Enhance your job application with our selection of free resume templates word tailored for loan officers. Our modern resume templates are ATS friendly, ensuring your application gets noticed. Download editable Word resume templates and take the first step towards your dream job.

Why Use Our Templates

- Attract employers with professionally designed, modern resume templates.

- Save time with editable Word resume templates that are easy to customize.

- Ensure compatibility with ATS to improve your chances of landing an interview.

- Access a variety of styles and formats to suit any career stage.

How to Choose Your Level

Select the appropriate resume template based on your experience level:

- Entry-Level: For recent graduates or those with less than two years of experience, focus on skills and education.

- Mid-Career: Ideal for professionals with 3-7 years of experience who have developed a solid track record and skills.

- Senior: Designed for those with 8+ years of experience, emphasizing leadership, achievements, and industry expertise.

Entry-Level Loan Officer Resume Templates

- (123) 456-7890

- john.smith@example.com

- Springfield, IL 62701

- Customer Service

- Loan Processing

- Financial Analysis

- Communication

- Attention to Detail

- Microsoft Excel

- Time Management

- Problem Solving

- Sales Techniques

- Team Collaboration

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

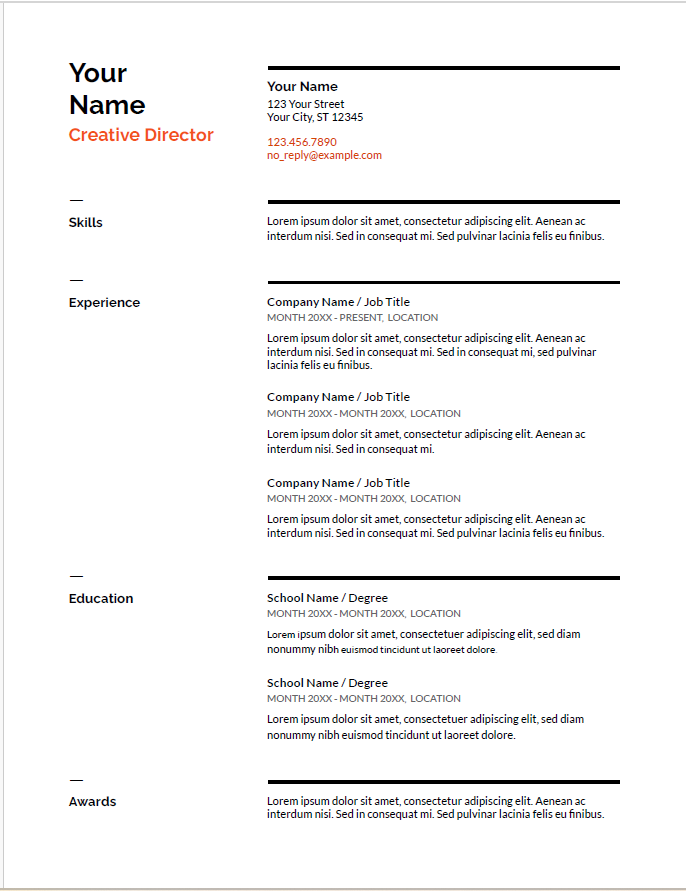

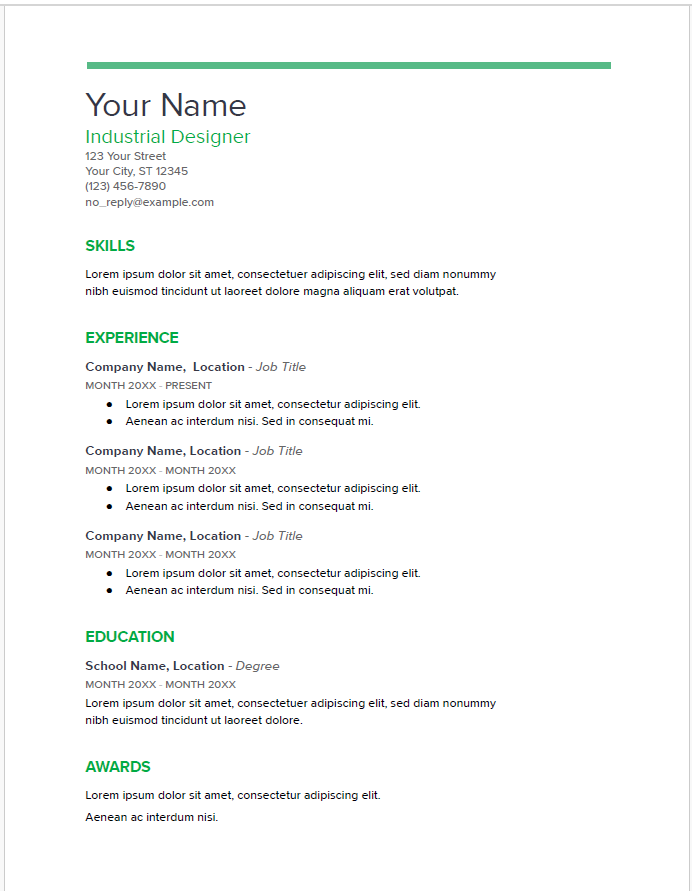

Steel Blue ModernProfessionalTwo-Column

A clean and modern two-column resume template featuring a deep steel blue header with white text for the candidate’s name. The left sidebar contains contact details and skills on a light grey background, while the main content area showcases summary, work experience, and education with clear section headings and ample white space.

Why This Template

Steel Blue provides a professional and organized layout that balances visual appeal with readability. The strong header draws immediate attention to your name, while the sidebar enables quick scanning of contact and skills. Its clear hierarchy guides recruiters smoothly through your career highlights.

Key Features

- Bold steel blue header for name visibility

- Two-column layout for organized content

- Sidebar for quick access to contact and skills

- Clear section headings for easy navigation

- Generous white space for readability

- ATS friendly format

- Editable in Microsoft Word and exportable to DOCX, PDF, TXT

- (123) 456-7890

- john.smith@example.com

- Springfield, IL 62701

- Customer Service

- Loan Processing

- Financial Analysis

- Communication

- Attention to Detail

- Microsoft Excel

- Time Management

- Problem Solving

- Sales Techniques

- Team Collaboration

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

- (123) 456-7890

- john.smith@example.com

- Springfield, IL, 62701

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

- Customer Service

- Financial Analysis

- Attention to Detail

- Time Management

- Sales Techniques

- Loan Processing

- Communication

- Microsoft Excel

- Problem Solving

- Team Collaboration

- (123) 456-7890

- Springfield, IL, 62701

- john.smith@example.com

- Customer Service

- Financial Analysis

- Attention to Detail

- Time Management

- Sales Techniques

- Loan Processing

- Communication

- Microsoft Excel

- Problem Solving

- Team Collaboration

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

- (123) 456-7890

- john.smith@example.com

- Springfield, IL, 62701

- Customer Service

- Loan Processing

- Financial Analysis

- Communication

- Attention to Detail

- Microsoft Excel

- Time Management

- Problem Solving

- Sales Techniques

- Team Collaboration

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

- (123) 456-7890

- john.smith@example.com

- Springfield, IL, 62701

- Customer Service

- Loan Processing

- Financial Analysis

- Communication

- Attention to Detail

- Microsoft Excel

- Time Management

- Problem Solving

- Sales Techniques

- Team Collaboration

- Assisted in processing loan applications, ensuring compliance with all regulatory requirements.

- Collaborated with senior loan officers to prepare financial documentation for clients.

- Provided exceptional service to clients, resolving inquiries related to loan products and services.

- Educated customers on loan terms and conditions, contributing to a 20% increase in customer satisfaction scores.

Mid-Career Loan Officer Resume Templates

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL, 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

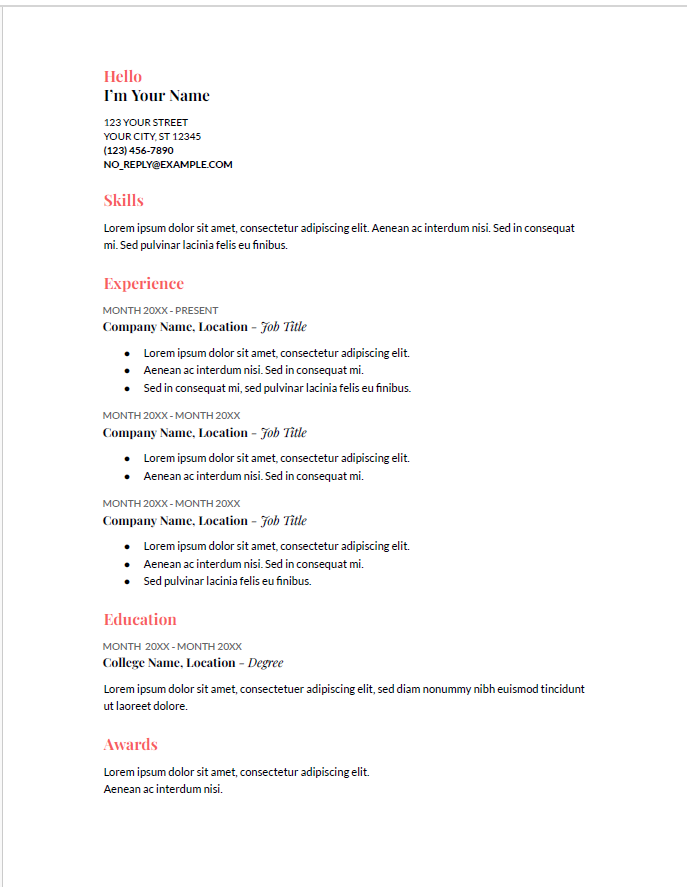

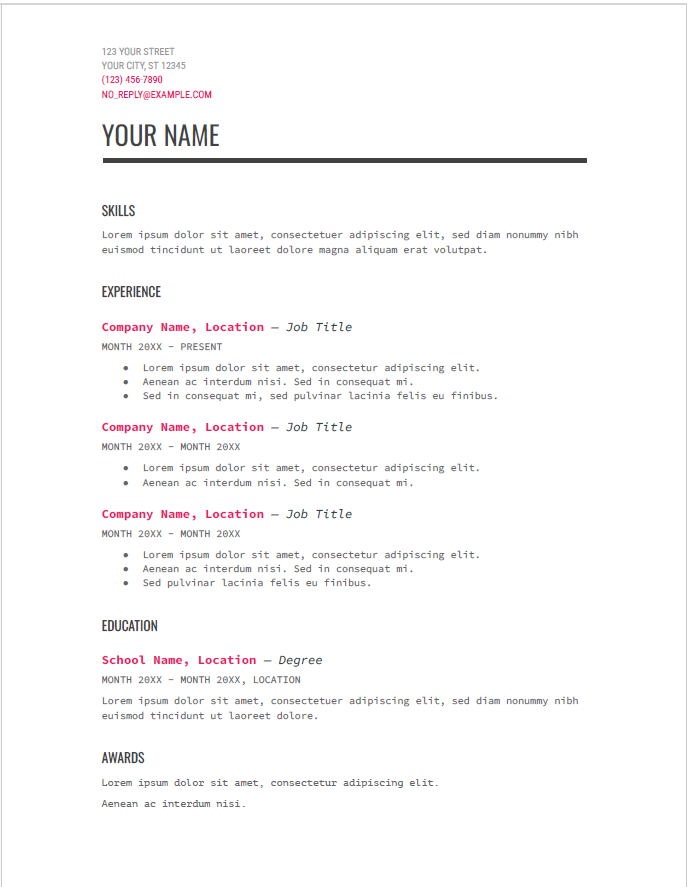

Slate Vertical ProfessionalTwo-ColumnClean

A professional two-column resume template featuring a clean vertical sidebar on the left with skills clearly listed, and a spacious right main section for summary, work experience, and education. The candidate’s name is prominently displayed in a light gray header spanning the top, with contact details arranged neatly alongside icons in the sidebar for easy scanning.

Why This Template

Slate Vertical provides a balanced, easy-to-navigate layout that highlights your skills and experience effectively. The sidebar’s vertical alignment of key skills and contact info lets recruiters quickly assess your qualifications, while the main content area offers plenty of room for detailed work history and education.

Key Features

- Vertical sidebar for skills and contact information

- Light gray header with bold candidate name

- Clear section headers and bullet points in main content

- Use of icons for contact details for visual clarity

- Well-organized content for easy recruiter scanning

- Suitable for administrative, clerical, and office roles

- Fully editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL, 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL, 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

- (234) 567-8901

- emily.johnson@example.com

- Chicago, IL, 60601

- Loan Origination

- Risk Assessment

- Credit Analysis

- Financial Reporting

- Regulatory Compliance

- Negotiation

- Sales Strategies

- Relationship Management

- Market Research

- Problem Resolution

- Successfully processed and closed over 150 loans annually, achieving a 30% increase in loan volume.

- Developed strong relationships with real estate agents and financial advisors, generating leads and referrals.

- Supported senior officers in loan processing and customer follow-up, contributing to a 25% reduction in processing time.

- Conducted thorough credit evaluations, resulting in a 90% approval rate for qualified applicants.

- NMLS License – National Mortgage Licensing System – 2018

Senior Loan Officer Resume Templates

- Strategic Planning

- Complex Loan Structuring

- Client Relationship Management

- Sales Leadership

- Training & Development

- Team Leadership

- Regulatory Compliance

- Market Analysis

- Financial Forecasting

- Performance Improvement

- Led a team of 5 loan officers, driving a 40% increase in overall loan production through effective training and mentoring.

- Implemented new sales strategies that resulted in a record-breaking $25 million in loan origination within the first year.

- Managed a diverse portfolio of clients, consistently exceeding annual sales goals by an average of 35%.

- Developed strategic partnerships with local businesses to expand the client base and enhance service offerings.

- Certified Mortgage Consultant (CMC) – Mortgage Bankers Association – 2015

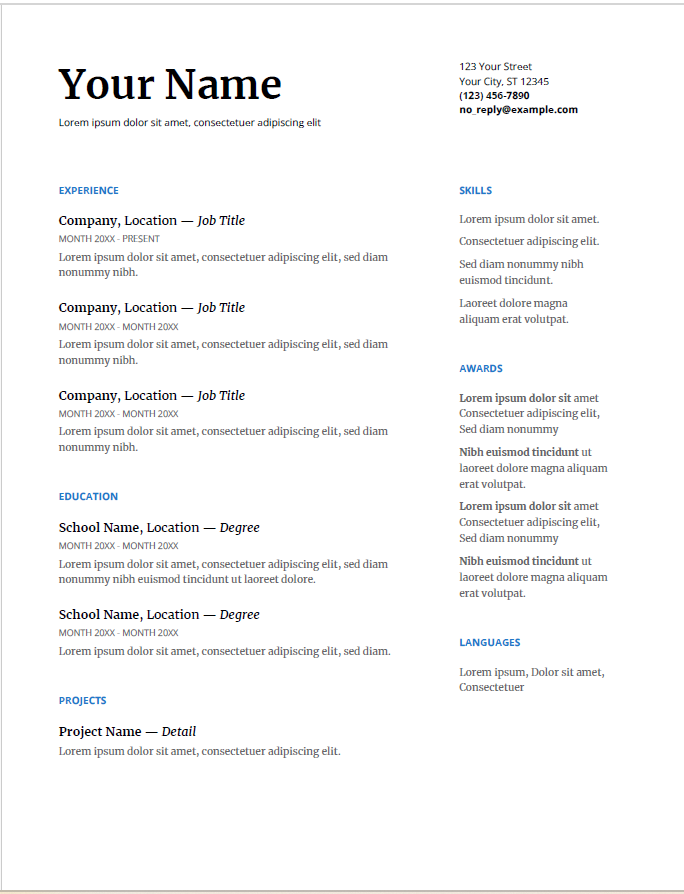

Golden Accent ElegantProfessionalSingle-Column

An elegant and professional single-column resume template featuring a clean white background with gold accent highlights for section headers and the candidate’s last name. The layout emphasizes clarity and structure with well-defined sections for summary, professional skills, work experience, and education. This template balances sophistication with readability.

Why This Template

Golden Accent offers a refined resume design that combines subtle luxury with professional simplicity. The gold highlights create visual interest without overwhelming content, while the clean layout ensures recruiters can easily navigate your qualifications. Ideal for professionals aiming to convey both competence and style.

Key Features

- Single-column layout for focused and linear reading

- Gold accent color highlights candidate’s last name and section headers

- Clear typography and spacing for enhanced readability

- Well-organized sections with bullet points for skills and experience

- Professional and sophisticated aesthetic

- Suitable for business, administrative, and corporate roles

- Editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility in mind

- Strategic Planning

- Complex Loan Structuring

- Client Relationship Management

- Sales Leadership

- Training & Development

- Team Leadership

- Regulatory Compliance

- Market Analysis

- Financial Forecasting

- Performance Improvement

- Led a team of 5 loan officers, driving a 40% increase in overall loan production through effective training and mentoring.

- Implemented new sales strategies that resulted in a record-breaking $25 million in loan origination within the first year.

- Managed a diverse portfolio of clients, consistently exceeding annual sales goals by an average of 35%.

- Developed strategic partnerships with local businesses to expand the client base and enhance service offerings.

- Certified Mortgage Consultant (CMC) – Mortgage Bankers Association – 2015

- (345) 678-9012

- Los Angeles, CA, 90001

- michael.brown@example.com

- Strategic Planning

- Complex Loan Structuring

- Client Relationship Management

- Sales Leadership

- Training & Development

- Team Leadership

- Regulatory Compliance

- Market Analysis

- Financial Forecasting

- Performance Improvement

- Led a team of 5 loan officers, driving a 40% increase in overall loan production through effective training and mentoring.

- Implemented new sales strategies that resulted in a record-breaking $25 million in loan origination within the first year.

- Managed a diverse portfolio of clients, consistently exceeding annual sales goals by an average of 35%.

- Developed strategic partnerships with local businesses to expand the client base and enhance service offerings.

- Certified Mortgage Consultant (CMC) – Mortgage Bankers Association – 2015

- (345) 678-9012

- michael.brown@example.com

- Los Angeles, CA, 90001

- Strategic Planning

- Team Leadership

- Complex Loan Structuring

- Regulatory Compliance

- Client Relationship Management

- Market Analysis

- Sales Leadership

- Financial Forecasting

- Training & Development

- Performance Improvement

- Led a team of 5 loan officers, driving a 40% increase in overall loan production through effective training and mentoring.

- Implemented new sales strategies that resulted in a record-breaking $25 million in loan origination within the first year.

- Managed a diverse portfolio of clients, consistently exceeding annual sales goals by an average of 35%.

- Developed strategic partnerships with local businesses to expand the client base and enhance service offerings.

- Certified Mortgage Consultant (CMC) – Mortgage Bankers Association – 2015

- (345) 678-9012

- Los Angeles, CA, 90001

- michael.brown@example.com

- Strategic Planning

- Complex Loan Structuring

- Client Relationship Management

- Sales Leadership

- Training & Development

- Team Leadership

- Regulatory Compliance

- Market Analysis

- Financial Forecasting

- Performance Improvement

- Led a team of 5 loan officers, driving a 40% increase in overall loan production through effective training and mentoring.

- Implemented new sales strategies that resulted in a record-breaking $25 million in loan origination within the first year.

- Managed a diverse portfolio of clients, consistently exceeding annual sales goals by an average of 35%.

- Developed strategic partnerships with local businesses to expand the client base and enhance service offerings.

- Certified Mortgage Consultant (CMC) – Mortgage Bankers Association – 2015

Editable Word & PDF Templates

Customize your resume in Microsoft Word easily. Simply download the template, open it in Word, and edit the sections to reflect your unique qualifications and experience.

Editable Google Docs Templates

For those who prefer an online solution, our Google Docs resume templates allow for easy customization.

Tips & FAQs

Design and ATS Tips

- Use a clean, simple layout with clear headings to ensure ATS compatibility.

- Limit the use of graphics and images that may confuse ATS scanners.

- Incorporate relevant keywords from the job description to enhance your resume’s visibility.

FAQs

What is an ATS friendly resume?

An ATS friendly resume is designed to be easily read by Applicant Tracking Systems, which scan resumes for keywords and formats.

Can I edit the templates?

Yes, our templates are editable in Word and Google Docs, allowing you to customize them to fit your needs.

Are all templates free to download?

While some templates are free, others may require payment. Be sure to check the details before downloading.

Ready to Build Your Resume?

Get started now with our resume builder tool and create a standout application.

Build Your ResumeView more resume templates here.

If you are considering positions in finance, check out our accounts payable resume templates that are specifically tailored to help you shine in the finance sector.

For those aiming for roles in investment analysis, we also provide investment analyst resume templates to help you create a professional representation of your skills and experiences.