Are you ready to elevate your job search with a compelling Mortgage Underwriter resume?

In a market where first impressions matter, our collection of resume examples for Mortgage Underwriter is designed to help you shine. Whether you’re an industry veteran or a newcomer, these carefully crafted templates and insights will empower you to showcase your skills and credentials effectively.

Stand out from the competition and grab the attention of hiring managers, let’s build your winning resume today!

Mortgage Underwriter Resume Examples – Free Download

Finding the right words for your resume summary or work experience can be challenging, especially when you need to show underwriting expertise, compliance knowledge, and measurable impact in just a few lines. That is where examples make all the difference. Instead of guessing what to write, you can model your resume after professionally crafted samples that highlight real achievements and relevant underwriting skills—similar to what you’ll see in a well-structured Loan Officer Resume guide.

In this section, you will find tailored examples for multiple job titles, including mortgage underwriter, loan underwriter, underwriter resume, certified mortgage underwriter, and certified residential underwriter. Each example demonstrates how to present results using numbers, industry keywords, and responsibilities that reflect modern mortgage lending requirements.

Use these samples as inspiration to shape your own resume in a clear and strategic way. You can also download the examples to build your resume faster and ensure it is ATS-friendly, concise, and aligned with what hiring managers expect.

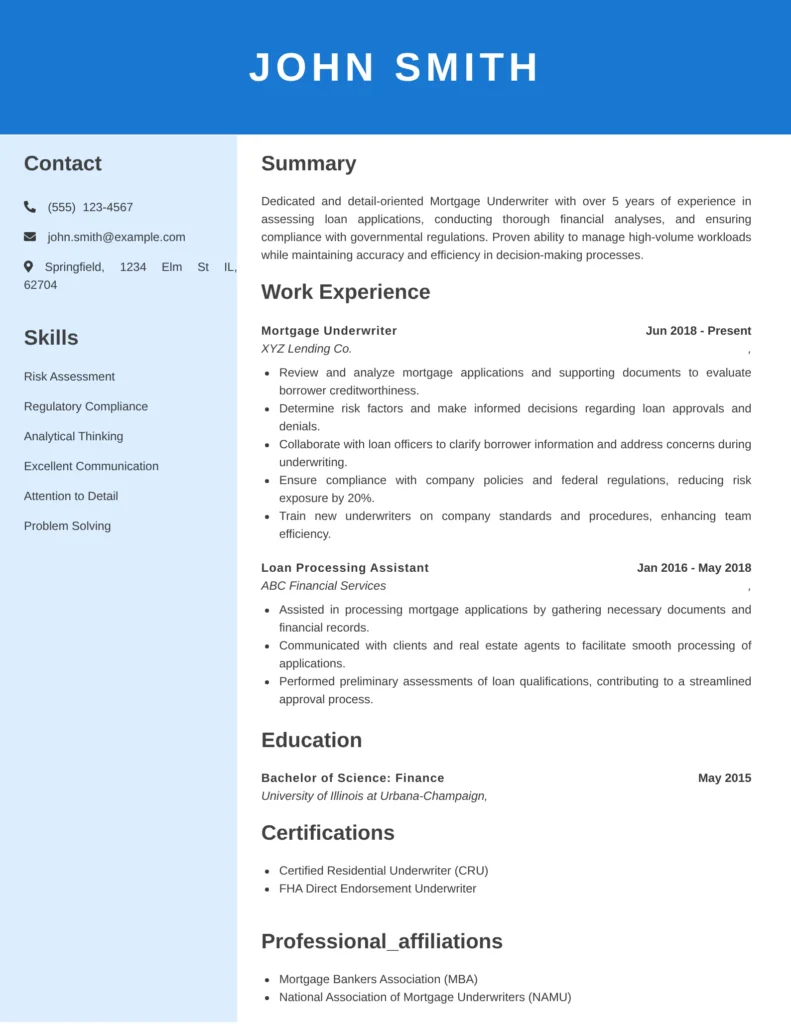

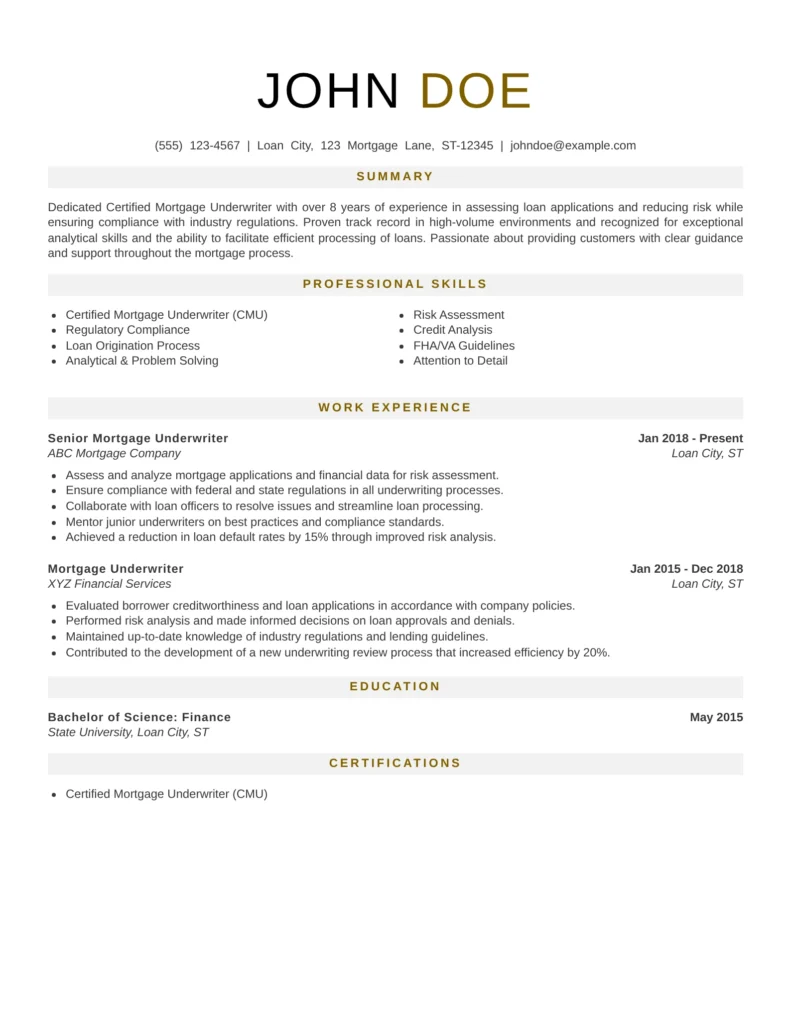

Mortgage Underwriter Resume Example

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

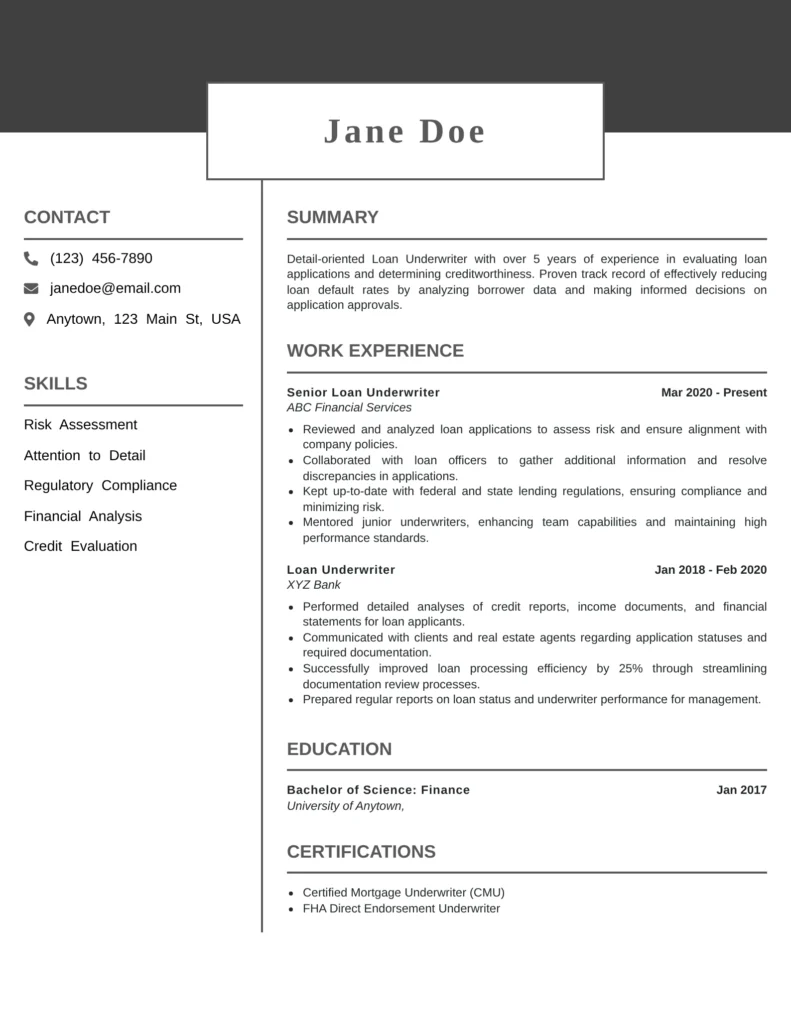

Loan Underwriter Resume Example

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

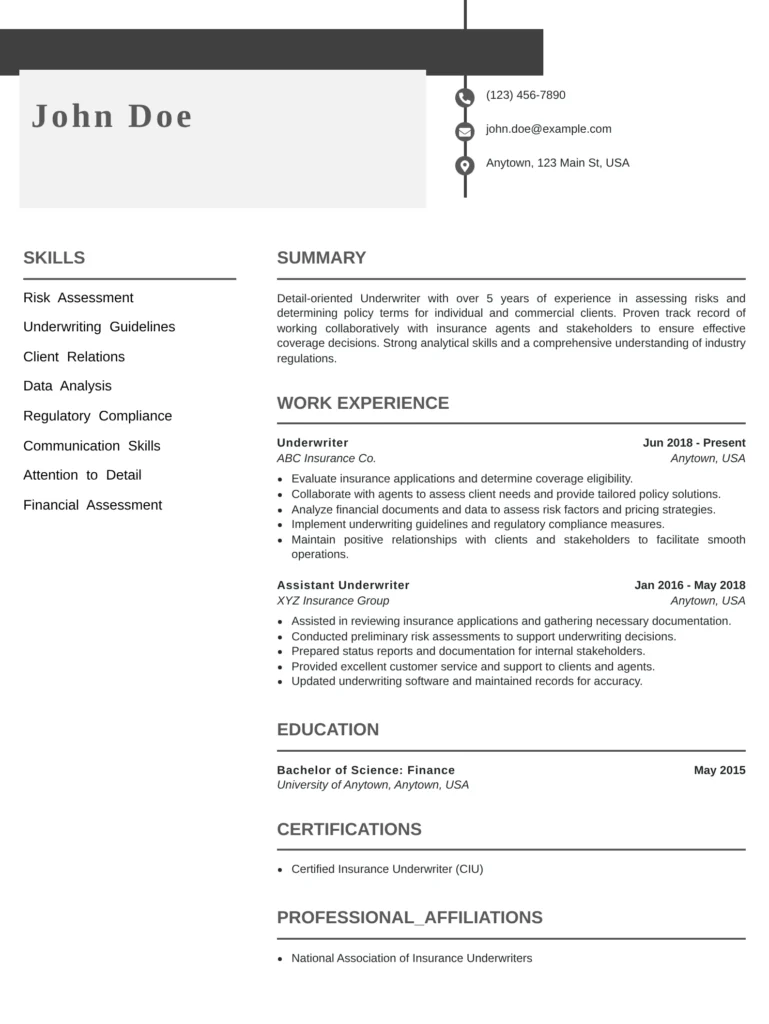

Underwriter Resume Sample (General Underwriter Profile)

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Certified Mortgage Underwriter Resume Example

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

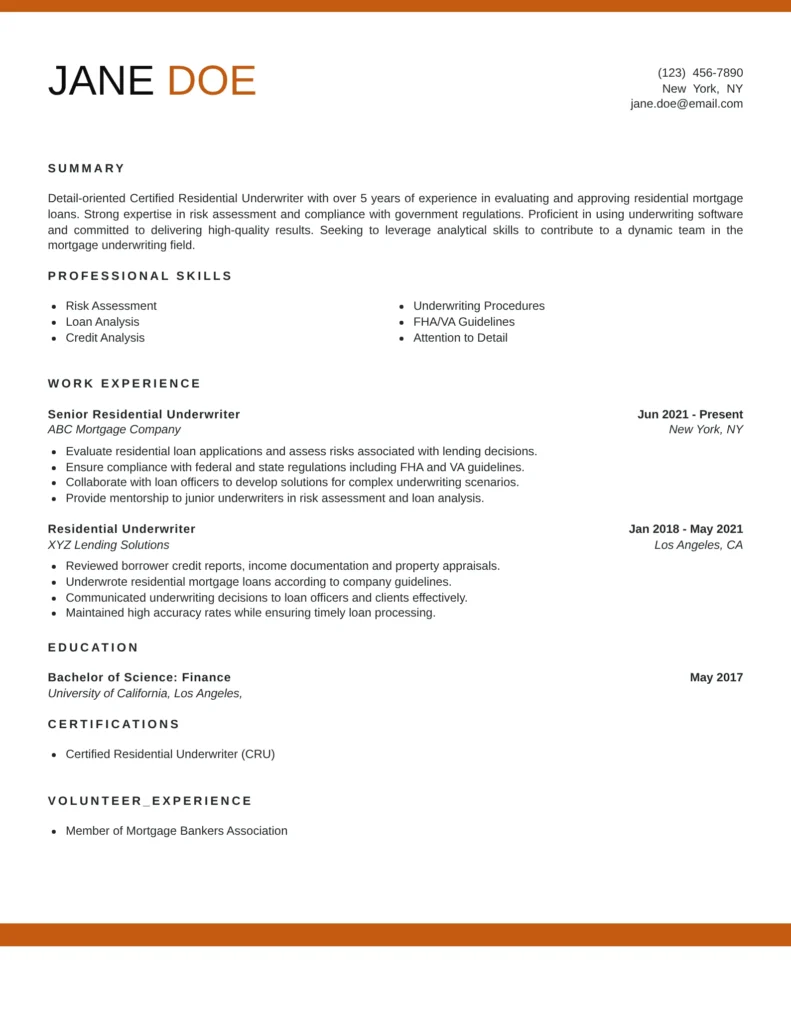

Certified Residential Underwriter Resume Example

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

How to Craft a Strong Mortgage Underwriter Resume

A well-crafted resume is crucial for Mortgage Underwriters, as it serves as your first impression to hiring managers. These professionals seek candidates with a keen eye for detail, a solid understanding of financial guidelines, and strong analytical skills. This guide will help you effectively highlight your strengths and stand out in a competitive job market. You might also explore ready-to-use resume templates to streamline the process and ensure a professional format from the start.

Mortgage Underwriter Resume Objective: How to Write a Strong Summary Statement

A strong mortgage underwriter resume objective or summary statement works as a quick, powerful pitch to hiring managers. It appears at the top of your underwriter resume and tells employers who you are, your underwriting expertise, years of experience, certifications, technical skills, and the value you bring. A well-written professional summary should be 3–4 lines, include industry terminology, demonstrate measurable achievements, and show familiarity with mortgage underwriting guidelines, automated underwriting systems, regulatory compliance, credit reports, loan documentation, financial statements, risk assessment, and loan approvals.

What a standard Mortgage Underwriter Resume summary should include:

| Element | What to include | Why it matters |

|---|---|---|

| Experience Level | Junior Mid-Level Senior Certified Mortgage Underwriter | Shows where you stand in the career ladder |

| Loan Types | FHA loans Conventional loans Jumbo loans Residential loans | Helps match you to the right job description |

| Skills | Risk assessment Credit analysis Underwriting process DTI ratios | ATS looks for technical underwriting skills |

| Tools/Systems | AUS/Desktop Underwriter (DU) Loan Prospector (LP) Encompass | Shows hands-on ability for loan underwriting |

| Results | % reduced defaults Time saved Number of files reviewed | Hiring managers trust measurable results |

| Keywords | mortgage underwriter resume underwriting guidelines mortgage underwriting financial risk management | Boosts ATS compliance for job seekers |

Below are six resume summaries, each written for a different role, explained clearly so you can select the one that fits your mortgage underwriter job.

1. Mortgage Underwriter — Summary Example (Impact-Focused, ATS Strong)

When to use: Perfect for candidates with 3+ years of experience and strong underwriting guidelines knowledge.

Why this works:

This summary highlights loan volume, mortgage underwriting experience, automated underwriting systems, and performance metrics, showing the ability to handle large workloads. It helps pass applicant tracking systems due to keyword richness.

Summary Example:

Mortgage Underwriter with 4+ years of experience in reviewing 900+ mortgage loan applications annually, improving loan approval turnaround time by 18% while maintaining strict regulatory compliance. Skilled in mortgage underwriting, credit analysis, risk assessment tools, and reviewing financial documents including income, assets, DTI, and credit reports. Experienced in AUS (DU & LP), conventional loans, and mortgage lending regulations, applying underwriting guidelines to ensure accurate loan eligibility determinations.

2. Loan Underwriter — Summary Example (Financial Data & Loan Risk Emphasis)

When to use: Ideal for roles where risk management & analytical skills are the priority.

Why this works:

This variation showcases deep knowledge of loan files, loan documentation, risk analysis, and borrower credibility assessment, perfect for risk-heavy environments.

Summary Example:

Loan Underwriter with 6+ years in financial risk management and proficiency in evaluating 1,200+ loan applications, reducing loan defaults by 11% through stringent risk assessment models. Skilled in analyzing borrower creditworthiness, reviewing financial statements, and collaborating with loan officers & loan originators to speed up loan processing. Adept with loan underwriting software, credit risk assessment, and mortgage lending procedures, ensuring accurate decision-making aligned with mortgage industry standards.

3. Underwriter Resume — Summary Example (Balanced Soft + Technical Skills)

When to use: Great for candidates wanting a professional summary that sounds well-rounded and human-driven.

Why this works:

It balances technical underwriting skills with soft skills such as communication, collaboration, and accuracy, showing hiring managers that the candidate fits the team culture.

Summary Example:

Detail-oriented Underwriter skilled in evaluating 750+ loan files across residential loans and jumbo loans, achieving 92% accuracy in credit risk assessments. Strong command over mortgage lending regulations, underwriting process, financial analysis, and risk management. Known for excellent communication with loan officers and mortgage team, maintaining efficient loan documentation workflows and supporting loan approvals without compromising regulatory compliance.

4. Certified Mortgage Underwriter — Summary Example (Certification Highlighting)

When to use: Suitable for applicants who hold a certification or are applying for roles requiring one.

Why this works:

This showcases relevant certification, tools, system proficiency and uses metrics to signal expertise and reliability.

Summary Example:

Certified Mortgage Underwriter (CML/UW Designation) with 7 years of extensive experience in evaluating loan documentation, assessing borrower creditworthiness, and applying underwriting guidelines to complex cases. Successfully approved $45M+ in mortgage loan applications while meeting mortgage lending compliance standards. Skilled in mortgage process automation, risk assessment tools, and reviewing financial documents & credit reports with precision.

5. Loan Officers Transitioning into Underwriting — Summary Example (Career Shifter)

When to use: Best for loan officers moving to underwriting, highlighting transferable skills.

Why this works:

Shows clear growth, leveraging previous achievements, helpful for junior underwriters stepping into underwriting roles.

Summary Example:

Former Loan Officer transitioning into a Mortgage Underwriter role, bringing 5 years experience in processing 1,500+ mortgage loan applications, improving borrower satisfaction scores by 21%, and collaborating with loan originators & mortgage bankers association-based programs. Strong foundation in credit reports review, debt-to-income ratios, loan eligibility, and financial risk evaluation, supported by strong analytical skills and knowledge of mortgage underwriting experience fundamentals.

6. Certified Residential Underwriter — Summary Example (Residential Loan-Specific)

When to use: Targeted summary for residential loan underwriting positions only.

Why this works:

Highly niche, matching ATS filters for residential roles, showcasing relevant experience and compliance knowledge.

Summary Example:

Certified Residential Underwriter with expertise in residential loans, FHA loans & conventional loans, having reviewed 1,050+ borrower files using automated underwriting systems while maintaining 98% compliance accuracy. Proficient in fannie mae standards, loan underwriting, mortgage lending, and analyzing borrower financial documents for loan eligibility decisions. Known for meticulous attention to detail and a proven track record of improving underwriting workflow efficiency.

Skills & Qualifications

Highlighting the right core and soft skills is essential for a Mortgage Underwriter. Core skills may include loan processing, financial analysis, and familiarity with underwriting guidelines. Soft skills such as effective communication, negotiation, and critical thinking are also important.

To identify the most relevant skills:

– Review job descriptions for common requirements.

– Use industry terms that reflect your expertise.

– Ensure your skills align with both the job postings and Applicant Tracking Systems (ATS).

A well-structured skills section will make your resume more appealing to hiring managers and ATS.

- Loan processing

- Risk assessment

- Financial analysis

- Attention to detail

- Effective communication

- Regulatory compliance

- Problem-solving

- Customer service

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Top ATS Keywords for Mortgage Underwriter

Work History

Your work history is one of the most important sections in a mortgage underwriter resume because hiring managers evaluate how well you have contributed to the underwriting process, regulatory compliance, and risk assessment in real situations.

Always list your positions in reverse chronological order, focusing on quantifiable achievements that demonstrate your ability to analyze borrower creditworthiness, reduce loan processing times, improve decision accuracy, and support mortgage lending goals. Use strong action verbs, measurable results, and industry terminology such as underwriting guidelines, mortgage loan applications, automated underwriting systems, and credit risk.

Including performance metrics in your underwriter resume helps prove your financial analysis expertise and shows you are capable of handling high-volume underwriting work efficiently. This is especially important for job seekers in the mortgage industry, where accurate credit report reviews, loan eligibility assessments, and timely approvals directly impact business outcomes. If you prefer a simple, easy-to-edit layout, you can start with a Google Docs resume template to build a clean, professional resume before adding those metrics.

When writing your bullet points:

• Start each bullet with a clear result or responsibility

• Quantify improvements in loan approvals, risk management, or turnaround time

• Mention loan types such as FHA loans, conventional loans, and residential loans

• Include collaboration with loan officers, mortgage team, or loan originators

• Highlight adherence to mortgage lending regulations and the underwriting process

Below are sample bullet points tailored for different job titles. Each line reflects a specific achievement using real metrics that hiring managers look for in a mortgage underwriter position.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Mortgage Underwriter: Sample Experience Bullets

- Evaluated 900 mortgage loan applications annually using Desktop Underwriter and Loan Prospector, increasing accurate approvals by 18 percent while maintaining regulatory compliance.

- Reduced underwriting turnaround time by 15 percent by implementing a structured financial risk review checklist for credit reports, income validation, and debt to income ratios.

- Improved mortgage lending workflow by collaborating with loan officers to clarify loan documentation requirements, decreasing borrower rework rates by 22 percent.

Loan Underwriter: Sample Experience Bullets

- Assessed borrower creditworthiness for 1,200 loan files with strong analytical skills, lowering loan defaults by 11 percent through optimized credit risk processes.

- Conducted in-depth financial documents analysis including tax returns and bank statements, resulting in faster risk management decisions and enhanced loan eligibility accuracy.

- Supported automated underwriting systems configuration to ensure accurate decisioning aligned with mortgage lending regulations and organizational guidelines.

Underwriter Resume Example: Sample Experience Bullets

- Analyzed residential loans and jumbo loans valued at 40 million dollars, achieving 92 percent accuracy in loan approvals and mitigating financial risk.

- Partnered with loan officers and loan originators to strengthen borrower communication during the mortgage process, boosting underwriting team efficiency by 20 percent.

- Enforced underwriting guidelines consistently, ensuring adherence to regulatory compliance benchmarks and preventing documentation errors in loan files.

Certified Mortgage Underwriter: Sample Experience Bullets

- Approved over 45 million dollars in mortgage loan applications as a certified mortgage underwriter while applying mortgage bankers association standards to maintain loan quality.

- Led risk assessment initiatives using industry risk assessment tools, contributing to a 10 percent improvement in portfolio credit performance.

- Conducted credit reports audits and enhanced risk assessment model accuracy, reducing decision discrepancies between AUS findings and manual underwriting reviews.

Loan Officers Transitioning to Underwriting: Sample Experience Bullets

- Processed and reviewed more than 1,500 mortgage loan applications, increasing borrower satisfaction scores by 21 percent through detailed loan documentation support.

- Strengthened communication flow between the mortgage team and underwriting department to reduce loan processing delays and improve file readiness for underwriting review.

- Demonstrated advanced knowledge of the mortgage industry by analyzing financial statements to support preliminary loan eligibility and credit analysis decisions.

Certified Residential Underwriter: Sample Experience Bullets

- Reviewed 1,050 residential loans including FHA loans and conventional loans, maintaining 98 percent mortgage lending compliance during underwriting evaluations.

- Evaluated borrower financial statements and updated internal underwriting process steps to improve customer outcomes and reduce loan processing timelines by 12 percent.

- Utilized risk assessment and financial analysis to ensure accurate loan underwriting for residential borrowers, contributing to a 14 percent increase in approved high-quality applications.

Ready to Land Your Next Job?

Don’t let your resume get lost in the stack. Build a professional, ATS-friendly resume that highlights your leadership, achievements, and industry expertise.

Education

A solid educational background is essential for a mortgage underwriter resume, as most hiring managers look for candidates with a degree in finance, mortgage lending, business administration, accounting, or another related discipline. Additional certifications in mortgage underwriting strengthen credibility and help your resume stand out.

When formatting your education section, keep it clean and consistent. Use bold for the degree or certification name, and italicize the institution name. The city, state, and graduation year should follow on the same or next line in a simple, readable format.

Include:

• Degree or Certification Title

• University or Institution Name

• Location

• Graduation Year

Example formatting:

Bachelor of Science in Finance

University of California, Los Angeles | Los Angeles, CA | 2021

Do’s

- Tailor your resume for ATS by using keywords from the job description.

- Showcase the impact of your work with quantifiable achievements.

- Use industry-specific terminology to demonstrate your expertise.

Don’ts

- Use generic statements that don’t reflect your unique contributions.

- Overlook the importance of soft skills; they are often just as vital as technical abilities.

- Overuse buzzwords; keep your language clear and straightforward.

By following these guidelines, you can craft a strong and effective Mortgage Underwriter resume that highlights your strengths and attracts the attention of hiring managers.

For those looking to create a polished and professional look for their resumes, consider exploring various resume templates available at My Resume Star, designed to meet diverse needs and preferences. Additionally, if you prefer a specific format, you can find resume templates word that cater to traditional styles.