

Why This Resume Works

- The summary is clear and concise, effectively showcasing Jane’s relevant experience and focus on investment research and portfolio management, aligning with the expectations for a mid-level finance role.

- The skills section highlights a blend of technical and soft skills, emphasizing proficiency in quantitative analysis and financial tools, which are critical for a hedge fund analyst position.

- The work history includes quantifiable achievements, such as a 12% portfolio return improvement and a 15% increase in client portfolio value, demonstrating a strong impact on organizational performance.

- The progression from Investment Research Associate to Hedge Fund Analyst indicates a clear career advancement, suggesting that Jane is well-suited for mid-level positions within the finance sector.

- The tone of the resume is professional and focused, maintaining a balance between technical jargon and accessibility, which is important for both technical and non-technical stakeholders in finance.

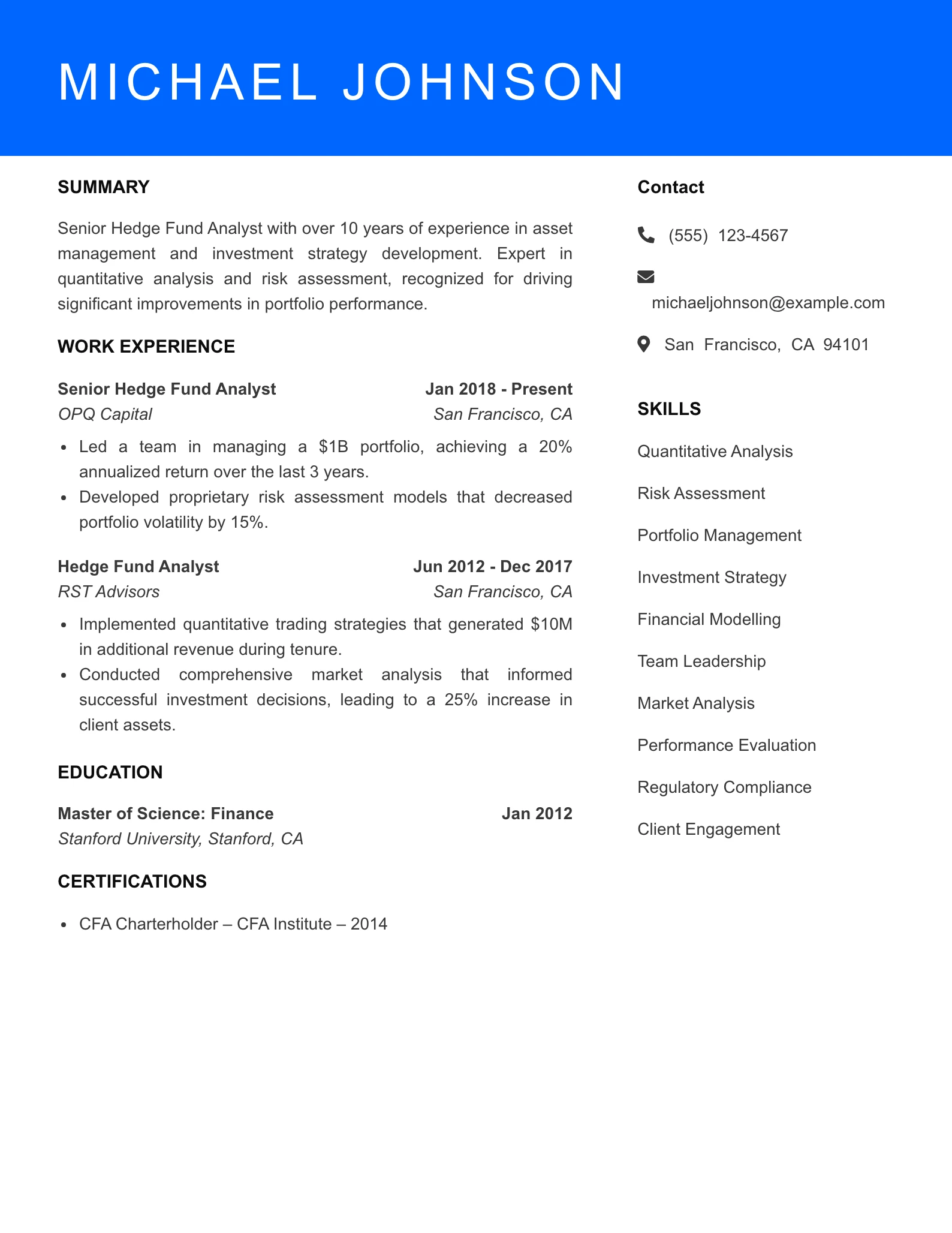

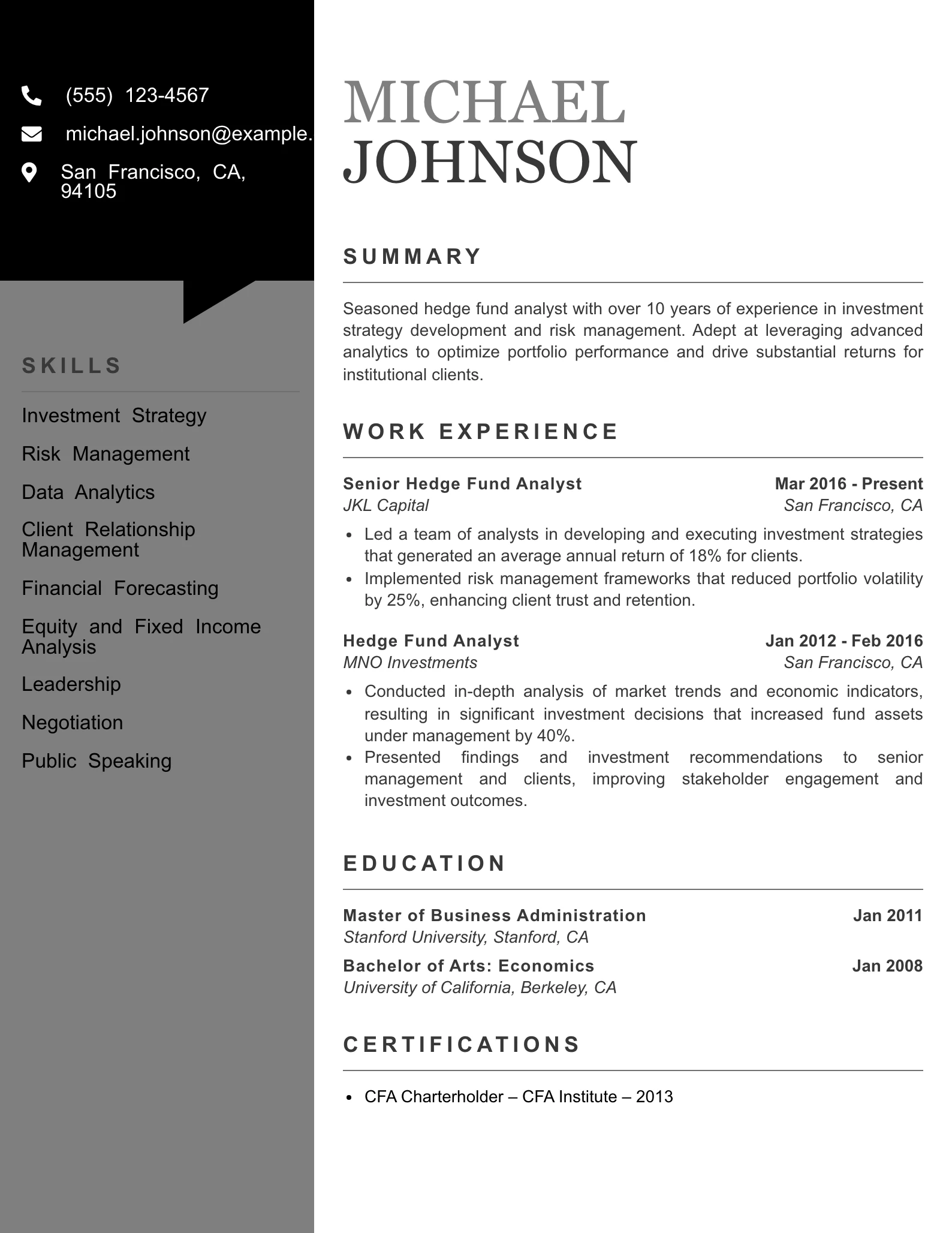

Senior Level Hedge Fund Analyst Resume Example

Why This Resume Works

- The summary clearly articulates Michael’s extensive experience and specific expertise in investment strategy and risk management, immediately positioning him as a seasoned professional in the finance sector.

- The skills section highlights relevant competencies that align well with the marketing manager role, showcasing a balance of analytical abilities and interpersonal skills necessary for client engagement and strategy execution.

- The work history demonstrates impactful results, such as generating an average annual return of 18% and increasing fund assets under management by 40%, illustrating Michael’s ability to drive significant financial success for his clients.

- The resume reflects a senior-level job fit, with responsibilities and achievements that indicate a high level of expertise and leadership within the hedge fund industry.

- The clarity and professional tone of the resume enhance its effectiveness, making it easy for hiring managers to quickly assess Michael’s qualifications and suitability for advanced roles in finance.

How to Craft a Strong Hedge Fund Analyst Resume

Creating a compelling resume is essential for any Hedge Fund Analyst seeking to stand out in a competitive job market. Hiring managers in this field typically look for candidates with strong analytical skills, financial acumen, and the ability to communicate complex ideas clearly. This guide will help you showcase your strengths effectively, ensuring that your resume captures the attention of potential employers.

Summary Statement

A strong summary statement is vital for setting the tone of your resume. It serves as your personal introduction, providing hiring managers with a quick snapshot of your professional identity and what you bring to the table.

In your summary, include key details such as your experience level, specialization within the hedge fund industry, relevant soft skills, and any pertinent certifications. The tone should be confident, tailored to the specific role, and focused on the results you can deliver.

Instead of providing examples directly here, please see the styled block below:

Detail-oriented finance graduate with a strong foundation in investment strategies and market analysis, seeking to leverage analytical skills in a challenging Hedge Fund Analyst role.

Mid-Level:

Results-driven Hedge Fund Analyst with over 4 years of experience in portfolio management and quantitative analysis, known for delivering insights that drive investment decisions.

Skills & Qualifications

When applying for a Hedge Fund Analyst position, it’s crucial to highlight both core and soft skills that align with the role’s demands. Core skills might include financial modeling, data analysis, and portfolio management, while soft skills such as communication, problem-solving, and attention to detail are equally important.

To ensure you pull the right skills, carefully review job descriptions and identify keywords that align with your experience. This will help you draft a skills section that not only resonates with hiring managers but also passes through Applicant Tracking Systems (ATS) effectively.

For sample skills, please see the skill highlight section below:

- Financial modeling

- Data analysis

- Portfolio management

- Risk assessment

- Quantitative research

- Communication skills

- Problem-solving

- Attention to detail

Top ATS Keywords for Hedge Fund Analyst

Work History

Your work history should focus on relevant experiences that showcase your analytical abilities and contributions to previous employers. Highlight metrics, leadership roles, and any specialized procedures you managed, depending on your experience level.

Formatting your work history in reverse chronological order is advisable, as it allows hiring managers to see your most recent and relevant experience first. Use quantified bullet points to illustrate your impact effectively.

For visual examples of work history, please refer to the styled block below:

Intern, XYZ Hedge Fund, New York, NY, June 2023 – Aug 2023

– Assisted in conducting market research and analyzing financial data for investment opportunities.

– Supported senior analysts in preparing reports on potential asset acquisitions.

Mid-Level:

Hedge Fund Analyst, ABC Investments, New York, NY, Jan 2020 – Present

– Managed a diverse portfolio of assets, achieving a 15% annual return on investments.

– Developed quantitative models to assess risk and inform trading strategies.

Education

A strong educational background is common among Hedge Fund Analysts, often including degrees in finance, economics, or a related field. When listing your education, ensure that you format your degrees and certifications clearly and consistently.

Typically, you will want to include the degree, the institution’s name, location, and graduation year. This gives hiring managers a straightforward view of your academic qualifications.

For a structured education template and example, please see the following:

Degree, School Name, City, State, Graduation Year

Example:

BBA in Finance, University of Chicago, Chicago, IL, 2019

Additional Sections

Consider adding optional sections to your resume that can further enhance your candidacy. Certifications, language proficiencies, and professional awards can all set you apart from other candidates.

For example, in the realm of hedge funds, certifications such as the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) can demonstrate your commitment to the field and enhance your credibility.

For specific certification formats, please see the block below:

- CFA Level I – CFA Institute – 2022

- FRM Certification – GARP – 2021

Do’s and Don’ts

To round out your resume, here are some practical tips for crafting an effective Hedge Fund Analyst resume:

Do: – Tailor your resume for ATS by using industry-specific terminology. – Showcase your impact by quantifying your achievements. – Use industry terms to demonstrate your knowledge and expertise.

Don’t: – Rely on generic statements that don’t illustrate your unique contributions. – Ignore the importance of soft skills; they’re crucial in this collaborative environment. – Overuse buzzwords without backing them up with clear examples.

For those looking for quality formats, consider exploring various resume templates free that can help you get started on a professional-looking document.

If you want to create a standout resume using cloud-based tools, check out the Google docs resume template that simplifies the process.

Additionally, if you’re seeking specific examples to guide your writing, the forensic accounting resume sample can provide insight into structuring your experiences effectively.

For those in related finance roles, a budget coordinator resume sample may also offer inspiration and structure to enhance your application.

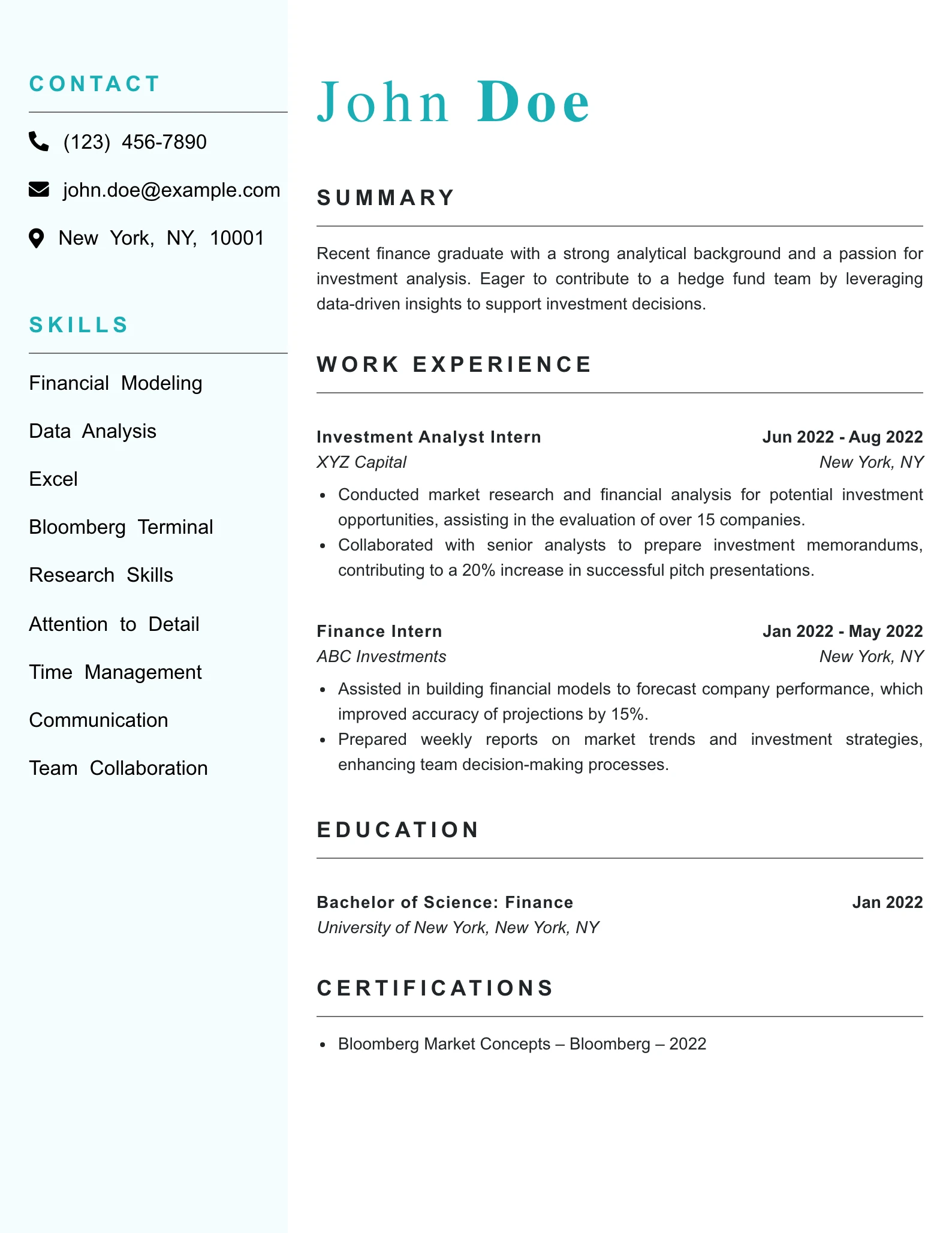

Text Resume Samples

John Doe

Level: Entry-Level

Location: New York, NY 10001

Phone: (123) 456-7890

Email: john.doe@example.com

Professional Summary

Recent finance graduate with a strong analytical background and a passion for investment analysis. Eager to contribute to a hedge fund team by leveraging data-driven insights to support investment decisions.

Skills

- Financial Modeling

- Data Analysis

- Excel

- Bloomberg Terminal

- Research Skills

- Attention to Detail

- Time Management

- Communication

- Team Collaboration

Education

Bachelor of Science in Finance, University of New York, New York, NY, 2022

Work Experience

Investment Analyst Intern – XYZ Capital

New York, NY | Jun 2022 – Aug 2022

- Conducted market research and financial analysis for potential investment opportunities, assisting in the evaluation of over 15 companies.

- Collaborated with senior analysts to prepare investment memorandums, contributing to a 20% increase in successful pitch presentations.

Finance Intern – ABC Investments

New York, NY | Jan 2022 – May 2022

- Assisted in building financial models to forecast company performance, which improved accuracy of projections by 15%.

- Prepared weekly reports on market trends and investment strategies, enhancing team decision-making processes.

References

Provided upon request

Certifications

- Bloomberg Market Concepts – Bloomberg – 2022