Unlock your potential with our free resume templates word designed specifically for insurance agents. Download editable Word resume templates that are modern and ATS friendly, ensuring you make a lasting impression.

Why Use Our Templates

- Access a variety of resume templates tailored for insurance agents.

- Download modern resume templates that are editable in Word, allowing for easy customizations.

- Our ATS friendly resume formats help your application get noticed.

- Quick and easy to use—perfect for all career stages.

How to Choose Your Level

When selecting a resume template, consider your career stage:

- Entry-Level: If you’re just starting in the insurance industry or have limited experience, choose entry-level templates that highlight your education and skills.

- Mid-Career: For those with a few years of experience, select mid-career templates that emphasize accomplishments and specialized skills.

- Senior: If you have extensive experience, opt for senior templates that showcase leadership, strategic achievements, and significant contributions to past employers.

Entry-Level Insurance Agent Resume Templates

- (123) 456-7890

- john.doe@example.com

- Anytown, CA 90210

- Customer Service

- Sales Techniques

- Communication

- Problem Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Basic Insurance Knowledge

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Insurance Agent License – State of CA – 2022

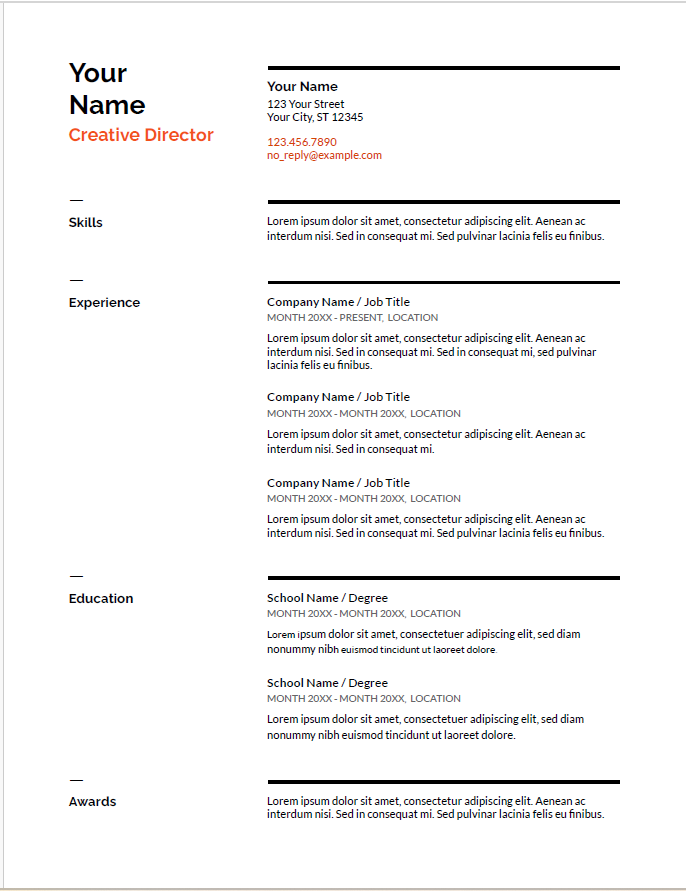

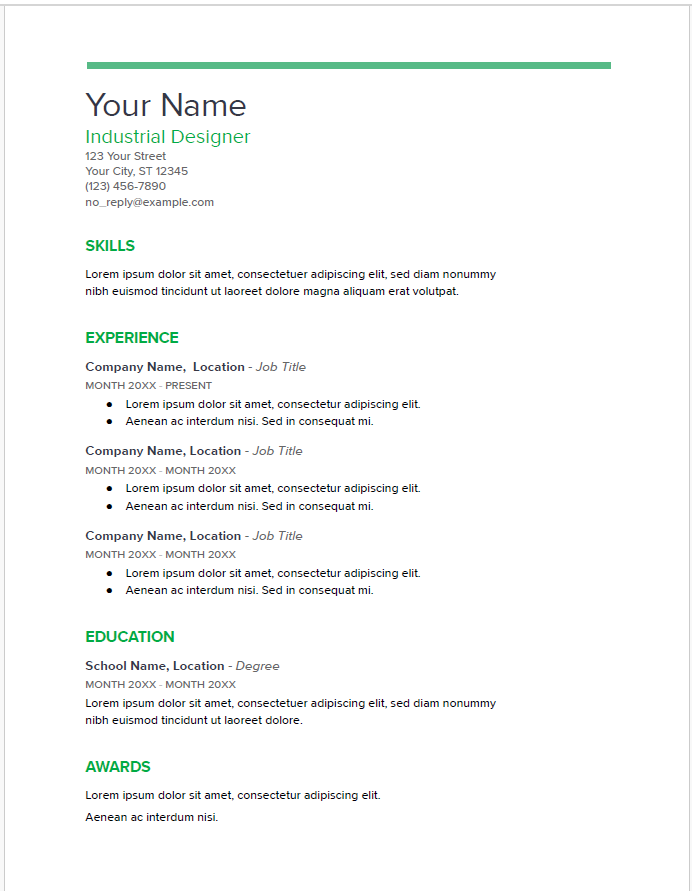

Steel Blue ModernProfessionalTwo-Column

A clean and modern two-column resume template featuring a deep steel blue header with white text for the candidate’s name. The left sidebar contains contact details and skills on a light grey background, while the main content area showcases summary, work experience, and education with clear section headings and ample white space.

Why This Template

Steel Blue provides a professional and organized layout that balances visual appeal with readability. The strong header draws immediate attention to your name, while the sidebar enables quick scanning of contact and skills. Its clear hierarchy guides recruiters smoothly through your career highlights.

Key Features

- Bold steel blue header for name visibility

- Two-column layout for organized content

- Sidebar for quick access to contact and skills

- Clear section headings for easy navigation

- Generous white space for readability

- ATS friendly format

- Editable in Microsoft Word and exportable to DOCX, PDF, TXT

- (123) 456-7890

- john.doe@example.com

- Anytown, CA 90210

- Customer Service

- Sales Techniques

- Communication

- Problem Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Basic Insurance Knowledge

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Insurance Agent License – State of CA – 2022

- (123) 456-7890

- john.doe@example.com

- Anytown, CA, 90210

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Customer Service

- Communication

- Attention to Detail

- Team Collaboration

- Sales Techniques

- Problem Solving

- Time Management

- Basic Insurance Knowledge

- Insurance Agent License – State of CA – 2022

- (123) 456-7890

- Anytown, CA, 90210

- john.doe@example.com

- Customer Service

- Communication

- Attention to Detail

- Team Collaboration

- Sales Techniques

- Problem Solving

- Time Management

- Basic Insurance Knowledge

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Insurance Agent License – State of CA – 2022

- (123) 456-7890

- john.doe@example.com

- Anytown, CA, 90210

- Customer Service

- Sales Techniques

- Communication

- Problem Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Basic Insurance Knowledge

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Insurance Agent License – State of CA – 2022

- (123) 456-7890

- john.doe@example.com

- Anytown, CA, 90210

- Customer Service

- Sales Techniques

- Communication

- Problem Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Basic Insurance Knowledge

- Assisted customers in selecting products, resulting in a 20% increase in sales during peak season.

- Resolved customer inquiries and complaints, improving customer satisfaction ratings by 15%.

- Supported agents in preparing insurance quotes and policy documents.

- Conducted market research to identify potential clients, contributing to a 10% increase in lead generation.

- Insurance Agent License – State of CA – 2022

Mid-Career Insurance Agent Resume Templates

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY, 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

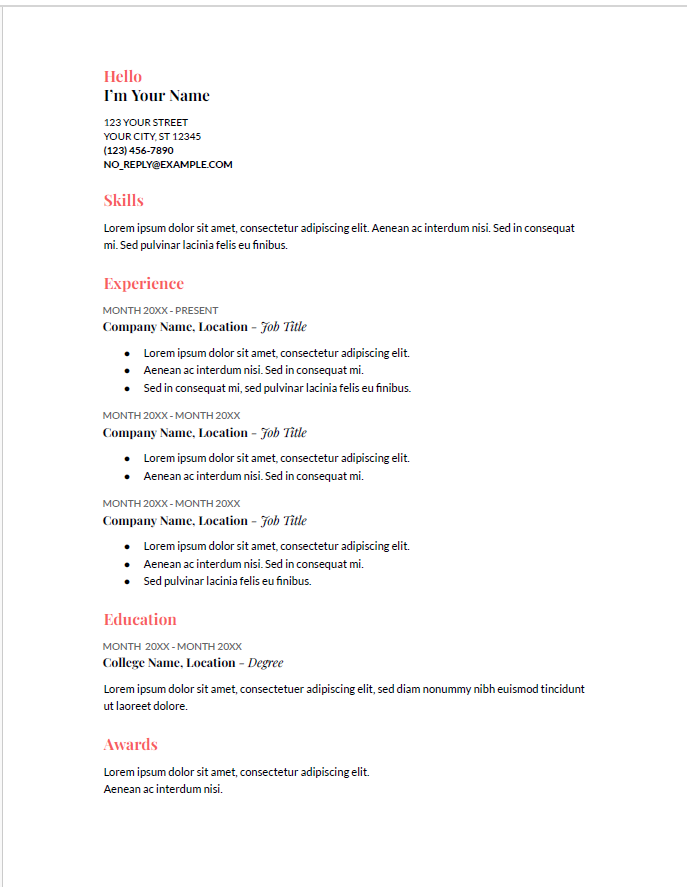

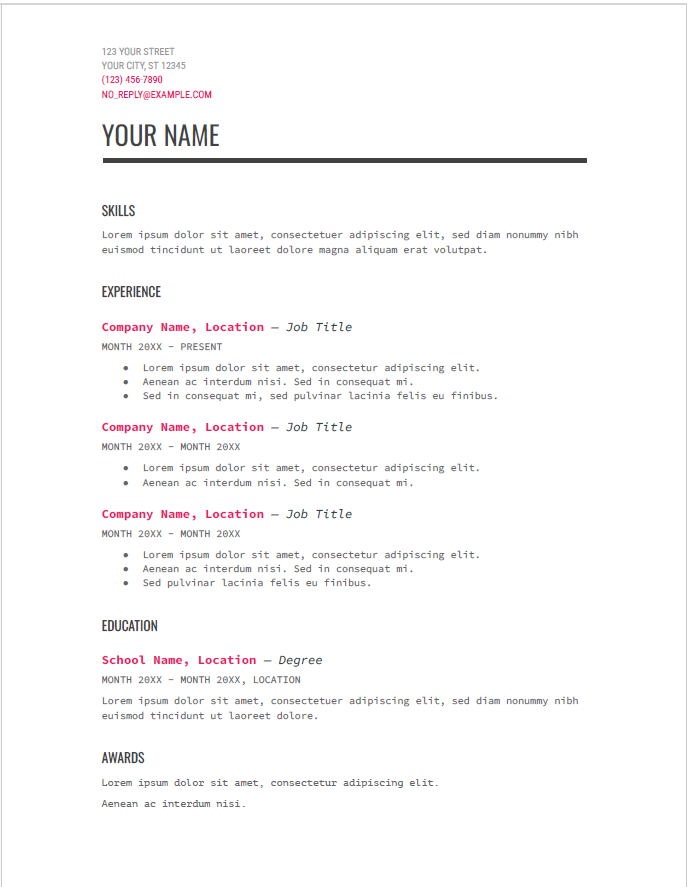

Slate Vertical ProfessionalTwo-ColumnClean

A professional two-column resume template featuring a clean vertical sidebar on the left with skills clearly listed, and a spacious right main section for summary, work experience, and education. The candidate’s name is prominently displayed in a light gray header spanning the top, with contact details arranged neatly alongside icons in the sidebar for easy scanning.

Why This Template

Slate Vertical provides a balanced, easy-to-navigate layout that highlights your skills and experience effectively. The sidebar’s vertical alignment of key skills and contact info lets recruiters quickly assess your qualifications, while the main content area offers plenty of room for detailed work history and education.

Key Features

- Vertical sidebar for skills and contact information

- Light gray header with bold candidate name

- Clear section headers and bullet points in main content

- Use of icons for contact details for visual clarity

- Well-organized content for easy recruiter scanning

- Suitable for administrative, clerical, and office roles

- Fully editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY, 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY, 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

- (987) 654-3210

- jane.smith@example.com

- Metropolis, NY, 10001

- Client Relationship Management

- Insurance Policy Analysis

- Negotiation

- Lead Generation

- Sales Strategy

- Risk Assessment

- Regulatory Compliance

- Data Analysis

- Increased client base by 30% through proactive outreach and referrals.

- Analyzed clients’ insurance needs and customized policies, improving client retention by 25%.

- Achieved 120% of sales target consistently over three years.

- Conducted annual policy reviews, resulting in a 15% upsell rate for additional coverage.

- Certified Insurance Counselor (CIC) – National Alliance – 2020

- Insurance Agent License – State of NY – 2016

Senior Insurance Agent Resume Templates

- Strategic Planning

- Advanced Sales Techniques

- Market Analysis

- Training & Development

- Team Leadership

- Client Acquisition

- Insurance Regulation Expertise

- Conflict Resolution

- Led a team of 10 agents, achieving a 40% increase in overall sales revenue within two years.

- Developed training programs that enhanced team performance and reduced onboarding time by 30%.

- Managed a diverse portfolio of over 300 clients, achieving a renewal rate of 95%.

- Implemented customer feedback strategies that improved service satisfaction scores by 20%.

- Chartered Property Casualty Underwriter (CPCU) – The Institutes – 2015

- Insurance Agent License – State of TX – 2010

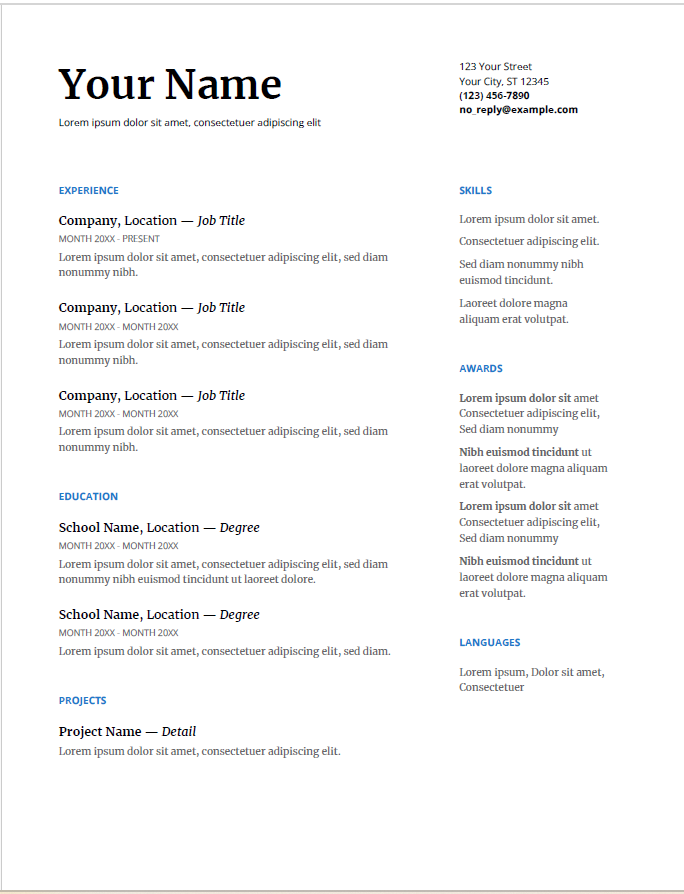

Golden Accent ElegantProfessionalSingle-Column

An elegant and professional single-column resume template featuring a clean white background with gold accent highlights for section headers and the candidate’s last name. The layout emphasizes clarity and structure with well-defined sections for summary, professional skills, work experience, and education. This template balances sophistication with readability.

Why This Template

Golden Accent offers a refined resume design that combines subtle luxury with professional simplicity. The gold highlights create visual interest without overwhelming content, while the clean layout ensures recruiters can easily navigate your qualifications. Ideal for professionals aiming to convey both competence and style.

Key Features

- Single-column layout for focused and linear reading

- Gold accent color highlights candidate’s last name and section headers

- Clear typography and spacing for enhanced readability

- Well-organized sections with bullet points for skills and experience

- Professional and sophisticated aesthetic

- Suitable for business, administrative, and corporate roles

- Editable in Microsoft Word and exportable to PDF/DOCX/TXT

- Designed with ATS compatibility in mind

- Strategic Planning

- Advanced Sales Techniques

- Market Analysis

- Training & Development

- Team Leadership

- Client Acquisition

- Insurance Regulation Expertise

- Conflict Resolution

- Led a team of 10 agents, achieving a 40% increase in overall sales revenue within two years.

- Developed training programs that enhanced team performance and reduced onboarding time by 30%.

- Managed a diverse portfolio of over 300 clients, achieving a renewal rate of 95%.

- Implemented customer feedback strategies that improved service satisfaction scores by 20%.

- Chartered Property Casualty Underwriter (CPCU) – The Institutes – 2015

- Insurance Agent License – State of TX – 2010

- (555) 123-4567

- Big City, TX, 73301

- michael.johnson@example.com

- Strategic Planning

- Advanced Sales Techniques

- Market Analysis

- Training & Development

- Team Leadership

- Client Acquisition

- Insurance Regulation Expertise

- Conflict Resolution

- Led a team of 10 agents, achieving a 40% increase in overall sales revenue within two years.

- Developed training programs that enhanced team performance and reduced onboarding time by 30%.

- Managed a diverse portfolio of over 300 clients, achieving a renewal rate of 95%.

- Implemented customer feedback strategies that improved service satisfaction scores by 20%.

- Chartered Property Casualty Underwriter (CPCU) – The Institutes – 2015

- Insurance Agent License – State of TX – 2010

- (555) 123-4567

- michael.johnson@example.com

- Big City, TX, 73301

- Strategic Planning

- Team Leadership

- Advanced Sales Techniques

- Client Acquisition

- Market Analysis

- Insurance Regulation Expertise

- Training & Development

- Conflict Resolution

- Led a team of 10 agents, achieving a 40% increase in overall sales revenue within two years.

- Developed training programs that enhanced team performance and reduced onboarding time by 30%.

- Managed a diverse portfolio of over 300 clients, achieving a renewal rate of 95%.

- Implemented customer feedback strategies that improved service satisfaction scores by 20%.

- Chartered Property Casualty Underwriter (CPCU) – The Institutes – 2015

- Insurance Agent License – State of TX – 2010

- (555) 123-4567

- Big City, TX, 73301

- michael.johnson@example.com

- Strategic Planning

- Advanced Sales Techniques

- Market Analysis

- Training & Development

- Team Leadership

- Client Acquisition

- Insurance Regulation Expertise

- Conflict Resolution

- Led a team of 10 agents, achieving a 40% increase in overall sales revenue within two years.

- Developed training programs that enhanced team performance and reduced onboarding time by 30%.

- Managed a diverse portfolio of over 300 clients, achieving a renewal rate of 95%.

- Implemented customer feedback strategies that improved service satisfaction scores by 20%.

- Chartered Property Casualty Underwriter (CPCU) – The Institutes – 2015

- Insurance Agent License – State of TX – 2010

Editable Word & PDF Templates

Editable Google Docs Templates

Customizing your resume in Word is straightforward: open the template, click to edit text, adjust formatting as needed, and save your document for future use. You can also explore our Google Docs resume template for an easy editing experience.

Tips & FAQs

Quick Design & ATS Tips

- Use standard fonts like Arial or Times New Roman to ensure compatibility with ATS systems.

- Keep your layout simple and organized; avoid complex designs that may confuse ATS readers.

- Incorporate relevant keywords from the job description to enhance your resume’s visibility.

FAQs

Can I download these templates for free?

Yes, most of our templates are available for free, while others may require a small fee.

Are these templates ATS friendly?

Absolutely! Our templates are designed to be ATS friendly, ensuring your application gets through initial screenings.

Can I edit the templates?

Yes, our Word resume templates are fully editable, allowing you to customize them to fit your needs.

Ready to Create Your Perfect Resume?

Take the next step in your career by building a standout resume. Click the button below to get started!

Build Your Resume NowView more resume templates free that can cater to various professions including specialized fields like finance. Enhance your job application with our tailored solutions!