Looking to enhance your job prospects with an appealing resume? Our selection of free resume templates for investment analysts, including modern and ATS-friendly options, ensures you stand out. Download free resume templates and elevate your application with ease.

Why Use Our Templates

- ATS-friendly designs that improve your chances of getting through automated screenings.

- Editable Word resume templates that allow you to personalize your information effortlessly.

- Modern resume templates that feature clean layouts, making your skills shine.

- Free resume templates available for various experience levels, ensuring tailored options for everyone.

How to Choose Your Level

Choosing the right resume template depends on your experience:

- Entry-Level: Use this template if you are new to the field or have limited experience.

- Mid-Career: Ideal for professionals with several years of experience looking to advance.

- Senior: Choose this template if you hold a senior position or have extensive experience in investment analysis.

Entry-Level Investment Analyst Resume Templates

- (123) 456-7890

- john.doe@example.com

- New York, NY 10001

- Financial Analysis

- Data Analysis

- Excel

- Financial Modeling

- Research Skills

- Communication

- Team Collaboration

- Attention to Detail

- Problem Solving

- Time Management

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Provided upon request

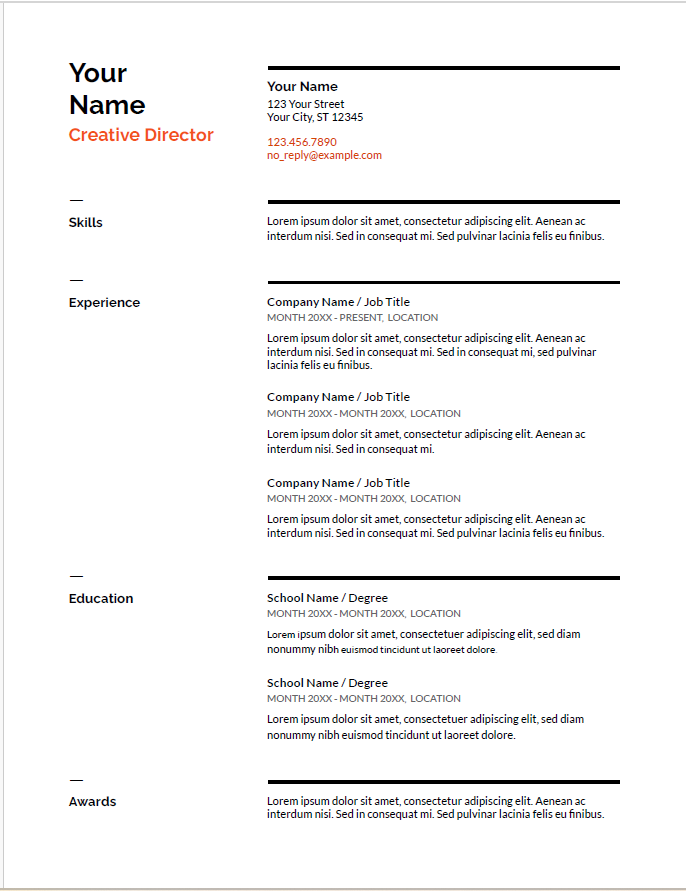

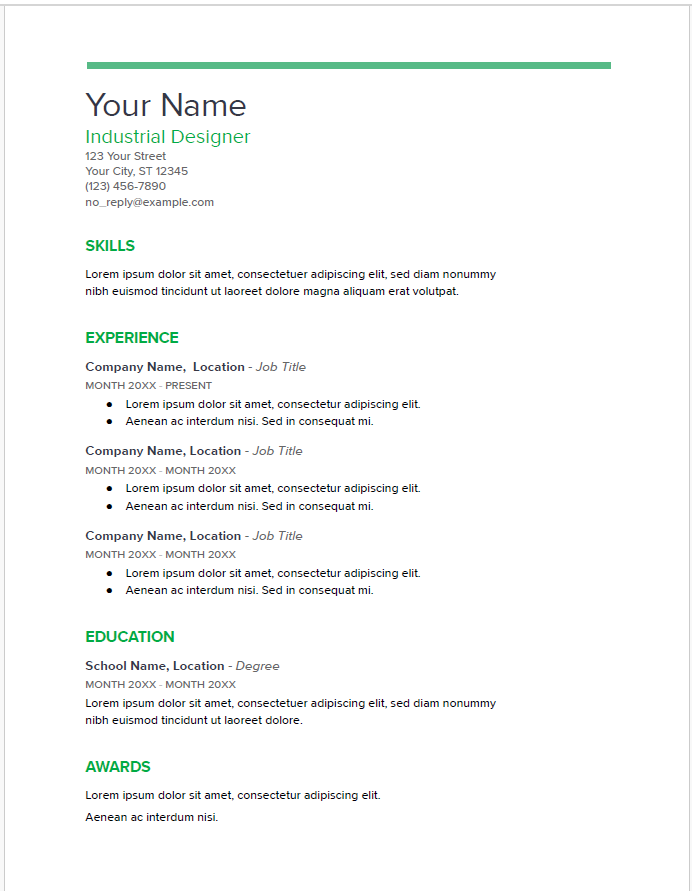

Steel Blue ModernProfessionalTwo-Column

A clean and modern two-column resume template featuring a deep steel blue header with white text for the candidate’s name. The left sidebar contains contact details and skills on a light grey background, while the main content area showcases summary, work experience, and education with clear section headings and ample white space.

Why This Template

Steel Blue provides a professional and organized layout that balances visual appeal with readability. The strong header draws immediate attention to your name, while the sidebar enables quick scanning of contact and skills. Its clear hierarchy guides recruiters smoothly through your career highlights.

Key Features

- Bold steel blue header for name visibility

- Two-column layout for organized content

- Sidebar for quick access to contact and skills

- Clear section headings for easy navigation

- Generous white space for readability

- ATS friendly format

- Editable in Microsoft Word and exportable to DOCX, PDF, TXT

- (123) 456-7890

- john.doe@example.com

- New York, NY 10001

- Financial Analysis

- Data Analysis

- Excel

- Financial Modeling

- Research Skills

- Communication

- Team Collaboration

- Attention to Detail

- Problem Solving

- Time Management

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Provided upon request

- (123) 456-7890

- john.doe@example.com

- New York, NY, 10001

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Financial Analysis

- Excel

- Research Skills

- Team Collaboration

- Problem Solving

- Data Analysis

- Financial Modeling

- Communication

- Attention to Detail

- Time Management

- Provided upon request

- (123) 456-7890

- New York, NY, 10001

- john.doe@example.com

- Financial Analysis

- Excel

- Research Skills

- Team Collaboration

- Problem Solving

- Data Analysis

- Financial Modeling

- Communication

- Attention to Detail

- Time Management

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Provided upon request

- (123) 456-7890

- john.doe@example.com

- New York, NY, 10001

- Financial Analysis

- Data Analysis

- Excel

- Financial Modeling

- Research Skills

- Communication

- Team Collaboration

- Attention to Detail

- Problem Solving

- Time Management

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Provided upon request

- (123) 456-7890

- john.doe@example.com

- New York, NY, 10001

- Financial Analysis

- Data Analysis

- Excel

- Financial Modeling

- Research Skills

- Communication

- Team Collaboration

- Attention to Detail

- Problem Solving

- Time Management

- Assisted in the analysis of investment portfolios, leading to a 10% increase in returns for client accounts.

- Conducted market research and presented findings to senior analysts, improving investment strategies.

- Supported the finance team in preparing monthly financial reports, increasing efficiency by 15%.

- Managed data entry and financial documentation, ensuring accuracy and compliance with company policies.

- Provided upon request

Mid-Career Investment Analyst Resume Templates

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

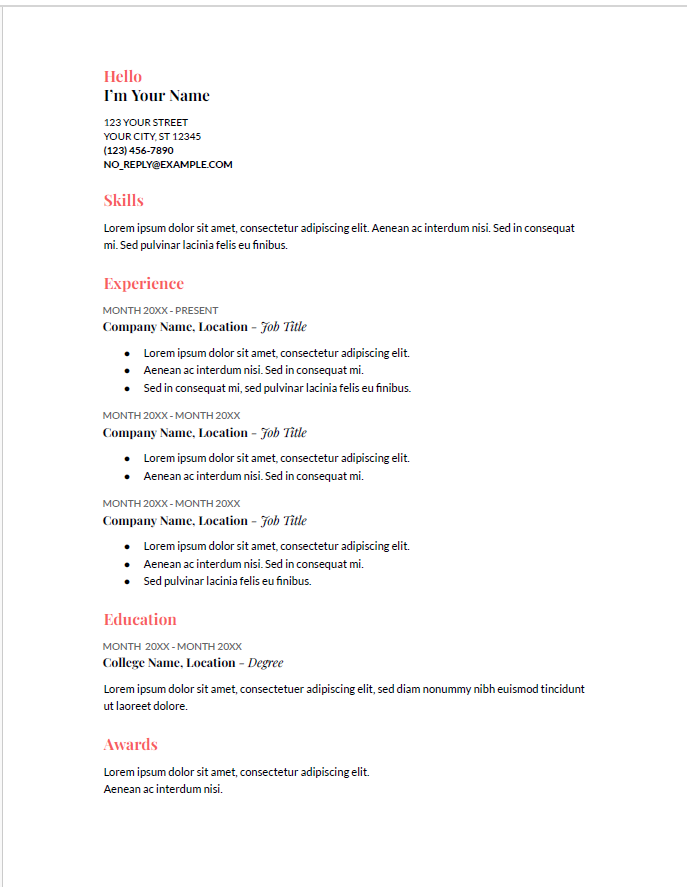

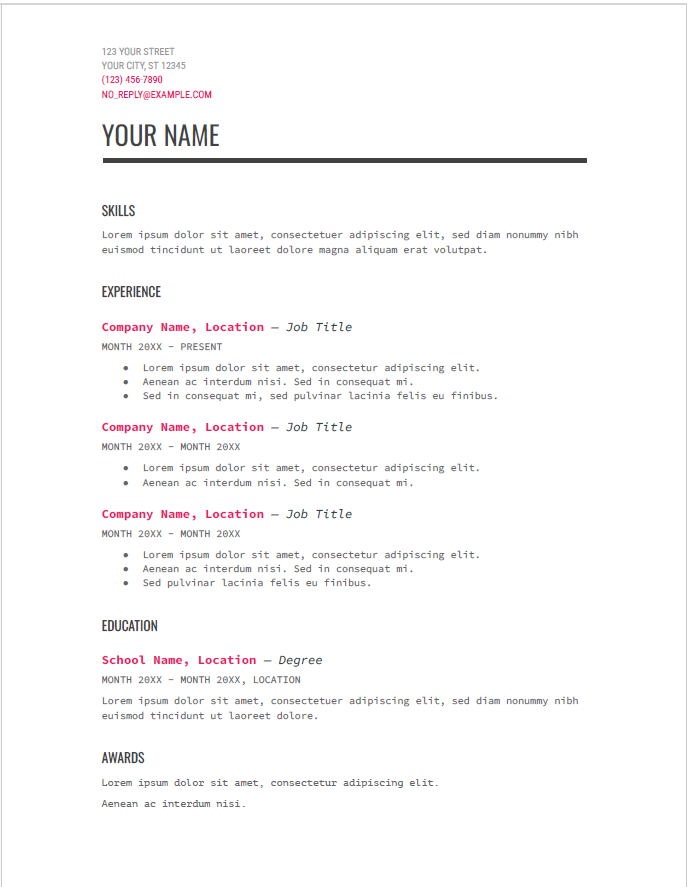

Slate Vertical ProfessionalTwo-ColumnClean

A professional two-column resume template featuring a clean vertical sidebar on the left with skills clearly listed, and a spacious right main section for summary, work experience, and education. The candidate’s name is prominently displayed in a light gray header spanning the top, with contact details arranged neatly alongside icons in the sidebar for easy scanning.

Why This Template

Slate Vertical provides a balanced, easy-to-navigate layout that highlights your skills and experience effectively. The sidebar’s vertical alignment of key skills and contact info lets recruiters quickly assess your qualifications, while the main content area offers plenty of room for detailed work history and education.

Key Features

- Vertical sidebar for skills and contact information

- Light gray header with bold candidate name

- Clear section headers and bullet points in main content

- Use of icons for contact details for visual clarity

- Well-organized content for easy recruiter scanning

- Suitable for administrative, clerical, and office roles

- Fully editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

- (987) 654-3210

- jane.smith@example.com

- Chicago, IL, 60601

- Portfolio Management

- Risk Assessment

- Quantitative Analysis

- Excel Modeling

- Market Research

- Financial Reporting

- Client Relationship Management

- Strategic Planning

- Team Leadership

- Communication Skills

- Developed and managed investment strategies that achieved an average annual return of 12% across multiple portfolios.

- Collaborated with the research team to analyze market trends, resulting in a 20% increase in client acquisitions.

- Performed detailed financial modeling and valuation analysis for potential investments, improving accuracy by 30%.

- Presented investment recommendations to senior management, leading to successful funding of 5 key projects.

- Chartered Financial Analyst (CFA) Level II – CFA Institute – 2021

Senior Investment Analyst Resume Templates

- Investment Strategy

- Financial Modeling

- Client Engagement

- Market Analysis

- Regulatory Compliance

- Portfolio Optimization

- Risk Management

- Leadership

- Performance Measurement

- Analytical Thinking

- Led the development of innovative investment strategies that resulted in a 25% increase in AUM over three years.

- Mentored junior analysts, fostering a culture of continuous improvement and professional development.

- Managed a diverse portfolio valued at over $500 million, achieving a consistent annual return of 15%.

- Conducted comprehensive risk assessments and implemented hedging strategies that reduced volatility by 40%.

- Analyzed financial data and market trends to support investment decisions, contributing to a 10% portfolio growth.

- Collaborated with cross-functional teams to enhance investment product offerings and client satisfaction.

- Chartered Financial Analyst (CFA) – CFA Institute – 2013

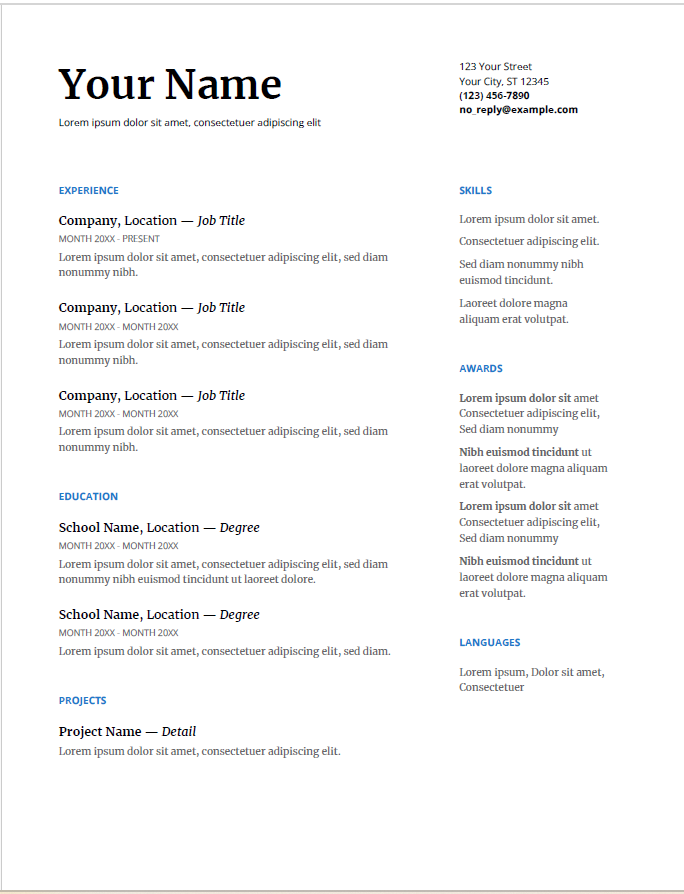

Golden Accent ElegantProfessionalSingle-Column

An elegant and professional single-column resume template featuring a clean white background with gold accent highlights for section headers and the candidate’s last name. The layout emphasizes clarity and structure with well-defined sections for summary, professional skills, work experience, and education. This template balances sophistication with readability.

Why This Template

Golden Accent offers a refined resume design that combines subtle luxury with professional simplicity. The gold highlights create visual interest without overwhelming content, while the clean layout ensures recruiters can easily navigate your qualifications. Ideal for professionals aiming to convey both competence and style.

Key Features

- Single-column layout for focused and linear reading

- Gold accent color highlights candidate’s last name and section headers

- Clear typography and spacing for enhanced readability

- Well-organized sections with bullet points for skills and experience

- Professional and sophisticated aesthetic

- Suitable for business, administrative, and corporate roles

- Editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility in mind

- Investment Strategy

- Financial Modeling

- Client Engagement

- Market Analysis

- Regulatory Compliance

- Portfolio Optimization

- Risk Management

- Leadership

- Performance Measurement

- Analytical Thinking

- Led the development of innovative investment strategies that resulted in a 25% increase in AUM over three years.

- Mentored junior analysts, fostering a culture of continuous improvement and professional development.

- Managed a diverse portfolio valued at over $500 million, achieving a consistent annual return of 15%.

- Conducted comprehensive risk assessments and implemented hedging strategies that reduced volatility by 40%.

- Analyzed financial data and market trends to support investment decisions, contributing to a 10% portfolio growth.

- Collaborated with cross-functional teams to enhance investment product offerings and client satisfaction.

- Chartered Financial Analyst (CFA) – CFA Institute – 2013

- (456) 789-0123

- San Francisco, CA, 94102

- michael.johnson@example.com

- Investment Strategy

- Financial Modeling

- Client Engagement

- Market Analysis

- Regulatory Compliance

- Portfolio Optimization

- Risk Management

- Leadership

- Performance Measurement

- Analytical Thinking

- Led the development of innovative investment strategies that resulted in a 25% increase in AUM over three years.

- Mentored junior analysts, fostering a culture of continuous improvement and professional development.

- Managed a diverse portfolio valued at over $500 million, achieving a consistent annual return of 15%.

- Conducted comprehensive risk assessments and implemented hedging strategies that reduced volatility by 40%.

- Analyzed financial data and market trends to support investment decisions, contributing to a 10% portfolio growth.

- Collaborated with cross-functional teams to enhance investment product offerings and client satisfaction.

- Chartered Financial Analyst (CFA) – CFA Institute – 2013

- (456) 789-0123

- michael.johnson@example.com

- San Francisco, CA, 94102

- Investment Strategy

- Portfolio Optimization

- Financial Modeling

- Risk Management

- Client Engagement

- Leadership

- Market Analysis

- Performance Measurement

- Regulatory Compliance

- Analytical Thinking

- Led the development of innovative investment strategies that resulted in a 25% increase in AUM over three years.

- Mentored junior analysts, fostering a culture of continuous improvement and professional development.

- Managed a diverse portfolio valued at over $500 million, achieving a consistent annual return of 15%.

- Conducted comprehensive risk assessments and implemented hedging strategies that reduced volatility by 40%.

- Analyzed financial data and market trends to support investment decisions, contributing to a 10% portfolio growth.

- Collaborated with cross-functional teams to enhance investment product offerings and client satisfaction.

- Chartered Financial Analyst (CFA) – CFA Institute – 2013

- (456) 789-0123

- San Francisco, CA, 94102

- michael.johnson@example.com

- Investment Strategy

- Financial Modeling

- Client Engagement

- Market Analysis

- Regulatory Compliance

- Portfolio Optimization

- Risk Management

- Leadership

- Performance Measurement

- Analytical Thinking

- Led the development of innovative investment strategies that resulted in a 25% increase in AUM over three years.

- Mentored junior analysts, fostering a culture of continuous improvement and professional development.

- Managed a diverse portfolio valued at over $500 million, achieving a consistent annual return of 15%.

- Conducted comprehensive risk assessments and implemented hedging strategies that reduced volatility by 40%.

- Analyzed financial data and market trends to support investment decisions, contributing to a 10% portfolio growth.

- Collaborated with cross-functional teams to enhance investment product offerings and client satisfaction.

- Chartered Financial Analyst (CFA) – CFA Institute – 2013

Editable Word & PDF Templates

Our editable Word resume templates allow you to customize your resume easily. Simply download the file, open it in Microsoft Word, and modify the text to reflect your skills and experiences. Check out our resume templates in Word for great options.

Editable Google Docs Templates

For those who prefer using Google Docs, we provide a variety of Google Docs resume templates that cater to your needs.

Tips & FAQs

Design & ATS Tips

- Keep your formatting simple to ensure compatibility with ATS.

- Use standard fonts like Arial or Times New Roman for readability.

- Incorporate relevant keywords from the job description to enhance visibility.

FAQs

Are all templates available for free?

While many of our templates are free, some premium options are available for purchase.

Can I customize the templates?

Yes, our Word and Google Docs templates are fully editable, allowing you to personalize them.

Do you offer templates for other professions?

Yes, we offer a wide range of resume templates for various professions beyond investment analysis. Visit our tax preparer resume templates for specific needs.

Ready to Create Your Resume?

Start building a professional resume tailored to your career goals. Click below to access our resume builder.

Build Your ResumeExplore more resume templates here.